Summary:

- CleanSpark has become one of the top players in the mining industry with a valuation of over $3 billion.

- The company’s Q2 earnings showed significant improvement, with revenue up over 160% YoY.

- CleanSpark’s balance sheet is strong, with a large BTC stack and ample liquidity for expansion and acquisitions.

imaginima/iStock via Getty Images

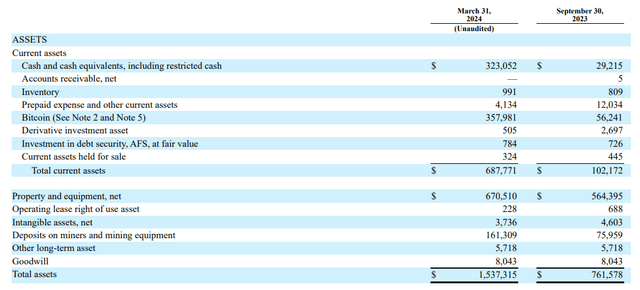

Over the last two years, CleanSpark (NASDAQ:CLSK) has morphed from a middle of the pack mining company to one of the top dogs in the industry. Going back to 2022, CleanSpark was valued below names like HIVE Digital Technologies (HIVE) and Bitfarms (BITF).

Currently, CleanSpark’s $3+ billion valuation now trails only Marathon Digital (MARA) as the industry’s largest public miner. Given the company’s quick production growth, this surge in valuation isn’t all the surprising. As we’ll explore later, this growth has certainly come at the cost of shareholder dilution. But with CleanSpark’s fiscal 2nd quarter now in the books, I think it’s worth revisiting CLSK given the company’s financial setup post-halving.

FY Q2 Earnings & April Production

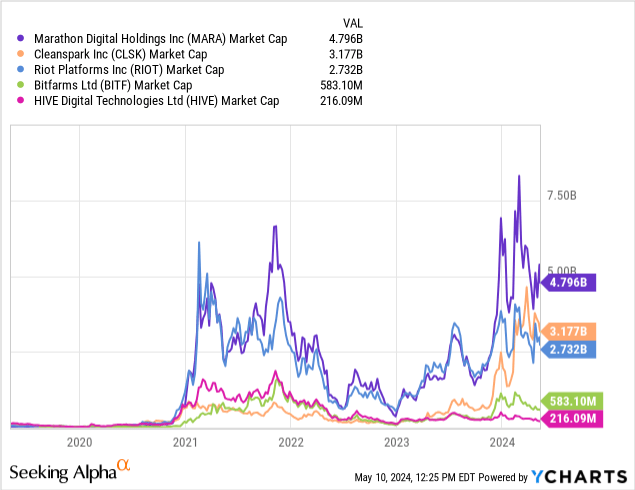

CleanSpark’s performance for the quarter-ended March marked a notable improvement over the prior year. Top-line revenue came in at $111.8 million, up over 160% year over year. This was substantially attributable to the increases in the price of Bitcoin (BTC-USD) as cost of revenues grew by just 55% over the same time period.

FY 2nd Quarter (CleanSpark 10-Q)

The company reported income from operations in the quarter of $137.1 million, versus a quarterly loss of $17.5 million last year. As has been the case with other miners, these positive net income figures in the quarter ended March are hugely impacted by changes in the FASB fair value accounting rules. If not for the $119.7 million unrealized gain in fair value of the company’s BTC, the income from operations in the quarter would have been closer to $17.4 million – which is admittedly still positive and a large improvement over the company’s performance a year ago.

Taking the company’s $34.3 million COGS and adjusting quarterly opex to $58 million in combined SG&A and depreciation/amortization, we get an estimated breakeven price of roughly $45.5k in the quarter based on CleanSpark’s 2,031 BTC mined between January and March. This was a noticeable improvement from previous quarters and the company’s lowest quarterly breakeven since June 2023.

Furthermore, the improvement in the price of Bitcoin has clearly also played a major part in CleanSpark’s performance, as the company’s Q2-24 average revenue per coin was $55k, up from roughly $23k in Q2-23. Machines deployed have also doubled from 68k last year to approximately 134k this year as CleanSpark has been aggressively scaling production capacity.

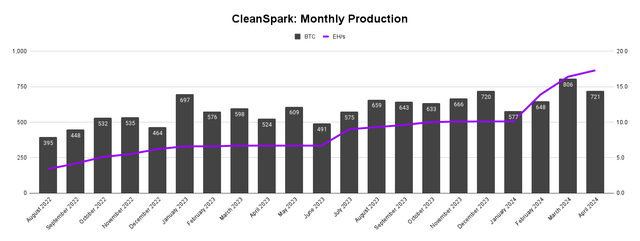

Author’s Chart (CleanSpark Disclosures)

As of the end of April, CleanSpark’s average exahash per second eclipsed 17 for the first time. The company now trails just Marathon Digital and Core Scientific (CORZ) for the largest public self-mining operation. CleanSpark’s treasury management strategy to close 2023 has continued into 2024:

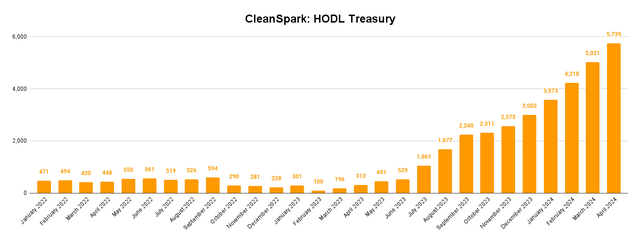

Author’s Chart (CleanSpark Disclosures)

At 5,739 BTC in treasury as of April, CleanSpark’s BTC HODL is the fourth largest of the public miners. Given how quickly the company has been able to scale up its Bitcoin stack, CleanSpark’s HODL could conceivably challenge that of both Riot Platforms (RIOT) and Hut 8 (HUT) next year, even adjusting for post-halving production numbers. Basically, CleanSpark is the 2nd largest valued Bitcoin miner for a reason, and it’s because the company has very little debt and keeps growing production while maintaining a sizeable BTC stack.

Balance Sheet & Growth Strategy

After raising more capital in the quarter, CleanSpark is well-positioned to take advantage of acquisitions following the block reward halving in April. Against total liabilities of just $74.4 million, CleanSpark had over $323 million in cash and equivalents plus $358 million in BTC at the end of March.

This level of liquidity will allow further expansion of the company’s production footprint through 2025, especially if CleanSpark’s mining operation can actually be self-sustaining through higher coin prices even as higher cost companies struggle. CEO Zach Bradford reiterated guidance for 32 EH/s online by the end of the year and 50 EH/s in 2025. And subsequent to the quarter ended March, CleanSpark has already begun deploying capital after buying 75 MW through sites in Wyoming for $18.75 million.

To this point, CleanSpark is looking for private acquisitions over mergers with other public companies, though management does forecast fewer public Bitcoin miners by the end of the calendar year. On the call, Bradford mentioned that acquisitions of other mining sites would likely be done with cash and equity, rather than through selling assets like BTC. He went on to explain why equity is possibly the better route going forward:

Historically, almost all of our transactions where we’ve acquired companies, it’s been in the form of cash, because the other parties needed cash to pay off debts or obligations, things like that, so they didn’t have a choice. Some of these operations now, again, it’s about joining the team. And so, I think that we could see an acquisition, even where equity is the sole use that we have where they become shareholders.

This speaks to the difference between desperate sellers who need cash to service large debt loads and sellers who simply can’t viably mine post-halving due to redundant overhead. Acquiring the latter is a much better reason for CleanSpark to dilute shareholders from where I sit because the company is simply addressing an efficiency issue rather than a financial one.

Post-Halving Risks

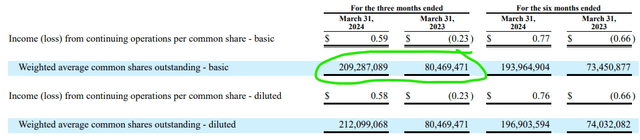

In my view, the company’s balance sheet management into the halving has been strong. However, as I alluded in the introduction, this growth has largely come at the cost of shareholder dilution. The weighted average common shares outstanding grew by 160% year over year. Interestingly, this was nearly an identical rate of growth as top line revenue.

Share Dilution (CleanSpark 10-Q)

While it is certainly justifiable to point out the company’s enormous level of shareholder dilution over the last 12 months, I’m of the view that CleanSpark’s approach has actually proven viable so far. In the current macro environment, debt is more expensive compared to previous years, and not every company in this space is in the position to raise capital the way CleanSpark is. On the conference call, CFO Gary Vecchiarelli made a telling point on raising capital:

We have raised approximately $1.4 billion since we entered the Bitcoin mining business in December 2020. Using this capital, we have grown this company to a market cap of almost $4 billion, which represents our ability to find accretive means to deploy capital. We continue to see opportunities for tuck-in acquisitions, which are accretive, and where we will be able to bring our operational expertise and strong balance sheet to grow our hashrate and efficiency even further.

It’s important to note that the entire reason why CleanSpark is positioned for acquisition opportunities in the market is because the economics of Bitcoin mining deteriorated dramatically in late April, when the block reward subsidy declined from 6.25 BTC to 3.125 BTC. I have mentioned repeatedly through various Seeking Alpha articles that this is a long-term headwind that is unlikely to be solved simply with higher BTC prices in perpetuity. Fees from network usage will ultimately have to become a larger portion of mining incentives, and so far, we’ve seen only flashes of high fees rather than sustained improvement in mining fundamentals. If we halving-adjust CleanSpark’s fiscal Q2 breakeven price of $45k and assume transaction fee revenue doesn’t meaningfully improve for the broader industry, CleanSpark’s fiscal Q3 quarter is unlikely to repeat the positive net income figure that the company just reported for end of March.

Summary

When I last covered CLSK for Seeking Alpha, I noted the massive surge in share price between November and February and cautioned chasing the stock at what I estimated to be an already rich valuation. Taking some profit at that time has proven to be the correct strategic course, as CLSK is now nearly 30% cheaper today. While there are indeed some positive signs from CleanSpark’s fiscal 2nd quarter results, I think it still makes to be cautious with mining equities. Short of taking responsibly-sized speculative positions or swing trade positions, miners are still unproven as a long-term investments. Perhaps paradoxically, CleanSpark may want to see temporary weakness in the price of Bitcoin through the rest of the year so that mining acquisition targets will capitulate and sell infrastructure to CleanSpark. In such a setup, CleanSpark appears ready and willing to make deals.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTC-USD, CLSK, MARA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.