Summary:

- Cisco Systems, Inc. is the latest addition to my YARP dividend stock portfolio.

- At a time when tech stocks are exciting, this formerly exciting business is now a mature, high quality company at a nice valuation.

- It is not easy to fit tech stocks into a dividend portfolio, but Cisco Systems makes the grade now.

Alexander Koerner

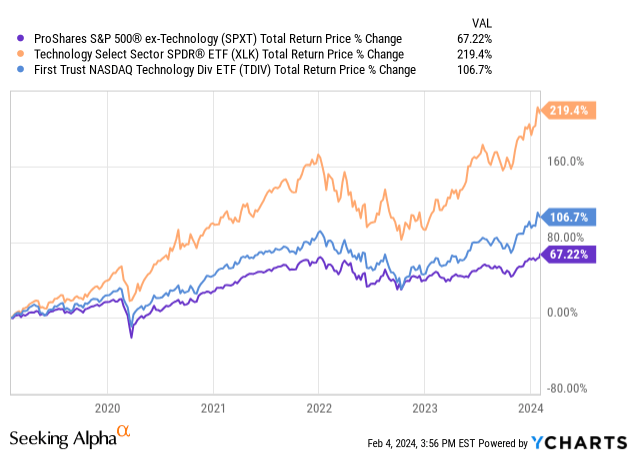

For the better part of the past decade, the U.S. large cap stock market could be summarized simply: technology stocks win. Just look at the performance of the tech sector of the S&P 500 (orange line) versus the other 10 sectors combined (purple line) in the chart below. If this were a courtroom, the purple line would plead “no contest.” OK, I’m not an attorney and I don’t exactly know what that means without looking it up, but the idea is that tech stocks have left the rest of the market in the proverbial dust. And after all, the market is a courtroom of opinions if there ever was one.

Also in that chart below is an exchange-traded fund, or ETF, that represents a basket of tech stocks that pay dividends, since many of the largest tend not to, or pay very low yields. That means that dividend investors cannot just buy up a bunch of mega cap tech leaders and count on much dividend. Not unless the denominator is very, very large (e.g., if you get 1% dividend yield on $100 million, that’s $1 million a year in dividends).

Dividend-paying tech stocks (blue line) have easily outperformed the non-tech market (that purple line) during this period, but that outperformance has all come since the autumn market bottom (for tech, more so than the other sectors) in 2022. And, while the returns of all 3 lines below are solid compared to long-term stock market returns, the fact is that that big tech has won. And, it has crowded out so much dividend and valuation analysis of other stocks.

There are even some big tech stocks that have missed out on that more recent tech-led rally and are solid businesses that now appear to me to be long-term undervalued. One of those is Cisco Systems, Inc. (NASDAQ:CSCO), which for those who are too young to remember, was on investors’ lips about as much as Google (GOOG) is today. But today, not so much.

I recently added CSCO to my Yield At a Reasonable Price (“YARP”) dividend portfolio, the first tech stock to enter that live money account I recently started for myself. My case for this former dot-com era darling is outlined below. This recent article describing YARP will serve as a refresher or initiation to those who have not read my work on it before. Note that while I find little to love about most of today’s U.S. stock market, there are some stocks that I consider worthy of taking a shot with, knowing that most of my portfolio is a fortress-like collection of T-bills, long-short ETF portfolios I have written on across hundreds of articles on Seeking Alpha, a small but mighty options account, and now the start of a YARP account (which includes a “tail risk” hedge itself).

CSCO: my latest YARP buy

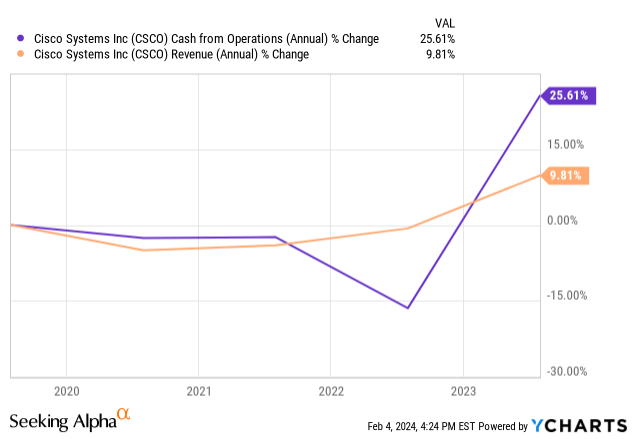

CSCO has had a fall from grace, despite the growth rate of 2 key fundamental items, cash from operations and revenue, that have recovered nicely from the pandemic period’s dips.

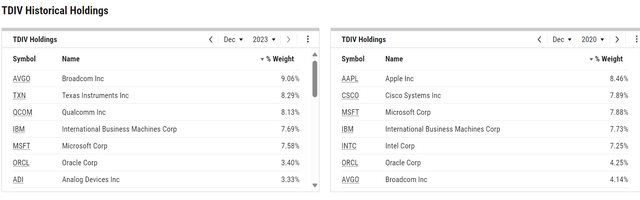

But the stock has not reflected that. In fact, partly due to the stock price success of some big tech rivals, and due to investors’ relatively sanguine attitude toward a now-mature CSCO, it has fallen out of the top 10 holdings of that tech dividend ETF. This table shows December 2023 (CSCO is below the top 10) versus just 3 years ago, when it ranked right below Apple (AAPL). That fall from grace shows up in many different ways, including not so obvious ones like this.

There are many outstanding fundamental analysts on this platform, and a terrific quant grading system. So as a reminder, I am not the guy you look to for detailed fundamental or quarterly earnings analysis. If anything, I complement that analysis found elsewhere with my technical-quantitative-YARP style of stock selection and allocation. I am a portfolio manager and investment strategist by trade, with technicals driving every final decision. So, what do I see in CSCO now?

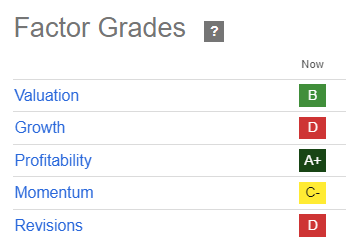

Factor grades only a YARP investor could love

CSCO remains a highly profitable company. In many cases, since my YARP methodology essentially takes a large universe of such stocks and then overlays dividend and price-driven metrics that translate to a rating and in turn to buy/sell decisions, that’s the one factor I need to be high. A+ is high enough!

Seeking Alpha

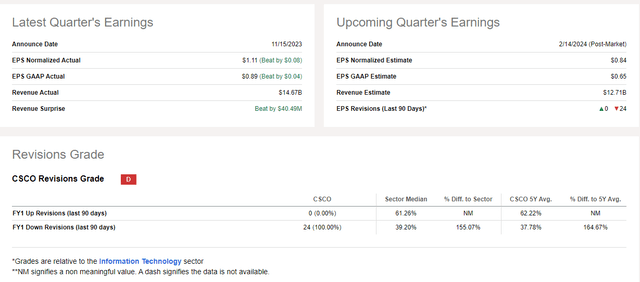

Valuation of B or better is preferable. I’d like to see a bit more momentum, but like I said above, that’s hard to find. Stock investing today (outside of trading FAANG names) is a proverbial “hit your head against the wall repeatedly” exercise, trying to find names that can go up in price with some sustainable pattern to them. Instead we get a lot of “fakeout breakouts,” and though CSCO just fell back sharply after a quick 10% runup (so typical of today’s market), I am eyeing the upcoming February 14 earnings announcement as another potential risk that CSCO turns even redder on Valentine’s Day.

As noted above, if you are looking for a detailed preview or analysis of a company’s quarterly earnings or a reaction to the earnings from a fundamental standpoint after they are released: kindly look elsewhere. Because I hate disappointing people and you’ll be disappointed if that deep dive is what you are after. Many other analysts on this platform are better at that than I am.

My attempt at adding alpha in stock analysis, as it relates to earnings, is to use my technical and quantitative analysis process I’ve honed over more than 30 years to manage money professionally.

As it relates to CSCO’s upcoming earnings, see below for the details. The only information that I feel is “actionable” in relation to a YARP analysis is the only thing that should matter to many investors: how does the earnings news impact price. That’s it. The rest is just people trying to sound smart (and many of them are smart!).

We are just over a week out from that announcement and the stock has pulled back 6% in recent days. That might have to do with general market weakness, the fact that analyst earnings revisions have come down in unison (D grade for revisions, with 24 changes the past 90 days, every darn one of them a downward change). Or it could have to do with factors beyond the norm, such as money flowing out of index funds that CSCO is a big holding in, including some big ones.

My out-of-consensus take on quarterly earnings (for CSCO and generally)

And after earnings are released, the stock will react. Up, down, both? Maybe all within 24 hours of the news. And the debate will ensue about whether it was a “beat” on earnings” or a “miss.” And then the headlines will fade and the market will move on to the next shiny object in its view. That’s modern Wall Street. It is very different than what we had last century.

CSCO might be the best of a bad bunch in that it is a tech stock with yield, because its price has not flown higher with the big ones. There’s no C in FAANG, if you will. But since YARP is more an intermediate-term yield-seeking strategy with a secondary momentum component, and CSCO is already over the bar from a longer-term fundamental quality standpoint, and I have no control over the market’s REACTION to earnings, I don’t spend time on that type of parlor game as many others do.

Those are short-term hurdles and I’m sensitive to them, but again, I look at CSCO as only the 5 holding in a portfolio that will eventually have 25 or more. The rest of it is in T-bill ETFs right now, so the overall YARP portfolio equity exposure is mild.

A rare tech stock whose yield amounts to something

So is CSCO’s P/E Ratio on GAAP earnings compared to the past 5 years. In fact, if I were charting this as a price, I’d spot a potential “quintuple bottom” in range around 14x trailing earnings.

I am not one of those who fawns over stocks just because they have paid or raised their dividend for decades. If the yield after all of that good stuff is only 1.5% or so, the stock has already rewarded investors and I’m likely too late.

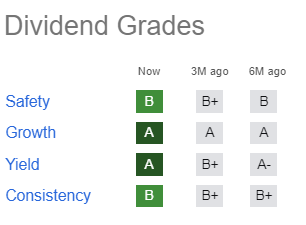

CSCO’s dividend grades check out. I’d like an A safety rating, but again, this is not a market where everything is on sale, so I have some give and take with any stock. And, as noted in prior articles, YARP dividend investing is not usually buy and hold for years. Rotation among the large potential watchlist of names is the key to collecting a lot of dividend payments and avoiding major drawdowns.

Seeking Alpha

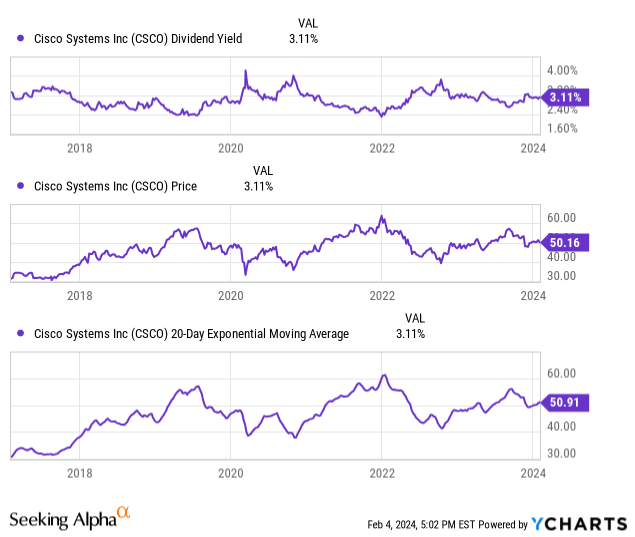

CSCO: YARP snapshot and conclusion

Above is a convenient little “snapshot” report I developed and will use as a staple of my YARP stock reports at Seeking Alpha going forward. It shows 3 things, which I’ll describe to finish this CSCO analysis.

First, the trailing 12-month dividend yield over the past 7 years. Ideally, I want to see the yield toward the top of that range and starting to fall, which is akin to the price rising. CSCO is not the most timely I’ve seen, but it is enough to allow me to get a tech stock in the YARP portfolio.

The price has gone nowhere since 2019, and that’s actually a long-term attraction point, albeit not one that helps with the timing aspect of this analysis. And the 20-day moving average is trending up since late 2022 like the tech sector overall, but it is a slow process, not more like the “swoosh” pattern I’d like to see (think Nike’s symbol). Still, beggars can’t be choosy in this market, and I’m trying to get toward at least a partially filled portfolio.

Tech investing can’t always be as pretty as bragging about your low-yielding FAANG stocks!

CSCO is a buy rating for me, with the usual YARP caveat that I am more likely to “rent” a stock multiple times over a 3-year time frame than “own” it straight through.

CSCO has been out of the spotlight and has dropped off the radar of some investors. Not me. Now yielding in 3.1% area, with the tech sector yield at 0.7%, Cisco Systems, Inc. makes it over the bar and into my YARP portfolio for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.