Summary:

- Cisco Systems has been left behind in the market dominated by AI, but it is a misunderstood company with potential.

- Despite facing competition and being perceived as “dead money,” CSCO has a solid financial foundation and strong operational performance.

- CSCO is like a technology utility, offering a low-single-digit yield, dividend growth, and potential for future growth.

PM Images

In a market focused on growth with Artificial Intelligence ((A.I.)) dominating the narrative, traditional technology companies such as Cisco Systems (NASDAQ:CSCO) have been left behind. More than 2 decades ago, CSCO had a market cap of $482 billion, making it the 2nd largest company in early 2000, and Paul Weinstein of Credit Suisse First Boston said it had the potential to become the first company valued over a trillion dollars. A lot has changed since then as shares of Microsoft (MSFT) went in one direction while shares of CSCO went in another direction. MSFT watched its market cap expand from $568 billion past $3 trillion, while CSCO’s market cap is less than $200 billion 24 years later. Despite CSCO’s growing revenue and profitability while returning a tremendous amount of capital to shareholders through its dividends and buybacks, the glory days haven’t returned for it. The same way I was bullish on International Business Machines (IBM) when so many felt it was dead money, I am bullish on CSCO. I think CSCO is a misunderstood company, and investors are looking over its fundamentals and profitability. Despite being looked at as the poster child for the dot-com bubble that never got back to where it once was, I still believe there is an opportunity for investors. I am looking at CSCO as a technology utility as its track record for dividend growth and modest yield is attractive while trading at a discounted valuation. Eventually, value stocks will come back into play, and I think this overlooked technology company of yesterday can catch a bid as capital flows back into the markets.

Following up on my previous article about CSCO

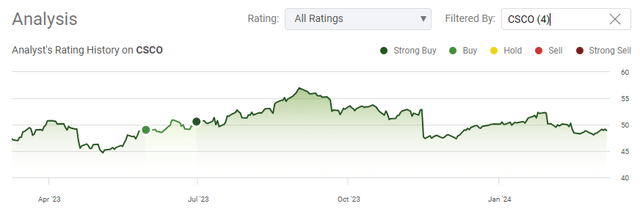

In my previous article about CSCO, which was published on June 30th, 2023 (can be read here), I discussed how CSCO was entering the A.I. race and why I felt shares were undervalued. So far, my investment thesis hasn’t played out the way I thought it would, as shares of CSCO have declined by -4.59% while the S&P 500 has appreciated by 15.88%. After the dividend is factored in, CSCO’s total return since that article has been -2.42%. I wanted to follow up on that article now that 2024 is upon us and discuss why I am still bullish on CSCO. IBM was dead money for years before it caught a bid over the past year, and I think shares of CSCO can be a good investment if you’re willing to wait things out.

Risks to investing in CSCO

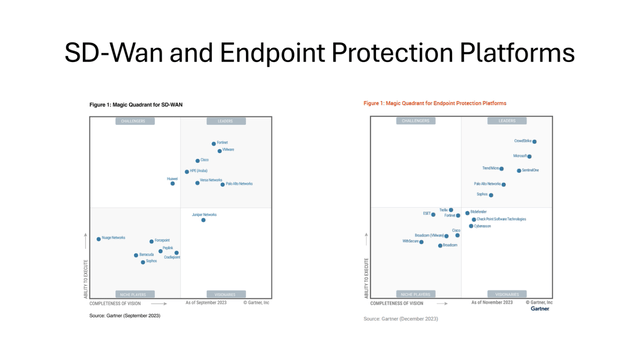

While CSCO is a massive company that has generated $57.23 billion in revenue and $13.44 billion in net income over the trailing twelve months (TTM) there are significant risks to my investment thesis. CSCO is facing immense competition in every sector in which it operates, and its diversification into software and services is facing considerable opposition from its peers. CSCO is no longer the 800-pound Gorilla in the room as in SD-WAN it’s a leader but is consistently competing against companies such as Fortinet (FTNT), and Palo Alto Networks (PANW), and in Endpoint Protection Platforms CSCO is a niche player compared to MSFT, CrowdStrike (CRWD), and SentinelOne (S). CSCO runs the risk of losing clients to an array of technology companies and always has to defend its territory. Unlike a company such as Meta Platforms (META), which has a large moat around its business, CSCO has to constantly stay in lockstep with the pack. There is also an opportunity cost when investing in CSCO, as many perceive it as dead money. There is the possibility that shares of CSCO will continue to go lower or trade sideways while the market continues to rally.

Why I believe CSCO is a misunderstood gem that can dazzle investors if looked at through a different lens

My feeling is that when investors see the name Cisco Systems, they associate it with boring networking equipment and a company that’s best days were more than 2 decades ago. Being known as a company that still hasn’t recovered since the dot com bubble burst has certainly not helped the narrative. I challenge the investment community to put any negative stigmas they may have associated with CSCO aside and tear through the financials with an unbiased lens. Businesses can have many goals, but at the end of the day, all companies are focused on the financials and turning a profit. When we allocate capital toward buying shares of a company as investors, we become an equity owner in that business, as each share represents a portion of the earnings and revenue generated. We are essentially paying the current value for all the future cash flow that the business will produce during the duration of our investment. When I look through the financials, CSCO is a company that looks massively undervalued, and from a fundamental perspective, I am shocked that it trades at this low valuation.

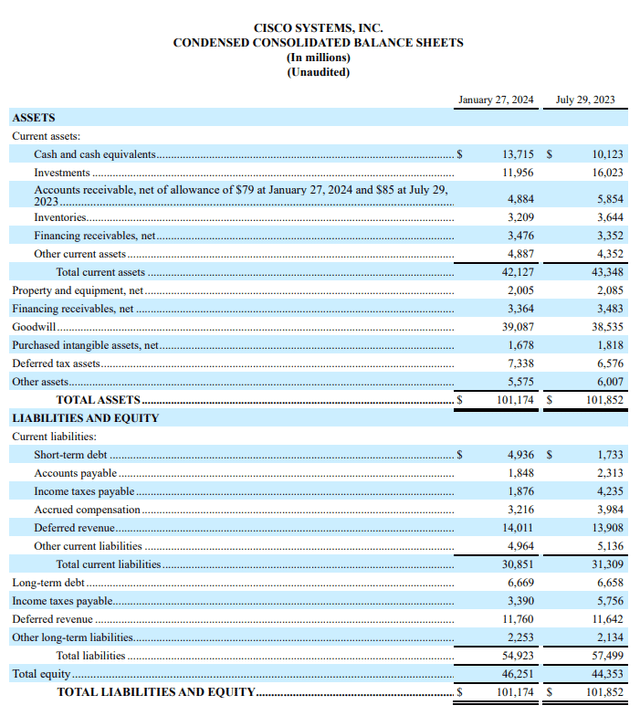

Frist, I want to start with the balance sheet to establish the financial health of the company. CSCO has $4.94 billion in short-term debt that comes due in 2024, with another $6.67 billion in long-term debt on the books. In total, CSCO has $11.61 billion in total debt on its balance sheet, which isn’t much for a company with a market cap of $197 billion. CSCO has $13.72 billion in cash and cash equivalents in its current assets, which could be used to eliminate 100% of its total debt, and it still has $2.11 billion in cash left over. In addition to a large stockpile of cash on the books, CSCO also has an additional $11.96 billion in investments. From its combined liquidity position, CSCO has just over $10 billion sitting in money market accounts, with an additional $2.4 billion in government securities, $5.14 billion in corporate debt securities, and $1.93 billion in U.S. agency-backed mortgage-backed securities. The remaining cash is spread across commercial paper and other investments. Over the past 12 months, CSCO has generated $1.26 billion in interest and dividend income from its liquidity utilization. When shares of CSCO are purchased, the investor is getting a solid financial foundation that has minimal leverage and its generating just over $100 million per month in interest and investment income.

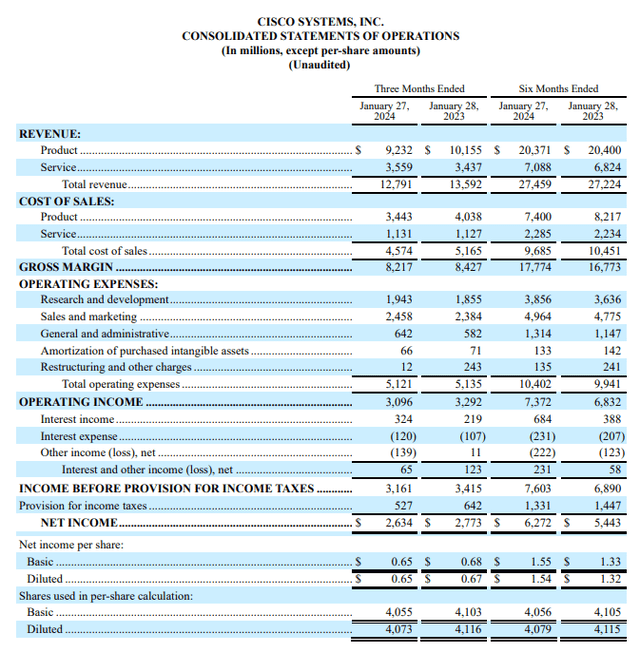

From a business operation standpoint, there isn’t much to complain about with CSCO. In the TTM, CSCO has generated $57.23 billion in revenue and has produced $13.44 billion in net income. In their 2024 fiscal year, CSCO has completed its first 6 months of operations. CSCO is improving its margins as revenue has increased by 0.86% to $27.46 billion, while its cost of operations has decreased by -$305 million to $20.09 billion. CSCO’s cost of revenue decreased by -$766 million in the first 6 months YoY while its total operating expenses increased by $461 million. From a margin perspective, CSCO is firing on all cylinders as they generated a $17.77 billion gross profit at a 64.73% margin while their profit margin was 22.84% as there was $6.27 billion in net income generated. CSCO’s gross profit margin has increased by 5.97% YoY, while its profit margin increased by 15.93% YoY in the first 6 months of operations. This has led to $1.55 per share in EPS, which is up 16.54% ($0.22) from where it was last year.

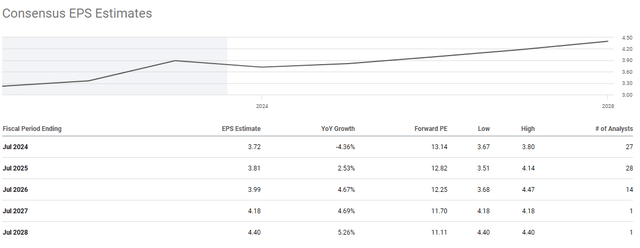

Operationally, CSCO is a powerhouse, but Wall Street didn’t like the forward guidance. I am more focused on the long-term viability rather than what a company may do over several quarters. CSCO guided for $3.68 to $3.74 in EPS per share on an adjusted basis and between $51.5 and $52.5 billion in revenue. The Street was looking for $3.86 in earnings for the full year from $54.41 billion in revenue. I think this is an opportunity as CSCO has solid financials, and this is a case of The Street and CSCO not being on the same page. This doesn’t mean that CSCO won’t deliver on The Street’s expectations in the future. CSCO is looking to cut roughly 5% of its workforce and realign the organization to focus on growth. Analysts are expecting EPS to decline in 2024 and then grow at a mid-single-digit rate over the next several years. Today, shares of CSCO are trading at 13.14 times 2024 earnings and 12.25 times 2026 earnings. When I think about companies with the combination of a clean balance sheet and large profitability that trade under 15 times 2024 earnings, the list is very slim. I think that it may take several quarters, but CSCO could be an extraordinary value play if it can capitalize on an organizational restructuring and beat on the growth estimates.

Cisco is basically a technology utility that continues to grow the dividend

There isn’t much to complain about when it comes to capital allocation as CSCO shareholders continue to receive dividend increases and share repurchases from the profits. In Q2, CSCO repurchased 25 million shares for $1.25 billion at an average price of $49.54. CSCO also paid $1.58 billion in dividends, which returned $2.84 billion to shareholders. CSCO continues to reward shareholders and plans to follow suit.

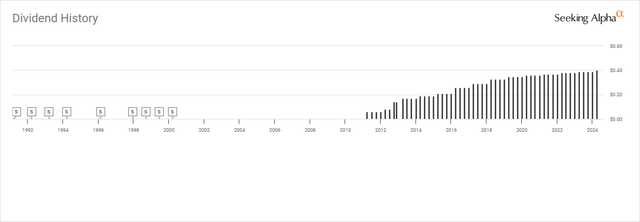

CSCO just announced its 12th annual dividend increase as it took the quarterly dividend up by $0.01 to $0.40 for an annualized dividend of $1.60. Today, shares of CSCO have a dividend yield of 3.27%. Over the past 5 years, CSCO has a dividend growth rate of 3.4%. This is why I feel that CSCO has become a technology utility company, as they are the backbone of many corporations and continue to generate a low-single-digit yield while giving shareholders an annual raise for over a decade. CSCO can continue rewarding shareholders through its capital allocation program and reinvest in future growth opportunities.

Conclusion

I think CSCO is a misunderstood value opportunity as the valuation is dirt cheap. Shares CSCO trade at less than 13 times 2025 earnings, and investors are getting a company that has more cash on hand than debt, a treasure trove of assets, and a business that generates over $10 billion in pure profits on an annualized basis. There are certainly risks to the investment thesis, and CSCO hasn’t done much over the past several quarters. I think that CSCO is an opportunity for patient investors looking for mature companies that generate income. CSCO should continue to generate a low single-digit yield and increase the dividend on an annual basis going forward, which is an incentive to wait for the restructuring to occur and for shares to turn the corner. CSCO may not have the flash but it has the ability to change The Streets narrative and trade at a higher valuation in the future. I am bullish on CSCO shares and plan on adding to my position as I feel shares should trade closer to $60 rather than $50.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSCO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.