Summary:

- Coca-Cola shares have dropped over the past month.

- With this decline, shares are now fairly valued.

- While KO stock is not a huge bargain, I see 8% annualized total returns from here, which may be an attractive offer for more conservative income investors.

Chinnachart Martmoh

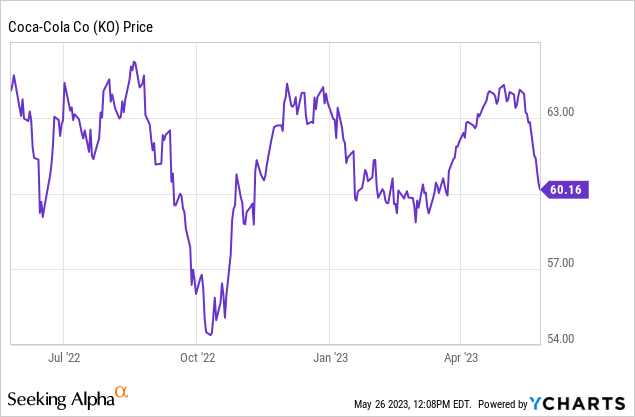

Consumer staples stocks have been on the downswing throughout May. While artificial intelligence has bolstered the outlook for a handful of tech stocks, much of the rest of the market is on its back foot. Coca-Cola (NYSE:KO), for example, has seen its stock slide more than 5% virtually in a straight line:

A 5% drop is not a big deal in the grand scheme of things, of course. But for a low-volatility company such as Coca-Cola, the entry price is really important for determining future returns. With KO stock back at $60, shares are just attractive enough to earn a buy rating for conservative investors today. Here’s why.

Strong Q1 Results

The bull case for Coca-Cola starts with its most recent quarterly earnings report. The company announced an impressive 12% organic revenue growth number. That was driven by both 3% growth in unit volumes and price increases. Coke has proven that its brand has sticking power with consumers during this current inflationary environment.

Coke’s earnings of 68 cents per share for the quarter topped expectations and rose meaningfully from the 64-cent figure for the same period of the prior year. After years of struggling to grow the top or bottom lines at all, Coca-Cola has shown a return to meaningful if modest growth.

I’m also encouraged by figures for emerging markets. Coke is posting robust growth numbers in areas such as Southeast Asia. In recent years, Coca-Cola saw its overseas results muted by a strong U.S. Dollar. If the dollar weakens to a degree as emerging markets gain some strength, it could add significantly to Coke’s overall financial outlook.

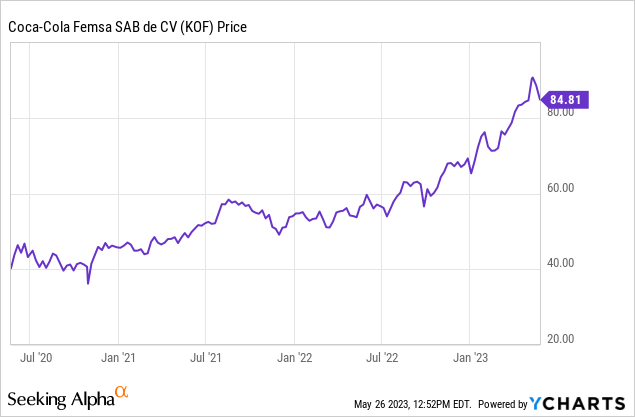

For another example of this, Coca-Cola’s leading LatAm bottler, Coca-Cola FEMSA (KOF), is on a major winning streak amid rapidly improving economic conditions in Mexico:

This should translate to more revenues for the corporate parent as well as Coca-Cola Femsa’s success reflects well on the overall state of Coca-Cola’s business in emerging markets such as Mexico.

While there are understandable concerns around the company’s core sugared drinks business, Coca-Cola has done a fine job of diversifying into other beverages. It now has 26 different billion-dollar brands. Coca-Cola also continues to diversify such as with the recent launch of its canned Jack and Coke product in partnership with Brown-Forman (BF.A) (BF.B). On the conference call, management said this product is proving to be compelling to retailers based on initial orders and inventory levels.

To highlight another case, Coke continues its efforts to develop the Fairlife ultra-filtered milk product. Despite initial skepticism around the brand, Coke announced that Fairlife has now topped $1 billion in annualized retail sales. This sort of innovation will be important in keeping Coke’s renewed operational momentum going.

Continued Margin Pressures

The price of many agricultural goods spiked at the onset of the invasion of Ukraine in early 2022. As farmers adapted to the changing conditions, output has increased in other regions, largely offsetting the loss of production in Eastern Europe. As a result, we’ve seen the price of key agriculture goods drop sharply. For example, the price of wheat has fallen more than half from its 2022 peak.

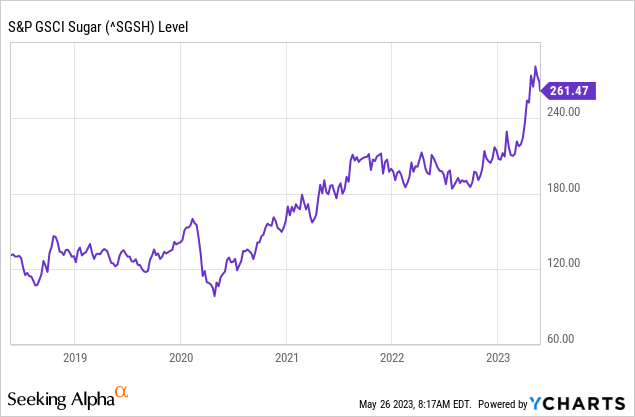

The one commodity that hasn’t seen any relief yet, however, is sugar. The price of sugar rose roughly 50% between 2020 and 2022 and has surged again to start 2023:

This will be a near-term drag on Coca-Cola and other staples companies, which use a significant amount of this input.

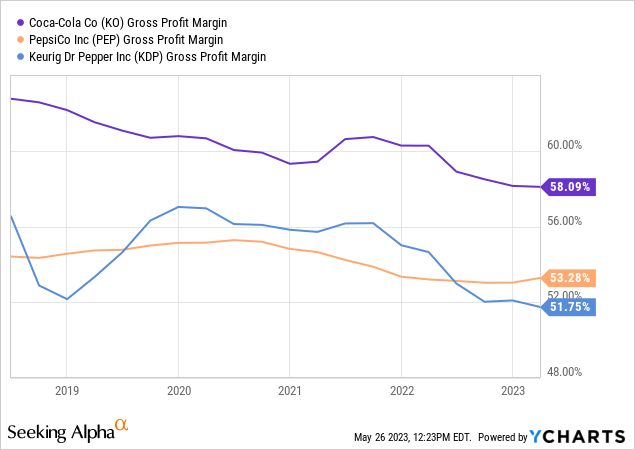

Specifically for the soft drink companies, all three major North American players have seen steadily declining margins over the past five years:

There is some noise here as PepsiCo (PEP) sells snack foods and Keurig Dr Pepper (KDP) has other beverage businesses outside of soft drinks. Regardless, the general point should be clear; these companies have seen a meaningful drop in their profit margins amid the rapidly-changing economic landscape. There has been pressure on packaging, labor costs, freight, and other matters in addition to raw inputs such as sugar.

With inflation now decelerating, there should be normalization of these factors in time. I expect profit margins for everyone in the drinks space, including Coca-Cola, to gradually improve over the next two years. That said, there are certain factors, such as the price of sugar, that will temporarily limit margin recovery in the beverage space as opposed to other parts of the consumer staples industry.

KO Stock Bottom Line

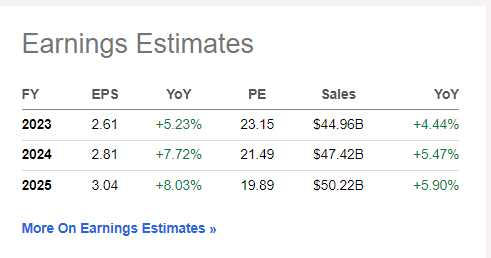

Coke shares are now trading for 23 times forward earnings, which is a slight discount to where they’ve been in recent years. And analysts see earnings growth picking up a bit in 2024 and 2025 as supply chains, inflation, and profit margins normalize:

Coke earnings consensus (Seeking Alpha)

Of importance, it appears that Coke is finally returning to meaningful top-line revenue growth after a decade where it struggled to do so amid falling unit sales for sugared soft drinks.

23x earnings is hardly a steal for a slow-growing enterprise like Coke, but it’s not a bad price either.

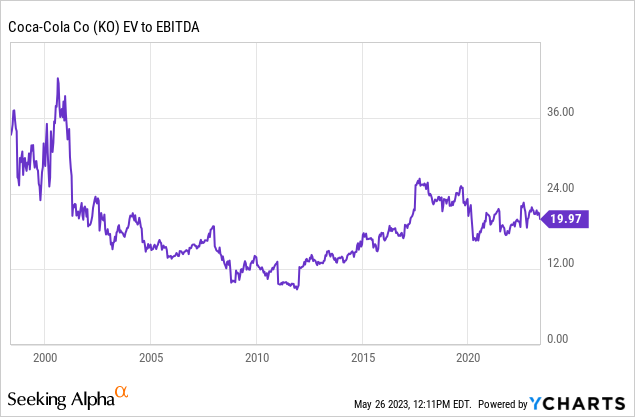

Using a long-term lens, looking at EV/EBITDA, KO stock also seems reasonably priced at the present time with shares in the middle of a 25-year range:

The stock got a lot cheaper in the late 2000s, but the company was undergoing a great deal of operational upheaval at that point. It seems unlikely that shares would drop much below 17x EV/EBITDA unless management really loses its way; this suggests downside wouldn’t be too bad from the current price even in a scenario where the whole market rolled over.

Going back to earnings, I’d argue that the current multiple is fair, and we should expect shares to continue to trade around this P/E level in the future. So, with no multiple expansion or compression, 5%/year earnings growth (slightly conservative versus analyst expectations), and a 3% dividend yield, we’d expect something in the neighborhood of an 8% total return going forward.

Is 8% tremendous? No, it’s not. I personally aim for at least 10% total returns on my slower-moving defensive growth and income names. That’d require that Coke’s stock starting out at closer to a 20x P/E, or an entry price in the low $50s.

That said, for investors that are happy with an 8% annualized return forecast from a safe blue chip defensive stock such as this one, Coca-Cola’s recent decline is enough to achieve that metric.

Shares are fairly valued here, and the company has seen an appreciable uptick in sales and pricing activity. This isn’t a pound-the-table buy by any means, but the recent stock price dip is enough to make KO stock worth the attention of conservative investors looking to put money to work in recession-proof stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KOF, BF.A either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you enjoyed this, consider Ian’s Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.