Summary:

- Cisco’s Q2 earnings have been impacted by increased competition and share loss in its core verticals.

- Supply chain constraints have resulted in pent-up demand that supported sales growth, but the growth trend in demand for Cisco’s routers and switches has been almost flat.

- I remained concerned about the enterprise IT spending outlook, as Cisco has a large exposure to the customer vertical.

- I currently maintain a hold rating on the stock with an end-of-year price target of $52.39.

raisbeckfoto

Thesis

Cisco Systems, Inc.’s (NASDAQ:CSCO) previous quarter earnings have been impacted by increased competition and share loss in its core verticals, as well as macroeconomic pressure. While the company has seen some success in improving its relative share in the cloud business, its move towards a software-based model has been slow. The pent-up demand and extended lead times that have supported growth are unlikely to drive it structurally. Unlike its smaller peer Juniper, Cisco’s broad portfolio and customer base make it less able to benefit from specific favourable trends, such as the shift to the cloud. While Cisco may be able to maintain high margins, it remains uncertain whether the recent pressure on the company can be reversed in the near future. I currently have an end-of-year price target of $52.39 on the stock based on earnings multiple of 13.0x applied to the consensus EPS estimate of $4.03.

Cisco’s stock price movement (Ycharts)

Future Outlook: Networking Themes to Stay Relatively Resilient

In the second fiscal quarter, developments in Cisco’s financial results and other trends strengthened slightly as compared to the first quarter, when the firm was able to return to growth. Cisco continued to make gradual progress moving towards more subscription-based revenues, but it is uncertain to which extent this development can strengthen the underlying growth potential of its core activities.

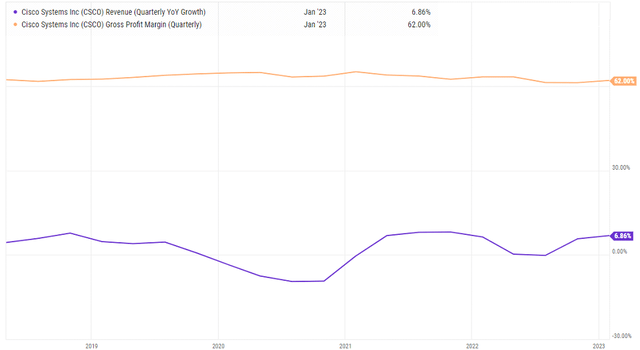

Supply chain constraints that have occurred in post-pandemic quarters have resulted in further pent-up demand that supported sales growth for the equipment during the past couple of quarters. However, on balance, the growth trend in demand for Cisco’s routers and switches has remained almost flat throughout the pandemic and the period that followed. Comparison with the growth trend at small competitor Juniper Networks, Inc. (JNPR) remained disadvantageous for Cisco. While the activities of the two are not fully comparable, the trend at Juniper has been significantly stronger and more consistent, already since the onset of the pandemic.

The networking segment is exhibiting resilient sales despite a difficult IT-spending environment that I believe could broadly permit in-line 1Q revenue and EPS for Cisco, Arista Networks, Inc. (ANET), Juniper Networks and Motorola Solutions (MSI). The conversion of record backlogs, along with low cancellation rates, should help support growth, even as TV and smartphone sales dynamics might be bottoming for Corning and Universal Display. Still, companies are cognizant of the tepid economic environment, which makes it hard to lift full-year outlooks.

An easing environment for supplies complements resilient cloud and enterprise data center networking sales, which are forecasted to grow 8% to $20.9 billion in 2023, according to 650 Group. Cloud and enterprise customers are still playing catch-up from delayed product shipments related to supply-chain constraints, which could help leading vendors like Cisco, Arista and Juniper weather a recessionary environment, in my view. The spending dynamics in enterprise data centers should remain favorable in 2023 for these leading vendors, as corporate networks were among the segments most impacted by supply-chain disruptions. I believe enterprises still need to invest in digital transformation activities due to the secular shift to public and private clouds driven by a more distributed workforce, as flexible work environments are more broadly accepted. Unlike cloud providers, enterprises still heavily rely on Cisco, Juniper and Arista for networking gear and are the leading beneficiaries of the rise in enterprise data center spending.

CSCO rev growth and gross margins (Ycharts)

100G Remains the Workhorse

Amid the high interest in 400/800G switching, 100G will play a more relevant role for switching providers and shouldn’t be overlooked, especially for Cisco. 100G is expected to account for 49% of data center switching sales in 2023 and 45% in 2024 and remains a $9.6-$10 billion sales opportunity. The resiliency in 100G may come from two factors: stronger enterprise adoption as part of data center upgrades and more 100G ports deployed in the access layers of cloud networks.

I believe Arista’s leadership in 100G in cloud customers could give it a leg up in enterprise deployments and view it as a foundation for its 25% total sales growth in 2023. But investors shouldn’t diminish Cisco’s networking leadership, and 100 G’s expansion into the enterprise could help improve its 25-30% segment revenue share.

Cisco’s Acacia M&A Paying Dividends

Cisco’s Acacia acquisition is proving to be one of its better recent deals, as traction in its pluggable optics and chips has been strong. Acacia remains somewhat independent from Cisco’s overall optical business due to its existing sales to other optical and routing-equipment providers, and I am encouraged that sales to Cisco competitors have yet to fall off, which speaks to Acacia’s ability to deliver innovation. However, Cisco is clearly leveraging Acacia to further prop up its own switching and routing businesses, aiming to add optics as part of the deal discussion, especially with cloud customers. Acacia is helping Cisco’s vision of a converged optical-routing telecom network. While this will take several years to realize, there’s growing reception, especially for edge applications.

Valuation

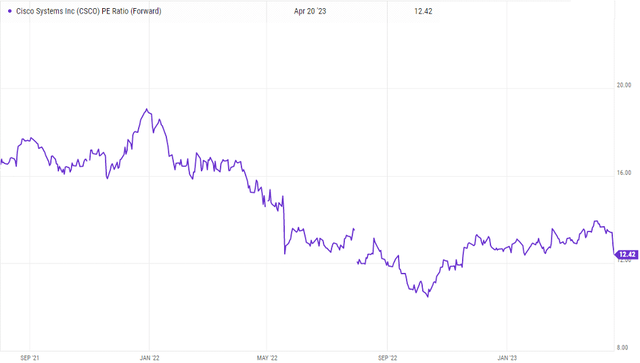

I believe the networking segment may need catalysts to support stronger 2024 EPS expansion and depressed valuations. Though market leaders such as Cisco and Juniper will likely deliver healthy EPS increases this year, their price-to-earnings ratios are below three-year averages as investors have shifted focus to 2024. I currently have an end-of-year price target of $52.39 on the stock based on earnings multiple of 13.0x applied to the consensus EPS estimate of $4.03.

CSCO forward PE ratio (Ycharts)

Final Thoughts

I maintain a hold rating on Cisco as I remain concerned about the enterprise IT spending outlook, as Cisco has a large exposure to the customer vertical. OEMS are decreasing deal sizes and doing more scrutiny in approving deals which makes me conservative at this stage. However, I expect that Cisco will still perform better than overall IT spending due to its significant backlog and near-term RPO. As supply constraints in Networking gradually ease and the backlog is reduced, it should bolster revenue growth in 2023. I currently have an end-of-year price target of $52.39 on the stock based on earnings multiple of 13.0x applied to the consensus EPS estimate of $4.03.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.