Summary:

- The consumer staples sector tends to be one of the best performing sectors during times of a recession.

- The Coca-Cola Company has increased its dividend for 61 consecutive years now, which has it part of the prestigious Dividend Kings list.

- CEO James Quincey continues to steer Coca-Cola in the right direction, one that is focused more on profitability and less on the number of products.

AlizadaStudios

The Coca-Cola Company (NYSE:KO) is the largest beverage company in the world, with a market cap of $272 billion.

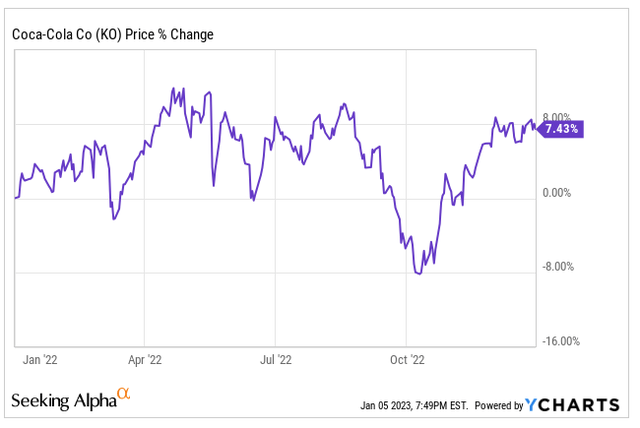

In a year when the S&P 500 Index (SP500) dropped into a bear market and the broader index ending 2022 down ~20%, Coca-Cola shares were green, climbing over 7% on the year.

What caused shares of Coca-Cola to be up 7% on a year the greater S&P 500 (SPY) fell by 20%, you may ask. Well, as you can see from the chart above, shares were positive for most of 2022, albeit with the one exception being the October lows. Investors early on (finally) came to the conclusion that:

- The economy was slowing

- The Fed was destined to lower inflation through aggressive monetary policy

- Valuations were unrealistic, especially in the technology sector.

As such, we saw leaders in the energy, health care, and consumer staples sectors outperform the S&P 500.

The beverage sector is largely controlled by both Coca-Cola, with its closest competitor being PepsiCo, Inc. (PEP). Combined, these two companies control roughly two-thirds of the global soft drink space.

However, are traditional soft drinks the growth driver going forward for KO? I actually believe it is the non-traditional soft drink products that will be key for the company moving forward, and that is evident based on the direction CEO James Quincey has been taking the company.

A Leaner Coca-Cola Company

A few years back, under the direction of CEO James Quincey, the company took a strategic approach to become more lean yet more available.

For years, the company started experimenting with different flavors and drink types, but in 2020, Mr. Quincey put a halt to that and actually slashed the company’s products in half. He believed that they were getting too stretched and it was having an impact on the business.

Instead, he wanted to focus more on the company’s most profitable products. Rather than creating new drink products, understanding the impact rising prices would eventually have on the consumer, Coca-Cola set its sights on creating more varieties of how the products are bottled. Creating different cans, bottles, and value backs, which would appease all types of consumers. Those that just want a little taste of their favorite coke product could now buy the small can or bottle products.

Smaller product types mean cheaper prices for consumers, which will certainly be beneficial in the wake of a recession, when consumer dollars become more tight.

Demand Expected To Remain Strong

In the company’s most recent quarterly report, Coca-Cola continued to see strong sales growth that was driven by both strong demand as well as higher prices.

During the Q3 ’22 quarter, Coca-Cola reported revenues of $11.05 billion, beating the $10.52 billion average estimate from analysts. EPS came in at $0.69 compared to analysts estimating $0.64, therefore beating on both the top and bottom lines during the quarter.

Organic revenue increased 16% during the quarter, largely driven by the higher prices that have been passed onto consumers. In the earnings release, management did not rule out further price hikes in 2023.

Quincey also reiterated during the call that “product innovation in 2023 would continue to focus on packaging to create more affordable options.”

Given the strong quarter, KO increased their adjusted EPS guidance for 2022 as well as their organic revenue growth. The company is expected to release Q4 ’22 earnings in early February, and they are also expected to release 2023 guidance at this time as well.

Is Coca-Cola Stock A Buy?

Coca-Cola shares had a pretty solid year in 2022 and now find themselves sitting only 7% from their all-time highs.

Growth stocks have been crushed over the past 12 months, as investors have once again come to their senses, as valuations were extremely unrealistic for many stocks in 2021. However, given these valuation corrections and the pending recession, investors have been looking to reposition their portfolio by moving more into defensive names, like stocks within the consumer staples sector.

When performing a discounted cash flow (“DCF”) analysis, in which I project 8% growth moving forward with an 8% required rate of return, it calculates KO shares having a fair value of $63, which is almost EXACTLY where the stock trades at today.

For shareholders that currently own KO stock, I think it is a great company to own, especially with the uncertainty ahead of us in terms of the economy. As for shareholders looking to initiate a position, they are probably better served waiting to see if we get a strong pullback market-wide in the near future. Many economy catalysts point to us retesting the October lows or falling even further before moving higher.

If you are looking for a place to park money, KO can be a safe long-term place, especially in a recession.

As such, I currently rate The Coca-Cola Company shares a HOLD in my opinion alone.

Investor Takeaway

Coca-Cola is an iconic brand, one that is actually performing quite well. Under the leadership of James Quincey, the company has become more lean in terms of products, but it has been innovative with its packaging and being able to connect with various customer types and price points. This is obviously working well based on the quarterly results and demand we are seeing.

The Coca-Cola Company is also a Dividend King for having paid a growing dividend for 50+ consecutive years. Given the company’s latest increase, Coca-Cola has now increased its dividend for 61 consecutive years.

Valuation is pretty much spot on right now, which even though I love everything about The Coca-Cola Company, these levels do not appear appealing for me to add to my position.

Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.