Summary:

- Cisco Systems (CSCO) is a strong buy due to its growth recovery, excellent execution, and attractive valuation with a 2.95% dividend yield.

- Cisco’s robust dividend growth and low P/E ratio make it a top dividend-paying tech stock, ideal for long-term investors.

- The AI revolution presents significant growth opportunities for Cisco, potentially driving a major upgrade cycle in networking infrastructure.

- Despite past underperformance, Cisco’s focus on financial health and AI investments positions it for double-digit revenue growth and substantial price appreciation.

sankai

Introduction

It looks like there is an increasing optimism about “no landing” optimism every week in the stock market because it keeps hitting all time highs despite the fact that the current valuation has already reached a far stretched level with PE of over 28%. The bond market also seems to confirm that we could be out of the woods in terms of a recession. Under these market macro drops, the best stock play is the value stock with GARP, a stock still reasonably valuated but demonstrating reasonable growth potentials.

Cisco Systems (CSCO) is at the top of my recommendations list based on my recent research work in this GARP category. Cisco is the number 1 vendor of the networking infra that has been one of the key foundations of the connected world since the internet era. The company has achieved excellence execution during the post-internet time, during which they have not seen major network upgrade cycles which have largely limited growth potentials for the company. But, thanks to the efforts of the company, the Dow 30 component remains a cash cow, and generously returns values to shareholders with 3% dividends and one of the strongest dividend growths records during its 13 years of dividend-paying history. Now, the company is expecting a renewed growth opportunity with areas reaching double digits in produce orders, thanks to the generational AI growth drive.

I rate CSCO a strong buy for its existing growth recovery, excellent company growth focus, and proven execution excellence. The stock is sitting at a relatively cheap valuation with respectable dividends and strong dividend growth record. Investors will be greatly rewarded for holding CSCO for a long term.

The Company

Cisco is best known for its contribution to building the internet that has become the basic foundation of the modern connected world. The company is a leading provider of networking and cybersecurity solutions. Cisco specializes in technologies and products in both hardware and software for switching, routing, and security.

Cisco has a huge established customer base. Nearly all IT departments will have to manage Cisco devices and services. So, Cisco is needed everywhere. As reported, “34,548 companies…use Cisco Switches”.

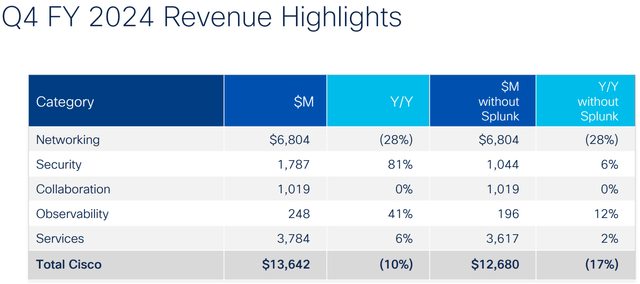

Cisco is also the major vendor providing the internet infrastructure equipment to the big telecommunication carriers , such as AT&T and Verizon, across the globe. This once most important area for Cisco has suffered a significant slow down of the spending in the recent years. Cisco’s revenue has experienced a rocky journey. The most recent Q4 reports a 10% revenue decline year-over-year as shown below. This is largely due to the slow networking sector and one of the supply difficulties the company has just overcome.

How ever the Security and Observability have shown a lot of growth potentials with double digits growth year-over-year. The company sees the “AI revolution” huge growth opportunities ahead.

The Value – Excellent dividend growth and stock buy back

Dividend growth is my favorite NorthStar indicator for a company’s financial operations. Cisco is a great dividend stock that pays about 2.95% currently and above 3% for the past few years. This is rather rare in the technology space, and Cisco can largely attribute these numbers to its very profitable business model and focus on returning value to shareholders.

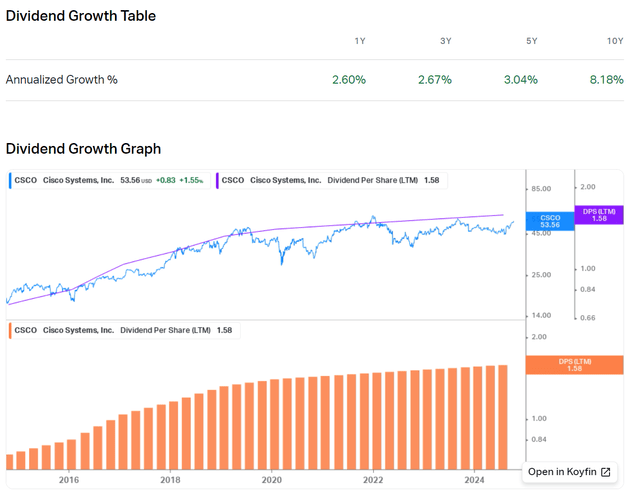

More importantly, its dividend growth has an excellent track record since the first dividend was issued in 2011 as shown below:

Cisco dividend growth history – from koyfin.com

Checking out the dividend history over the years, Cisco has been growing the dividend and payout by a rate of 2.87% on average over 5 years. The dividend payout ratio is 42.36%, and has been increasing the dividend for the past 13 years ever since its first dividend payment in 2011. My opinion is that it is the number 1 dividend-paying tech company. Its dividend-paying history may not be as long as some of the old tech companies that have gone through tougher economical situations but the last fallout from the COVID-19 pandemic has proven that Cisco is focused on shareholders as well as strong financial results from the excellence execution.

Cisco has spent half of their cash flow on dividends and share buybacks. In 2009, there were roughly 5.8 billion shares outstanding for Cisco. Now, there are about 4 billion shares outstanding. I think that buyback is a better way to return value to shareholders for technology companies because not only does it decreases the amount of outstanding shares, but it also reduces the dividend payout ratio, making dividend more sustainable.

The Growth – GARP is expected

The company has illustrated strong GARP characteristics driven mainly by the company operations, including a stable industry, relentless focus on growth opportunities, and excellent financials. Barring the major upgrade cycle in the future, Cisco has to support existing big customers such as AT&T, Verizon, the telecommunication and cable operator, which represents the bulk of the businesses. The so-called oversubscription is estimated to be about 20 years for the internet era. This illustrates that no major upgrade cycle has seen; the closest one was the 5G. In fact, Cisco once aligned the company resources around the 5G in anticipation of a big new wave to arrive, a market estimated at staging 40% CAGR reaching $3.6T in 2023. But 5G has not been materialized.

More realistically, I’d expect the growth to return to high single and low double-digit ranges. The company could be a great GARP stock based on the following characteristics:

- Relatively low price/earnings (P/E) multiples: 14.54

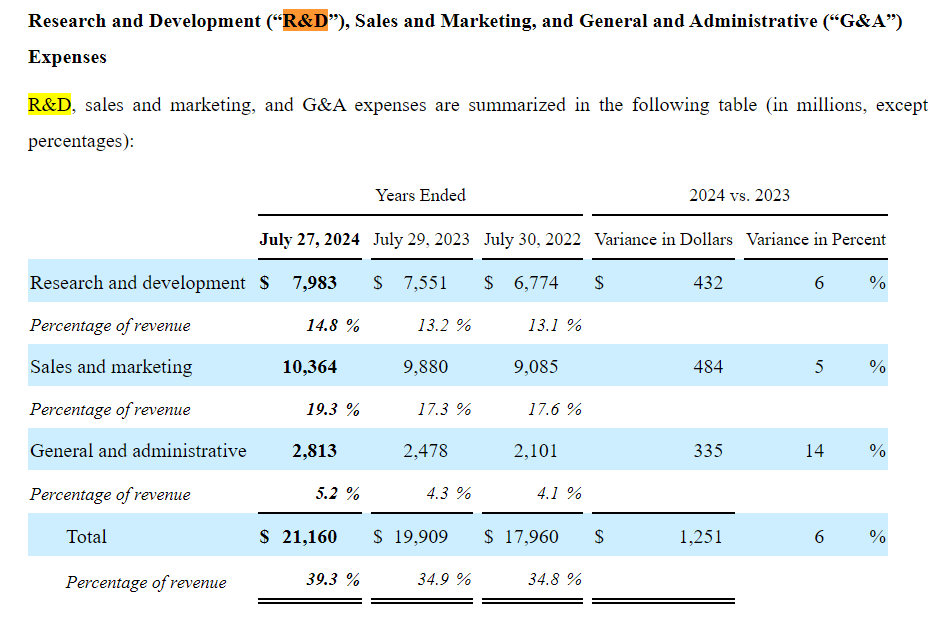

- Close to low PEG (1 or less) based on my estimation from the base of current 9% earning growth and P/E of 12.96 (for 2027 per SA stats). I believe that the current 7% reduction of the workforce will contribute 7% to earnings. I would count on Cisco’s history of exceeding earnings estimates by 2% on the upper side and factor in the growth that could provide a 10% earnings surprise during a fast growth time. So, if I apply about 15%-20% more to earnings, it will reduce the P/E to 10-11. Now if I give Cisco an 11% growth rate, it will make its PEG lower than 1. I think this is possible for Cisco to accomplish based on its conservative style. The growth estimate is a big question because it appears to be a bit stretched. But, it could be offset by reducing 10% R&D spending to adjust for slower growth. In fact, this is quite possible; if we look at the R&D spending in the last 2 years, the current 14.8% could be brought down to 13.1%, which was the R&D spending at just one year ago, as shown below.

Cisco R&D Spending – from Cisco

- Cisco for the last 5 years has proven its defensive characteristics. This is because the networking infra has been basic needs. The company focuses on margin and cash.

AI growth tailwind comes at the right time for networking industry

It’s fair to say that Cisco stock has been viewed as a “boring” value stock for many years, despite the CEO and leadership team having put a “laser focus” of the company on the growth. The company has spent $8B on innovation according to company’s most recent quarterly report.

However, I think that the AI generational growth presents huge opportunities for the networking industry, and Cisco can quickly get back on the growth train as the number one networking provider. The networking industry is always one of the centerpieces for datacenter and cloud infrastructure, together with computing and storage. My view is that if the internet is about communication of information, providing a so-called information superhighway, then the AI revolution will demand superior communication for big data and intelligence. The following illustrates that Cisco stands to a be a big beneficiary.

- Cisco’s latest “9-figure” deals come from Nexus HyperFabric for big enterprises and web service providers. Cisco has seen orders in the double digits growth. The CEO admitted that it is the first time for quite some time that Cisco has seen such an order of growth and magnitude. It remains to be seen if the double digit growth of order could continue and materialize into a multiple-year expansion. But, there are certainly a lot of reasons to be optimistic about it thanks to the AI revolution.

- Cisco seems to be ready for the big AI move. The CEO mentioned in a recent earnings conference that “it’s up to us to execute”. Notice that this is one of the most confident comments heard from the CISCO CEO in many years, and execution has been an historical strong point for Cisco.

- Cisco has a new vision called “secured networking”, previously “network security”. Notice the difference; now, “networking” is the operating word and I believe that Cisco is moving back to its home game. In fact, the CEO announced a rather astonishing announcement by creating one organization to align all relevant resources. I think that it is a great initiative and the first important step to embracing the new networking cycle in the AI era.

The major networking cycle upgrade has not really come to the networking industry for the last 20 years. The AI revolution, which has just started its “first inning,” is expected to call for a major upgrade cycle for networking. Cisco has seen double digit product orders in many of its solutions related to new secure networking solutions, such as Nexus HyperFabric connecting AI servers, HyperSecurity and enhanced intelligence network operations, etc. It is well positioned for the future AI growth.

Risk Analysis

The legacy resulting from the internet overbuild (20-year oversubscription) could continue to affect the company’s overall growth. A huge customer base has already been established. The company has been aggressively restructuring resources and realigning them with growth areas. The most recent 7% layoff is perhaps the most telling example. However, the company has to balance support for its existing vast base of services. It is not an easy task to balance the maintenance of its extensive legacy with areas of new growth, which requires large R&D resources. After all, their existing customer base provide a sustained revenue stream that can be used to scale growth down the road.

The macro economy conditions will affect IT spending for corporate America. In fact, IT spending growth projections are moderate overall. Although the mainstream of investment seems to believe in the secular growth of the AI revolution, one of the market drives will ultimately come from IT spending patterns. The slowdown of the business will cause spending to slow down significantly should a recession become a more likely scenario in the near future. The (AI) growth outlook could be dimmed. In this case Cisco stock will very likely be under severe pressure and perform badly based on historical behavior.

From a financial fundamental perspective, it is a good idea to monitor Cisco growth margins and dividend payouts. These could provide key signals for any weakness of the company’s operation and help spot the risks for dividend cuts and stock underperformance.

Closing Thoughts

Cisco has been the top companies in the networking industry, which has not seen major network upgrade cycles since the internet era. Cisco has managed to execute very well during this transition period and has been able to generate a lot of free cash. As a result, the company has become a good value company with a sector low P/E ratio and an excellent dividend growth history (13 consecutive years of growth at a yield about 3%) ever since the first time of the dividend issuance in 2012. CSCO has shown strong GARP characteristics and based on my estimate for future growth, it is a good long-term holding for both income investors thanks to the companies investors focus, and investors looking for “undiscovered” growth opportunities will also like to benefit from the company’s “laser focus” on growth. AI could prove to be a good opportunity to drive a new major upgrade cycle for networking and related services. With Cisco’s great financials, laser focus on (AI) growth areas, and AI investments, I believe Cisco may finally find the path to double digits revenue growth. I rate Cisco stock a buy. It is a good long-term core play for many enticing features including decent income from 3% dividend, super steady dividend growth history, cheap stock price at a low P/E ratio, and, most importantly, a generational AI growth tailwind that could propel a significant price appreciation over a long time.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSCO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.