Summary:

- The Coca-Cola Company has done very well in an inflationary environment because of the company’s brands and pricing power, but challenges remain.

- Coca-Cola faces two significant challenges to revenue growth in the near-term, a rising dollar and slowing growth in Asia.

- Valuation at current level is fair, The Coca-Cola Company stock is a hold.

Georgiy Datsenko

Not all brands are created equally. While inflation, labor shortage issues, and supply chain problems have impacted most companies worldwide, some stocks have seen their earnings and revenues continue to hold up well in this challenging economic environment.

The Coca-Cola Company (NYSE:KO) (“Coke”) is one stock whose premium brands and strong pricing power have enabled management to offset most of the inflationary pressures and other issues the company has faced recently.

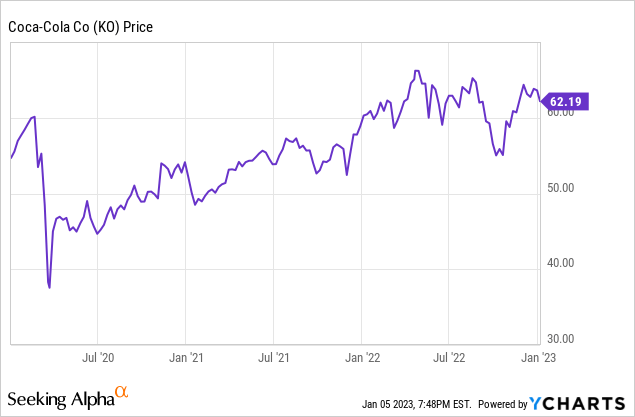

Coke’s share prices has remained range bound over the last year, but the stock has still continued to do well over the last 3 years in a very challenging environment. Coke’s earnings have not been significantly impacted by the supply chain, labor shortages, or overall inflationary pressures. The company’s strong brands and impressive pricing power has enabled management to weather the storm.

Coke earned $2.32 a share in 2021, and the company reported $2.49 a share in profits in 2022. These strong earnings reports came while many companies with well-known consumer brands such as Kimberly-Clark (KMB) and Clorox (CLX) were not able to offset rising costs and other inflationary pressures. Coke’s management also said in the company’s third quarter earnings call that they expect adjusted revenue growth of 6-7% a year in 2023. The company expects organic revenue growth of 14-15% in 2023.

Still, while Coke has done well to offset inflationary pressures and other challenges, the company has still not been able to consistently grow earnings at more than a mid-single digit rate for two main reasons. The two biggest challenges Coke faces are a rising dollar and the continued impact of Covid in China and the rest of Asia. Coke gets nearly 65% of the company’s revenues from outside of the United States, and nearly 12% of their earnings come from Asia. In the 4th quarter alone, Coke expects currency pressure to lower net sales by 8% and overall adjusted earnings by 9%. Forex issues also lowered Coke’s earnings by nearly 8% in 2022. The company expects currency pressures to lower overall revenue growth by nearly 10% in 2023.

Asia remains an issue as well. Coke reported in the third quarter that revenues rose 4% in Europe, the Middle East, and Africa, 12% in Latin America, 21% in North America, and 4% for the Asia Pacific region. Coke obviously isn’t going to see consistent double-digit revenue growth in more mature markets such as the U.S. and North America long-term, the company needs stronger growth in China and the Asia Pacific region.

China continues to have issues with Covid, and the government’s zero-tolerance approach to the virus has slowed growth significantly in the world’s second-largest economy. Beijing and Shanghai have both shut down major parts of their cities as recently as November and December because of Covid. Asia makes up nearly 13% of Coke’s overall revenues. Coke is likely to see slow growth in China for some time.

Coke’s shares are not cheap, either, given the near-term challenges the company will likely continue to face. The company currently trades at 25x forward earnings, 7x forward sales, and 12x book value. Obviously, Coke trades at a premium to the consumer and beverage industry average for a reason, but this company’s valuation still looks high in the challenging current environment. The average valuation within the sector is nearly 20x forward earnings, 1x forward sales, and 2.4x book value. Coke’s shares are also trading at a slight premium to the 5 year average as well.

Coke is one of the strongest brands in the world, and the company has a recession-resistant business model. Still, most economist are known forecasting a recession, and Coke’s finance chief, John Murphy, recently said he clearly sees a recession coming. Coke’s business model will likely continue to do well during a recession in mature markets, but the company is likely to see slower growth in emerging markets as incomes fall. Coke will also likely see forex challenges the company already faces accelerate if a recession occurs. The U.S. economy remains the strongest in the world by far, and the dollar is likely to continue to rise significantly if a protracted global recession occurs. The Fed has also committed to continuing to raise rates for some time to deal with inflation, and that will likely continue to support the dollar’s rise against most major currencies as well.

Coke’s management team has done a very good job dealing with the various challenges that the company has faced over the last 2 years, but management can’t control forex moves, the Pandemic’s continued impact on Asian economies, or the macroeconomic environment. With growth already slow in Asia, and the dollar continuing to rise, this company will likely continue to find driving revenue growth at more than mid-single digit rate challenging for some time. With The Coca-Cola Company trading at 25x forward earnings even though management is forecasting mid-single digit growth, KO stock is likely overvalued in the current challenging environment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.