Summary:

- Cisco has underwhelmed the market in recent years.

- The company has consistently beaten expectations, but the consensus targets have been modest.

- Cisco is investing in hybrid cloud, but is far behind the leaders.

- The Wall Street consensus outlook is that the shares have some upside potential over the next year.

- The market-implied outlook (calculated from options prices) is bullish to the middle of 2023 and into the start of 2024.

JasonDoiy

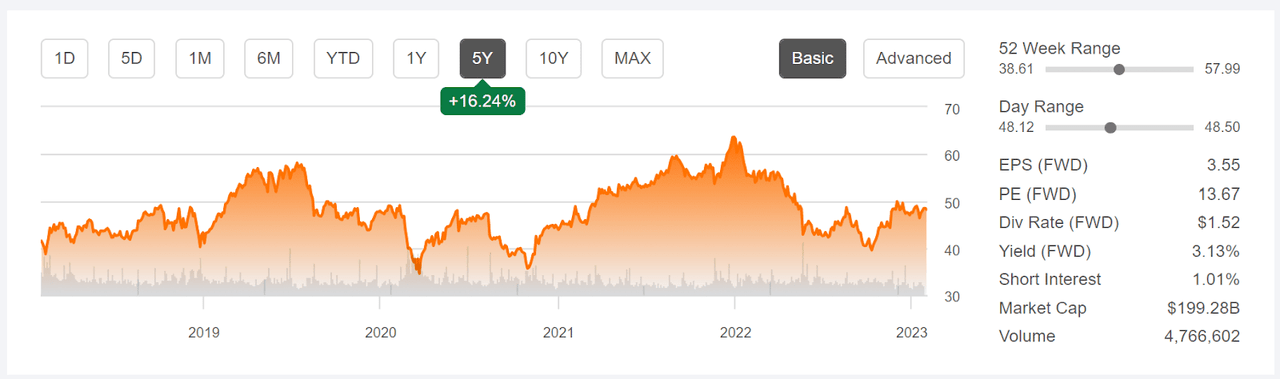

Cisco Systems (NASDAQ:CSCO) shareholders have received modest gains over the past 5 years, with annualized total return of 5.4% per year vs. 9.6% per year for the S&P 500 (SPY), 12.4% per year for the NASDAQ 100 (QQQ), and 7.2% per year for the Dow Jones Industrial Average (DIA). The iShares Telecom ETF (IYZ), in which CSCO is the largest holding, returned -1.7% per year over this 5-year period.

CSCO closed at a 10-year high of $63.96 on December 29, 2021, fell to a 2022 low closing price of $39.27 on October 12th, and then rebounded to around $50 by the end of 2022.

12-Month price history and basic statistics for CSCO (Seeking Alpha)

CSCO is focusing on several growth trends. One of these is digital transformation, which the company defines as “the application of technology to create new business processes”. The key idea is to leverage technology to create improved products and services that technology makes possible. Sample application areas include making hybrid work seamless and using Software-as-a-Service (SaaS) to increase efficiency and ease of access across enterprises. The company is also emphasizing hybrid cloud solutions. In addition, CSCO offers data analytics to create value, including AI and machine learning tools. All of these components of CSCO’s roadmap are in line with industry trends and make sense, the company has not yet managed to accelerate earnings growth.

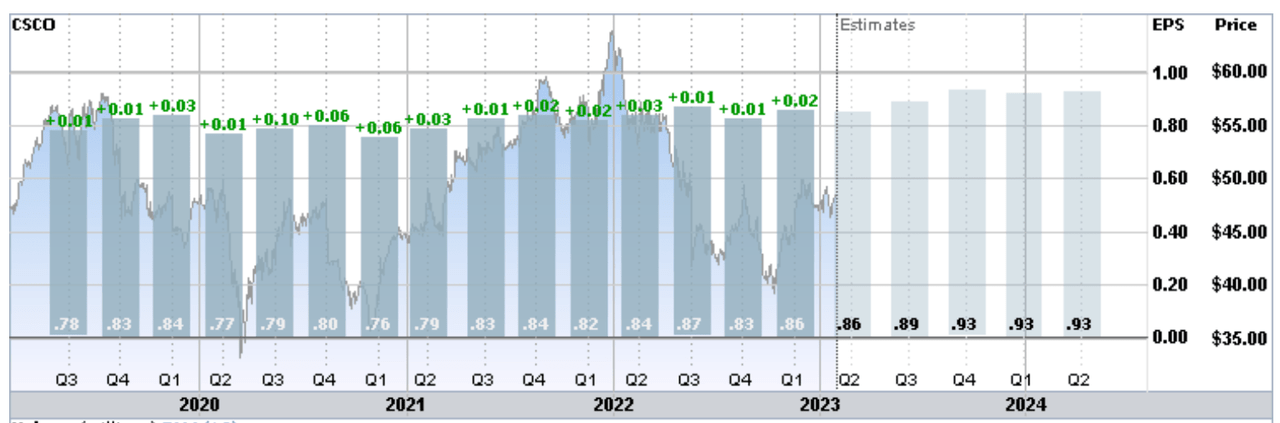

CSCO reports results for the 2nd quarter of FY 2023 on February 15th. Earnings have been growing very slowly in recent years, although quarterly EPS has been slightly above expectations for every quarter over the past 4 years. The consensus outlook is for continuing slow growth in the coming years. The consensus estimate for EPS growth over the next 3 to 5 years is 5.1% per year. The weak growth outlook is why CSCO has such a low forward P/E.

Trailing (4 years) and estimated future quarterly EPS for CSCO. Green values are the amounts by which EPS beat the consensus estimated value (ETrade)

CSCO has a forward dividend yield of 3.13% and 3-, 5-, and 10-year annualized dividend growth rates of 2.8%, 5.6%, and 13.2% per year, respectively. The sharp decline in the dividend growth rate in recent years is sensible, given the muted earnings growth, but will be a concern for income-oriented investors.

I last wrote about CSCO on January 26, 2022, almost exactly a year ago, and I maintained a buy rating on the stock. In the period since that post, CSCO has returned a total (calculated using Yahoo! Finance dividend-adjusted closing prices) of -9.8%, as compared to -5.8% for the S&P 500, -14.8% for the NASDAQ 100, and -17.4% for the iShares Telecom ETF.

As of January 26, 2022, the narrative was similar to what we see today, with concerns about increasing growth. The Wall Street consensus rating was a buy, with a consensus 12-month price target that mapped to an expected total return of 16% over the next year. The market-implied outlook, a probabilistic price forecast that represents the consensus view from the options market, was bullish to the middle of 2022 and neutral, with a slight bullish tilt, to mid-January of 2023. The expected volatility calculated from the market-implied outlook was about 32%. While the low growth was a negative, the low valuation suggested that muted expectations were largely priced in. Considering the Wall Street consensus and the market-implied outlook, maintaining a buy rating was a straightforward decision.

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate the probable price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper discussion than is provided here and in the previous link, I recommend this outstanding monograph published by the CFA Institute.

I have calculated updated market-implied outlooks for CSCO and I’ve compared these with the current Wall Street consensus outlook in revisiting my rating.

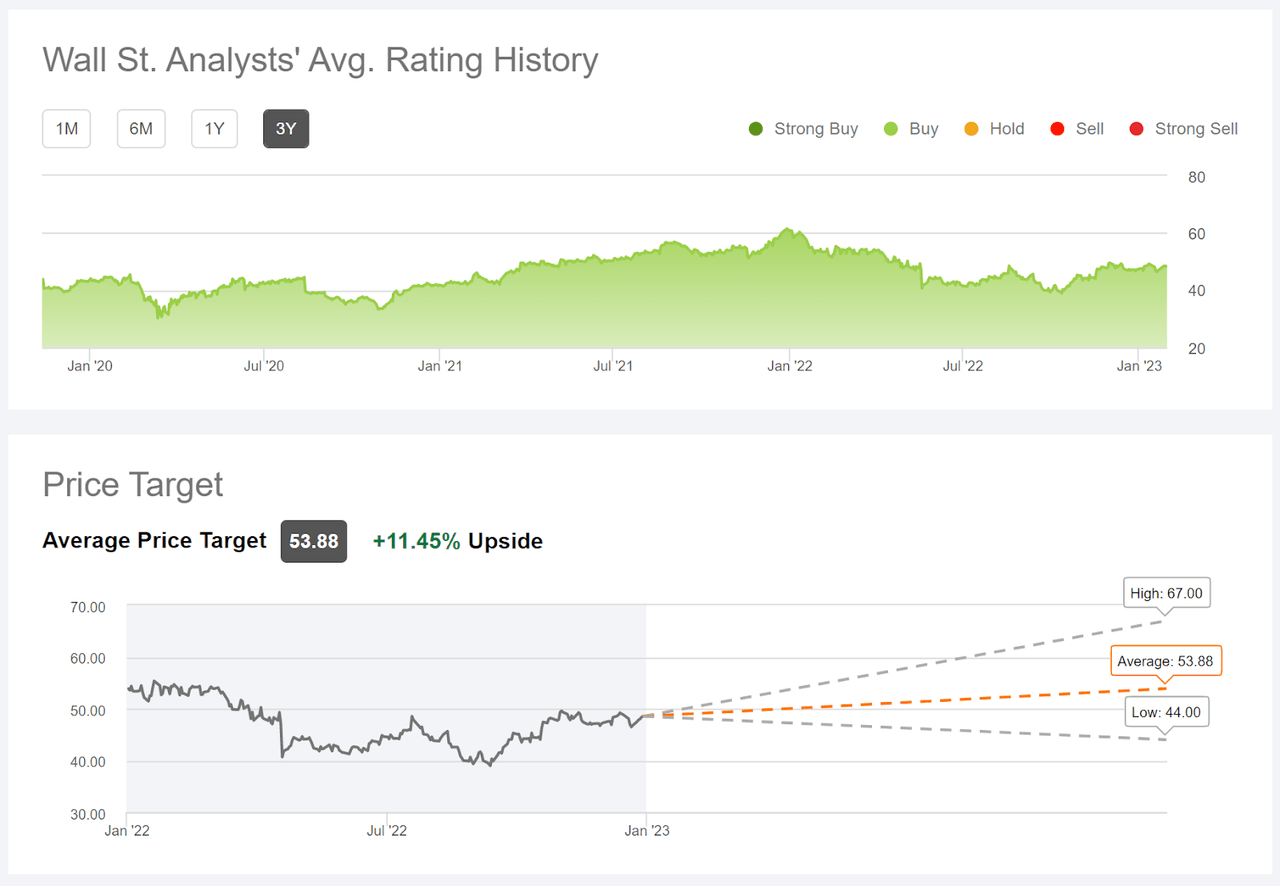

Wall Street Consensus Outlook for CSCO

Seeking Alpha calculates the Wall Street consensus outlook for CSCO by combining the views of 27 analysts who have published ratings and price targets for the stock over the past 90 days. The consensus rating is a buy and the consensus 12-month price target is 11.45% above the current share price, corresponding to an expected total return of 14.58% over the next year. For context, CSCO’s 10-year annualized total return is 10.96% per year, but the 3-, 5-, and 15-year annualized returns are 3.7%, 5.4%, and 6.3% per year, respectively.

Wall Street consensus rating and 12-month price target for CSCO (Seeking Alpha)

It is worth noting that the consensus rating has been a buy for all of the past 3 years, a period during which the shares did not perform very well. The consistency of both the Wall Street consensus and the muted earnings growth suggests that the analysts have consistently tended to overestimate CSCO’s progress.

Market-Implied Outlook for CSCO

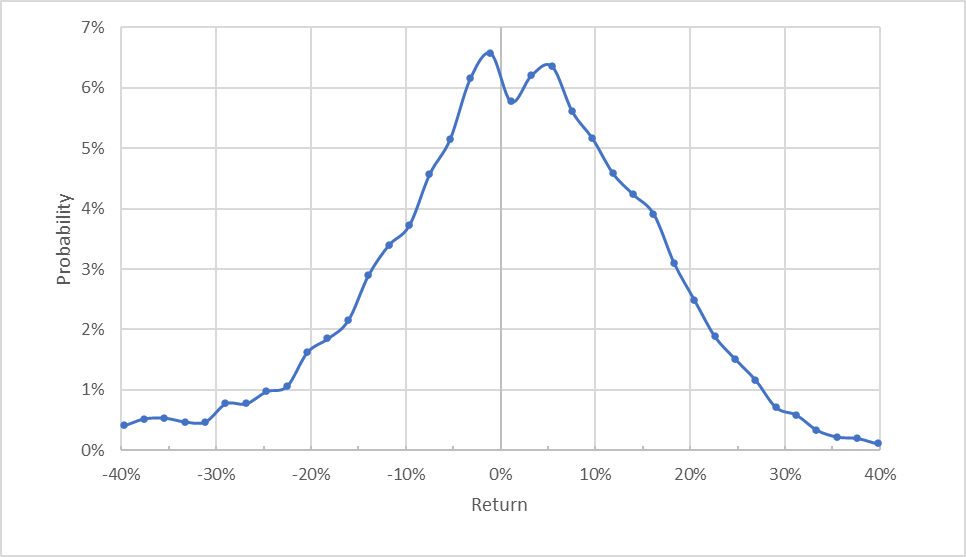

I have calculated the market-implied outlook for CSCO for the 4.5-month period from now until June 16, 2023 and for the 11.6-month period from now until January 19, 2024, using the prices of call and put options that expire on these dates. I selected these specific expiration dates to provide a view to the middle of 2023 and through the entire year.

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

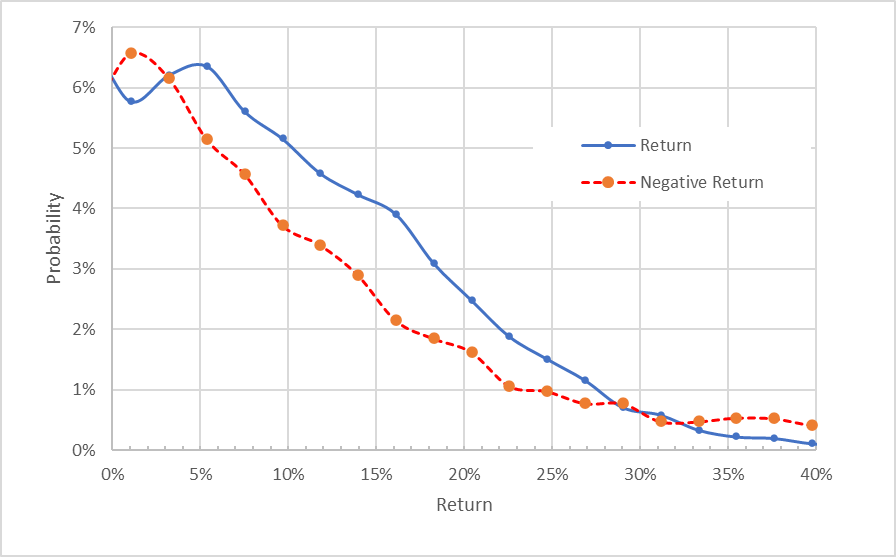

Market-implied price return probabilities for CSCO for the 4.5-month period from now until June 16, 2023 (Geoff Considine)

The market-implied outlook to the middle of 2023 is tilted to favor positive returns, even though the maximum probability corresponds to a price return of -1%. Compare, for example, the probability of having a +10% return to the probability of a -10% return. The expected volatility calculated from this distribution is 25% (annualized), as compared to 32% for the outlook to the middle of 2023 from January of 2022.

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Market-implied price return probabilities for CSCO for the 4.5-month period from now until June 16, 2023. The negative return side of the distribution has been rotated about the vertical axis (Geoff Considine)

This view highlights that the probabilities of positive returns are consistently and substantially higher than the probabilities of negative returns of the same size, across a wide range of the most-probable outcomes (the solid blue line is above the dashed red line over almost all of the left ¾ of the chart above). This is a bullish market-implied outlook and is quite similar to the outlook from late January of 2022 to mid-June of 2022 in my previous post.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. The expectation of a negative bias reinforces the bullishness of the market-implied outlook to the middle of 2023.

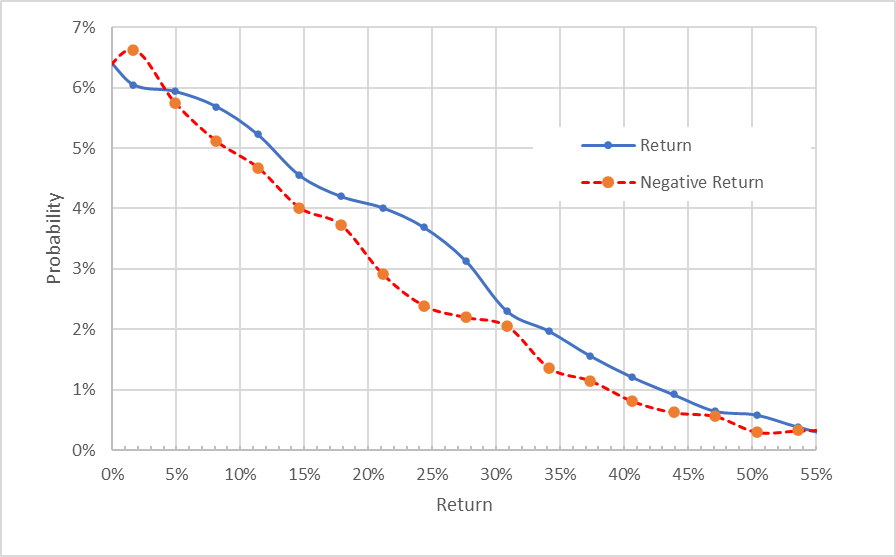

The market-implied outlook to January 19, 2024 is also bullish, with an expected volatility of 25% (annualized). The equivalent outlook from my last post, using options that expired in January of 2023, was neutral with perhaps a slight bullish tilt.

Market-implied price return probabilities for CSCO for the 11.6-month period from now until January 19, 2024. The negative return side of the distribution has been rotated about the vertical axis (Geoff Considine)

The market-implied outlooks to the middle of 2023 and into the start of 2024 are very consistent with one another: bullish with expected volatility of 25%. The decline in expected volatility corresponds to a reduction in overall market volatility over the past year. On January 31, 2022, VIX was about 23, as compared with 20 today.

As I was writing this post, I bought (more) shares of CSCO for $48.30 and sold call options with a strike price of $50, expiring on January 19, 2024, for $4.00. The net position provides option premium yield of 8.28% ($4.00 / $48.30) plus an expected dividend yield of 3.13% between now and January 19, 2023, for a total income yield of 11.4%. This position also retains 3.5% of potential price appreciation. If CSCO’s price rises 11.5% (as expected from the consensus price target), my position will return 11.8% (3.5% of price appreciation plus 8.28% of option premium yield), not including dividends.

Summary

Cisco has met, and slightly beaten, analyst expectations for earnings over the past several years. The problem, however, is that the expectations for growth were weak. The company is saying and doing the right things to compete with the other firms in the cloud data and analytics space, with CSCO’s native strength coming from the network side. The question is whether the firm can differentiate itself and grow market share. The market has discounted the shares substantially to reflect low growth rates. I am inclined to continue to give CSCO the benefit of the doubt here. The Wall Street consensus outlook continues to be a buy, with a consensus 12-month price target that implies a 14.6% total return over the next year. As a rule of thumb for a buy rating, I want to see an expected total return that is at least ½ the expected volatility. Taking the analyst consensus price target at face value, CSCO meets this criterion. The analysts have tended to be too bullish on CSCO, however. The market-implied outlook is bullish to the middle of 2023 and into the start of 2024. I am maintaining a buy rating on CSCO. Selling covered calls provides a way to manage the potential that CSCO does not demonstrate sufficient growth over the next year.

Disclosure: I/we have a beneficial long position in the shares of CSCO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I have sold covered calls against my long position in CSCO