Summary:

- Coca-Cola is expected to announce its 62nd consecutive dividend increase on February 15th, 2024.

- The company has been increasing its dividend by at least 4% for the past two years, indicating positive trends.

- The payout ratio based on earnings per share is improving, but the payout ratio based on free cash flow is a concern.

- I predict a new quarterly dividend of 48 cents per share.

jetcityimage/iStock Editorial via Getty Images

The Coca-Cola Company (NYSE:KO) investors like myself tend to look forward to February of every year as the company’s annual dividend increases have historically been announced the third Thursday of February. I personally have a history of previewing Coca-Cola’s dividend increases to set expectations straight with the Seeking Alpha community, as evidenced by this article previewing 2022’s increase and this article previewing 2023’s increase.

It is now time to preview the extremely likely, 62nd consecutive dividend increase coming up in the next few weeks. Let us get into the details.

Upcoming Dividend Increase

Coca-Cola will likely announce its 62nd consecutive dividend increase on February 15th, 2024. And no, this says nothing about me but rather speaks volumes about Coca-Cola’s stability and predictability. The company tends to announce its annual dividend increase on the third Thursday of February.

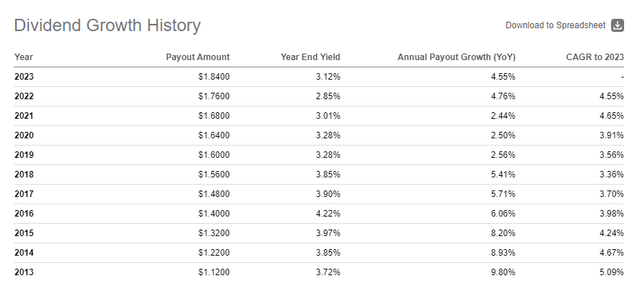

Last year’s (2023) dividend increase was about 4.50 and while that paled in comparison to inflation, it was the 2nd consecutive year that the company handed at least a 4% increase after three consecutive increase around the 2% range. So, trending in the right direction one can say.

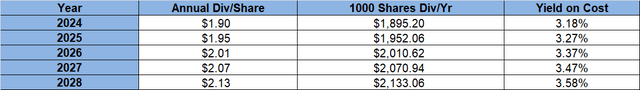

In the 2022 and 2023 previews, I had used a measly 2% and 3% annual dividend growth rate assumptions for the next few years. Given the nice little surprises from Coke (5% increase in 2022 and 4.50% in 2023), the projected returns below look a little better than during last year’s review. If Coke manages a 3% increase per year, the yield on cost reaches almost 3.60% for someone buying today at $59.65, compared to the 3.24% and 3.04% 5-year yield on cost during the last two reviews. That difference may not seem like a lot until you factor in: (A) further potential upside surprises from Coke; (B) any opportunity that may come our way to buy below $59.65; and (C) the law of large numbers, especially when compounded. For each $1,000 invested, that’s a difference of $2 in income per year in 5 years under pessimistic assumptions.

As I’ve written in the past, Coca-Cola has rarely yielded above 4% and the “base” yield on the stock tends to be between 3.30% and 3.50% where it attracts a lot of buyers. So, the increasing dividends, even if smaller as the years go by, tend to increase the floor price of the stock. But, does Coca-Cola have the prowess to offer more than the 3% DGR assumed above, say 5% again? Let’s see.

- Current outstanding share count is at 4.323 Billion, more or less the same as last year.

- A 5% dividend increase next month will mean a quarterly dividend of 48.3 cents per share.

- That would represent a commitment of $2.08 Billion/quarter towards dividends (4.325 Billion shares times 48.3 cents).

- Coca-Cola’s free cash flow[FCF], on paper, should not worry investors. After all, this company rakes in the money through the sheer strength of its distribution system and its brand recognition. However, a good investor checks.

- The current average quarterly FCF is $2.54 billion using the most recent 4 quarters, up a fraction from the $2.50 billion last year. This would represent a payout ratio of nearly 82% ($2.08 billion divided by $2.54 billion). Using the five-year average quarterly FCF of $2.411 billion, we get a payout ratio of nearly 87%, which concerns me.

- Using forward earnings per share projections of $2.68 per share, a projected new quarterly dividend of 48.3 cents per share would represent a payout ratio of 72%, which is going in the right direction as it was at 74% last time around and 76% before that.

- In summary, while the payout ratio looks better based on EPS, it is getting progressively worse based on FCF, which I use as the better metric due to the fluctuations associated with EPS (one-time gains or write offs etc.). Investors would do well by expecting another sub 5% dividend increase this time as well. Coca-Cola’s last few dividend increases have been cent or two (per quarter) and I have no reason to believe 2024’s increase will be any different. I am predicting a new quarterly dividend of 48 cents or $1.92 annualized. That should make the payout ratios about a little better but there is not much room for comfort, especially on the FCF front as I highlighted after the company’s 2023 increase.

Other Thoughts And Conclusion

Despite underperforming the market significantly in 2023, Coca-Cola stock is still trading at a rich premium of 22 times forward earnings. It’d be blasphemous for me to suggest selling the stock but I don’t believe it warrants an outright buy rating either. I am sticking with my hold rating and I am continuing to reinvest my dividends, while looking forward to number 62 in a few short weeks.

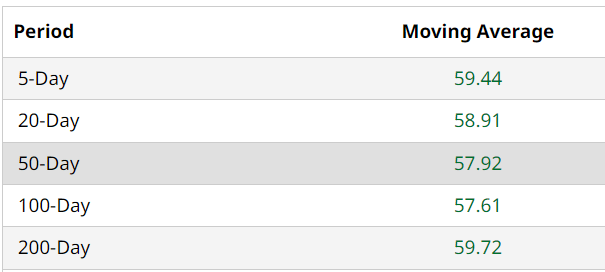

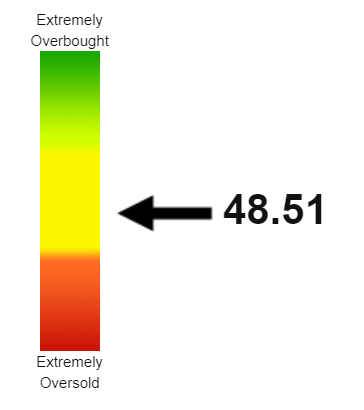

The stock has recently moved past all the commonly used moving averages and is still close to the oversold levels than it is to being overbought. This should augur well heading into the earnings report next month as expectations seem fairly muted. While it is too early in 2024 to predict a trend, the fact that big tech is off to a shaky start should augur well for the likes of Coca-Cola as investors may seek safety after last year’s magical run in tech stocks. We’ve already seen a glimpse of this in 2024 and unless the Federal Reserve has other plans, I expect Coca-Cola stock to have a better year compared to last.

But, I cannot guarantee that. What I can almost guarantee (no credit to me) is a dividend increase in February. See you all after the increase.

KO Moving Avgs (barchart.com) KO RSI (stockrsi.com)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.