Summary:

- CleanSpark is actively increasing their production rates through the construction and expansion of new facilities with the target of 2EH/s by the end of 1H24.

- The company has expanded their Sandersville facility and energized the first 100MW of its expansion plan, increasing their hash rate to 14EH/s. Total firm rate now stands at 16EH/s.

- CleanSpark has an estimated breakeven cost-to-mine rate of $28,093 post-halving, suggesting profitability may continue with the assumption that the price of bitcoin remains at current levels.

spawns

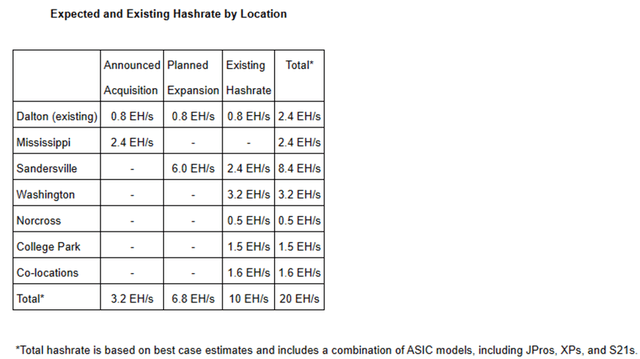

CleanSpark, Inc. (NASDAQ:CLSK) is taking on the Bitcoin halving event by storm by actively increasing their production rates through the construction and expansion of new facilities. CleanSpark has the growth initiative to reach 20EH/s (exahashes per second) during e1h24 with the long-term goal of 50EH/s in 2025 and is making strides to reach these targets. With an estimated breakeven cost-to-mine of $28,093/btc post-halving, I believe that the firm is positioned to effectively operate in the current market given Bitcoin’s elevated price of $70,800/btc as of 3/31/24. I provide CLSK a BUY recommendation with a price target of $42.32 at 19.92x eFY25 EV/aEBITDA.

Operations

CleanSpark recently expanded their Sandersville facility and energized the first 100MW of its expansion plan, increasing their hash rate to 14EH/s. This is up from their previously reported deployed hash rate of 12.5EH/s on their q1’24 earnings release. CleanSpark has also commenced operations at their three Mississippi facilities, which are expected to add an additional 2.4EH/s once the S21s are fully deployed. As reported in their March 1, 2024 press release, CleanSpark’s production has exceeded 16EH/s with over 131,000 operating miners deployed. With the 60% increase in production, CleanSpark mined nearly 650BTC for the month of February 2024, most of which was added to their treasury. At the time of the press release, this figure equated to $260mm in added reserves. CleanSpark acquired the three facilities for a cash payment of $19.8mm and anticipates reaching full capacity by April 2024.

Management expects that the firm can perform at 32EH/s at full deployment of 215,000 miners. Though I believe this to be a longer-term strategy given their present growth rate, this may come to fruition over the course of the next few years post-BTC halving. My thought process behind this is that less efficient mining facilities will be faced with significant headwinds post-halving and may be faced with selling assets or closing shops. This can be beneficial to CleanSpark as the firm currently has $48.5mm in cash & equiv. on the balance sheet, not inclusive of digital assets. If considering their Bitcoin holdings, as of 3/31/24, their balance is closer to $299mm.

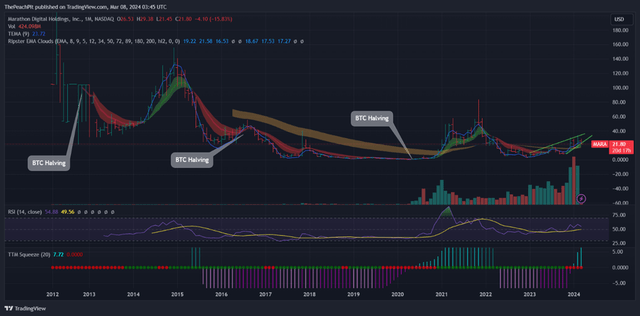

Given the pace of growth CleanSpark has engaged in going into the halving event, I believe management has been opportunistic in their mining operations in preparation for the more challenging operating environment. I believe this strategy will somewhat pay off for CleanSpark as the halving event will significantly reduce the reward for mining efforts once enacted. Management mentioned on their q1’24 earnings call that the halving event won’t necessarily be a -50% cut to operations, but closer to a -15-30% drop in the overall hash rate. Management does believe that the halving event will be a positive catalyst to Bitcoin pricing going forward; however, historical pricing suggests a lagging effect prior to any upside in pricing.

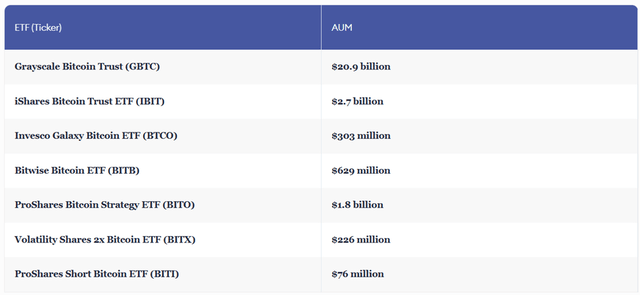

As I had discussed in my report covering Marathon Digital Holdings, Inc. (MARA), I believe there will be a shift in how shareholders view Bitcoin mining firms as Bitcoin ETFs become available at the start of 2024. There are two sides to the coin. The first is that there is somewhat of a floor in demand for Bitcoin as the ETFs must hold a certain number of Bitcoins to satisfy the trust. Investors certainly have taken notice of the ETFs as the Fidelity Wise Origin Bitcoin ETF has accumulated $6.43b in assets as of 2/29/2024. Forbes published a list of some of the top Bitcoin ETFs on the market, spanning from $303mm in AUM to Grayscale’s Bitcoin trust at $20.9b.

Overall, I believe that investors’ interest in the ETFs will help create price stability for Bitcoin over time. In the near-to-midterm, I expect that the growing interest by investors will create strong tailwinds for Bitcoin pricing up until a point of dilution that major price swings won’t be as prevalent. This should be a positive catalyst for CleanSpark as the stronger price per coin will contribute to the miner’s growth and longer-term, price stability will make cash flows less uncertain.

On the flip side, Bitcoin ETFs have created a vehicle for investors to directly invest in Bitcoin without having to use alternative vehicles, such as Bitcoin miners, as a proxy. What I mean by this is that investors no longer have to bear the operational risk as a shareholder in order to invest in Bitcoin exposure. I believe that this changes the dynamics for investing in Bitcoin mining companies as investors can satisfy their exposure more directly. What I expect is that companies like CleanSpark will likely be valued on generating cash flow going forward as opposed to their Bitcoin holdings. Though holding Bitcoin has the ability to create tremendous value for the firm, I believe that given this paradigm shift, the firm must operationally perform for value and not just growth.

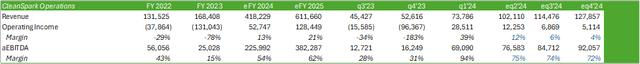

As CleanSpark nears the Bitcoin halving event, management has taken tremendous steps in cleaning up their operations. This has resulted in a -24% reduction in professional services fees and a -35% reduction in G&A. These operational improvements have clearly shown in the company’s reported earnings as the firm cleared $69mm in aEBITDA at a 94% margin. It is debatable as to whether eliminating D&A is reasonable for valuing CleanSpark as this line item accounts for 66% of total costs to operate in their q1’24 earnings report. Given that running their mining machines at full capacity is the growth driver for the business, D&A is essentially a core cost of doing business, despite being a non-cash expense.

Forecasting operations, I do anticipate the firm to realize substantial growth through their expanded mining operations. Assuming Bitcoin remains in the current range, I believe that CleanSpark can reach $418mm in revenue for eFY24 and $611mm for eFY25. I believe that management rushing to get sites online before the halving event was a strong move as it allows the firm to be advantageous in optimizing the reward before it is reduced post-halving. Management anticipates that the firm’s cost-to-mine after the halving event will be $28,093 given their current fleet. This compares to $47,117 for the industry average. I believe that this low breakeven cost can create significant tailwinds for CleanSpark with the assumption that interest in Bitcoin continues to grow. As alluded to earlier in this report, I believe that the approval of Bitcoin spot ETFs has created somewhat of a floor for demand for Bitcoin holdings, allowing miners to realize higher prices. This is a phenomenon that is currently being seen in uranium mining along with the Sprott Uranium Spot ETF (U.U).

In terms of power costs, I do believe management made the right decision to acquire power for the new facilities under a fixed price agreement. I believe that with the increased power demands for Bitcoin mining paired with the increasing rate of growth in the data center space, the increased power consumption for computing capacity will potentially drive up electricity costs. CleanSpark has already faced challenges with sourcing electricity in the recent quarter as the firm faced headwinds in sourcing adequate power due to their utility substation transformer not passing its most recent inspection. I believe this will not be an isolated event going forward as much of the grid requires significant upgrading as more compute capacity comes online for AI and as electric vehicle popularity grows.

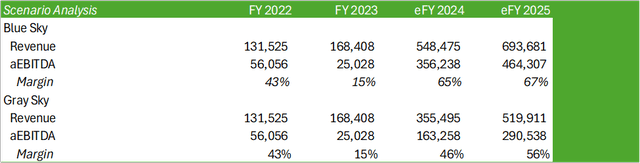

Considering multiple scenarios, the blue sky assumes Bitcoin averages 20% above the current price and the gray sky assumes Bitcoin’s price declines by ~45% from its current levels, holding all else equal. This base case scenario has a lot of unknown factors that I cannot control for, including utilization rate, the firm’s ability to source power to run machines at full capacity, and their ability to source machines and get them racked and running on time, amongst other factors. I believe that these scenarios laid out provide a reasonable baseline expectation based on the price of Bitcoin and the firm’s operating efficiencies.

Valuation & Shareholder Value

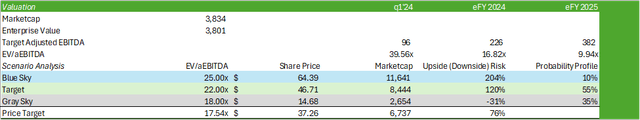

I believe valuing CLSK going forward will be based on the firm’s operational efficiencies over the book value of their Bitcoin holdings given the argument above as it pertains to Bitcoin spot ETFs. Given the firm’s growth trajectory and the perceived value of Bitcoin, I believe that CLSK holds a significant amount of upside potential as the firm expands their operations while managing their operational leverage. I believe management has laid out an appealing growth strategy that can effectively mine Bitcoin at a profit going forward, assuming the price of Bitcoin remains relatively elevated. I provide CLSK shares a BUY recommendation with a price target of $42.32/share at 19.92x my target eFY25 EV/aEBITDA forecast. I believe this price target poses a good midpoint given the volatility in spot Bitcoin prices and provides a roadmap for the firm’s growth in hash rates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.