Summary:

- Coca-Cola is partnering with Pernod Ricard to launch “Absolut Vodka & Sprite” in 2024, targeting the growing market for convenient, premium beverages.

- The company’s Q3 2023 revenue surged to $12.0 billion, reflecting its strong market position and successful brand strategies.

- Coca-Cola’s venture into the alcoholic beverage segment aligns with current consumer trends and market dynamics, supporting its bullish rating.

- The company’s organic revenue growth of 11% reflects its products and marketing strategies resonating with consumers.

banjongseal324/iStock via Getty Images

Investment Thesis

The Coca-Cola Company (NYSE:KO), in partnership with Pernod Ricard (OTCPK:PRNDY), is set to launch “Absolut Vodka & Sprite” in 2024, a ready-to-drink cocktail leveraging the renown of both brands. Aiming to tap into the growing market for convenient, premium beverages, this strategic move promises to expand Coca-Cola’s reach, particularly in Europe.

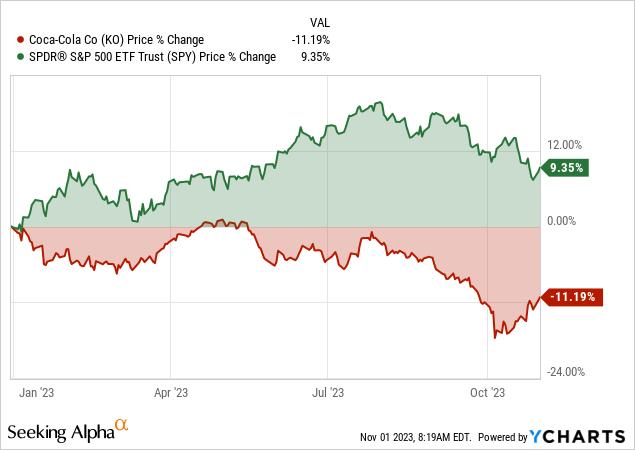

The multinational giant remains strong, with a Q3 2023 revenue surge to $12.0 billion, reflecting its robust market position and successful brand strategies. Projected to achieve significant organic revenue growth and with a promising stock appreciation forecast, Coca-Cola’s venture into the alcoholic beverage segment aligns with current consumer trends and market dynamics and supports the buy rating amidst a volatile environment.

Absolut Vodka & Sprite: A Bubbly Cocktail of Innovation & Global Ambition

Coca-Cola breeds rapid growth potential in the context of its recent partnership with Pernod Ricard to launch Absolut Vodka & Sprite as a ready-to-drink pre-mixed cocktail in 2024. Notably, brands like Coca-Cola, Sprite, and Absolut have gained immense consumer recognition and trust over the years.

The launch of Absolut Vodka and Sprite as ready-to-drink cocktails leverage the power of these well-established brands. Coca-Cola’s ability to combine its iconic brands with others, like Absolut, demonstrates a savvy strategy for creating innovative products with widespread appeal.

Additionally, Coca-Cola’s global presence is a fundamental strength contributing to its rapid growth potential. The initial launch of Absolut & Sprite in select European countries is just one example of the company’s global reach. Undoubtedly, its extensive distribution network and market insights allow efficient market entry and expansion.

Coca-Cola’s familiarity with various international markets positions it well to understand and adapt to local preferences, regulatory requirements, and market dynamics. Also, the decision to enter the ready-to-drink alcoholic beverage space with Absolut & Sprite clearly illustrates that the company is keenly attuned to the demand for convenience and premium-quality beverages, and it rapidly responds to these trends.

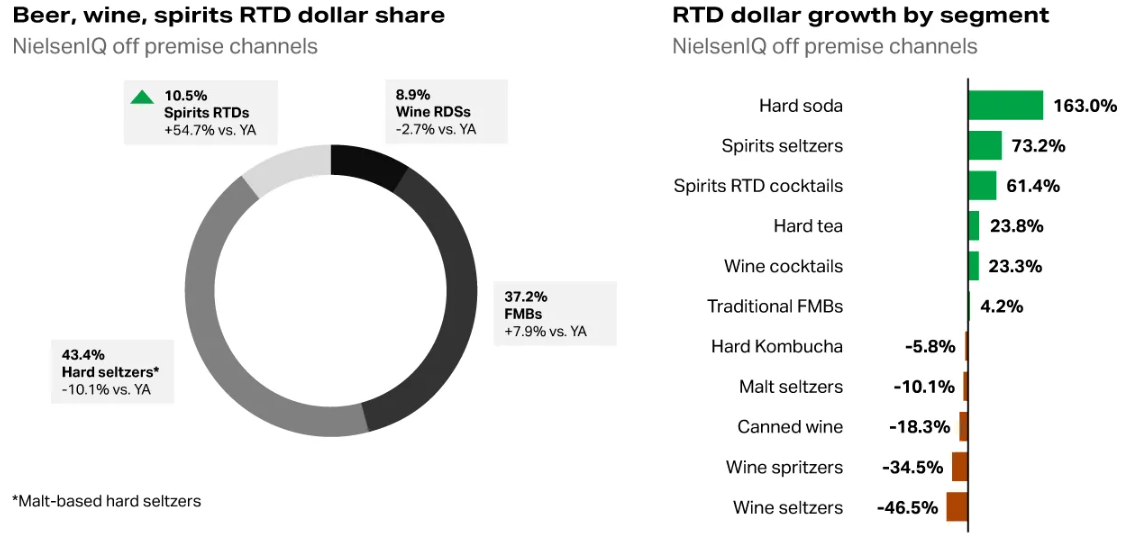

Interestingly, as the Nielsen data shows, prepared cocktails are among the fastest-growing segments (+61.4% dollar growth) in the distilled spirits industry. Coca-Cola’s move into this space aligns with this trend, allowing the company to capitalize on the growing popularity of ready-to-drink cocktails.

Therefore, diversification mitigates the risks associated with overreliance on a single product category, such as traditional soft drinks. By expanding into adjacent segments like alcoholic beverages, the company diversifies its revenue streams and reduces its vulnerability to market fluctuations.

nielseniq.com

Coca-Cola’s Q3 Earnings Soar: A Testament to Brand Resilience and Strategic Growth

Coca-Cola’s ability to consistently increase its top-line revenue represents its brand strength and adaptability. The 8% increase in net revenues, reaching $12.0 billion in Q3 2023, reflects the company’s capacity to capture market share and generate substantial sales figures.

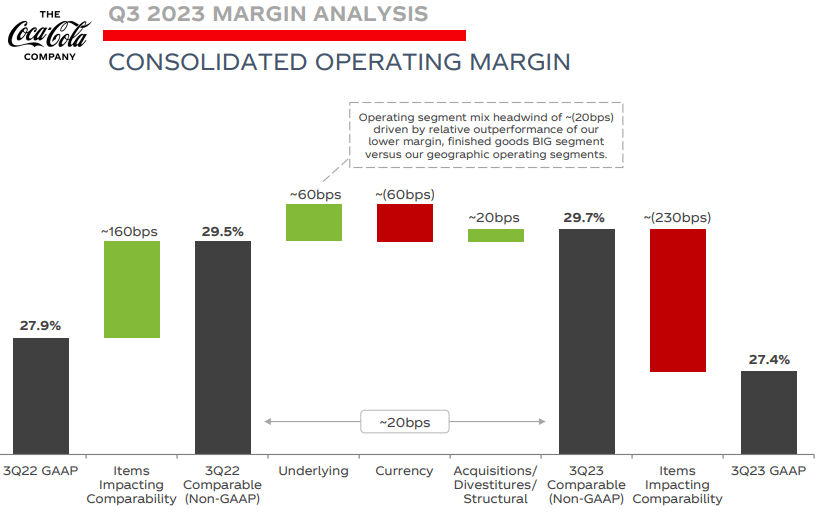

Organic revenue growth, a key performance indicator, outperformed, growing by 11%, proving that Coca-Cola’s products and marketing strategies resonate with consumers. At the bottom line, the comparable operating margin (non-GAAP) improved from 29.5% to 29.7%, suggesting that Coca-Cola’s operational efficiency is robust, even in macroeconomic adversities.

Additionally, Coca-Cola’s ability to achieve a 9% growth in price/mix and a 2% growth in concentrate sales is a significant driver of its revenue growth. Price/mix growth indicates the company’s pricing power and its ability to enhance revenue through strategic pricing actions and product mix optimization. Concentrate sales being in line with unit case volume is important because it shows that Coca-Cola is effectively managing its inventory and production to meet market demand, ensuring minimal waste and efficient resource utilization.

KO’s Margin Analysis Q3 2023

On the other hand, Coca-Cola’s focus on sustainability is a crucial strength in today’s market, where consumers increasingly favor eco-friendly products and responsible corporate practices. The company’s initiatives to increase the availability of packages made from recycled materials align with its “World Without Waste” strategy, which aims to create a circular economy for packaging materials. Lastly, concrete actions, such as launching 100% recycled PET packaging in India, Indonesia, and Thailand, demonstrate the company’s tangible efforts towards sustainability.

Finally, Coca-Cola’s long-term partnership with the U.S. Soccer Federation and collaborations with influencers and events like the FIFA Women’s World Cup 2023 indicate the company’s proactive approach to brand promotion and market engagement. These partnerships help Coca-Cola strengthen its brand, expand its reach, and engage with new and diverse audiences, wisely leveraging the popularity and visibility of such partnerships to enhance brand recognition.

2023 Outlook: Poised for Impressive Growth Amid Global Challenges

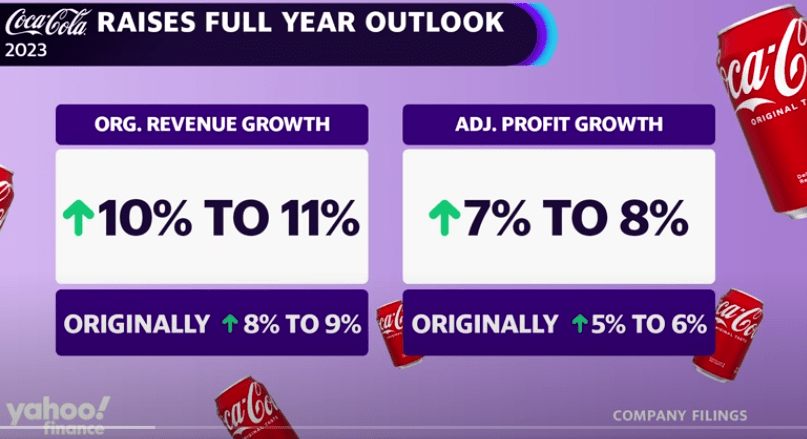

Coca-Cola anticipates delivering robust organic revenue growth of 10% to 11% in 2023. This is a substantial achievement for a company of its size and illustrates the enduring popularity of its beverage products. The diversified product portfolio, including carbonated soft drinks, water, juices, and teas, allows the company to capture revenue from various beverage categories and adapt to changing consumer preferences.

The company acknowledges a 4% currency headwind based on current rates, considering hedged positions. By hedging against volatile exchange rates, the company secures its international revenues, reducing the impact of currency fluctuations on its financial performance, which is more relevant when the dollar is strengthening against peer currencies.

Moreover, Coca-Cola’s recognition of a 1% headwind from acquisitions, divestitures, and structural changes indicates a proactive approach to portfolio management. By fine-tuning its portfolio, Coca-Cola optimizes resource allocation, redirecting capital and efforts towards high-potential ventures, enhancing profitability, and fueling value growth. Coca-Cola’s projection of delivering EPS growth of 13% to 14% and comparable EPS growth of 7% to 8% in 2023 is a clear indication of its ability to manage its expenses and drive profitability efficiently.

Lastly, the expectation of generating approximately $9.5 billion in free cash flow through operations of approximately $11.4 billion, less capital expenditures, provides the company with a considerable financial cushion.

Yahoo Finance

A Dividend Dynamo with Remarkable Growth Potential for 2023-2027

Coca-Cola’s forward dividend yield of 3.3% is an attractive feature for income-focused investors. The yield is not only healthy but also reflects a consistent dividend policy, making the stock appealing to dividend investors. Furthermore, the dividend yield has shown a remarkable motion of 5.3% over the 5-year average.

Moreover, the forward dividend per share growth rate of 4.5% is another key strength of Coca-Cola, demonstrating the company’s ability to increase dividends to shareholders over time, an essential component of total return for investors. Looking at dividend safety, Coca-Cola’s return on common equity is an impressive 43.9% for twelve months, significantly above the sector median, highlighting Coca-Cola’s superior performance compared to its industry peers.

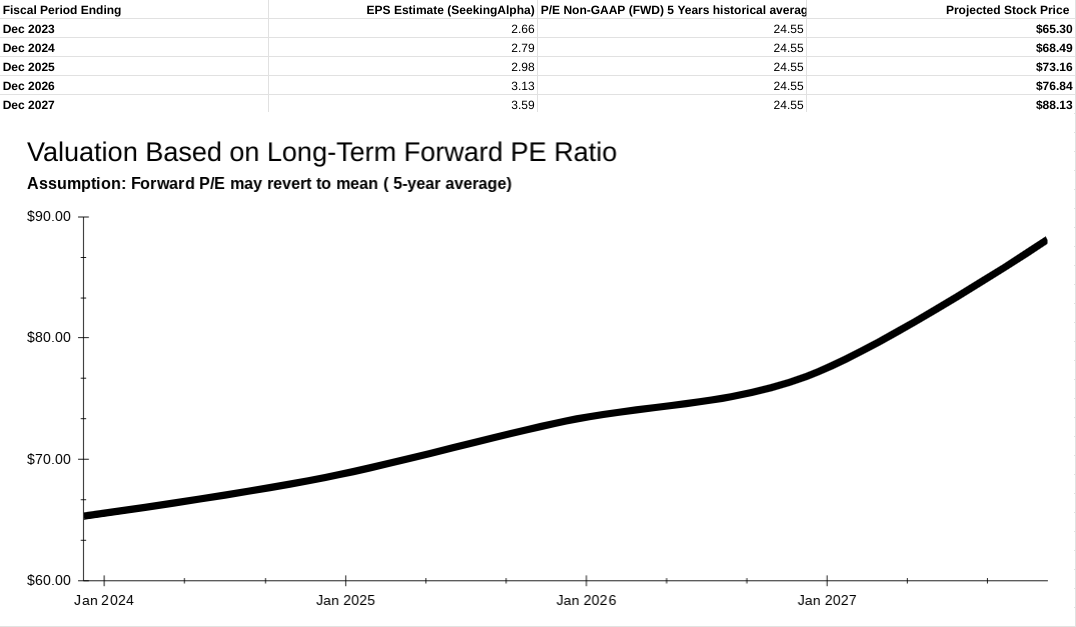

Next, Coca-Cola’s cash per share for the trailing twelve months is $2.91, 38.6% above the sector median. The strong cash position is an essential factor for dividend sustainability and long-term growth potential. Looking at the valuation, the company’s P/E Non-GAAP (forward) is noteworthy, as it represents a significant undervaluation of 16.4% from the historical mean over the past five years, offering a fair margin of safety for investors.

Finally, one of the most compelling aspects of Coca-Cola’s growth potential is the projection of a 16% to 58% upside over the next five years (2023-2027). The projection is based on mean reversion, which suggests that undervalued stocks tend to move back toward their historical valuations over time. If the market eventually corrects and reverts to the historical mean, it implies that the stock has room to appreciate.

Author & seekingalpha.com

Takeaway

Coca-Cola’s venture into the alcoholic beverage market through its “Absolut Vodka & Sprite” collaboration with Pernod Ricard epitomizes strategic innovation and market responsiveness. The company’s robust Q3 2023 performance, enhanced operational efficiencies, and focus on sustainability and diversification underscore its adaptability and growth potential.

Finally, with a solid financial foundation and an eye on evolving market dynamics, Coca-Cola’s expansion into new beverage categories, coupled with its strong global presence and commitment to environmental responsibility, sets it up for continued success and resilience in a competitive landscape.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.