Summary:

- CleanSpark’s acquisition of GRIID Infrastructure for $155 million could be viewed as costly due to GRIID’s financial struggles.

- However, the acquisition allows CleanSpark to expand its mining footprint and increase power capacity, positioning it well in the competitive industry.

- CleanSpark’s aggressive expansion strategy and use of renewables have led to better performance compared to competitors like Marathon Digital Holdings.

- However, given that the industry continues to consolidate after the April post-halving event, it is better to wait for the volatility to elapse before investing.

Hispanolistic

CleanSpark’s (NASDAQ:NASDAQ:CLSK) announcement on June 27 to acquire non-profitable and indebted Bitcoin (BTC-USD) miner GRIID Infrastructure (NASDAQ:OTCPK:GRDI) for an enterprise value of $155 million may seem on the high side.

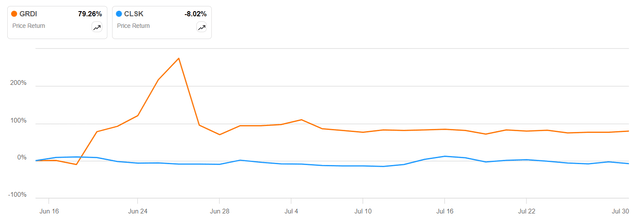

However, as seen in the year-to-date price action below, while GRIID’s shares surged as for a typical M&A, CleanSpark dipped only slightly before recouping its losses hinting that investors are not too worried about the transaction.

Comparing the price action of CleanSpark and GRIID at the time of acquisition and after (www.seekingalpha.com)

I believe that the market is right and this thesis aims to show that the acquisition represents a cost-beneficial way for the company to expand its mining footprint. It also comes at a crucial time when the industry is adjusting to the April Bitcoin halving event which has resulted in miners generating half the number of coins out of their huge mining farms as they did previously.

Consolidation in the Mining Industry

In this context, the halving has impacted miners hard because it cut in half, or from 6.25 BTC to 3.125 BTC the reward they receive for each block added to the blockchain after solving complex math problems, meaning far less money for the same amount of work. This directly impacts their profitability and has even raised concerns about the long-term viability of some mining companies.

One of them is GRIID which generated only $19.8 million of income and suffered from an operating loss of $12.9 million in the financial year 2023. Furthermore, it is loaded with debt of $81 million versus only $0.8 million of cash, implying it may not possess the financial capability to invest in renewing its fleet of mining rigs which rapidly get outdated as new and more energy-efficient equipment makes its way into the market.

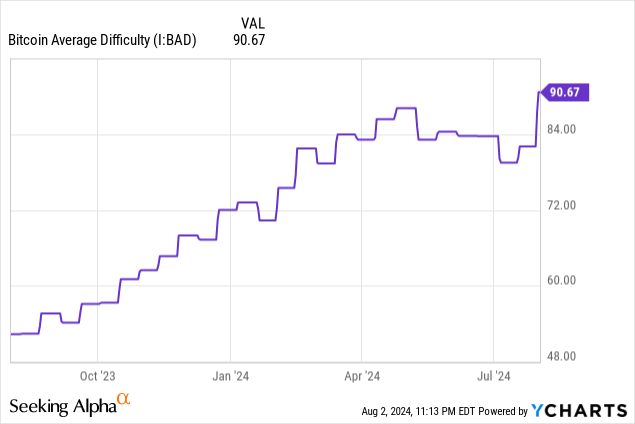

Looking across the industry, in addition to reducing rewards, halving has also increased the level of competition level as the number of coins left for mining has decreased to less than 6%. This has resulted in a difficulty level that continues to go up reaching a new peak of 90.67 as shown below.

Thus, only the most efficient and well-funded miners will be able to stay in business. In these circumstances, it comes as no surprise that GRIID got acquired by CleanSpark which is one of the industry’s more established players which is also equipped with a strong balance sheet.

An Opportunistic Acquisition for CleanSpark

As for CleanSpark, the operation helps it to move closer to a total planned power capacity of over one gigawatt (1 GW) over the next three years. This includes over 400 MW to be harvested in Tennessee over the next two years after the GRIID acquisition, with 20 MW available after completion of the deal. The other 600 MW will come from sites in Georgia Mississippi, and New York, either fully owned or operated as co-location facilities. It also acquired two Bitcoin mining locations in Wyoming and another five in rural Georgia.

Justifying the acquisition, with an EV (enterprise value) of $3.4 billion, CleanSpark owned and operated about 300 MW of infrastructure as of mid-June. With the $500 million disbursed for GRIID, it can increase its EV by 14.7% (500/3400) while potentially increasing its power capacity by 400/300 MW, or 33%. In other words, for each dollar spent on GRIID, CleanSpark can potentially double the number of MW it can scale to meaning that this was an opportunistic acquisition.

Furthermore, after mining 494 bitcoins in July, the company’s total holdings were 7,082, and this was after it sold 2.54 coins. Now, at an average price of approximately $61,417 per Bitcoin (at the time of writing), the miner’s BTC treasury can potentially be valued at $435 million, which it has the option to rapidly convert into sales.

However, analysts seem to have already priced in the opportunities in the consensus revenue estimates of $423.62 million for the fiscal period ending in September 2024 as shown below. This amount is only about $12 million short of the $435 million that the miner could harvest if it sells all its Bitcoins.

Revenue estimates (seekingalpha.com)

Moreover, its forward price to sales of 8.28x is overpriced relative to the IT sector by nearly 186% which is the reason for my Hold position.

Factoring the Volatility to Identify a Target Price

Now, the value of its holding could reach $517 million based on BTC valued at 73K, but there is no indication that demand for the digital asset will go up. On the contrary, the market has been volatile last week abroad a broad sell-off driven by slowing U.S. job growth. Thus, BTC was down by around 11% compared to 2% for the S&P 500 during the last five days, with the cryptocurrency appearing to be suffering more because it had benefited from election-led enthusiasm earlier as one of the candidates was seen as crypto-friendly.

Thus, with the setback in hiring hinting at a slowdown in the economy in the face of above-5% interest rates, volatility could continue as the effect of tight monetary policy on businesses and households becomes more evident. Of course, rate cuts are on the horizon, but there is still time before this happens, without forgetting election-related uncertainty. Thus, it is better to take a step back.

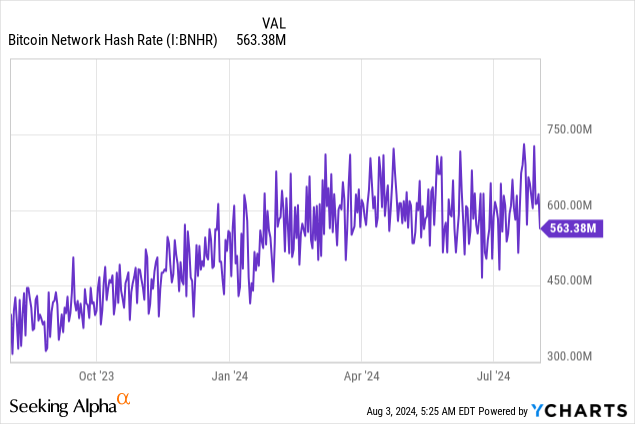

Moreover, on the supply side, after increasing steadily in the period leading to Bitcoin halving which occurred on April 19, the Bitcoin hash rate as per the chart below seems not to have yet normalized. Thus, the hash rate initially moved down as troubled miners reduced their production output before going up slightly, but not moving upward in a sustainable way. This probably shows that the process of mining consolidation is ongoing whereby miners with weak balance sheets are continuing to sell more coins thereby increasing the supply of coins, in sharp contrast to CleanSpark which only sold 2.54 out of the 494 Bitcoins mined in July.

Therefore, with demand-supply conditions not being favorable to an increase in asset prices, there could be further pullback.

In this case, the company could represent an opportunity at a lower forward P/S of 6.81x, or its five-year average, representing a 21.68% decline from the current value of 8.28x. This translates into a target of $10.56 (13.48 x 0.7832) based on its share price of $13.48 at the time of writing. Noteworthily, this would still see it overpriced relative to the sector but, I am optimistic about the long term based on a comparison with Marathon Digital Holdings (MARA), the largest publicly listed miner.

Comparing Revenue Growth and Operating Expenses with Marathon

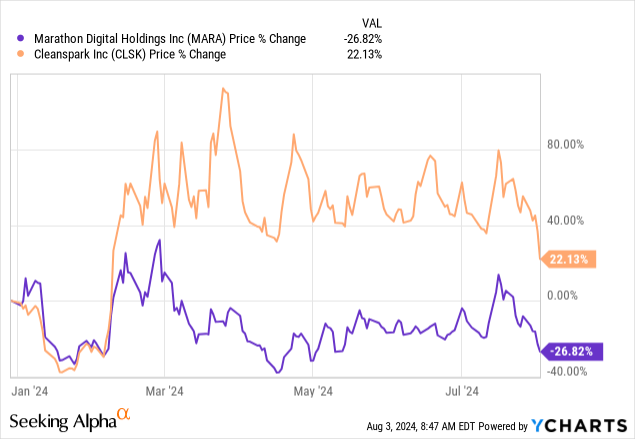

In this respect, despite Marathon’s superior productive capacity of 31.5 exahash per second (EH/s) as of June 30 compared to 20 EH/s for CleanSpark, it is the latter that has performed better and returned 22% year to date, while Marathon has suffered nearly 27% downside as charted below.

The reason is mainly CleanSpark’s aggressive expansion approach in the period leading to Bitcoin halving while using a high degree of renewables as part of the energy mix. This has put it in a better position to mitigate the effects of reducing mining rewards. Thus from about 10 EH/s at the end of 2023, the hash rate reached 20 EH/s at the end of June, or surged by 100%. This compares to a 36% increase for Marathon, from 23.2 EH/s at the end of 2023 to 31.5 EH/s at the end of June.

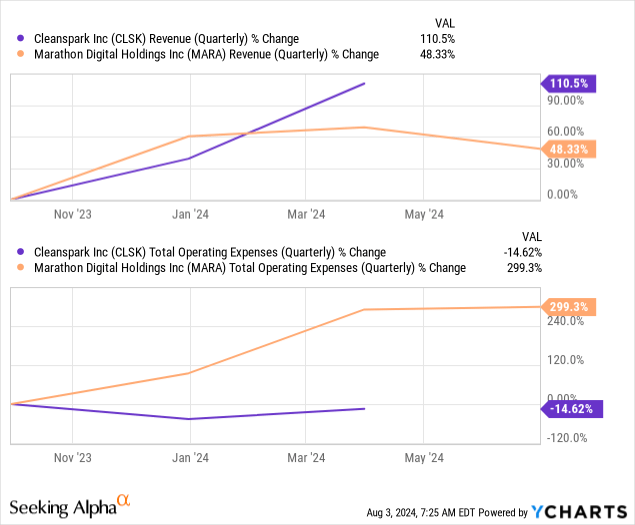

Equipped with better production capacity, CleanSpark has produced and sold more BTCs in the market, which explains why sales surged by 110% during the last year compared to about 70% for Marathon as charted below.

At the same time, as shown above, CleanSpark has managed to reduce operating expenses by 15.6% signifying much better operational efficiency.

GRIID Constitutes A Justified Acquisition

Moreover, looking at the expansion strategy, while Marathon paid $87.3 million in cash from its balance sheet to acquire the 200-megawatt Bitcoin mining data center from Applied Digital Corporation (APLD) to increase its production capacity to 1.1 GW, it was an all-stock transaction for the GRIID deal with CleanSpark only having to provide a $5 million working capital together with and bridge loan of about $50.9 million to satisfy certain obligations. While it will have to eventually repay GRIID’s outstanding debt, the $55.9 million to be disbursed by CleanSpark can be achieved from its $321 million cash balance.

Equally important, depending on execution, the $500 million paid for GRIID’s 400 MW of potential will eventually constitute 40% of CleanSpark’s 1 GW planned capacity. Now, for a miner, scaling means more hash rates thereby increasing the probability of successfully producing new blocks in a highly competitive industry where the first one to mine a new block earns the BTC reward which is synonymous with higher returns. In this case, being bigger also puts a miner in a better position to negotiate with mining rig suppliers and power utilities. However, as seen with the Marathon comparison, it is not only size that matters but also a miner’s ability to optimize overheads like labor and cooling systems. Eventually, this leads to lower operating expenses and better profits as is the case for CleanSpark.

Moreover, investors will note that since miners generate revenue through sales of BTCs which also depends on the amount they want to accumulate or HODL, I have also compared how the two miners have scaled their hash rates in the pre-halving period. In this case, not only has CleanSpark increased its production capacity faster but in a more profitable way as well.

Finally, as seen with GRIID, there are other miners out there who are facing difficulties and unless there is no clear indication that the industry-level consolidation is over, the supply of BTCs is likely to be sustained as troubled miners liquidate their treasuries. Therefore, volatility should persist, at least till September when the Federal Reserve proceeds to a rate cut as expected by the market, signifying that till then, it is better to be cautious.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.