Summary:

- Cisco’s AI potential is underrated.

- Cisco’s cash on hand and free cash flow have grown substantially over the last year.

- Cisco’s 3% dividend is one of the largest in the high-tech market.

raisbeckfoto

Overview

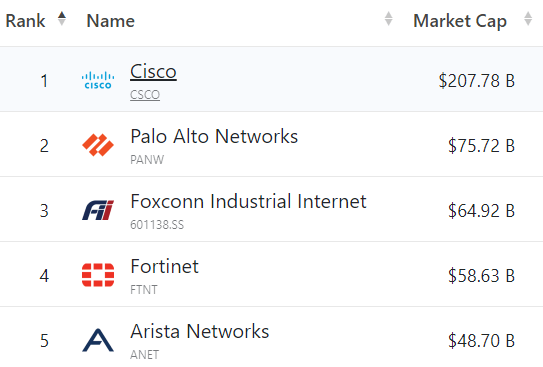

Cisco Systems (NASDAQ:CSCO) is one of the largest network hardware companies in the world with a market value of over $200 billion.

companiesmarketcap.com

Cisco also has one of the largest dividends in the high-tech market having increased its dividend by almost 10% per year for the last ten years and it currently pays about 3%.

Most people are not aware of the potential AI (Artificial Intelligence) has in the networking market. If you think about it, what can be a more important use of AI than in securing networks?

With the advent of AI software on those networks, it becomes even more important to network users to know that they are well protected from outside incursions into their data via their networks.

I think this is one area of AI that is underestimated at this point and the realization will grow in the future and with it Cisco’s value.

So from an investor standpoint, one needs to look at Cisco as a dividend stock with a solid 3% plus payout which is very high for anybody providing AI services.

So in this line, we look at Cisco and its prospects to see where we think it will be going with the networking AI kicker hitting the market over the next few years.

Cisco stock key metrics

Let’s look at Cisco’s financial metrics comparing the last TTM’s (Twelve Month Trailing) periods. I use financial metrics to discover what I consider to be positive investment numbers in the yellow boxes and compare them with any negative investment numbers in orange.

Seeking Alpha and author

The first thing to notice in the financial metrics is a rather large increase in both the share price and the market value. This could indicate that Cisco is already realizing some of the gains that I am predicting for AI although there is no proof that those better numbers are strictly from the AI potential of Cisco. But regardless of that fact, a stock that has gone up 21% in the last year would be hard to consider as a turnaround candidate unless you thought it was going to go up much higher something similar to Nvidia.

The good news is in the yellow boxes where you can see that the current debt (Line 12) is negative meaning there is more cash than debt. That number has increased by a third from $12 billion to $16 billion a very nice increase in cash on hand. Also, free cash flow is increased by 26% (Line 15), and ditto the price to free cash flow (Line 16) has dropped. That would imply that Cisco’s current price, based on free cash flow, is actually better now than it was a year ago.

Note that in the last year, the dividend (Line 17) has only increased by 1%. Hopefully, with the amount of cash they have on hand that would improve going forward.

Overall I would say that Cisco’s financial metrics look good especially when considering the free cash flow and debt metrics.

What do analysts think?

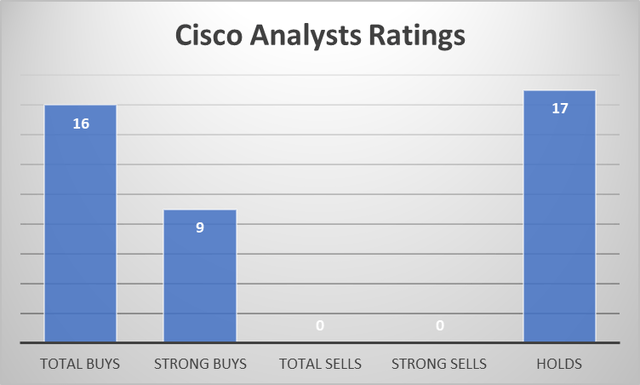

Wall Street and Seeking Alpha analysts are very positive about Cisco’s prospects with 16 Buys and zero, none, nada Sells. However, the number of holds is 17 which is more than the number of Buys so there is some doubt in analysts’ minds about Cisco’s future price appreciation.

Seeking Alpha and author

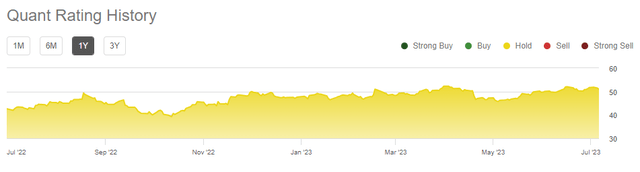

This neutral sentiment is reflected in the quants analysis of Cisco also with a steady Hold rating over the last 12 months. Note there are no Buy recommendations by quants for the last year.

Seeking Alpha

So although the quants are neutral on Cisco I feel that the analysts’ 17 Buy recommendations compared to zero Sell recommendations would imply that Cisco is a buy at this point.

Dividends And Share Buybacks.

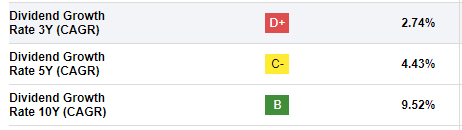

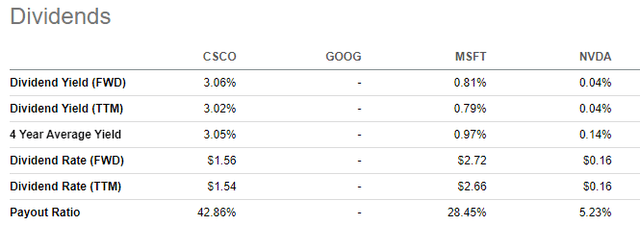

If we look at Cisco’s dividend record it looks excellent over the last 10 years at better than 9% growth per year. However, during the last 3 years that rate has dropped to less than 3%.

Seeking Alpha

And compared to other tech stocks on the AI hype train, Cisco’s 3% looks very good.

Seeking Alpha

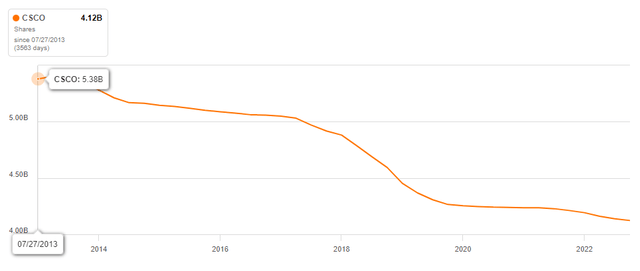

When it comes to share buybacks, Cisco’s 10-year record is impressive having bought back approximately 20% of their shares over that time lowering their share count from 5.38 billion shares to 4.12 billion shares.

Seeking Alpha

So when it comes to dividends Cisco needs to do some more work to get that rate back up towards the 10% mark but on the share buybacks it has been a consistent buyer over the last 10 years.

How Does Cisco’s Price Compare To Other AI Stocks?

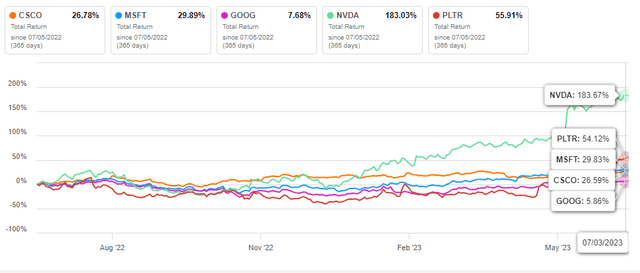

A legitimate question when looking at any stock is to compare its potential with other stocks in the same market sector. If we look at Cisco’s performance over the last year and compare it to other large stocks in the AI sector, we can see all have done well over the last 12 months but Cisco has outperformed Google over the last year and almost matched Microsoft. Cisco is well behind NVIDIA but that is to be expected.

Seeking Alpha

This would imply that Cisco is being rewarded by the stock market before it has been recognized for its AI expertise and value.

Is Cisco Stock A Buy, Sell, or Hold?

To show the amount of interest that Cisco has in AI we can look at the latest earnings call where we find 14 references to AI including the following statement from CEO Chuck Robbins:

And third, generative AI and cloud. At Cisco, we already use predictive AI extensively across our portfolio. In addition, our core networking technology is already powering some of the leading AI models run by hyperscalers around the world. We have also moved rapidly to leverage generative AI capabilities in our own products, which you will hear more about in the next few weeks and beyond starting at Cisco Live.

So as time goes forward Cisco will be emphasizing AI more and more in my estimation and this will enhance the market’s perception of Cisco as something other than just a high-end hardware vendor. The inclusion of AI in everything Cisco does should be an extreme benefit to Cisco’s share price as time goes forward.

At this point, I would rate Cisco as a buy not only for its dividend and AI but for the fact that as the cloud grows and 5G networks expand Cisco will sell more and more hardware as an upgrade and that hardware will include more and more AI services. With services having much higher margins than the hardware itself, this should see an expansion of Cisco’s margins and therefore earnings and free cash flow.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.