Summary:

- Cisco Systems has had negative returns on a 1, 3, and 5-year timeframe despite the tech stock and AI hype.

- With AI being the next big thing, one could expect Cisco Systems to have a rise in stock price similar to the dotcom bubble.

- Cisco Systems failed to manifest itself in the cloud market.

- At least in the near future, I see no way for Cisco Systems to profit from the AI revolution or the demand for data centers.

Sundry Photography

Thesis

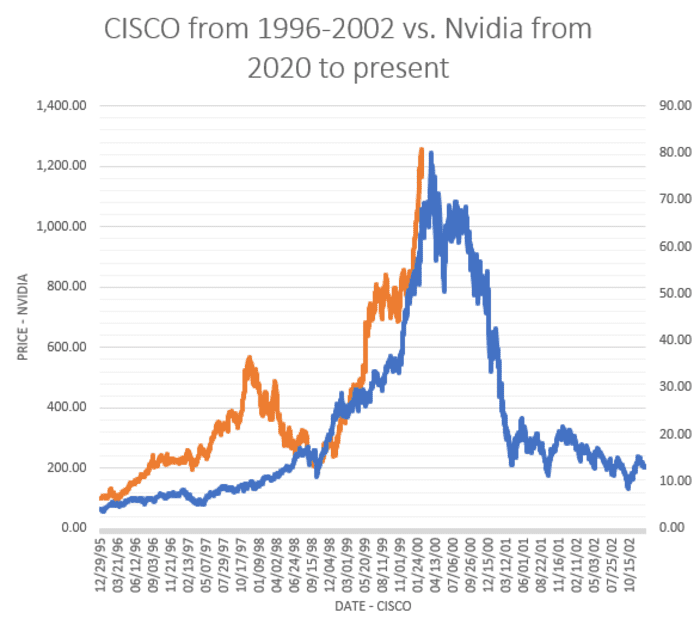

Cisco Systems (NASDAQ:CSCO), often compared to Nvidia (NVDA) during the 2000s dotcom bubble, has shown stagnant performance since 2019, with negative returns over 1, 3, and 5-year periods, despite the ongoing tech and AI hype over the past two years. As AI emerges as the next major transformative technology, similar to the internet in the 90s and early 2000s, one might expect Cisco Systems (CSCO) to experience a dotcom bubble-like surge in stock price due to its leadership in essential technology.

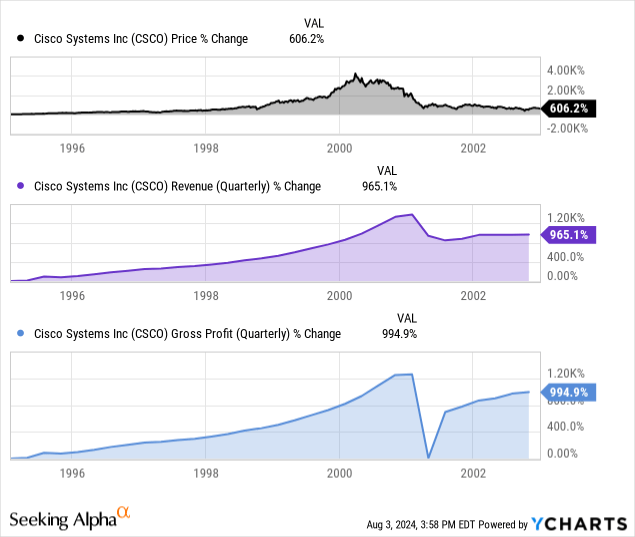

It would be unrealistic to expect similar results, as the market dynamics and the context of the internet and AI are different. However, it is a valid question why Cisco Systems’ price, revenue, and profit look as they do:

Given the high demand for data centers to support AI development, and Cisco Systems’ significant role in providing the necessary hardware, this performance is somewhat disappointing.

It seems evident that Cisco Systems is no longer a key player in AI, and thus, another Dotcom-Bubble-like profit surge from this transformative technology is unlikely. Considering this, I would say Cisco Systems isn’t a good growth or turnaround stock when you’re looking to invest in AI.

A short review of what happened in the late 90s to early 2000s and the difference to today

During the Dotcom Bubble, the internet experienced a massive boom, leading to speculative investments in technology companies. Cisco Systems benefited significantly during this period, emerging as a leading provider of network infrastructure for the internet. Cisco’s stock price rose sharply as demand for Internet connections and services grew, and Cisco was the market leader in providing these products and services. When the bubble burst around 2000, many companies, including Cisco, experienced dramatic declines in value as numerous business models were revealed to be overvalued. You can see the influence on CSCO in the chart above. Oftentimes, I see the current rise of Nvidia’s stock price being compared to CSCO’s stock price in the 90s – 2000:

NVDA vs CSCO (Marketwatch.com)

Although the recent decline in NVDA’s stock price aligns with past patterns, a direct comparison is not entirely accurate. The key difference lies in the nature of the two periods: the Dotcom Bubble was driven by speculation and expectations, whereas the rise in ‘AI stocks’ is grounded in concrete results and companies that are already profitable.

Overall, I believe comparing these two stocks does not yield meaningful insights into the companies’ performance. What we should compare is the influence of both situations on CSCO. The initial conditions appear quite similar:

- Dotcom Bubble: The internet was the next major world-changing technology. Expanding its development required data centers, with CSCO supplying a significant portion of the necessary products and services.

- The AI situation: AI is the next major disruptor, influencing and transforming many aspects of life. This requires substantial data center infrastructure, which CSCO continues to supply significantly.

- To me, the conditions seem pretty similar.

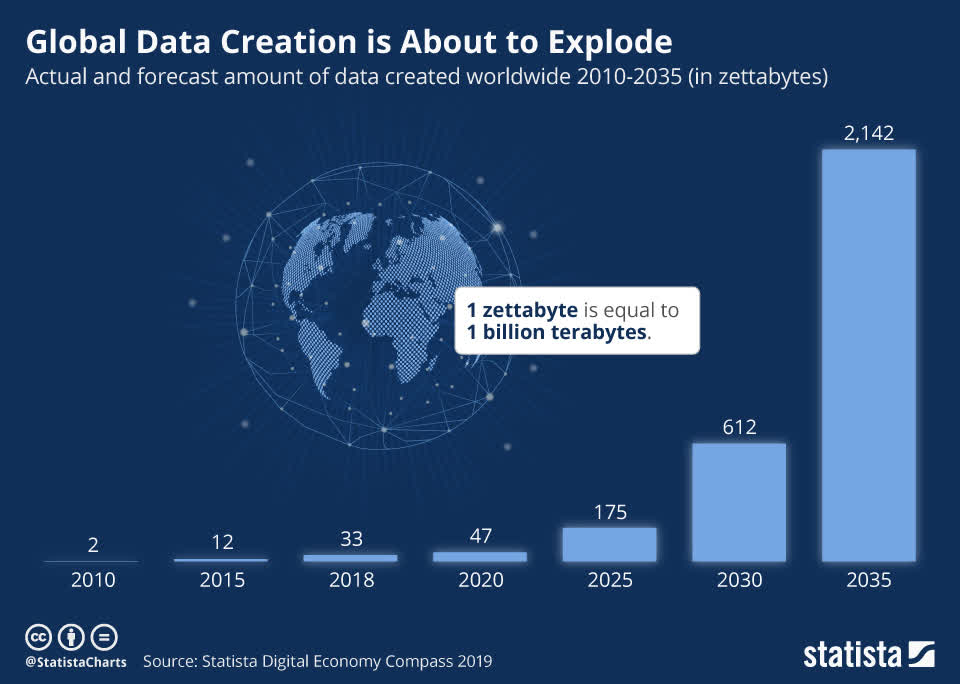

Projections for data growth are substantial:

Data creation projections (statista.de, 2019)

And these projections are from 2019. It is reasonable to expect that with AI, the potential for data creation could be even greater.

Why hasn’t CSCO profited off this yet, and why do I think they won’t at all?

CSCO’s recent development

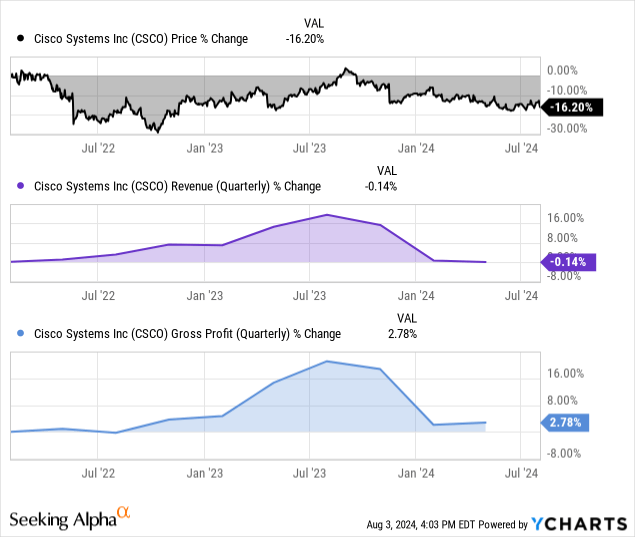

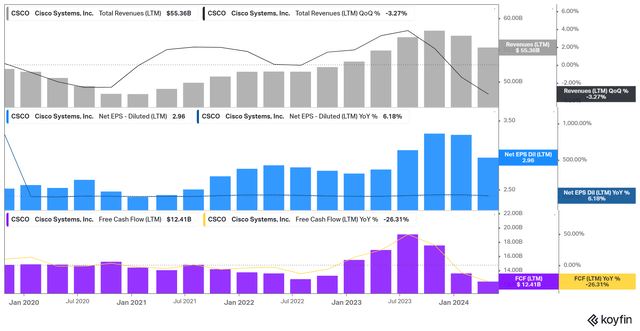

CSCO’s recent revenue and earnings trends are quite disappointing, to say the least.

CSCO’s recent revenue, EPS, and FCF (Koyfin.com)

Revenue and free cash flow (FCF) have declined since mid to late 2023, while net earnings per share (EPS) have been struggling since mid-2022. This is far from what one would expect from a company that should logically thrive in the current environment.

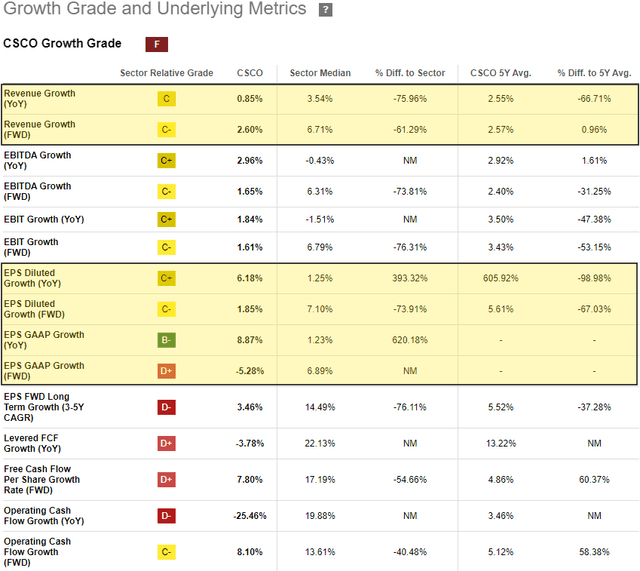

The Seeking Alpha quant rating for CSCO’s growth is “F”

SA growth grade (Seekingalpha.com)

While I think an “F” is a bit undeserved, I am not pleased with what I see here. In almost all of the metrics, CSCO is below the sector and even its own medians. Interestingly, this is also the case for the forward (fwd) metrics. This indicates that analysts’ expectations for the future are also more disappointing than promising.

What is the problem? Why isn’t CSCO profiting off the current development?

Here is what the company itself says about this:

- Macroeconomic uncertainties: According to the latest earnings report, the current macroeconomic uncertainties cause a decline in the spending of its customers and therefore less demand for its products and services.

- Shift to cloud-based solutions: according to the management, there is an increasing trend of companies choosing cloud-based solutions and reducing the demand for traditional network hardware products.

- Integration of already delivered products: many customers are currently busy implementing and integrating products they have already purchased, reducing immediate demand for additional new purchases.

- Competition: CSCO has more and more competition which offers products and services cheaper and more specialized.

Here is my opinion on these reasons:

- Macroeconomics: While this is indeed an issue affecting many companies, it has not halted or slowed the demand for other AI-related products and services.

- Shift to cloud-based solutions: this is what I see as one of the main reasons for the poor performance of CSCO. I will get to this in more detail in the next paragraph.

- Integration of already delivered products: well, I could be wrong here, but isn’t this always the case? In the decades before, didn’t the customers need time to install the parts, too? Furthermore, it’s not as if CSCO experienced significant growth previously or delivered an unusually large number of products that would require installation now. Not a good excuse in my opinion.

- Competition: this is one of the biggest differences to the 90s-2000s time, in which CSCO had very little competition. Also, the whole products and services need to be way more specialized and not as “general” as in the beginning.

Shift to cloud-based solutions as a problem for CSCO

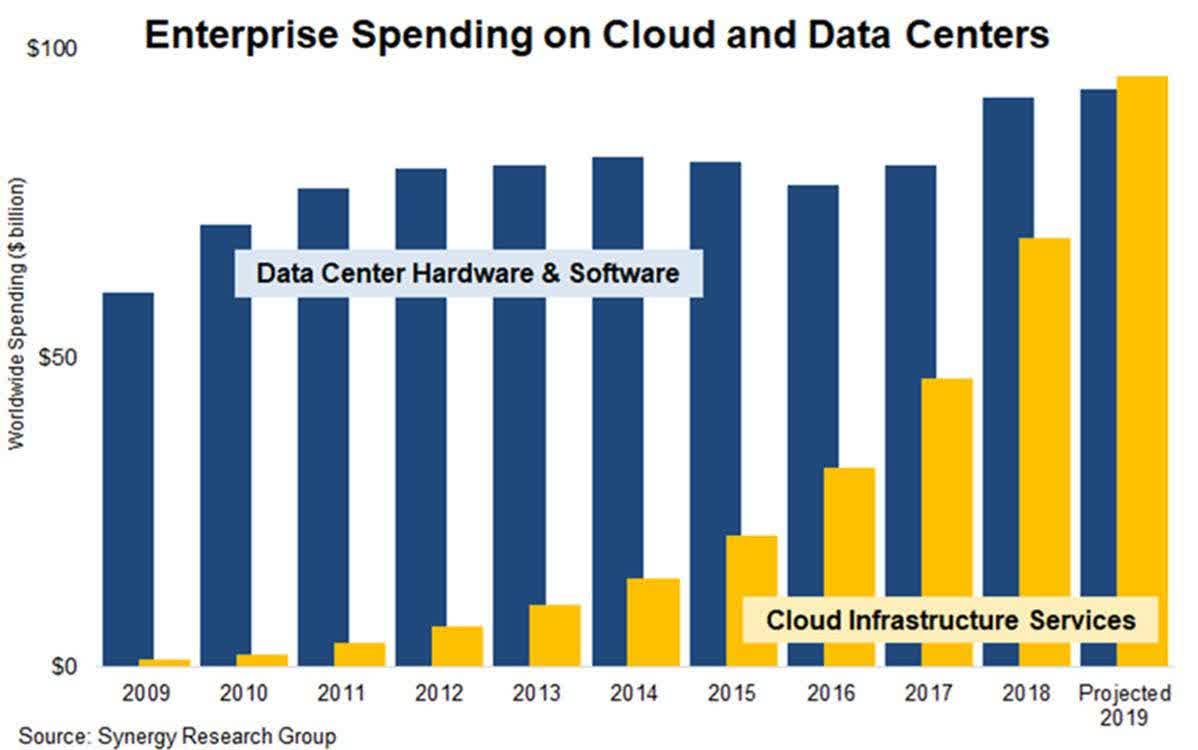

There definitely is a shift from hardware to cloud when it comes to data centers:

Enterprise spending on cloud and data centers (crn.com)

As illustrated in the chart above, this shift is not new. The growth in the cloud segment has been high and consistent since 2009 while traditional, hardware-based, data centers had less growth and stagnated in some years.

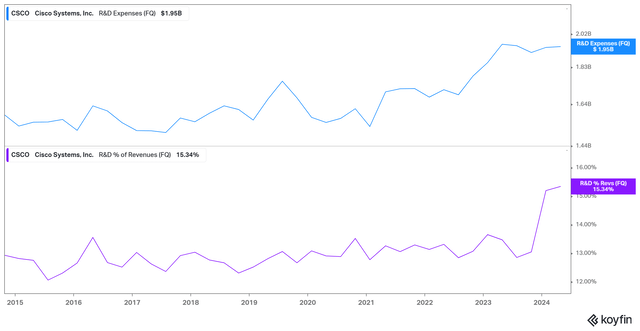

CSCO has been working on cloud solutions since 2011. However, it still constitutes a smaller portion of CSCO’s revenue. CSCO’s cloud products and services are mainly located in the software segment, which only makes for about 25% of the revenue. Therefore, I would say that cloud solutions aren’t the main competence of CSCO. Furthermore, I am a bit disappointed in the research and development (R&D) development of CSCO:

As you can see, the R&D expenses stayed the same for most of the last 10 years. Only since the end of 2022, have the R&D expenses grown. But the % of R&D expenses of revenue stayed the same until this year, when revenue fell and therefore the percentage grew. I would have preferred to see more aggressive R&D spending on cloud solutions. Especially since CSCO is quite cash-rich and has a strong balance sheet.

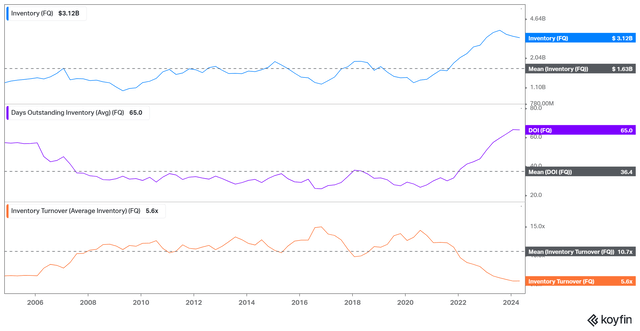

The inventory development of CSCO shows the result of the shift to cloud solutions and some other stuff like macroeconomics:

Inventory development of CSCO (Koyfin.com)

Since mid-2020, CSCO has faced issues with its inventory. The amount of inventory sharply increased to unprecedented levels, far above the average of the last 10 years. The days outstanding for the inventory, the amount of time CSCO needs to sell inventory, also rose sharply and currently sits way above the 10-year mean. Inventory turnover, a metric that measures how effectively a company sells its inventory, consequently also declined and is currently well below the 10-year average. Much of this development occurred after AI became a major global topic.

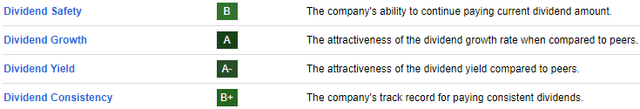

There is stuff to like about CSCO

CSCO is not as negative as it might appear based on the initial part of this article. CSCO has something going for it. It has an S&P rating of AA-, a strong balance sheet, high profitability, and pays a reliable dividend.

SA profitability grade (seekingalpha.com) SA dividend grade (seekingalpha.com) Debt Analysis, Interest Rate Coverage, Debt Coverage, Bankruptcy Risk (Koyfin.com)

Regarding the strong and secure balance sheet, although the development over the last twelve months (TTM) has been somewhat negative, I would still consider CSCO a relatively safe company.

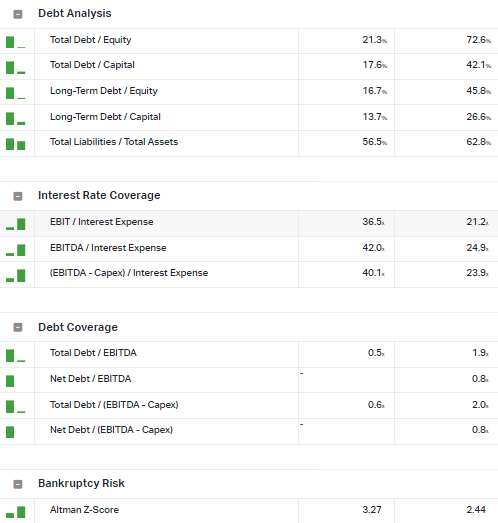

CSCO also has favorable valuation metrics, with an SA grade of B. The forward P/E is at an all-time low. According to Fastgraphs, CSCO currently trades below its historical P/E mean of 14.25x.

Stock price vs valuation (Fastgraphs.com)

Looking forward, CSCO would reach a yearly total return of 10.5% by the end of 2026 when it returns to its 10-year P/E mean of 14.07x and the analyst’s expectations are met:

CSCO forecasting (Fastgraphs.com)

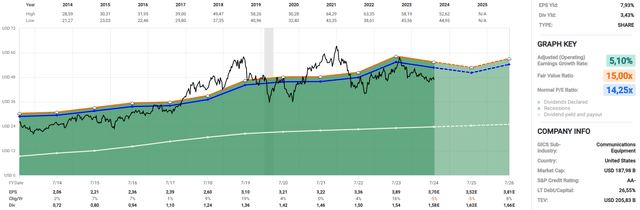

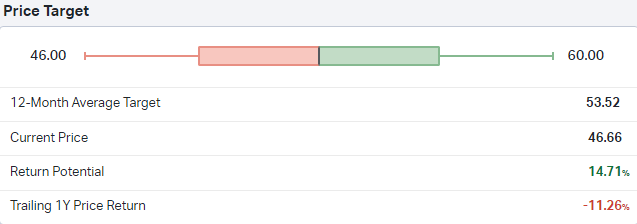

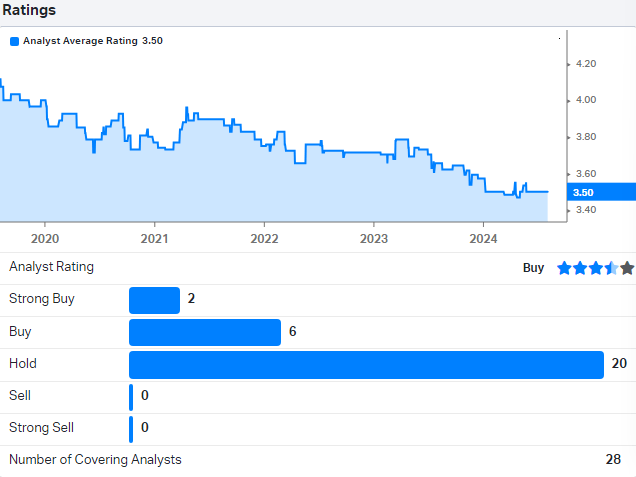

An average of 28 analysts projects a potential return of 14.7% over the next twelve months, with 20 analysts rating the stock as a hold, 6 as a buy, and 2 as a strong buy.

Analysts rating (Koyfin.com) Analysts rating (Koyfin.com)

As you can see, the average rating of analysts has consequently declined since 2019, steepening since the start of 2023.

Conclusion

Although the stock has some positive aspects, I believe CSCO is not well-positioned to capitalize on AI, the most hyped technology of recent times. Additionally, beyond AI, I think CSCO has lost the race for cloud solutions and is at risk of being overtaken by competitors. With the ongoing shift to cloud-based solutions and the resulting decline in demand for CSCO’s hardware-based solutions, I don’t foresee better years ahead for the stock unless CSCO makes significant advances in cloud-based products and services. Before considering an investment in CSCO, I would like to see positive developments in their shift to the cloud.

Given that CSCO remains one of the largest players in the sector and has some positive aspects, I rate it as a hold. However, it is not a buy, especially for those interested in investing in AI stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.