Summary:

- CleanSpark is expanding its BTC mining operations with new facilities in Wyoming and Georgia, aiming to reach 31.6 exahash/second.

- CleanSpark is utilizing their balance sheet to acquire additional data centers and engage in M&A for inorganic growth.

- CleanSpark’s shares trade directionally with BTC and may realize strength as BTC is more widely held by retail investors.

Vertigo3d

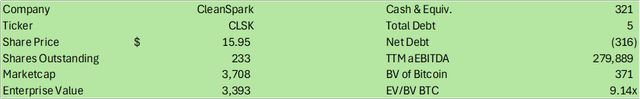

CleanSpark (NASDAQ:CLSK) has found itself in a unique position when compared to other BTC mining operators as the firm remains flush with cash, bitcoin holdings, and a growing operation with the goal of reaching 50exahash/second in eFY25. As the firm operates in a more challenging BTC mining environment post-BTC halving, management has been opportunistic in acquiring competing mining operations to expand and benefit from the challenging environment. In addition to this, CleanSpark is in the process of building out an additional 75MW of capacity in Wyoming for an additional 4.2exahash/second to be added to the fleet for a total of 20.9exahash/second. Inclusive of their 5 new facilities in Georgia, the firm will have a total of 31.6exahash/second. Given CleanSpark’s expanding holdings of BTC and new operating facilities, I reiterate my BUY rating for CLSK shares with a price target of $28.67/share at 18x price/BV of BTC holdings.

Be sure to review my initial coverage of CleanSpark here:

CleanSpark May Benefit From The Bitcoin Halving Event

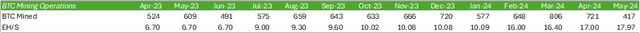

CleanSpark Operations

CleanSpark is entering the next stage in company development as the firm breaks ground at their newly announced 75MW mining facilities located in Wyoming. Management anticipates the 45MW mining operation to begin mining as soon as 120 days as of q2’24. This site is an existing site that will require CleanSpark to bring in their equipment as the previous tenant exits the space. The 30MW site is a greenfield project that will require more construction; however, management anticipates having both sites operational before winter begins in Wyoming. Management mentioned on the q2’24 earnings call that the firm has secured 50MW of transformers and switching gear in anticipation of the build-out as well as execution of their option to acquire 100,000 S21 Pro miners. These two facilities are expected to add an additional 4.2 exahash/second to the firm’s existing 16.7exahash/second. CleanSpark will also have the flexibility to add additional capacity to these two sites for a total of 130MW for a total hash rate of 7.4exahash/second, leading to the firm having a total of 24.1exahash/second, a 44% increase to their existing hashrate.

These facilities will likely bring CleanSpark economies of scale as the new S21 Pro equipment is expected to lower the firm’s average hash cost from $32 down to $28. This compares to their expected hash price of $50, resulting in the potential for wider operating margins in the coming year despite the BTC halving event. Overall operating capacity increased by 63%, leading to significantly stronger operations YTD.

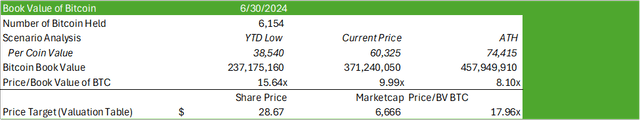

Looking at CleanSpark’s mining rate per exahash, it is clear that the halving event has affected operations as the BTC yield has significantly declined. Though I believe that this will impact the firm’s operations and margins in the coming quarters, CleanSpark’s operational efficiencies that have resulted from higher compute power and energy efficiency may help soften the blow to the bottom line. CleanSpark’s average revenue per BTC mined significantly improved sequentially from $36.5k to $55k, adding significant cushion to their bottom line. As of the firm’s May 2024 BTC mining update that was released on June 4, 2024, CleanSpark now holds 6,154BTC on its books.

CleanSpark announced the acquisition of 5 new BTC mining facilities in Georgia for $25.8mm in cash on June 18, 2024. These facilities will add 60MW of infrastructure and is expected to increase the firm’s hashrate by 3.7exahash/second to over 20exahash/second in total by the end of the month. Management noted that the data centers already have existing equipment on site and that the mining hardware has already been purchased.

On June 27, 2024, CleanSpark announced their intent to acquire GRIID Infrastructure based on an enterprise value of $155mm in an all-stock deal. CleanSpark’s management announced that GRIID’s Tennessee assets will adopt CleanSpark’s mining operational efficiencies and will allow for the firm to expand their operations to 100MW in Tennessee by the end of CY24. Management also anticipates to reach 400MW by 2026.

Management made some very strong comments during the q2’24 earnings call about the state of the market for BTC miners. Zachary Bradford, CEO of CleanSpark, discussed the imminent consolidation of the BTC mining industry as firms that operate at lower efficiency will likely be acquired or collapse as a result of the BTC halving event. Given the firm’s recently announced acquisitions post-q2’24 earnings, it is clear that this process has begun and will likely continue throughout the duration of the year. Given CleanSpark’s $681mm of liquidity as of q2’24, I believe the firm is in a prime position to continue outpacing less efficient mining operations and is well-position to acquire the laggards.

Management also provided an update on their Sandersville location. As of q2’24, CleanSpark was operating at 180MW of the expected 230MW capacity. As of the earnings call, the firm is constrained by the utility in testing their 50MW transformers in order to build out the new substation. Though this will somewhat hinder mining operations, I do not anticipate this to significantly impact the firm long-term as they near their goal of 50exahash/second.

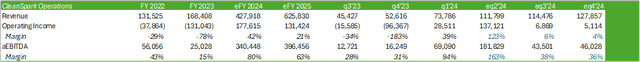

CleanSpark Financials

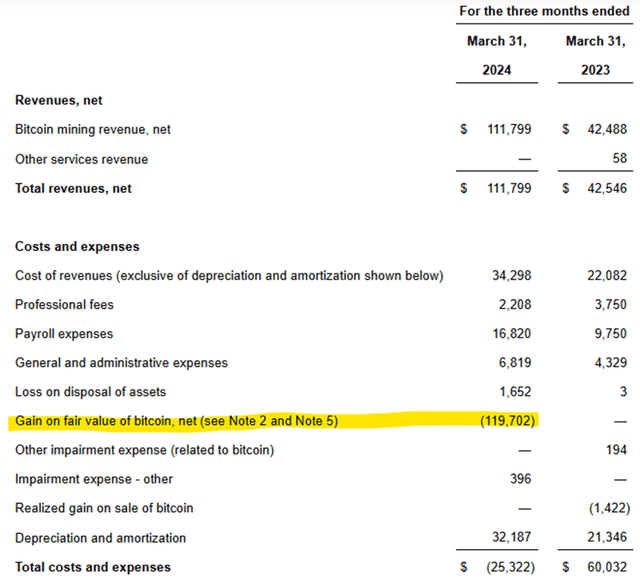

CleanSpark experienced a $119mm gain on the fair value of BTC as per the remeasurement rule, leading to an adjustment to the firm’s reported total costs & expenses. Net of this adjustment, CleanSpark would have reported operating income of $17mm and net earnings of $7mm as opposed to the reported $137mm and $126mm, respectively.

This reporting rule change can work to benefit CleanSpark as the firm has added significant amounts of BTC to the books since reporting q2’24 earnings results, assuming the price of BTC improves into the next reportable quarter. The downside risk is that the price of BTC may work against CleanSpark as the price/coin remains in a volatile state.

Valuation & Shareholder Value

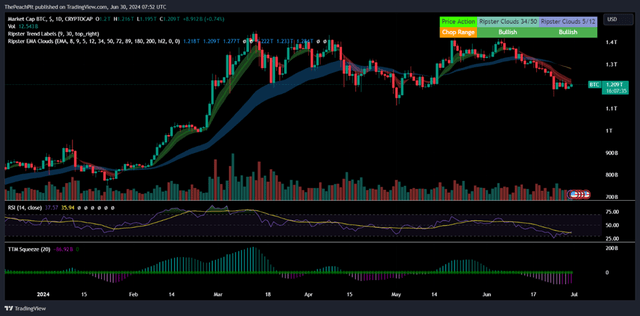

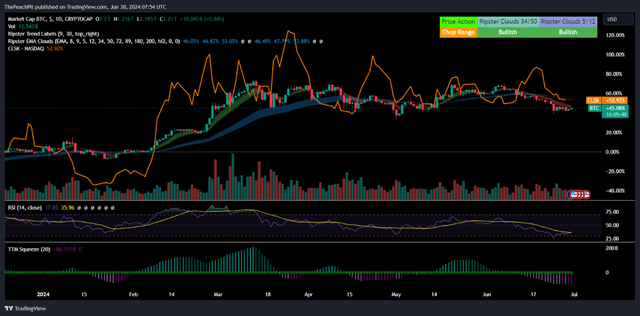

Comparing the price performance of BTC to CLSK, it is apparent that CLSK shares move in tandem with the direction of BTC given this accounting phenomenon.

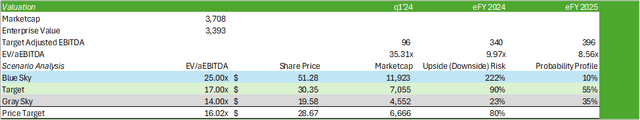

If BTC were to continue its decline into the end of the reportable quarter for CleanSpark, the firm may report an impairment on their financials as a result of the price decline. Given this correlation, CLSK shares will likely be valued to the price of BTC as opposed to revenue or aEBITDA as it relates to the firm’s sales of BTC. Given CleanSpark’s multi-pronged valuation streams, I will value the firm based on aEBITDA generation paired with the value of BTC, as denoted by the two tables below.

Corporate Reports Corporate Reports

With my expected aEBITDA generation, I believe CLSK shares should be priced at $28.67/share at 18x price/BV of BTC, providing the firm significant upside potential as the firm generates cash through the sale of BTC as well as manages their holdings of the token. I recommend CLSK with a BUY rating.

As denoted above, this buy rating comes with significant risks as CLSK shares are directionally motivated by the price of BTC. As denoted in the chart above, BTC appears to be rolling over and may continue this decline. One risk denoted in my recent report covering the iShares Bitcoin Trust ETF (IBIT) is that as more institutional investors migrate a portion of their holdings to BTC, additional inherent risks will be involved with the pricing dynamics, which include rebalances, cash raises, and potential correlation with the broader indices in the instance of a market selloff. Given that I am not a BTC trader, I cannot recommend CLSK beyond their operational risk as it pertains to BTC directional risk.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.