Summary:

- CleanSpark has achieved significant growth through acquisitions, doubling its revenues and increasing its hashrate.

- Acquisitions should boost the company’s total capacity to over 24 EH/s once fully operational.

- However, the economics of Bitcoin mining pose challenges, as the amount of Bitcoin mined decreases over time despite increased computational capacity.

LPETTET

I was wrong on CleanSpark (NASDAQ:CLSK). At the time I wrote my article almost 4 years ago, I was bullish on Bitcoin. CleanSpark, at the time, was a technology solutions provider for the energy industry. My thinking was that by using as cheap an energy source as possible, the company could easily profitably mine Bitcoin. That did not pan out, as the economics of Bitcoin mining are pretty difficult. The company has since exited the energy business, becoming a pure-play Bitcoin miner, and I have become much more bearish.

CleanSpark Grows By Acquisition

Looking at CleanSpark’s Q2 2024 results (the company has a different fiscal year), it can be seen that the firm has achieved some significant wins. The company more than doubled its revenues from $42.5 million to $111.8 million. The company mined 2,031 bitcoins this quarter with an average price of $55,029 compared to the 1,871 bitcoins the same time last year with an average price of $22,706.

The increase in mined BTC was due to the increase in the number of miners in operation, which increases the company’s hashrate. The hashrate is the computational power that when combined with the global hashrate determines the number of BTC CleanSpark can mine. This increase in hashrate was largely due to the company expanding its operational capacity via acquisitions.

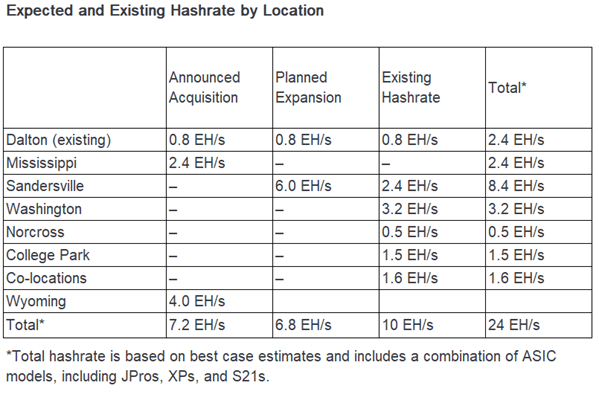

Operational capacity increased by 60% due to two bitcoin mining acquisitions in Mississippi and Georgia. Last February, CleanSpark acquired three turnkey bitcoin mining Mississippi facilities for $19.8 million in cash. These facilities had a combined operational hashrate of 2.4 EH/s.

The additional Georgia facility, on the other hand, cost $6.9 million in total and has a target hashrate of 0.8 EH/s. Within the Georgia facility, CleanSpark is also making expansions to boost output. The expansion will consist of a 15MW facility running a fleet of S21s. Once complete, this expansion will add another 0.8 exahashes per second (EH/s) to the company’s total capacity. The total capacity for the company’s Georgia facility (which includes existing, acquisition, and expansion) is 2.4 EH/s.

The company continues to go on its buying spree, as it recently announced that it will acquire two Bitcoin mining locations in Wyoming for a cash payment of $18.75 million. These facilities have 75 MW of available power and are targeted to add 4 EH/s to CleanSpark’s operations. According to the press release, the company “plans to deploy a combination of S21 and S21 pros, the most powerful and efficient generation of bitcoin mining machines, from orders placed and fully funded earlier this year”.

These acquisitions should boost the company’s total capacity to over 24 EH/s once fully operational. These acquisitions are especially important post-halving, as existing facilities will now be able to only mine half as much Bitcoin as they used to. While all these acquisitions are good, it shows that the company is inorganically growing its revenues. It demonstrates the impact that the halving has in terms of Bitcoin mined. In other words, there is a race to continue to expand operational capacity while not necessarily getting more Bitcoin out of it.

Author table from company data

CLSK Quarterly Results Analysis

Looking at the rest of the financial data for CleanSpark’s latest quarter, we can see that the company is in a good place. CleanSpark has an ample amount of liquidity as the company has total current assets of $687.8 million, which is comprised of $323.1 million in cash position and $358.0 million in Bitcoin. This is much higher than the company’s long-term debt of $12.8 million of debt. This strong balance sheet puts the company in a prime spot should it want to pursue additional acquisitions.

On the income front, CleanSpark had a Net Income of $126.7 million or $0.59 basic income per share for the quarter. This was a massive improvement from the loss of ($18.5) million or ($0.23) loss per share at the same time last year. Adjusted EBITDA surged year-over-year from $12.7 million to $181.8 million. The company’s Net Income gains are driven by the rise in operational capacity as well as the surge in Bitcoin prices. The former, i.e. operational capacity increase, is driven by capital expenditures. In a vacuum, this all works fine, however, given the unique economics of Bitcoin mining makes this business model challenging.

The More Bitcoin is Mined, The less you get for Mining

The fundamental long-term problem with Bitcoin mining in general is that over time you get less Bitcoin mined even as computational capacity increases. This is because the more Bitcoin is mined, the less Bitcoin is received as rewards for mining. This factor is apart from the Bitcoin “halving” which occurs roughly every four years when the reward for each block of Bitcoin mined is cut in half. The most recent halving event took place on April 19 where the reward for each Bitcoin block was reduced from 6.25 BTC to 3.125 BTC.

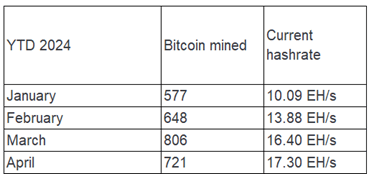

We can see this play out when we examine CleanSpark’s Bitcoin updates for January, February, March, and April this year. Looking at the table below, it can be seen that the number of Bitcoin mined from January to March has been increasing as the company’s hashrate increases. From 577 Bitcoin mined to 806 Bitcoin mined respectively. However in April, despite having the highest hashrate of 17.3 EH/s the amount of Bitcoin mined was less than in March. This was having the post-halving rewards for 1/3 of the month, as the halving occurred on April 19th. The next update for May will show how much Bitcoin we can expect CleanSpark to mine post-halving. In other words, I believe that despite all the money CleanSpark spent on acquisitions, the actual number of Bitcoin mined might not see much of an improvement.

Author table from company data

Conclusion

Putting all these together, what I am saying is that CleanSpark, like other Bitcoin miners, will have to continuously spend money to even maintain its present number of Bitcoin mined. The company is going on an aggressive acquisition spree. However, time will tell if it is able to constantly maintain its number of Bitcoins mined. Therefore, I have always believed that in the long-term, investors are better off simply buying Bitcoin itself through one of the many now available ETFs.

The key risk to my thesis though is that many other smaller bitcoin miners would go out of business. This would reduce worldwide hashrate letting the remaining miners earn more rewards. In this scenario, CleanSpark would be able to acquire these much smaller miners at a favorable price. However, I still view Bitcoin mining to be difficult to profit long-term due to the halving events as well as being wholly dependent on Bitcoin prices.

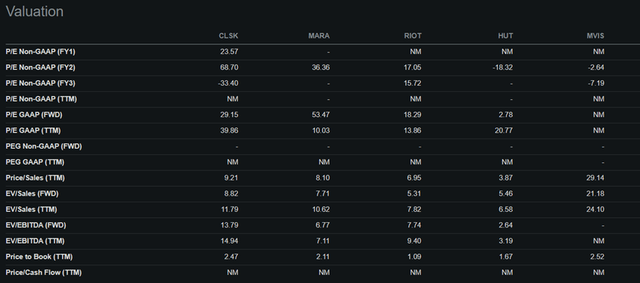

Even putting aside my bearish view of the business model, CleanSpark is trading at unattractive valuations. The company is trading at a TTM P/E of 39.86x and a forward P/E of 29.15x. The company’s TTM P/E is higher than the sector median TTM P/E of 30.70 and its forward P/E is at the median of the IT sector of 29.73x forward P/E. Even comparing to its direct Bitcoin mining peers, CleanSpark on forecast year 2 has a P/E of 68.7x, which is higher than Marathon Digital (MARA) or Riot Platforms (RIOT). The unattractive business model and the higher valuation makes this company a “Sell” rating for me.

Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.