Summary:

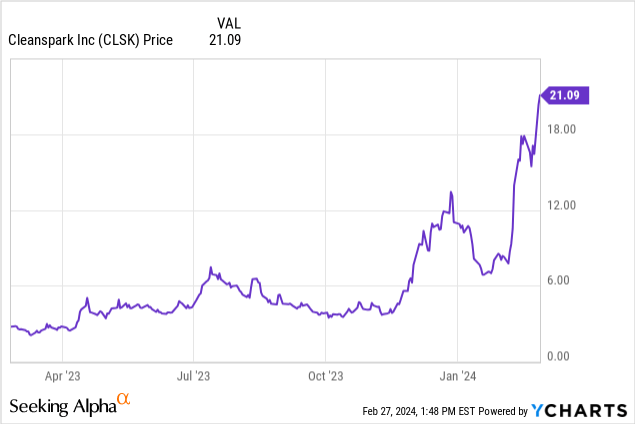

- CleanSpark’s stock has surged over the last ten months, returning over 500% since April 2023.

- The company has maintained high production levels while also growing its BTC reserve before the halving.

- CleanSpark’s breakeven price has increased significantly and it’s only going to get more difficult in the second half of this year when the block subsidy declines.

Adrian Vidal

I’ve covered CleanSpark (NASDAQ:CLSK) for Seeking Alpha four times over the last 13 months. From the depths of “crypto winter” to spot Bitcoin (BTC-USD) ETFs in the US market bringing in over $6 billion in positive net flow, it’s been quite the run to say the least.

- CleanSpark: Production Growth Is On Track

- CleanSpark: Stacking Sats And Growing Hash

- CleanSpark: Well-Positioned For The Future

In the three months since my last article, CLSK shares have absolutely rocketed from just shy of $9 per share to over $23 at one point on February 27th, 2024.

But going back even further than December, CLSK shares have returned over 500% since the time I first called the stock a “buy” in April 2023. Frankly, this stock has performed well beyond my expectations. The question now is can we still justify buying the stock at this price? Or is it time to lock in the massive winner?

January Production & Growth Plan

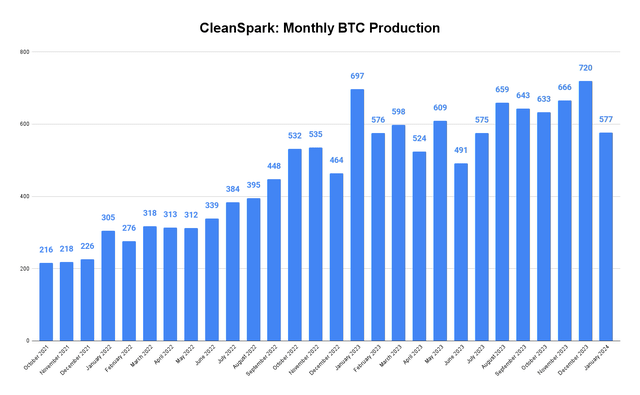

In the month of January, CleanSpark reported 10.1 exahash per second. This puts the company solidly within in the top 5 producers of the roughly two dozen public Bitcoin miners after Marathon Digital (MARA), Riot Platforms (RIOT), and Core Scientific (CORZ).

Monthly BTC Production (CleanSpark, Author’s Chart)

In the face of an ever-increasing global hash rate, CleanSpark has done a very nice job keeping production high and remaining competitive with the other leading companies in the public market. And because the company as funded growth more through share issuance than debt, it has been able to grow its Bitcoin reserve very quickly over the last 7 months:

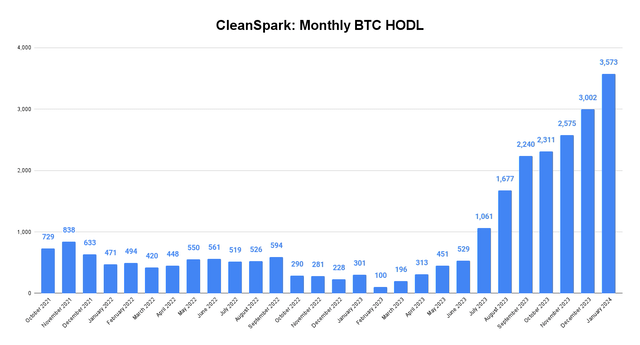

BTC Holdings (CleanSpark, Author’s Chart)

Since June 2023, CleanSpark has increased BTC holdings by over 500%. CleanSpark has managed to grow aggregate BTC holdings in line with Marathon Digital despite having less than half the exahash. I think this speaks to how well the company has positioned itself to benefit from higher BTC prices. This is important given the block reward halving and we’ll get into that more shortly.

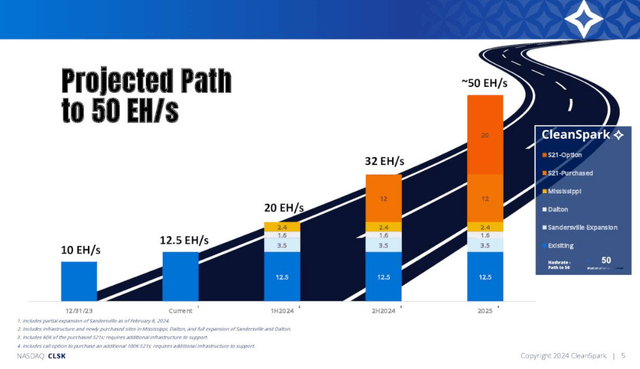

Investor Deck, Slide 5 (CleanSpark)

Short of transaction fees driving revenue, it is imperative that CleanSpark grows EH/s faster than global hash to make up for the dwindling coin issuance subsidy that has historically incentivized transaction validation. Here we see aggressive expansion plans for CLSK with a near doubling of mining compute in the first half of this year and 32 EH/s in the second half of 2024.

Financials

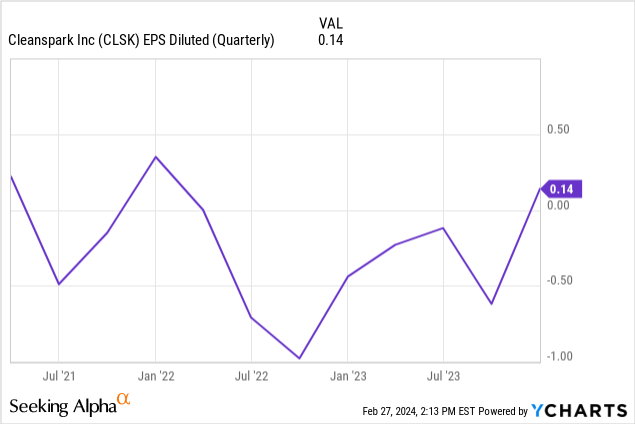

What helped send CleanSpark shares flying in February was the response to the company’s surprise earnings beat from its Q4-23 performance:

CleanSpark reported an EPS of $0.14 against an estimated -$0.25 per share for the quarter. This was the company’s first positive quarterly EPS since Q4-21 though there is an important caveat; $36 million of the company’s $29.2 million operating income came from an accounting change where CleanSpark is adjusting for unrealized gains on Bitcoin holdings – most of which were not added during the same quarter. Taking that out, CleanSpark would have had another quarter of negative operations in Q4.

I’ve shared this table in the past and I’m updating it again:

| Q1-23 | Q2-23 | Q3-23 | Q4-23 | TTM | |

|---|---|---|---|---|---|

| Cost of Revenues | $22,100,000 | $20,700,000 | $30,400,000 | $93,600,000 | $166,800,000 |

| Total Opex | $37,800,000 | $39,700,000 | $83,100,000 | $203,900,000 | $364,500,000 |

| BTC Mined | 1,871 | 1,624 | 1,877 | 2,019 | 7,391 |

| Breakeven Price | $32,015 | $37,192 | $60,469 | $147,350 | $71,885 |

Source: Seeking Alpha, Author’s Calculations

In the table above, we’re adding cost of revenue with total opex and dividing that figure by the total BTC mined during the quarter. The result of this calculation shows Q4 having a massive sequential increase in breakeven price from $60.5k in Q3 to $147k in Q4. Trailing twelve months, this figure comes in just shy of $72k – which is a price that now exceeds Bitcoin’s all time high as of article submission.

Post-Halving Projections & Multiples

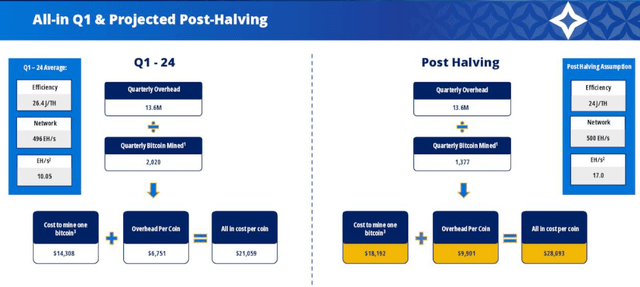

The biggest headwind to all Bitcoin miners going forward is the block reward halving in late-April. Thus, CleanSpark has one more quarterly earnings report before the hit to revenue from the halving will begin to show up in the company’s financials. CleanSpark’s internal post-halving projection has all-in cost per coin at $28k. It also has the Q1-24 all in cost at $21k per coin:

Investor Deck, Exhibit 1 (CleanSpark)

Frankly, I think these are optimistic expectations. For instance, consider the network hash figure that is being used in each of these scenarios. The Q1 figure assumes an average of 496 EH/s and 10.1 EH/s for the company.

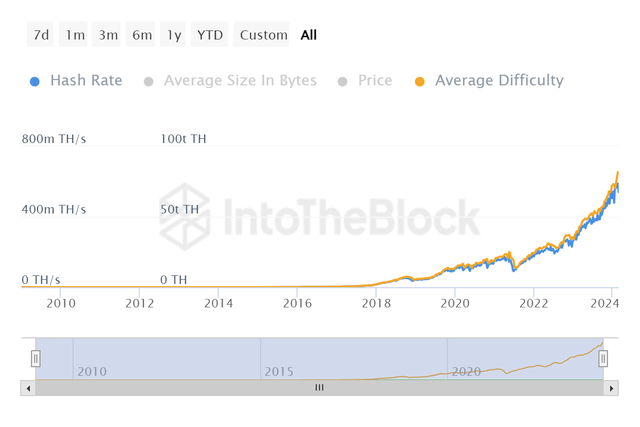

Hash Rate Trend (IntoTheBlock)

The long-term hash rate trend has been one of exponential growth throughout Bitcoin’s existence. More recently, the only meaningful pullback in global hash was because of China’s mining ban in 2021. But more importantly, as of February 27th, the average daily hash rate year to date is 551. Not only is this well ahead of the CleanSpark’s Q1 exhibit but it’s already 10% higher than the post-halving assumption of 500.

How we get to 500 global exahash after the halving is unclear. It is entirely possible that weak miners will throw in the towel and start turning off machines in the second half of this year. This would benefit larger players with high efficiency marks, of which CleanSpark is on that short list. But the higher Bitcoin goes, the more the weak miners are incentivized to keep hashing.

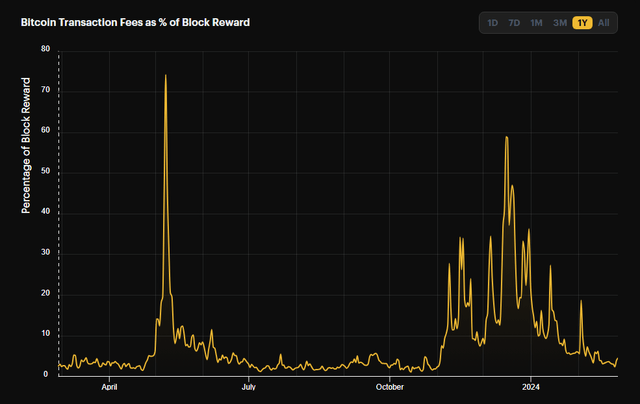

Transaction Fee % (Hashrate Index)

The other element of this that is important to mention is Bitcoin transaction fees in January and February have not lived up to what we observed in November and December. So if we assume global hash stays flat and we annualize CleanSpark’s January production based on a projected 17 EH/s, we can try to model the second half of CleanSpark’s 2024 revenue when we will have two full quarters of post-halving performance. I think top line figures could look like this:

| BTC Price | Monthly BTC | Annualized Rev |

|---|---|---|

| $60,000 | $29,160,000 | $349,920,000 |

| $70,000 | $34,020,000 | $408,240,000 |

| $80,000 | $38,880,000 | $466,560,000 |

| $90,000 | $43,740,000 | $524,880,000 |

| $100,000 | $48,600,000 | $583,200,000 |

Source: Author’s Calculations, 17 EH/s production

This table assumes 17 EH/s for CleanSpark with global hash in line with January. I’ve also applied a BTC per EH/s adjustment post-halving based on CleanSpark’s efficiency figures from January. At $100k post-halving BTC price, CleanSpark’s annualized post-halving revenue at an average of 17 EH/s comes out to $583.2 million – and that’s assuming the company sells all of its production. At a $4 billion market cap currently, CLSK is trading at 7 times forward sales. The info tech sector median is less than 3x.

Risks

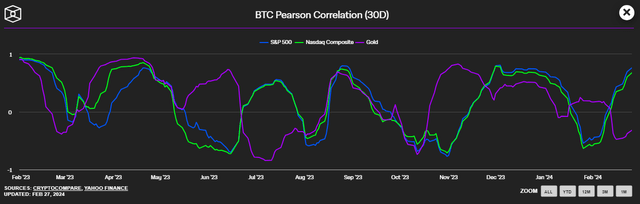

At this point, I think we’ve hammered home the halving in April. But there are macro headwinds to consider as well. Disciplined investors and traders should always be mindful that possible unknowns can unwind markets. Buying stocks with a Buffett Indicator at 158 might have made sense to some in February 2020 – things quickly changed. The Wilshire 5000 to GDP is even more overvalued now than it was pre-COVID. Even Bitcoin wasn’t immune from a nasty 63% drawdown between the February 2020 high and March 2020 low. And I’d argue BTC is an even more “TradFi” now than it was then.

Bitcoin is again highly correlated to a stock market that I personally think is significantly overvalued. FOMO and pricing to perfection works until it doesn’t. The broad market has spent much of the last several months pricing in rate cuts that we now know probably won’t happen in until June at the earliest. Furthermore, the BTFP program is supposed to be ending in March. Assuming that is not extended, I suspect we may see some downside volatility in equities in the weeks and months ahead.

Investor Summary

Personally, I think CleanSpark has done a nice job navigating crypto winter and I think it’s an essential holding for the upcoming Bitcoin bull run. That said, don’t forget to take some profit along the way and manage positions responsibly.

That was from my final thoughts section in my last CLSK article. It still holds up. There’s an old saying in the market that goes something like this; pigs get fat, hogs get slaughtered. Sitting on 500% gains feels like hog-ish behavior to me. I’m still bullish Bitcoin long term, and I still think CleanSpark is one of the miners that will be best-equipped to navigate the second half of 2024. CLSK is still my largest single miner holding. However, I have taken quite a bit of profit at this point in time. I’m still long and plan to sit on what I’m holding. But it’s house money at this point. In my opinion, the risk/reward between holding even the leading miners versus holding Bitcoin more directly now favors holding Bitcoin directly.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTC-USD, CLSK, MARA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.