Summary:

- CleanSpark delivered over 600% share price growth in 4 months, they have to be worth a look.

- CleanSpark has outperformed Bitcoin and other miners, but questions remain about the sustainability of their performance and market timing strategies.

- CleanSpark’s focus on efficiency, market timing, and aggressive expansion through acquisitions present both bullish and bearish risks for investors.

by Martin Nancekievill

During 2023, I was a big buyer of Bitfarms (BITF). I chose them after analyzing several miners (writing about Hut 8 Corp (HUT),, Hive Digital Technologies (HIVE), Cipher Mining (CIFR) and Bitfarms (BITF) ). BITF turned out to be a great choice, returning over 100% on two occasions and 25% on the third.

Things are changing, and I have decided I need a new miner to replace Bitfarms in my portfolio. The CEO and driving force behind everything I liked about Bitfarms has left in acrimonious circumstances, and they are being circled by acquisition orientated companies.

I began a search for a new miner restricted to those with a market cap over $1 billion. The industry is maturing, and the halving has reduced the rewards miners get for their operations, making the industry even more competitive than it was. In this new reality, I think size is going to matter, I expect a lot of smaller miners to have trouble surviving the halving, and any without the most efficient operations may be squeezed into an unprofitable scenario. Economies of scale will be important, likely only the biggest will survive, and the interest in Bitfarms as an acquisition target may be the first soundings of an industry consolidation.

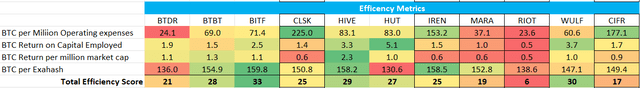

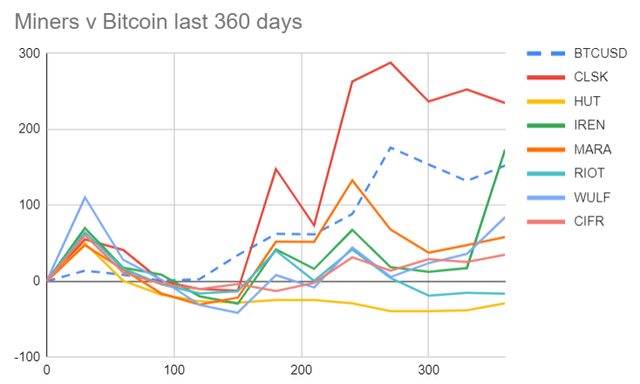

This means I am looking at 7 miners, and the first thing I did was look at their stock price performance against the price of Bitcoin (BTC-USD).

Price Charts (Author Database)

On this graph, which plots the change in price over the last 360 days (so 12 months ago was day 0), CleanSpark is the standout performer. As a result, it is the first miner I will look at.

CleanSpark has been a better investment than Bitcoin

In an industry that has thrived on hype and experienced many high-flying companies come crashing down to earth, we have to ask if the CleanSpark outperformance of Bitcoin is justified? It is in marked contrast to the other miners who have struggled to deliver the investment returns of Bitcoin.

The price performance of CleanSpark shares is pretty astonishing, the share price moved from $3.50 in December 2023 to over $24.50 by the end of March 2024. That’s an astonishing 600% in 4 months, since March, the price has fallen to around $14.50 today, still it is up massively from December. Such a move does suggest hype rather than substance.

Can Miners outperform Bitcoin?

I believe that all miners, if sufficiently efficient, should be a better investment than BTC and the BTC ETFs. An ETF gives you exposure to bitcoin at the spot price, you could also buy from a crypto exchange at something very close to this spot price. A miner, on the other hand, generates its bitcoins at a significant discount to spot sometimes more than 50% discount, when you buy a miner you are buying exposure to their holding of bitcoins being acquired at a substantial discount to spot prices.

Of course, the market is never completely rational about these things, and it is always supply and demand that drives prices, not any belief in a fair value.

CleanSpark Efficiency Rating

Getting a fair value for Bitcoin miners is difficult, and there is no accepted view. You cannot use discounted cash flow as they are not aiming to generate cash, we need some sort of discounted bit flow, but no such measure exists.

Nonetheless, I will try to analyze CleanSpark relative to the competition. CleanSpark could be more efficient than the competition, simply better at doing what it does, this would account for the price premium. A new strategy or a more fundamental reason could explain the outperformance of both the Bitcoin mining sector and Bitcoin itself.

If I cannot find a solid fundamental reason for the outperformance, then the most likely scenario is for its price to revert back towards the mean performance of Bitcoin miners in the way Marathon Digital (MARA) did on the chart. Mean reversion is a well-known phenomenon in trading, and many people use it as a trading strategy.

When I last wrote about Bitfarms, I included this graphic that attempts to measure the efficiency of the miners I follow. It relates to Bitcoins mined in Q1 2024 and the previous five years’ capital expenditure plus operating expenses in the last quarter. CleanSpark stands out, having the highest score for BTC per million of operating expenses. They and the other miners suffer on some of the measures related to market cap versus the smaller miners. It does point to the efficient use of capital and resources; however, it is a flawed measure in isolation. CLSK only mines bitcoin, so every cent of operating expenses goes toward bitcoins. Other companies run data centers and have moved into AI so much of their operating expenses are being spent elsewhere.

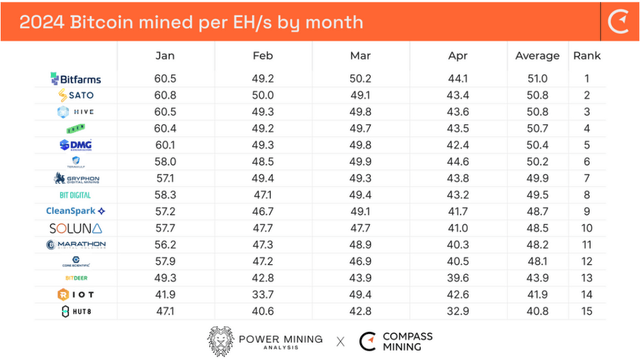

A second view of efficiency comes from Compass Mining, it is a monthly report written by Anthony Power and is well worth reading, I read it every month.

Bitcoins mined 2024 (Compass Mining)

It shows CleanSpark mid-table for 2024 and the gap between it and the top-rated Bitfarms has increased from 1.1 bitcoin per exahash in March to 2.4 in April. I compare CleanSpark with Bitfarms as they are the other miner focussed on solely being a vertically integrated self-miner. The others typically have a range of activities, so the comparisons are not as clear.

It means CleanSpark is not getting the same amount of Bitcoins from their fleet of miners as other companies, suggesting they are not that efficient.

CleanSpark History

CleanSpark began life as a renewable energy company, converting waste into gas. They merged with a microgrid company and then decided to build their own data centers and mine Bitcoin rather than sell microgrids to data centers.

Now CleanSpark is a vertically integrated Bitcoin miner. I like this strategy, it is one of the main reasons I bought into Bitfarms. CleanSpark are not trying to move into AI, they are not hosting data centers for others; they are buying miners, building data centers, developing the infrastructure to maintain their fleet, and mining Bitcoins. I like the focused strategy.

CleanSpark are market timers

CleanSpark strongly believes in its ability to strategically manage their business better than other bitcoin miners. This comes across in almost all of their public interviews; in a special call last month with the bank H.C. Wainwright (who have CLSK as their top pick for 2024) they repeatedly stressed their belief in their strategic advantage. They said their business was driven by “strategy over ideology”. The crypto industry is full of ideologies, with many people having strong views about how the industry should behave and what bitcoin means to the world. The idea of using business strategy to maximise profits and not concentrate on the ideology of the industry is one I find appealing.

In the Q2 2024 earnings call, the CEO said “Our strategic approach sets us apart in an industry”

Although I admire their confidence, it comes with consequences, it has turned them into market timers.

The CEO said at the Wainwright talk.

an example of this is we sold Bitcoin at the peak of the market last year because everybody else thought you should hold it, and I looked at the market and said everyone’s lost their minds.

The problem with timing the market, as everyone reading this will know, most people get it wrong most of the time. I am no exception to this rule, I have bought at the top and sold at the bottom more times than I care to remember and, as a rule, I have learned to be sceptical of people who tell me they know how to time markets.

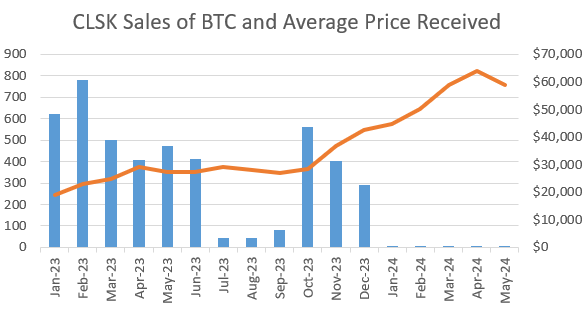

When I looked at the data, the same is true of the managers at CleanSpark, they sold their bitcoin hodle last year at the low point and stopped selling when the price began to recover.

CLSK selling (Author database)

The blue bars are the number of Bitcoins CleanSpark sold each month in 2023, and the orange line is the average price they received per bitcoin. As you can see, they stopped selling just as the price began to move higher. In October they managed to capture the final low point in BTC when they sold 562 bitcoins for $28,600 each. Today, those bitcoins are worth $65,000 and their attempt at market timing cost the company more than $20 million.

CleanSpark and Electricity Prices

Bitcoin mining is all about managing energy. All the miners have access to the same mining rigs, the same switching gear and transformers. The key to profitability is in the cost of electricity to power the rigs.

CleanSparks history as an energy company has them believing that they understand the electricity market better than their competitors and that they can time the market giving them a price advantage. From the Wainwright call

using all of the kind of advantages that came out of several years of renewable energy generation and development modeling solutions around cost avoidance or time-of-use charges….provides us some insight that I think maybe is unique in the Bitcoin mining space

CleanSpark has deviated from the more common path of signing fixed-rate electricity deals. They are market timers and prefer to have a floating rate energy cost. They turn off the machines when prices are high and run them full speed when prices are low. It is not the rebate kind of deal where they get paid to throttle back they just pay for what they use.

In the Wainwright call they discussed the floating rate power deal. They said Now we don’t turn our facilities off often. But for example, avoiding 100 to 200 hours a year, which is just a fraction of the time we can have up to 30% less power prices.

The CEO discussed the Mississippi takeover, which is coming with a fixed-rate electricity deal, and said they will look to move it to a floating rate saying “this is what we do best”. His view is that the fixed rate deal is an energy hedge and his goal is to beat the hedge price. Later in the call he said “

power is consistently in the month of March was in the $0.01 plus range, right?

If this is true, and they are getting electricity at $0.01 CleanSpark has been incredibly successful, when I wrote about Bitfarms the lowest electricity costs on fixed rate deals seemed to be around $0.042.

Looking at the Q2 earnings, things were not quite as good as suggested. CleanSpark has a cohosted site in New York and in Q2 prices were high at $0.075 which lifted the average to $0.043, a good price but not spectacular. I have known many market timers in my career, and they tend to focus on the big wins and ignore the losses. It is not unreasonable to level this accusation at CLSK. In the Wainwright call they mentioned the $0.01 but did not mention the $0.075

A price of $0.01 is the big win but all of that effort in timing the market, turning machines off for a couple of hundred hours a year trying to beat the hedge when actually, on average, they didn’t.

The floating rate puts them at risk of any significant and prolonged surge in the price of energy, they are confident that they understand the market well enough to manage this situation but black swans are real and that is why the majority of the industry hedges its prices with a fixed rate deal, CleanSpark are taking on significantly extra risk and not showing any significant return for this extra risk.

Distressed Asset Acquisition

CLSK grows by acquisition, they have grown fast and intend to grow even faster. They are expecting a flurry of M&A (Q2 earnings call) activity post halving. They believe that miners struggling before the halving, who do not have the balance sheet or the cash to upgrade their mining fleet, will be looking to offload data centers and slim down operations. They did say in the Wainwright call they are not interested in mergers, only acquisitions.

Cleanspark has no debt and the CEO said, “we’ve gone through a couple of $0.5 billion ATM transactions”. When you add the $1 billion of dilution to the cash raised from selling bitcoins last year, you get a lot of cash on the balance sheet. CleanSpark intends to use the balance sheet to grow significantly. They have given guidance of 50 exahash in the next 12 months, a significant increase from todays 17. The 17 figure shows huge growth, almost trebling from the position 12 months ago.

Recent expansion saw them moving into Mississippi, buying three facilities. They announced just before the Q2 earnings call they were buying two facilities in Wyoming.

The CEO said in the earnings call “We expect to be one of the most measured and active acquirers in the industry.” And discussed their aggressive purchasing of new mining machines; they have placed orders for Bitmains s21 Pro miners and guided to 20,000 arriving in April, May, and June in the Wainwright call.

In the Q2 earnings call, the CEO stressed that he believes the halving will lead to distressed miners selling datacenters

The opportunity for CleanSpark isn’t just in the amount of hashrate that drops off, but in the data centers that become available as a result

and expanded by saying the decrease in network hashrate of 15% since the halving means that data center space equal to five times the capacity of CleanSpark has become available. The plan is to buy data centers and swap out inefficient mining rigs with the new S21 rigs they have bought. CleanSpark has ordered an additional 100,000 rigs (In the earnings call they confirmed that this option had been exercised) that will take the total exahash over 50. That is a huge increase and will make them one of the biggest, perhaps the biggest, bitcoin miners. It will put them on par with Marathon, who are also targeting 50 exahash.

At the moment, they do not have anywhere to put those 100,000 rigs, they are relying on timing this market correctly and negotiating acquisitions at the right price and in the right geographical place with the economics for profitable mining. It seems like a big gamble to me; looking at the 100,000 rigs means they need to acquire three times as much data center capacity as they currently have and are committed to doing this in H2 2024 and H1 2025.

CleanSpark Finances

With equity (assets – liabilities) greater than $1 billion and debt of under a million, CleanSpark is in excellent financial shape. It has just turned profitable but has not yet delivered positive cash flow.

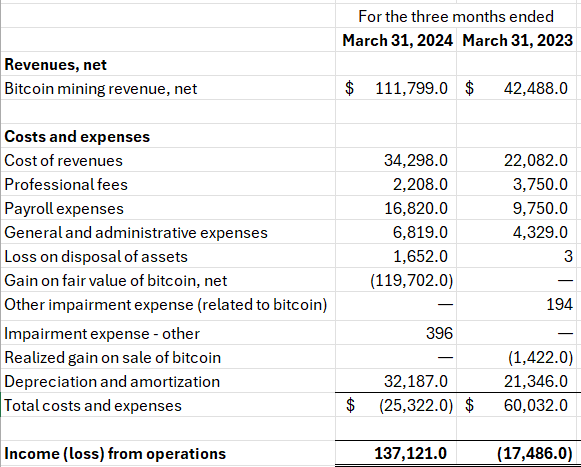

The profitability of miners cannot be thought of in the same way as profitability for most companies. The gain or loss on the value of bitcoins they have on the balance sheet makes an enormous difference to the profits they report. If you look at Q2 for 2023 and 2024 you can see this in action. Q2 2024 showed a gain of $119 million (all figures in ‘000s) whereas this line item was zero for 2023, these huge swings in the value of bitcoin will always make analyzing these companies difficult.

Y-on-Y line items (Author Database)

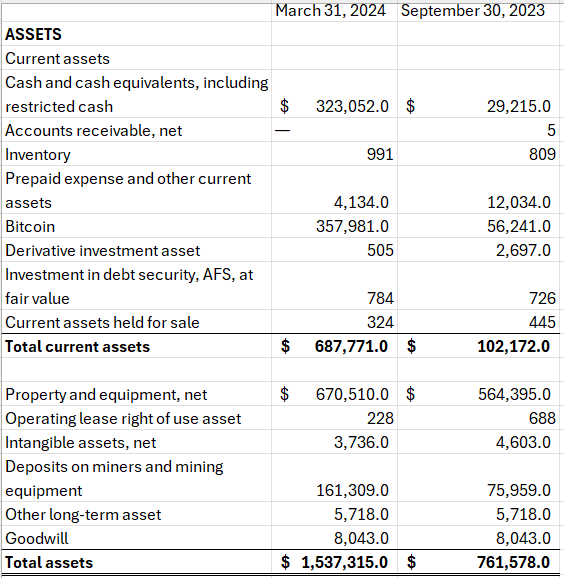

The balance sheet has a similar issue, Cleanspark shows current assets of $687 million, with $358 of that being the bitcoin held in treasury. We cannot ignore the bitcoin, but unlike all of the other short term assets, it is subject to huge swings in value. It could easily double in value before the next earnings release, making the profits look fantastic and the balance sheet robust or halve in value, giving the opposite view, but nothing about the business may have changed.

Balance sheet Y-o-Y (Author Database)

If we look at the cash (ignoring bitcoins) CleanSpark has a cash runway of just over 12 months, adjusting for the amount of bitcoins it rises to almost three years. Either way, it is a pretty solid balance sheet.

CleanSpark management seems intent on investing heavily over the next 12 months, acquiring data centers and mining rigs, which may have a material impact on the balance sheet, if bitcoin prices rise it may not be such a problem.

Dilution

In the last 12 months investors have suffered more than 100% dilution, an enormous figure, but it does not seem to have dented appetite for the stock which has soared higher.

Dilution is likely to continue, the acquisition plan may require more cash or be paid for in equity. We do not know how much will be spent. Still, they are attempting to treble the size of the business. Property and equipment on the balance sheet is $670 million, so trebling it could be in the order of $1.5 billion, which would require significant further dilution.

The general public owns 52% of shares, institutions 45%, and insiders less than 3%. The high general public ownership makes volatility more likely, and I worry that the relatively low insider holdings does not align the interests of the management with the interests of the shareholders.

The CEO, Zachary Bradford, received a total package of $7 million in 2023, which is about average for a company of this size, he sold shares for $9 million in March 2024, leaving him with around $50 million of shares left.

Risks Bearish and Bullish

Bitcoin Prices

The price of Bitcoin could soar, massively increasing the value of the CLSK treasury, but with that comes problems. It will be challenging to find distressed miners if there is a very high bitcoin price, even inefficient miners would cover their costs. The expansion plan would be put into difficulty and the cost of housing the 100,000 new miners would rise. In this case, the current price premium of shares may fall in line with those of other companies.

The price of Bitcoin could remain reasonably stable, which might imply that they can carry out their plan as they have laid it out. If miners are in distress now, a flat Bitcoin price will not help and their assets may be available at reduced prices. This would probably be the best scenario for CleanSpark as their efficient operational business model could be expanded at relatively low cost.

A significant fall in Bitcoin prices would be difficult for the whole industry, I would expect to see CleanSpark try to take advantage of it and buy distressed assets at fire sale prices. If the Bitcoin price recovered, CleanSpark could emerge as a much bigger force, maybe even a world-leading miner. If the Bitcoin price does not recover, then CleanSpark will be in trouble. They would have increased operations and costs and possibly be unable to mine bitcoins at a profit. I doubt they could survive that situation for long.

The second risk is Electricity Costs

A prolonged surge in electricity prices would leave CleanSpark at a significant disadvantage to the rest of the industry on their fixed price deals. Other companies have also spread operations around the world whereas CleanSpark remains almost entirely US-based, it does come with regulatory risk and the risk of some issue affecting the US electricity grid, which forces prices up across the country.

If electricity prices fall, then CLSK stands to gain relative to the rest of the industry, they have said they can get variable prices as low as $0.01 a quarter of the price most miners are paying. If that became a standard price, they would have an enormous competitive advantage. In a low electricity price environment, CleanSpark is well-placed to lead this market.

Conclusion

It could work out, the floating rate electricity deals could deliver a lower cost of energy to CleanSpark than the rest of the industry gets with fixed rate deals.

They negotiated a fantastic price for the 100,000 Bitmain S21 pro machines and could secure new data centers at a similarly low price from distressed miners who have already dealt with the regulatory issues and utility connection problems surrounding greenfield site builds.

On the other hand, the floating rate energy price may continue to deliver an average price in line with the rest of the market. They may face competition from the other big miners when they seek to acquire data centers. We know Riot Platforms is interested in acquisition as Riot made an offer for Bitfarms who said they had received other expressions of interest.

CleanSark have said they believe that the ETFs will continue to power demand and have an insatiable appetite for Bitcoin. Unfortunately, that may not be true, as the ETFs have suffered substantial outflows of late.

I am not going to buy CleanSpark, the risks seem great and the elevated share price relative to the rest of the industry suggests some mean reversion may be about to play out. CleanSpark management seems overconfident, and have exposed the company to a black swan event. In the crypto industry, the last thing I want to see is more risk.

I will continue my search for a miner to replace my previous favorite BITF in my portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BITF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I expect to exit my BITF position soon

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.