Summary:

- Despite the company’s YoY revenue decline in fiscal Q1 2025, I remain extremely bullish on Cisco Systems, Inc. stock due to its strong value play and growth potential in AI and subscription services.

- Cisco is undervalued compared to peers, trading at 15.81 times this year’s earnings, with a robust dividend and share repurchase program enhancing shareholder value.

- Cisco’s sticky business model and diversified revenue streams, including a significant increase in annualized recurring revenue and remaining performance obligations, position it for future growth.

- Risks include competition and historical underperformance compared to the S&P 500, but I believe CSCO will exceed $65 in 2025 as market conditions improve.

PM Images

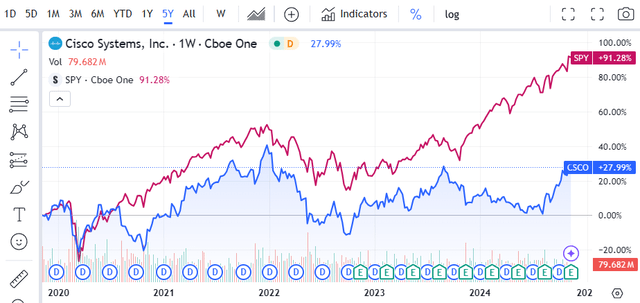

It’s easy to sit back and collect the dividend, but being a long-term shareholder of Cisco Systems, Inc. (NASDAQ:CSCO) is anything but easy. It’s been more than 2 decades since shares of CSCO established their all-time high. Despite growing its annualized revenue from the 1999 fiscal year to the 2024 fiscal year by $41.65 billion (342.82%), CSCO has never recaptured the market cap that it once commanded. CSCO just released their fiscal Q1 2025 results, and while they delivered a double beat on the consensus estimates with $13.84 billion in revenue and $0.91 in Non-GAAP EPS, the market isn’t excited as shares are off by more than 1%. The problem is that revenue declined by -5.7% YoY in Q1 despite the beat of $70 million. I have been very bullish on CSCO, and while I think there is a possibility that shares can retrace to the mid to low $50s, I think that CSCO is one of the best value plays in the market.

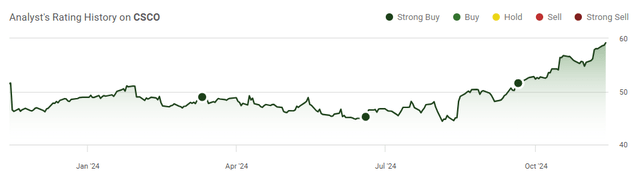

Citi maintained its buy rating and took their price target to $64 from $62 despite declining growth in Q1, and Bank of America (BAC) kept its buy rating and took its price target up to $72 from $60. CSCO has forecasted for its total revenue to come in at $55.3 billion to $56.3 billion, which would be a YoY increase of $1.5 billion (2.78%) on the low end of their guidance. When I look at a long-term chart of CSCO, there is a lot of resistance whenever shares approach the $60 range. However, I am very bullish that CSCO will benefit from a massive upgrade cycle in AI products, and further diversification will occur throughout their subscription business. CSCO is a cash cow that continues to utilize its cash to improve shareholder value, and even in a market that is focusing on growth again, I think that CSCO can break out of its sideways trend and exceed $65 in 2025.

Following up on my previous article about Cisco

- In September, I wrote an article on CSCO (can be read here), and I discussed why I believed CSCO would benefit from advancements in AI. Since then, shares have appreciated by 13.04%, and when the dividend is factored in, the return is 13.91% compared to the S&P 500 (SP500), which has gained 4.91% over this period. Now that the 2024 fiscal year is over and Q1 results are in for the 2025 fiscal year, I wanted to follow up with a new article. Despite the YoY decline in revenue during Q1, I am extremely bullish on shares of CSCO going forward as it continues to look like an incredible value play that the market is overlooking.

Risks to investing in CSCO

While I am very bullish about CSCO, there are several risk factors that could negatively impact my investment methodology. There could be a tremendous opportunity cost to investing in CSCO as just investing in the SPDR® S&P 500 ETF Trust (SPY) has generated more than triple the returns of CSCO over the past 5-years. It’s been more than 2 decades since CSCO reached its all-time highs, and every time CSCO has crossed over the $60 level, shares have retraced. It’s never been able to keep the forward momentum going.

There is also an immense amount of competition from traditional networking companies and software solutions such as Arctic Wolf that focus on network and security software. While CSCO continues to make acquisitions and diversify its business model, their top-line revenue numbers have barely grown over the past 9-years as they have increased by 9.44% ($4.64 billion) from the close of the 2015 fiscal year to the close of the 2024 fiscal year.

While CSCO is a cash cow that rewards shareholders through dividends and buybacks, the market is looking for growth. CSCO’s average top-line growth of 1.05% over the past 9 years hasn’t been cutting CSCO continues to underperform the S&P by large margins. Sometimes, it’s not worth it to fight the market, and investors should consider these risk factors before allocating capital toward CSCO.

Why I am still very bullish on Cisco after a decline in revenue in the Q1 2025 results

I like sticky businesses that become a nightmare for customers to leave. Before getting into financial metrics, I am going to break down the business aspect of CSCO that makes them very attractive to me.

Unlike home computing, where you typically have a cable line coming into your home and then an Ethernet cord connecting a router to the modem to provide Wi-Fi, businesses are much more complex. To outfit a business, whether it’s an office of 20 or many sites with 20,000 people, the networking infrastructure to make everything work is very different. From a hardware perspective, you need servers, network switches, wireless access points, and firewalls at the very minimum. Unless you’re in a completely wireless environment, there is a tremendous amount of Ethernet cable is run, and there could be hundreds of drops for all the computers on the network that terminate in the server room. The setup for large companies is similar at satellite locations, but often, it’s a scaled-back network setup compared to the main hub.

After the physical hardware is in place, you require monitoring software and security software. If you don’t like your router or even your Internet service, you can buy a new router on Amazon (AMZN) and install it the next day. Or, you can call a different Internet provider and cancel your package with the current provider. From a corporate standpoint, ripping and replacing network infrastructure is costly, time-consuming, and a strain on internal resources. Networking equipment is also something that hasn’t changed frequently, and companies could get 5–10 years out of their network switches and other products.

Once the hardware is in place, there is an increased chance that the company will select its monitoring and security products because they work in unison with each other. The undertaking of a large-scale enterprise customer or even a middle-market company to switch from CSCO to another networking company isn’t easy, and it could create disruptions in the business. CSCO is the backbone of many companies’ networking capabilities, and its products and services will be extremely sticky once they are implemented.

I always look at the business case and why a company’s products and services are needed before looking at the financials. Networking infrastructure from hardware to security has only expanded as the market revenue forecasts for just networking equipment is expected to grow from $61.45 billion to $86.02 billion from 2024 through 2030. CSCO has done an incredible job diversifying into the security and services businesses, as this allows them to generate recurring revenue after their products are purchased and installed. In Q1 2025, networking equipment only represented 48.79% of its total revenue, meaning that CSCO generates more than $7 billion every 3-months from recurring revenue sources. Once CSCO sells the hardware, they can double-dip and provide ongoing services, increasing their profitability.

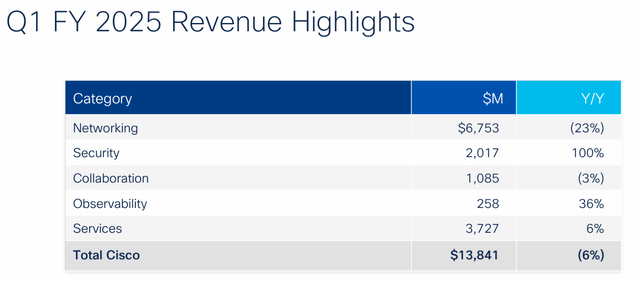

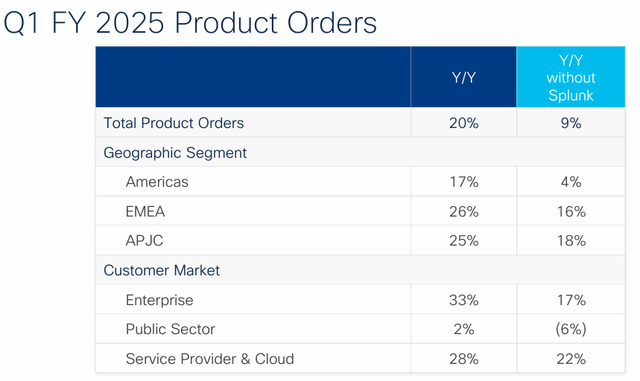

Based on CSCO’s price action, the market wasn’t thrilled with a -6% decline in revenue YoY during Q1, but there are many other positive aspects. CSCO is seeing accelerated levels of product orders as they are up 9% YoY organically pre-Splunk acquisition, and when Splunk is included, this metric has increased by 20% YoY. The main reason Q1 revenue declined YoY was because its product revenue recognized a -9% YoY decline, while its services revenue increased 6%. CSCO expanded its gross margins to 65.9% compared to 65.2% in Q1 2024 as its products gross margin increased 1.4% YoY and services margin grew 0.7% YoY. Overall, 57% of CSCO’s total revenue in Q1 came from subscriptions. CSCO’s total annualized recurring revenue (ARR) increased 22% YoY to $29.9 billion, and its total remaining performance obligations (RPO) increased by 15% YoY to $40 billion.

For me, product orders is the key metric to focus on. Total product orders are up 9% organically and 20% YoY when Splunk is accounted for. The Splunk acquisition adds a new dynamic of customers to which CSCO can cross-sell products and services. As more products are put into circulation, they will correlate to additional services, which should drive higher revenue and earnings.

While CSCO didn’t deliver YoY growth in Q1, the numbers were still solid. Both the top and bottom lines exceeded expectations. CSCO is operating from a position of strength as its expenses are managed well. CSCO generated $9.12 billion in gross profit, which allowed it to generate a 65.90% gross profit margin. On the bottom line, CSCO generated $2.71 billion in net income for a profit margin of 19.59% and $3.44 billion in free cash flow (FCF) for a 24.88% margin. Every dollar that CSCO generates adds roughly 20% to the bottom line and 25% to their FCF. This allows CSCO to maintain a robust capital return program through share repurchases and dividends. CSCO is forecasting that they will generate $55.3 billion in revenue on the low end and $56.3 billion on the high end, which will be a continuation of their forward growth. CSCO is in a position to continue driving EPS growth, and I believe that the market will eventually reward it as demand for its products and services increases.

Investors are getting a lot from CSCO with the current valuation

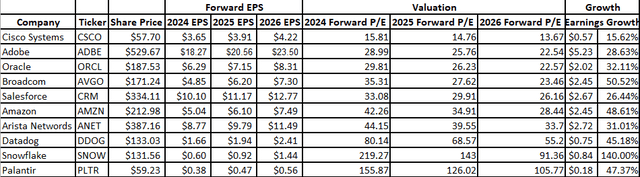

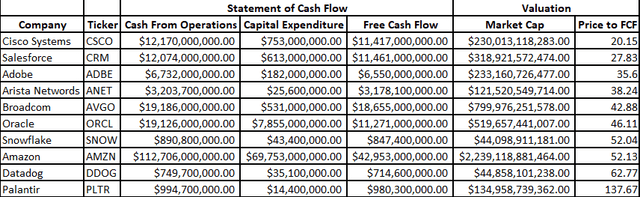

At some point, numbers matter, and CSCO looks very undervalued as a company that has continued to grow its profitability and generates over $10 billion in annual FCF. I created 2 tables below and compared CSCO to Adobe (ADBE), Oracle (ORCL), Broadcom (AVGO), Salesforce (CRM), Amazon (AMZN), Arista Networks (ANET), Datadog (DDOG), Snowflake (SNOW), and Palantir (PLTR) to provide a range of similar software and hardware companies. Unlike the other companies, CSCO’s fiscal year ends in the middle of the year, so I am going based on calendar years for the forward EPS metrics.

CSCO is expected to generate $3.65 of EPS this year and $4.22 in 2026. This is 15.62% EPS growth over the next 2 years and trades at 15.81 times this year’s earnings and 13.67 times 2026 earnings. The peer group average trades at 68.47% of this year’s earnings and 42.29 times 2026 earnings. ANET, a very similar company, trades at 44.15 times this year’s earnings and 33.7 times 2026 earnings.

At some point, numbers matter, and when I look at the FCF metrics, it further validates how much CSCO is undervalued. CSCO has generated $11.42 billion in FCF over the trailing twelve months (TTM) and trades at 20.15 times their FCF. The only other company that trades below 30 times FCF in this peer group is CRM, and the peer group average is 51.54 times. CSCO has climbed higher slowly, and the current valuation metrics justify a higher multiple.

Steven Firoillo, Seeking Alpha Steven Firoillo, Seeking Alpha

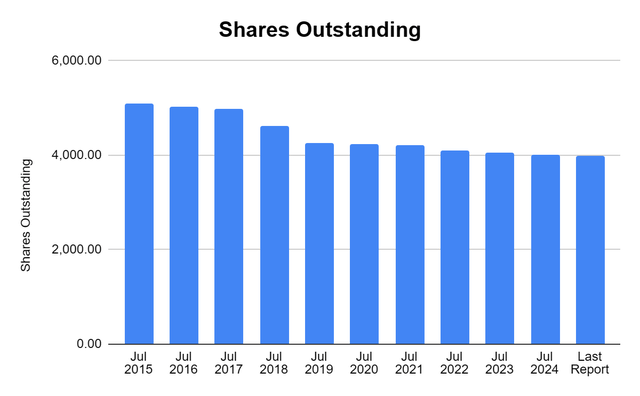

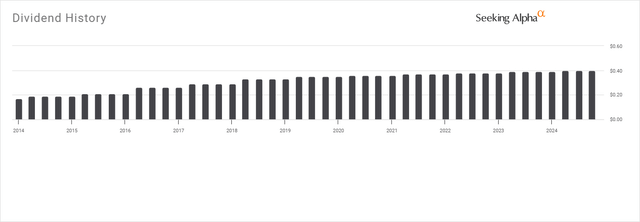

In addition to an attractive valuation, CSCO has been a very shareholder friendly company. In Q1 2025, CSCO repurchased $2 billion worth of shares and returned $1.59 billion through its dividend program. Since the close of the 2015 fiscal year, the number of shares outstanding has declined by 21.53%. CSCO continues to repurchase shares, which is bullish for its forward EPS metrics as its earnings are spread across fewer shares, and there is further room for dividend increases. CSCO has increased its dividends on an annual basis for the past 13 years. CSCO is paying a dividend of $1.60 per share with roughly a 2.7% yield. CSCO’s dividend has a 5-year growth rate of 2.87%. CSCO continues to be a champion of allocating capital to shareholders, and investors can expect more buybacks and dividend increases going forward.

Steven Firoillo, Seeking Alpha Seeking Alpha

Conclusion

I continue to be bullish on CSCO’s shares as they look extremely undervalued. Shares of CSCO caught a bid this year as they appreciated by almost 15% YTD, but still underperformed the market. CSCO has done an excellent job at diversifying its revenue, and its ARR has increased 22% YoY, while its RPO has increased 15%.

I think that as capital comes back into the market, investors will search for companies that present a value opportunity, and Cisco Systems, Inc. will check off the boxes. CSCO’s business is very sticky, and there is more than 15% EPS growth on the horizon over the next 2-years. As time progresses, I think the valuation will look even cheaper as CSCO continues to repurchase shares, and investors could benefit from larger dividend increases in the future. I intend to increase my position in CSCO, as I believe we will see shares exceed $65 at some point in 2025.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSCO, AMZN, PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.