Summary:

- Bank of America is scheduled to report their Q3 ’24 earnings release on October 16th, with consensus expecting $0.77 in EPS on $28.3 billion in net revenue for expected y-o-y growth of -14% on flat or 0% revenue.

- One major positive to BAC is the way the stock absorbed the selling by Berkshire of Hathaway of a substantial part of its Bank of America position.

- When Citigroup also reports their third quarter ’24 financial results on October 16th, analyst consensus is expecting $1.31 in EPS on $19.8 billion in net revenue for expected y-o-y declines of -14% and -1%, respectively.

JaruekChairak/iStock via Getty Images

Bank of America (NYSE:BAC) is scheduled to report their third quarter ’24 earnings release on Tuesday morning, October 16th, ’24, with consensus expecting $0.77 in EPS on $28.3 billion in net revenue for expected y-o-y growth of -14% on flat or 0% revenue.

To say the sell side has subdued expectations for Bank of America is an understatement, although this preview of the financial sector numbers was also subdued given the tough compare with 2023.

Low expectations can be a good thing, particularly in a bull equity market.

One major positive to BAC, in my opinion, is the way the stock absorbed the selling by Berkshire of Hathaway of a substantial part of its Bank of America position. Per the mainstream financial media, Mr. Buffett has reduced their BAC position to under 10% of outstanding.

Two issues have supposedly hurt the stock over the last few years: a liability-sensitive balance sheet, which means BAC’s liabilities have re-priced faster than assets, which is not necessarily a good thing with fed funds rate increases and a term structure that has seen higher yields from early ’22 through late ’23, and issues around expense control, or the sell-side’s desire for better expense control (let’s put it that way).

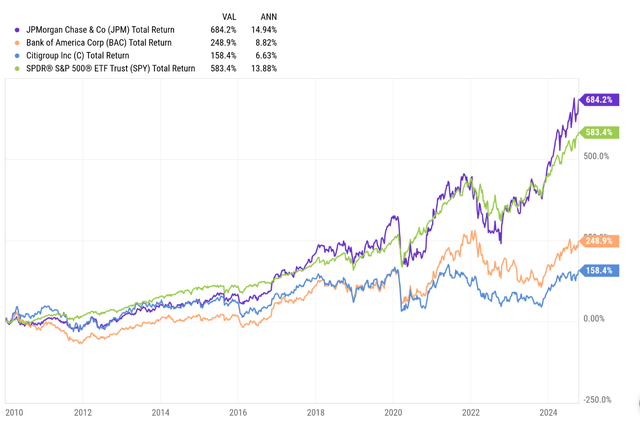

Here’s the longer-term performance charts of our favorite banks:

Looking back to 1/1/2010, only JPMorgan (JPM) is beating the S&P 500 (SPY).

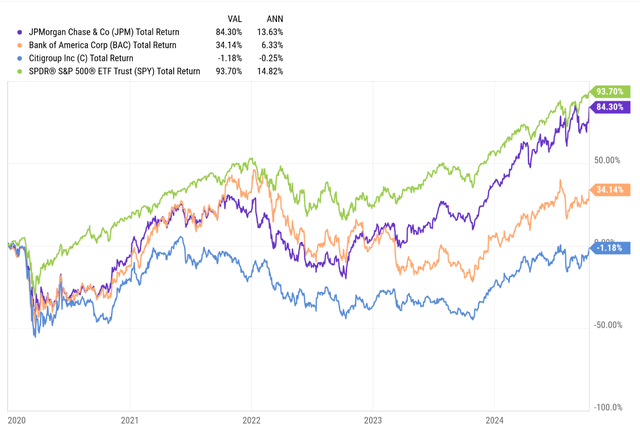

Since 1/1/2020, none of the above bank stocks have managed to beat the S&P 500.

As you’d expect, JPMorgan’s total return is pretty close to the S&P 500’s this decade as of 10/11/24.

Valuation

For full-year 2024, BAC is expecting 1% revenue growth on -6% EPS growth, so the results seems rather contained for the bank giant. The next 2 years – ’25 to ’27 BAC consensus is expecting 5% revenue growth to generate 13-15% EPS growth.

Today, at $42 per share, BAC is trading at 13x an expected ’24 EPS of $3.21, and with a 3-year average P/E of 12x, EPS growth is expected to average 7%.

Trading at 1.2x book and 1.7x tangible book value (TBV), Bank of America is much more modestly valued on a book basis than, say, JPMorgan but not as cheap as Citigroup (NYSE:C), which will follow this earnings preview.

BAC also sports a lower-teens ROTCE (return on tangible common equity), much lower than that of JPM but higher than Citigroup.

BAC’s stock price peaked in early ’22 at $50 per share in January and then again in February ’22. It should be able to easily trade back that level in a good market for financial stocks.

Citigroup earnings preview

When Citigroup also reports their third quarter ’24 financial results Tuesday morning, October 16th, analyst consensus is expecting $1.31 in EPS on $19.8 billion in net revenue for expected y-o-y declines of -14% and -1%, respectively.

In the second quarter of ’24, Citi grew net revenue of +3%, on EPS growth of +14%. Jane Fraser is trying to reduce headcount, but as of the 2nd quarter Citi’s total headcount was 229k, down from a peak of 240k but well up from 220k in December 2020. I’ve heard both ways on expected headcount changes, i.e., headcount reduction is done, and there is more to come.

In terms of relative sector performance, looking at the above 14-year and 4-year total returns respectively, Citigroup has been a big laggard, although Jane Fraser has started to turn the bank around operationally. Citi’s ROTCE is below that of BAC and well below that of JPMorgan, but on a book value basis, Citi is the cheapest of the bigger banks.

Citi’s book value (BV) and tangible book value (TBV) valuations: Citi’s book value as of the June ’24 quarter was $99.70 per share while the tangible book value was $87.50 per share, leaving Citi trading at 0.66x BV and 0.76x TBV at that time.

The expected ROTCE for Citi (per Morningstar) is 10-12%, which is an improvement from Citi’s 7% historically.

Summary / conclusion

Many of the major banks (and certainly the regionals) have not made new all-time highs since 2021 given the impact of fed funds rate hikes on the bank balance sheets, but if BAC can trade over $55 (2006 high), it will make a new all-time high, and if Citi can trade over $80 (mid-2021 high), it too will have made a post-2008 new high.

JPMorgan is the cream of the crop, but from a portfolio construction standpoint, BAC and C can provide a defensive element to the financial services weighting within portfolios. Better expense control comes up with both BAC and C in terms of ’24 and ’25 expectations, so that’s one avenue to add incremental EPS growth, and it’s completely under management control.

For both banks, expected 2025 and 2026 EPS growth is expected to be stronger than in 2024, but let’s wait and see what guidance holds in January ’25.

The fact is both BAC and C are less momentumy (not a great word) than a JPM, and thus, would likely probably hold their value better in a decent correct of 15-20%. Both stocks recently increased their dividend, with Citi now sporting a 3.25% yield.

It’s an almost perfect environment for the larger banks that were just decimated in 2008, with mostly very good consumer credit activity, corporate loan growth still in the 3-4% range, net interest income after rate hikes offering additional portfolio yield and higher net interest margins, solid capital market activity particularly on the bond side as credit spreads remain tight, and home prices still rising, not to mention an easier Fed. The only negative heard on the capital market side is a lack of any IPO market, or at least much smaller than expected given the strength in US equity markets.

None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of future results. Investing can, and does, involve the loss of principal, even for short periods of time. All EPS and revenue estimates are sourced from LSEG.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.