Summary:

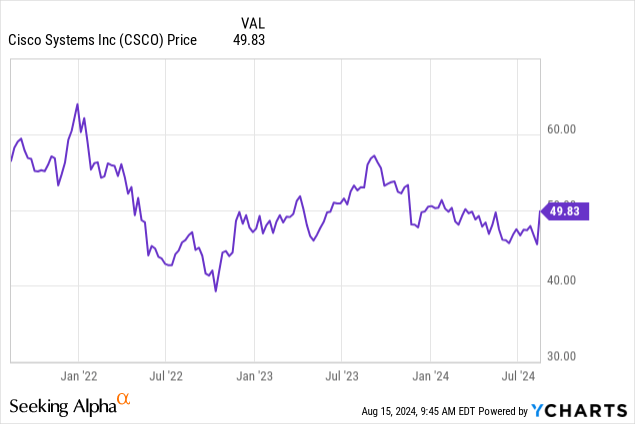

- Cisco Systems stock has been stagnant for months, barely reaching $50 despite a recent pop.

- Revenues down 10% but services revenue up 6% with Splunk contributing $960 million.

- Margins improved but operating expenses up 12% and net income down 45%, cautious optimism for future Cisco performance.

gremlin/E+ via Getty Images

Shares of Cisco Systems, Inc. (NASDAQ:CSCO) have quite a storied history, but in trading and investing, it does not matter where a company or stock has been, it matters where it is going. For many quarters, performance at Cisco has been one of very slow progress. The stock in turn has reflected the slow progress and really has been a zombie, slowly moving sideways to down for many, many months. Although shares are popping today, they are barely back to the $50 mark.

Now, that said, investors who came in pre-COVID or bought at the lows of the pandemic or the bear market of 2022 are likely up. However, in an age where markets have surged for two years straight, CSCO stock has lagged. We expect more sideways action, though the acquisition of Splunk we see as a positive. The company just reported earnings, and they were positive, while the outlook was mostly in line with analyst expectations. In short, the excitement is less about the numbers and more about hope for change and growth at the company in the coming quarters. Let us discuss the results.

Revenues Still Down

So, while this was a better-than-expected quarter overall, we think it is important to remind you revenues are still falling, even if this was expected. Total revenue was $13.6 billion, down 10%, with product revenue down 15%. However, services revenues were up 6%, which was positive. We also want to point out that Splunk contributed approximately $960 million of total revenue for Q4.

Geographic sales

When looking at a global company like Cisco, it is essential to get a feel for what is happening in its geographic operating areas. Overall sales were down 10%, but as it turns out, sales were down everywhere. In the Americas sales were down 11%, in EMEA they were down 11%, and in APJC they were down 6%.

Product sales

While sales were down in all regions, we do note some growth in certain product revenue categories. For example, with the threat of more and more invasive behavior in today’s technological world, we saw that revenues in Security products were up 81% while so-called Observability product sales were up 41%. However, much of this was related to picking up Splunk. Organically, that is, backing out the impact of Splunk, Security was up just 6%, while Observability was up 12%. On the negative side, revenue from Networking was down 28% while product revenue in Collaboration was flat.

Profit Power

One strength in this quarter was margin expansion. On a GAAP basis, total gross margin, product gross margin, and services gross margin were 64.4%, 63.0%, and 67.8%, respectively. This is up from total gross margin, product gross margin, and services gross margins of 64.1%, 63.6%, and 65.7%, respectively, in Q4 last year. This is positive. Making adjustments, we see adjusted total gross margin, product gross margin, and services gross margins were 67.9%, 67.0%, and 70.3%. This was up across the board from 65.9%, 65.5%, and 67.5%, for adjusted total gross margin, product gross margin, and services gross margins, respectively in Q4. Margins were highest in EMEA at 69.2%.

Even though revenues were down from a year ago, operating expenses were actually up 12% to $6.2 billion, or 45.2% of revenue. Adjusted operating expenses were $4.8 billion, up 4%, and were 35.4% of revenue. We never like to see falling revenue and increasing operating expenses. It is a tough combination to get behind. This obviously led to a hit to operating Income. Operating income was $2.6 billion, down 38%, with a GAAP operating margin of 19.2%. Adjusted operating income was $4.4 billion, down 17%, with Adjusted operating margin at 32.5%. That was a negative and led to net income that was down badly from a year ago. Net income was $2.2 billion, a decrease of 45%, and EPS was $0.54, dropping 44%. Adjusted net income was $3.5 billion, falling 25% from a year ago, and while EPS was $0.87, a decrease of 24%. Those results matter.

Forward View

But again, it does not matter where a stock has been, it matters where it is going. We think that while this quarter was more positive than expected, the outlook was really so-so. After many disappointing guides, a relatively inline guide is being taken as bullish. Of course, now the company is involved in AI of sorts, and this has generated some buzz. We, however, want to see better cash flow. Cash flow from operating activities was just $3.7 billion in Q4, a decrease of 37% compared with $6.0 billion a year ago. Tough sell for us to get bullish on such declines.

As we look ahead, the forward view was in line, mostly. Perhaps slightly better than expected. For fiscal Q1, revenue was guided at $13.65 billion to $13.85 billion while the consensus was $13.76 billion, so this is in line. On the EPS front, on a reported basis the company expects $0.35 to $0.42, and on an adjusted basis, it sees $0.86 to $0.88 vs. consensus of $0.85, so better than expected here. The 2025 annual guide was exactly in line with expectations. Revenue was guided to $55.0 billion to $56.2 billion, vs. consensus of $55.68 billion. Adjusted EPS is seen at $3.52 to $3.58 vs. consensus of $3.55.

Today’s Cisco Systems, Inc. stock rally is certainly welcomed and comes on the back of a better-than-expected quarter with a mostly in-line guide. Of course, the stock has largely been a zombie the last few years, and today’s rally has it barely back to $50. We are cautiously optimistic about the future for Cisco, and the Splunk acquisition is a game changer, but we remain on the sidelines with this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We make winners. Come make money with us

Like our thought process? Stop wasting time and join the traders at BAD BEAT Investing at a 60% off sale annually!

Our hedge fund analysts are available all day during market hours to answer questions, and help you learn and grow. Learn how to best position yourself to catch rapid-return trades, while finding deep value for the long term.

- Available all day during market hours with a vibrant chat.

- Rapid-return trade ideas each week from our hedge fund analysts

- Crystal clear entries, profit taking, and stop levels

- Deep value situations

- Stocks, options, trades, dividends and one-on-one attention