Summary:

- Bitcoin miners are taking a breather due to the impending halving, which makes mining more difficult.

- CleanSpark is well-positioned among miners, with potential for short-term gains and long-term growth.

- The company has efficient growth strategies, a clean balance sheet, and a growing stash of Bitcoin, making it a potential long candidate.

Dragos Condrea

The rally in Bitcoin continues to take crypto-related stocks with it to the proverbial moon, but of late, miners of the OG alt-currency have taken a breather. That decoupling from Bitcoin is due to the impending halving, which should take place in the coming days. For a primer on the halving, see here.

At its core, the halving is bad for miners given that it essentially becomes twice as difficult to mine Bitcoin at the same dollar value as pre-halving. However, this is a very well known market event and miner stocks have been priced accordingly. In addition, prior halving events have sent the price Bitcoin soaring in the months following the event, so it’s entirely possible the increased difficulty will be partially or even fully offset by a higher price in Bitcoin. That’s a discussion for another day, but right now, I believe CleanSpark (NASDAQ:CLSK) is extremely well positioned among the miners. I like CleanSpark for the short-term based upon the chart, but also long-term on the valuation and growth prospects, so I’m slapping a strong buy on the stock. Let’s dig in.

Will this consolidation hold?

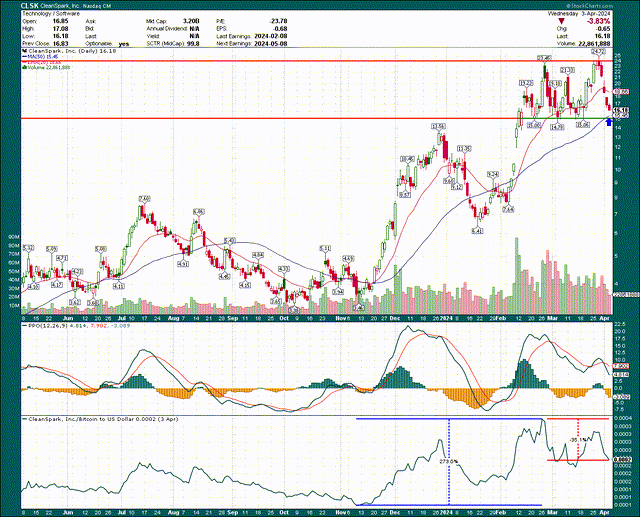

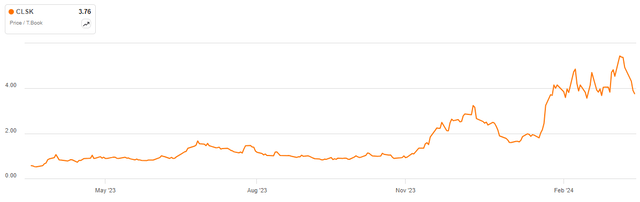

Let’s begin with the chart, as always, to get the lay of the land from a technical perspective. CleanSpark put in an absolutely epic rally from the November bottom to the recent top, seeing its price increase about 8X. That kind of move is obviously not sustainable; however, remember that Bitcoin almost doubled during that time frame, so the operating margins of miners exploded to the upside.

Right now, CleanSpark has put in five consecutive down days with gap downs at the open and selling throughout the day. Not a good look. However, there are two support levels in the same area around $15/$16 that I’m watching with great interest, seeing if the bulls make a stand.

The rising 50-day moving average is $15.45 but rising quickly, and there’s support from a triple bottom put in during February/March around $15. The 50-day didn’t hold last time it was tested in January, so it’s possible we see the stock just go through it. But the more consequential support to me is the triple bottom, so that’s the level I expect will hold.

The PPO is resetting after some absurd values in the area of +20 were printed during the run to $24. We’re back to 5 to 7, so it’s much more reasonable. My preferred scenario is that the PPO doesn’t go under the centerline.

Finally, the bottom panel shows CleanSpark’s price relative to Bitcoin as a way to value the stock. The move from the November bottom to the 2024 high saw this ratio increase 273%, but it has since given up 35% from the highs. I am not going to try and convince you this makes CleanSpark cheap, but remember that operating leverage with miners is enormous; when the price of Bitcoin goes up, the gains in mining margin goes up much more quickly given mining costs are largely fixed. The opposite is true when Bitcoin falls, but we’re in a bull market, so it certainly makes sense we’d see valuations go up.

The point on the chart is that if we hold the $15 area, I think we’re going to see a move at least back to $24, and if I’m right about the post-halving direction of Bitcoin itself, CleanSpark will be much higher than $24 later this year.

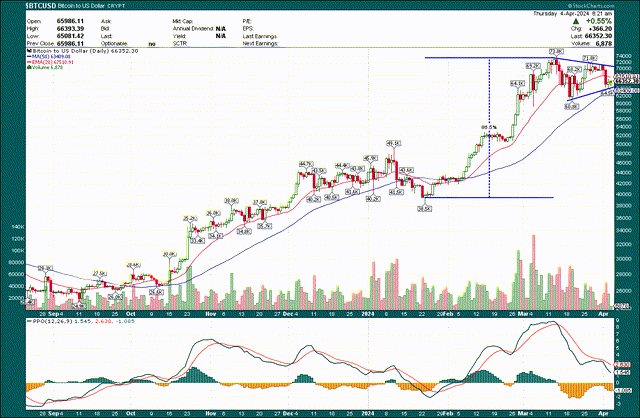

Speaking of Bitcoin, let’s quickly take a look at the chart there to get an idea of what we may be able to expect.

The consolidation we’ve seen since early March – to me – looks like a bull pennant. This is a continuation pattern that essentially digests a big uptrend in a symmetrical triangle formation that generally continues the direction of the prior trend. If we measure the up move into the pennant, it was about $34k, or ~86%. If we measure that to the upside on a breakout of the pennant formation, we’re looking at a target in the area of $105k, give or take. I certainly would not be surprised to see that price in Bitcoin in the coming months given this pattern, but also previous post-halving behavior. If that happens, margins for miners will go much, much higher, and CleanSpark stands to benefit substantially. We’ll see.

Efficient growth is the name of the game

We know that in Bitcoin mining, the only way to win is through efficient growth. Mining Bitcoin costs a lot of money in equipment, but also electricity. That means scale, efficient rigs, and power usage are extremely important.

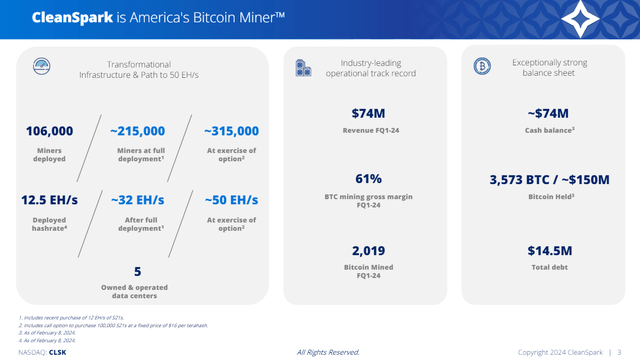

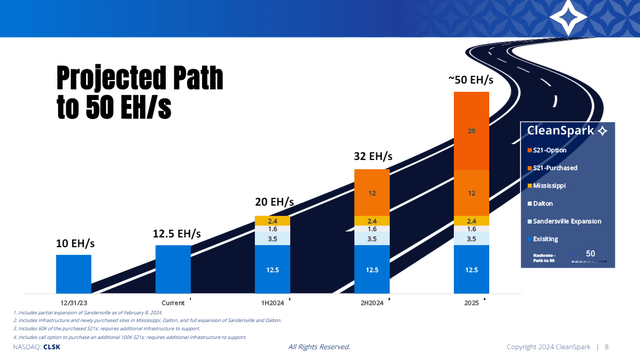

CleanSpark has more than 16EH/s deployed at the moment, and is building its way to 50EH/s. That doesn’t make it the largest outright miner, as Riot (RIOT) and Marathon Digital (MARA) have similar footprints. However, it’s certainly one of the largest in terms of current and projected scale.

The relative position of miners changes all the time, but this data from February shows CleanSpark is right near the top in terms of deployed EH/s.

Investor presentation

In addition, the balance sheet, as you can see above, is extremely clean with almost no debt. That means the company can finance its operations by selling a very small sliver of its mined Bitcoin, and not borrowing or issuing expensive preferred stock.

On the flip side, like just about every other miner, CleanSpark does take advantage of equity rallies and issues new shares at times. This most recent $800M authorization is big, and the stock fell precipitously on the news. I don’t like dilution, as I’ve said repeatedly in the past, but the company believes it can invest the proceeds more profitably than the implied cost of the equity. Given the company’s track record, we have to assume this is an efficient use of capital, but it’s certainly a risk. Additional issuances shouldn’t be needed anytime soon given the balance sheet situation, but we don’t get warning before an equity issuance, so this is a risk to consider if you want to own miners.

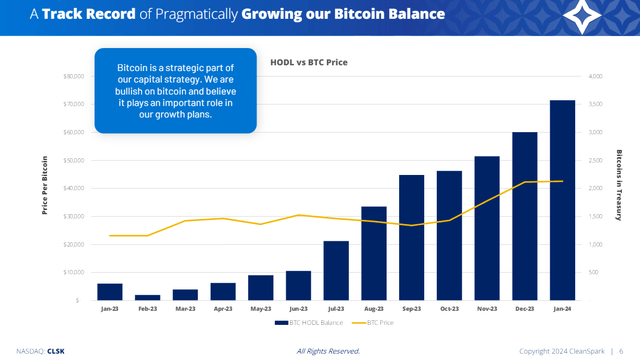

Now, part of the bull case for CleanSpark is that it’s not only a miner, but it’s a big holder of Bitcoin.

The company’s stash has grown sharply in recent months as it hasn’t needed to sell Bitcoin to fund operations, and in March, the company mined 806 coins, up from 648 in February. It only sold 3.37 coins, or basically nothing, so its stash continues to grow extremely rapidly. It now has 5,021 coins as of the end of March, worth about $330M today. That’s a liquid asset that can quickly be turned into cash, and keep in mind if I’m right about the direction of Bitcoin, its Bitcoin holdings could generate significant value just by sitting on the balance sheet. The opposite is true as well, of course, and if I’m wrong we risk the value of its holdings falling, and likely taking the share price with it.

Looking ahead

I mentioned the company’s scale above, and we can see the plan to get to 50EH/s in the future below. Keep in mind it’s about one-third that level today, so we’re talking about a lot of scale building.

The goal is to hit 20EH/s by the end of June, 32EH/s by this December, and then 50EH/s by the end of next year. I have zero concerns about the company’s ability to fund this growth given it owns over $300M of essentially unencumbered Bitcoin, but also will have the proceeds of the equity issuance to give it tremendous flexibility. The big wildcard here is where Bitcoin pricing will be in 2025 to make it all worthwhile; I made my views on that matter clear above but I could definitely be proven wrong.

Trying to value a Bitcoin miner is an exercise that is not for the feint of heart, as we generally cannot use traditional metrics. However, we have some options, and keep in mind that what we’re buying here is growth potential and exposure to Bitcoin pricing. Those things are both volatile, so miner stocks are tremendously volatile (and therefore risky).

Let’s start with tangible book value.

Tangible book value has exploded higher, as you’d expect given the rally we’ve seen. I wouldn’t call this cheap by any means, as it’s almost 4X tangible book. However, if Bitcoin keeps rising, I expect this ratio could go much higher than 4X, as we’ve seen for miners in prior Bitcoin bull markets exhibit similar behavior.

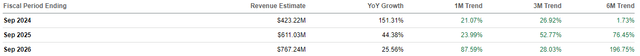

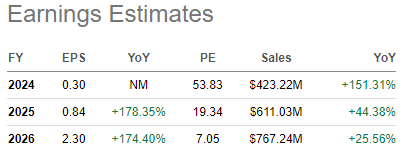

On the revenue front, I don’t think things could look much better. Revenue for a miner is a function of scale (EH/s deployed) and the price of Bitcoin. We know scale is ramping and it is my belief we’ll see higher Bitcoin pricing. We also know the halving is coming in the next couple of weeks, so scale gets slashed, effectively. But as I said above, everyone knows this is coming, and look at the revisions for revenue from analysts above. These numbers are huge and this is exactly the kind of stock I want to own; massively higher revisions and big YoY growth. The risk here is obviously that CleanSpark doesn’t execute on its growth plans, and/or that Bitcoin pricing falls precipitously, so you have to make that judgment for yourself.

Seeking Alpha

Finally, CleanSpark is currently slated to earn $2.30 per share in 2026, and while I realize that’s a long time from now, it’s also trading for just seven times that number. If you’re looking for a reason why the stock has exploded higher in recent months, I’d refer you to this table.

If we wrap this up, I see a stock with a potentially bullish consolidation pattern, massive growth potential that’s fully funded, and a valuation I can actually get behind for the long-term. Keep in mind Bitcoin pricing, as well as the stock prices of miners can be extremely volatile. I’m not saying CleanSpark will never go down again; I’m simply saying that over time, I see significant value being possible here, and for that reason, I’m hitting it with a strong buy rating for those enterprising investors among us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CLSK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.