Summary:

- Cisco Systems reported a strong end to FY24 with sequential growth in networking equipment sales as customer inventory digestion occurs.

- Management laid out the groundwork for the next generation of Cisco as the firm undergoes a major restructuring to enhance their AI networking capabilities.

- Despite a dimming macroeconomic environment, Cisco is well-positioned for growth as enterprises invest in faster bandwidth capabilities for AI/ML testing and inferencing.

imaginima/E+ via Getty Images

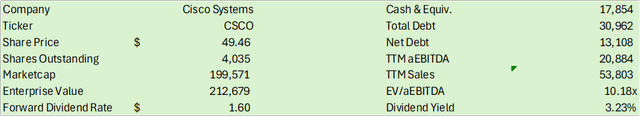

Cisco Systems, Inc. (NASDAQ:CSCO) reported a strong end to fiscal year 2024 as the firm is beginning to realize sequential growth in their networking equipment sales paired with strength in cybersecurity. On the Q4’24 earnings call, management laid out the groundwork for the next generation of Cisco as the firm restructures for the future of networking. Despite the dimming macroeconomic environment, Cisco should be well-positioned as enterprises and hyperscalers invest in faster bandwidth capabilities to support AI/ML testing and inferencing. I recommend CSCO shares with a BUY rating with a price target of $54/share at 9.61x EV/aEBITDA.

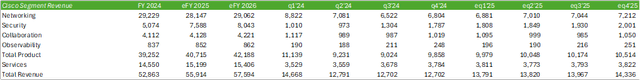

Cisco Systems Operations

Cisco reported a strong end to FY24 as management believes the networking equipment inventory destocking is behind them. Looking to Q1’25, networking equipment will likely experience a sequential improvement as new equipment is shipped out to customers seeking to upgrade their campus and data center networking equipment for the next generation of AI application support.

We think the inventory digestion is complete and we’re now returning to a more normalized demand environment.

Chuck Robbins, Chair & CEO

This phenomenon was voiced by competing networking company Arista Networks, Inc. (ANET) in their recent Q2’24 earnings call as the firm experienced an upswing to margins as a result. In addition to this, customers are shifting their focus into the next generation of AI-enabling networking equipment in order to achieve higher speeds with lower latency.

We saw that there was a lot of pivot going on from the classic cloud, as I like to call it, to the AI in terms of spend.

Jayshree Ullal, Chairperson & CEO, Arista Networks

This should be viewed as a positive sign for Cisco going into FY25 as the firm pivots to cater to the higher-bandwidth, AI-enabling technologies demanded by hyperscalers and enterprises alike. Management at Cisco also voiced a customer shift into Ethernet and optics for higher data rates. In Q4’24, Cisco crossed the $1b mark in AI orders with their web-scale customers, three of whom were the top four hyperscalers for Ethernet AI fabric deployment. Management also suggested that AI product orders are expected to add an additional $1b in FY25, suggesting that demand for AI infrastructure remains strong.

This shift will play heavily into the firm’s restructuring plan as the firm eliminates 7% of their 84,900 employees to concentrate efforts on the next generation of networking. This workforce reduction will result in a $1b severance payment; however, this will allow the firm to relocate core operations to lower-cost regions and focus their workforce on AI-related expertise. In addition to this, the firm will be expanding the role of their Chief Product Officer, Jeetu Patel, to combine their networking, security, and collaboration teams in order to create a more integrated product offering.

Given the platformization trends across the networking and cybersecurity industry with companies like CrowdStrike Holdings, Inc. (CRWD), Palo Alto Networks, Inc. (PANW), and Check Point Software Technologies Ltd. (CHKP), Cisco may be doing much of the same as the firm further entrenches itself into infrastructure security with their recent acquisition of Splunk.

Cisco’s competitive edge in the cybersecurity space is their Hypershield offering, which combines networking and security across the distributed network, whether on-prem or in the cloud. This product offering is said to have an AI-native security architecture that automates the security policy lifecycle across the infrastructure and is capable of extending into accelerators running on network devices. In addition to this, Hypershield can autonomously segment the network for new applications, allowing for fewer hours spent mapping out optimized workload traffic flows.

Bringing Splunk into the mix further broadens Cisco’s reach into visibility across network and infrastructure. It’s clear that the Splunk acquisition has been highly accretive for Cisco, leading to both growth and adjusted margins. Total product orders for FY24 grew by 14% and only 6% excluding Splunk. Given Cisco’s platformization of their security offerings, the firm may realize further competitive strength when comparing their platform to those offered by Arista Networks or Check Point.

Having Splunk on the firm’s roster also allows for both companies to cross-sell more out-of-the-box platform solutions that may have required more technical staff if the two remained independent companies. This includes their unified observability experience with Splunk Log Observer Connect for Cisco AppDynamics, which will allow for improved visibility into the network and applications. In addition to this, Cisco released their Advanced AI in Splunk IT Service Intelligence, which utilizes AI/ML capabilities for more precise alerts with enhanced visibility across the network and infrastructure.

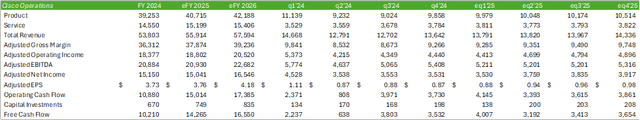

Cisco Financials

Corporate Reports

Starting with the segments, I anticipate Cisco to experience sequential incremental improvement in their networking segment as customers digest their inventory builds from Q4’23 and Q1’24. This may lead to challenging year-over-year comps for the segment; however, I believe the recovery will be a gradual build as hyperscalers and enterprises improve their network performance capabilities in order to support AI/ML applications. I also anticipate sustained growth in their security segment as more integrated features are built out with Splunk.

Given the macroeconomic uncertainty, I anticipate the collaboration segment to remain relatively flat in FY25 as firms manage costs and headcount. This industry-wide initiative may become more of a trend in the coming year as enterprises seek to manage their spending by automating more processes with AI/ML applications. Though it may be too early to expect drastic changes as a result of AI inferencing, I believe we may begin seeing some signs of change in CY2H25. Given that Advanced Micro Devices, Inc.’s (AMD) MI300X series GPUs and the firm’s to-be-released MI400s are preferred for inferencing, further adoption of these GPUs could foreshadow what’s to come for employment at the enterprise level. This could potentially place further pressure on the firm’s collaboration segment if fewer licenses are required on a per-firm basis. Services will likely remain at the forefront as networks become more complex for AI training and inferencing.

Corporate Reports

Forecasting out to FY26, I believe Cisco will realize modest margin expansion on an adjusted basis as the firm manages down their headcount and associated costs.

I also anticipate Cisco to manage their working capital as we enter the next fiscal year. Days inventory, which has grown to 64.88 days in Q4’24, up from 58 days in Q3’24, will likely decline to a more normalized range in FY25 as more networking equipment moves through the channels. Depending on the economic outlook for the next year, we could see receivables be modestly pulled in to manage customer risk. With this presumption and the improved profitability, Cisco’s adjusted free cash flow may significantly improve from the FY24 trough. I anticipate free cash flow to be in the ballpark of $14b in FY25 and $16.5b in FY26.

Risks Analysis

Bull Case For Cisco

Networking equipment has reached the trough and may be returning to growth driven by the need for stronger bandwidth capabilities to cater to the demands of AI/ML training and inferencing. Campus networking equipment will likely follow suit to ensure minimal latency, whether these applications are housed on-prem or in the cloud to minimize speed bottlenecks. Cisco also has a strong opportunity to further enhance network security and visibility with their recent Splunk acquisition, creating a more competitive platform and broadening their market reach. Investments in networking infrastructure across the hyperscalers will likely persist as new AI factories are built out to cater to the growing demand for AI training.

Bear Case For Cisco

The macroeconomic environment may shift towards a contraction as consumers remain relatively budget-conscious, resulting in tighter growth across the enterprises. Despite CPI and PPI continuing to tame in July, costs continue to expand, which may result in more selective purchasing paired with a relatively flat growth trajectory. This may lead to fewer enterprise investments for network infrastructure. Fewer investments towards AI could potentially result in delays for new AI factories and may further pressure network equipment sales in the coming periods.

Valuation & Shareholder Value

Corporate Reports

Investors responded exceptionally positively to the firm’s Q4’24 earnings release as the share price improved by nearly 10% post-release. Shares have continued their positive trajectory in the days following the release, suggesting that the firm’s fundamentals support the valuation. Taking into consideration Cisco’s growth trajectory and 3.23% forward dividend yield, I believe CSCO shares make an appealing case for their durability. Given these factors, I recommend CSCO shares with a BUY rating with a price target of $54/share at 9.61x FY26 EV/aEBITDA.

Corporate Reports

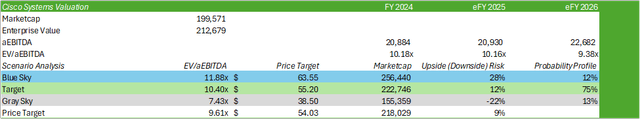

Taking into consideration company comps, CSCO shares are relatively undervalued, especially when considering ANET’s 39.51x EV/EBITDA trading multiple.

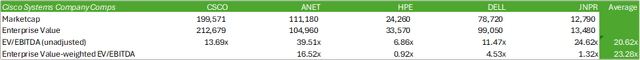

Seeking Alpha

Though I do not anticipate CSCO to experience as expansive of a trading multiple, I believe this leaves some room for moderate expansion as the firm gravitates towards higher bandwidth capabilities and network automation. At its recent peak, CSCO shares traded as high as 16x EV/EBITDA on an unadjusted basis. Though this is far off from the enterprise, value-weighted average of 23.28x EV/EBITDA amongst its peers, this could potentially lead to a stronger valuation if Cisco continues to improve their cash generation.

Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.