Summary:

- Cisco Systems’ Q3 earnings showed a slight increase in revenue and beat analysts’ expectations on both the top and bottom lines.

- The company’s product revenue declined during the quarter, but is expected to show growth with the recent close of their acquisition Splunk.

- Cisco’s well-covered dividend and frequent buybacks make it an attractive investment, especially with its low forward P/E ratio.

- I expect the company to get back to solid growth in 2026 & beyond.

- CSCO also offers strong upside potential for long-term investors. This growth can will likely lead to higher dividend increases.

jejim

Introduction

Cisco Systems (NASDAQ:CSCO) is a company that’s long been on my radar. And although I never watched them too closely, I’ve always kept an ear to their earnings and briefly reviewed their financials. I was actually a shareholder briefly a while back before selling my position.

Since their latest Q3 earnings, I’ve revisited the company, and due to their strong fundamentals, and growth potential, I am bullish and decided to open a position. I also take a look at the company’s recent earnings, fundamentals, and reasons why Cisco may be a dividend stock that rewards investors in 2026 & beyond.

Brief Overview

For years I’ve had familiarity with Cisco Systems as many Information Systems Technicians, or ITs in the Navy often work for the company after retirement with their computer backgrounds.

Cisco has been around since the early 80’s and went public in 1990. The technology company was one of the largest in the late 90’s/early 2000’s with a market cap over $500 billion. The tech company grew fast in the 90’s like many businesses in the information technology sector before the Dot-Com Bust caused the share price to crash and it has never recovered.

Cisco sells and manufactures internet protocol & networking products to the IT industry in the U.S and beyond. This includes: Europe, The Middle East, and China. They operate in various segments: Cloud, Security, and Software.

Cisco

Latest Earnings

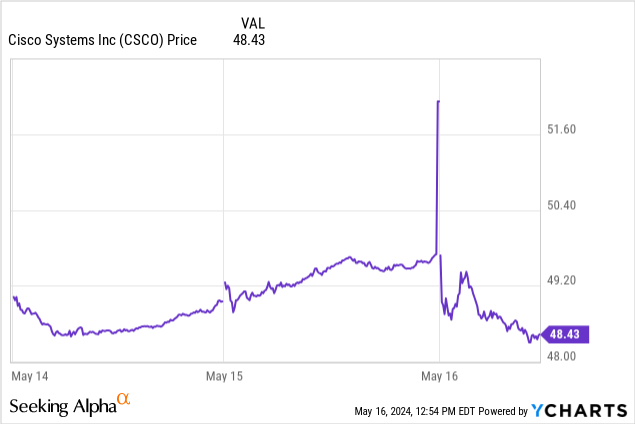

Cisco reported their Q3 earnings on May 15th and the share price quickly rose before coming back down to slightly above $48 where it currently trades. Investors were optimistic as the tech company raised their full-year guidance, something that usually sparks a positive response in the market. In the chart below you can see CSCO’s share price pop above $52 briefly.

On the other hand, slashed guidance can also illicit a response from the market as well, although this is usually negative met with a share price decline, similar to Starbucks (SBUX) when they slashed their full-year guidance for FY24.

Cisco however raised theirs and now expects revenue to come in at $53.6 billion – $53.8 billion, up from $51.5 billion to $52.5 billion prior. And although expected revenue growth is great for the company to be able to raise guidance, this is still down from the near $57 billion in revenue for FY23.

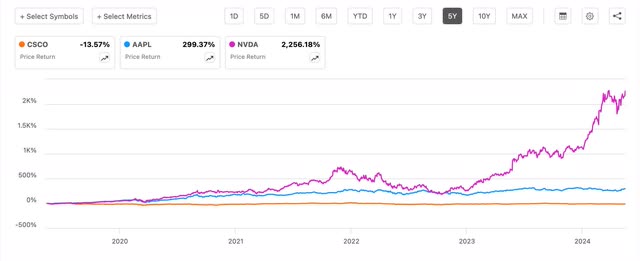

I think the market realized this, causing investors to curb their optimism. For a company like CSCO, their slow growth has stunted their share price growth while other tech giants like Apple (AAPL) and Nvidia (NVDA) have seen some strong growth recently. Cisco is down double-digits in the past 5 years while both peers have enjoyed strong price returns at nearly 300% and 2300% respectively.

Seeking Alpha

Another reason for the quick jump in price is they managed to beat analysts’ expectations on both the top and bottom lines. EPS of $0.88 beat by $0.06 while revenue of $12.7 billion beat the $12.63 billion consensus. EPS also ticked up from the prior quarter by $0.01 while revenue declined slightly from $12.79 billion

Furthermore, earnings & revenue both declined on an annualized basis from $1.00 and $14.57 billion. I usually start getting skeptical when companies post year-over-year declines. But for reasons I’ll get into later, I expect CSCO to post some solid growth in the years to come.

|

Q3 ‘23 |

Q3 ‘24 |

|

|

EPS |

$1.00 |

$0.88 |

|

Revenue (In Billions) |

$14.57 |

$12.7 |

Declining Segment Revenue Also A Concern

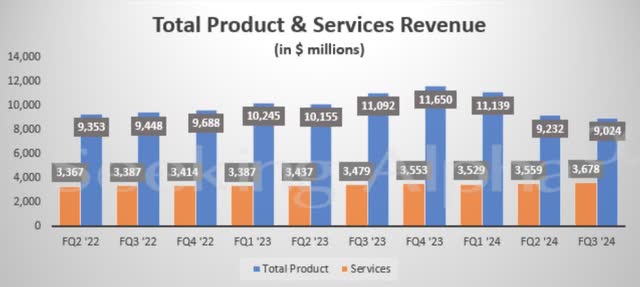

During Q3 however, product revenue fell 19% from roughly $9.2 billion to $9 billion. Service revenue ticked up slightly to $3.7 billion from $3.6 billion in the prior quarter. Their largest product category, Networking, also declined 27%. Management attributed this to implementation of inventory. But looking out over the longer term, I expect these to show growth with the close of their largest acquisition to date, Splunk.

Seeking Alpha

Because CSCO just closed on this during the recent quarter, the company needs some time for the acquisition to become accretive and show growth. This is definitely something I will be keeping an eye on going forward. On an annualized basis, product revenue also declined from roughly $11.1 billion while services revenue grew over the same period.

Margins & Geographic Segment Improvement

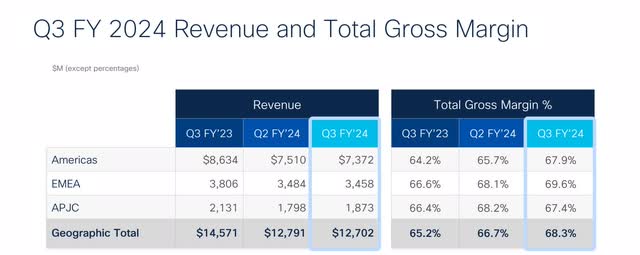

Sifting through the declines in product & services revenue, Cisco did show improvements in its margins during the quarter. Product gross margins were up slightly to 66.9% from 66.5% during the beginning of the year in Q1.

Total non-GAAP gross margins were also up to 68.3% from 67.1% over the same period. For comparison purposes peer Arista Networks (ANET) non-GAAP gross margins during their Q1 were 64.2% while their operating non-GAAP margins were 47.4%. For Q4 non-GAAP gross margins are anticipated to drop slightly to a range of 66.5% – 67.5% while non-GAAP operating margins are expected to be 31.5% – 32.5%. ANET also expects margins to decline to 64% and 44% respectively in Q2.

|

Q1 ‘24 |

CSCO |

ANET |

|

Operating Non-GAAP Margins |

66.5% |

47.4% |

|

Product Gross Margins |

66.9% |

64.2% |

Additionally, on an annualized basis, service non-GAAP gross margins were up 340 basis points while non-GAAP operating margins were up 30 basis points to 34.2% Geographically, CSCO’s segments also showed improvements year-over-year with the Americas up 6% and EMEA up 4%. APJC was down slightly at 1%.

All three showed strong growth from the beginning of the year as Americas was down 19% during Q1 while EMEA & APJC were down 13% and 38% respectively. Total gross margins also improved year-over-year for all three locations.

CSCO investor presentation

AI Potential

It’s no secret AI is the next big thing. And with the $28 billion Splunk acquisition, Cisco looks to capitalize on this going forward. Management stated during the beginning of the year that the AI switching market is expected to exceed $10 billion in the next three years.

Regarding growth and AI timing their CEO spoke about this during earnings stating they we’re going to start low at the beginning of 2025, and expect it to ramp later in the year. But that 2026 will likely be the year that CSCO see strong growth

Additionally, the company introduced Cisco Hypershield, an AI-native cybersecurity solution, expected to be woven into the company’s fabric. This is expected to defend AI-scale data centers, providing protection to businesses from constant security threats. This is anticipated to revolutionize security both on-premises and cloud environments. The first shipment is scheduled for this upcoming August.

CSCO

Strong Capital Returns

Another reason I decided to open a position in Cisco is the company’s well-covered dividend and frequent buybacks, returning capital to shareholders. Although I would expect a larger dividend increase than the $0.01 increases the past few years, their share repurchases show the company’s strong financial position.

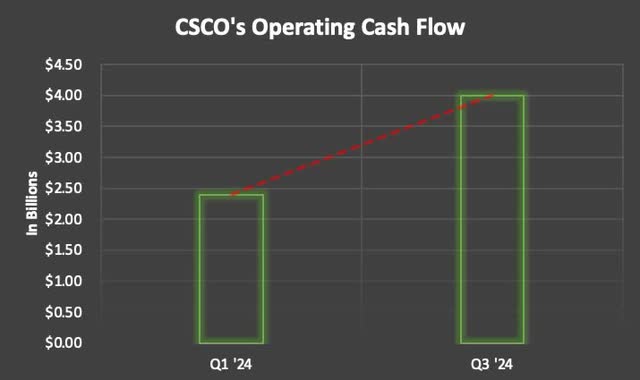

During the quarter, they returned $2.9 billion through buybacks and dividends. YTD they’ve returned a total of $8.5 billion. And the $0.40 dividend was well-covered with operating cash flow of $4 billion. This grew from $2.4 billion in the first quarter of the fiscal year.

Author creation

Management has been taking advantage of the company’s suppressed share price, opportunistically buying back shares. Last FY they repurchased 88 million shares and over the past decade having bought back more than 1 billion. Not including repurchases, CSCO’s free cash flow payout ratio is less than 50%.

This gives them ample room for larger increases, which I think is likely giving the recent acquisition and expected growth over the next 2 years or so. CSCO does have a respectable track record of dividend increases and I think the company will get back to larger dividend increases while slowing down their buybacks. This should lead to higher share price growth in the future as well.

Furthermore, they had ample liquidity on their balance sheet at $18.8 billion. This declined from $23.5 billion in the beginning of the year as a result of the Splunk acquisition and capital allocation strategy. They also have more cash than current debt, and this is minimal in comparison to their market cap of $195 billion.

Upside Potential

With a forward P/E of roughly 13x, I think the stock is compelling at current levels, especially for long-term investors. It also trades below CSCO’s 5-year average of 14.37x and the sector median’s near 24x. Additionally, this is much lower than the forward P/E of roughly 41x from peer Arista Networks.

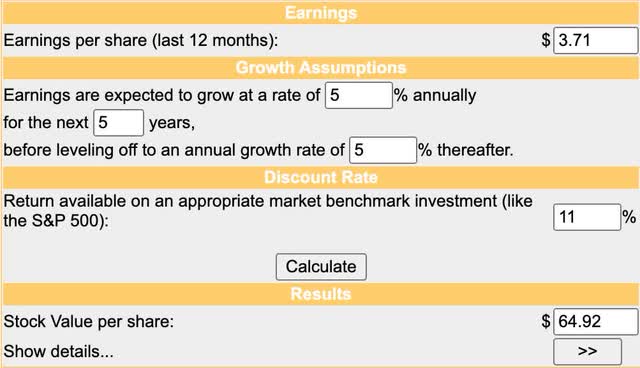

As a result of its slow growth, and volatile financials, I think the market is pricing the tech giant much lower in comparison to its newer peer ANET. But this presents a great entry price if you believe in the company’s turnaround with the recent Splunk acquisitions and move into the AI space. Using the Discounted Cash Flow method, I have a price target of roughly $65 for CSCO.

moneychimp

Of course, this is over the longer term. But I expect CSCO to get back to growth over the next two years. Looking at their earnings estimates, the company is expected to post growth of roughly 8.5% in 2026 and roughly 16.5% in 2028.

To manage expectations and curb enthusiasm, I decided to use a 5% expected growth rate, which I suspect CSCO can achieve if their recent acquisitions pan out. Moreover, this gives patient investors double-digit upside and a well-covered dividend while they wait. Additionally, Wall Street rates them a buy with a high price target of $76.

Risks & Bottom Line

Cisco has been a slow moving stock down more than 5% over the past 5 years. The company has been making acquisitions to get back on the path to growth, which I think is the right move. However, if margins and segment revenue continue to decline and their recent acquisitions don’t provide some level of growth, this could lead to further price declines.

Additionally, the company faces growing competition from competitors like Arista Networks who IPO’d only a decade ago and already has 9000+ customers. For now however, I think the biggest risk to CSCO is the company itself. With growth expected to happen sometime in 2025 according to management, their share price will be impacted by margin & revenue growth in the coming quarters.

If this continues to move downward, their share price will likely follow. And the company will continue to be lapped by competitors. But as mentioned previously, I think the company can turn the ship around for positive growth somewhere near the end of 2025, beginning of 2026. As a result of this, I am bullish on the company and rate them a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSCO, SBUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.