Summary:

- Splunk executed a successful turnaround from perpetual license model to subscription sales with the help of Silicon Valley activist investors.

- Cisco plans to acquire Splunk for $157/share in cash, which we believe offers an opportunity to realize gains in SPLK stock.

- We move to a Distribute rating on SPLK. We sold our personal account Splunk LEAPs at the open and intend to sell our SPLK common stock holdings by the close of September 21.

amgun/iStock via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

It’s Great When A Plan Comes Together

We’ve covered Splunk (NASDAQ:SPLK) on these pages for some time now. When we were in short trousers here at Cestrian, we knew Splunk as a hot VC-backed private company, then a leader in machine learning. The company was a very successful investment which at IPO generated very significant gains for its prior investors. Eclipsing old-line sysadmin tools from companies such as BMC, the business went on to deliver excellent post-IPO stock performance too. Agog with its own glory, the then-management team forgot one thing about being the hot young thing in tech. Which is that if you’re not the predator, you become the prey rather quickly. SPLK failed to notice the shift to subscription pricing quickly enough, and found itself on the back foot, owning a mature revenue line with the company and its sales execs hooked on that good upfront perpetual license model. And as everyone knows, the kind of vegan satisfaction that arises from selling subscriptions that see revenue (and sales commission) recognized ratably over months and years? That just isn’t the kind of buzz that your old-fashioned, meat-eating enterprise sales team used to like to indulge in. With the shift to subscription sales in enterprise software, out went Presidents’ Club on Maui and in came basket-weaving workshops at the local wellness retreat. Yay.

Well, with the help of a number of Silicon Valley royalty investors, among them Silver Lake and Hellman & Friedman, Splunk executed a perfect turnaround from the old world to the new. Others have done something similar, earlier most notably Autodesk (ADSK), Cadence (CDNS) and Synopsys (SNPS), so the playbook was there, but we shouldn’t denigrate the achievements here. The activist shareholders and board members at Splunk tossed everything under the bus, including the prior CEO and CFO, on the way to subscription success.

You can read all our prior coverage of Splunk here. We made a bear call here with the stock at $199 in November 2020 and then our first bull call here with the stock at $141 in November 2021, with a number of subsequent bull calls at lower prices. Our finest bull call was here with the stock at $100 in March 2023.

Today, Cisco (NASDAQ:CSCO) announced its planned acquisition of the stock for $157/share in cash, to close next year. The stock has moved up to $144 at the time of writing. The $13 delta is merger arbitrage territory, which is not our game, so we move now to a Distribute rating on SPLK. In staff personal accounts we sold our holdings in SPLK LEAPs at the open and we intend to sell our common stock positions around the close of today.

As always with acquisition, a better bid could be around the corner. So in selling now – and in moving our rating to Distribute – we risk losing some upside. That’s fine by us. The company has been professionally sold, with Qatalyst Partners and Morgan Stanley as sellside M&A advisors, and if it was to be acquired by one of the LBO shops that hold stock already, we believe that transaction would have happened earlier this year when the stock had yet to launch. So whilst anything may happen, we’re happy taking the money to rotate into something else.

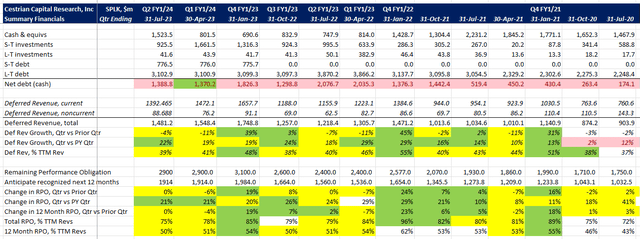

Is this a good deal for Cisco? Well, the company has rock-solid fundamentals and Cisco’s future surely lies in more software not more hardware. Splunk customers are sticky – it’s hard to unplug it and replace with newer vendors such as Datadog or Dynatrace, and it’s harder still to retrain staff who have learned to speak Splunk their whole careers. At $157/share, Cisco would be paying 7x TTM revenue for a business growing at 26% (and accelerating) with 17% unlevered pretax free cashflow margins and an order book (RPO) worth almost as much as the last twelve months’ recognized revenue? We don’t think that’s a bad buy for the acquiror. Particularly since, if the company continues to perform as it is, those valuation multiples will fall as time goes by between today’s announcement and the actual closing of the deal.

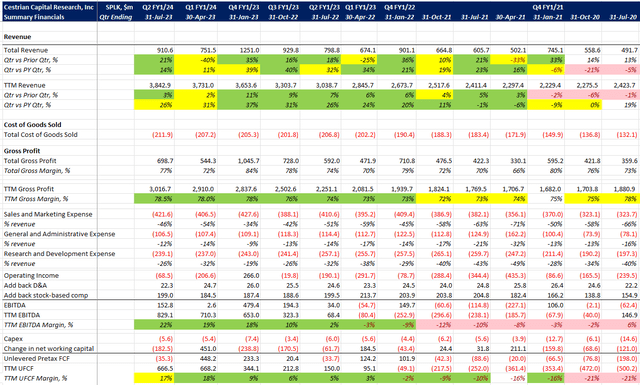

For the sake of form let’s just take a look at Splunk’s numbers. (In the valuation table below we include the current stock price, not the proposed acquisition price).

SPLK Fundamentals I (Company SEC Filings, Cestrian Analysis) SPLK Fundamentals II (Company SEC Filings, Cestrian Analysis) SPLK Valuation Analysis (Company SEC filings, YCharts.com, Cestrian Analysis)

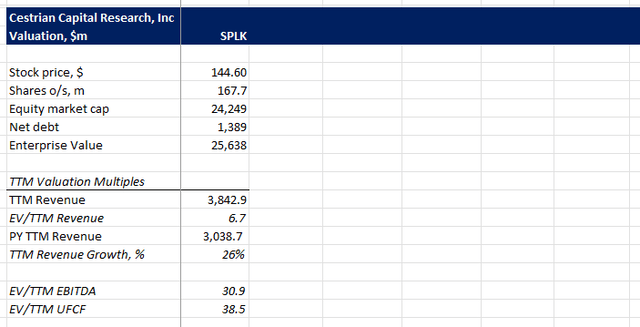

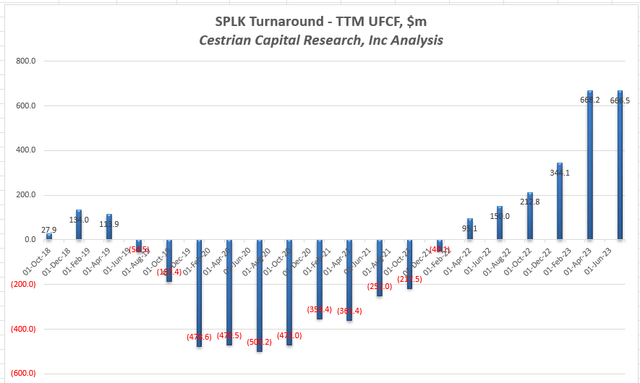

By the way – if you want to see what good looks like in a turnaround from upfront to subscription licensing? This is what good looks like.

SPLK Cashflow Analysis (Company SEC Filings, Cestrian Analysis)

Not too shabby.

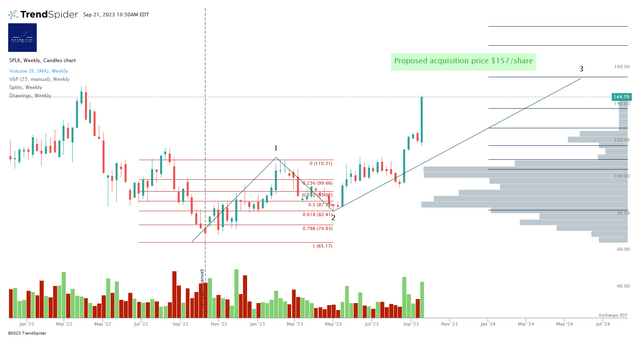

Finally – the stock chart no longer matters, but it amused us at least to see that the agreed sale price is almost to the dollar a classical Wave 3 high from the 2022 lows (specifically it is $1-$2 short of the 1.618 Fibonacci extension of the Wave 1 high placed at the Wave 2 low). We take that to be in-joke amongst the learned shareholders and advisors.

You can open a full-page version of this chart, here.

SPLK Stock Chart (TrendSpider, Cestrian Analysis)

So – we move to a Distribute rating on SPLK and consider this job done.

Cestrian Capital Research, Inc – 21 September 2023.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPLK, ADSK, DDOG either through stock ownership, options, or other derivatives.

Business relationship disclosure: See disclaimer text at the top of this article.

Cestrian Capital Research, Inc staff personal accounts hold long positions in SPLK, ADSK, DDOG. Those accounts intend to sell their SPLK holdings by the close of trading on 21 September 2023.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

NEW – LOW COST NEWSLETTER FROM CESTRIAN CAPITAL RESEARCH

Our Growth Investor Pro service remains the #1 trending service on all of Seeking Alpha. Choose from the basic newsletter at just $99 for your first year, or the full real-time service. You can learn all about it here including the wall of 5-star reviews we’ve received in bear and bull markets alike.