Summary:

- The Coca-Cola Company is a wonderful business, boasting a wide moat.

- The company has performed remarkably well during fiscal year 2022 which has been reflected in the stock price.

- However, the stock has become very pricey, and I expect below-market returns in the long run if you would buy Coca-Cola shares now.

- Therefore, investors would be better off buying the broader market or look for other investment opportunities.

AlizadaStudios

The investment thesis

I am not going to lie – it feels quite uncomfortable to recommend avoiding The Coca-Cola Company (NYSE:KO). This stock is one of the core holdings in Warren Buffett’s Berkshire Hathaway (BRK.B) and I am a firm believer of his investing philosophy. One of Buffett’s most well-known investing lessons is that it is far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Coca-Cola is a wonderful company indeed, but the stock has been overvalued for quite some time now. I therefore believe that Coca-Cola shares will not continue to outperform the broader market in the foreseeable future. Investors would be better off buying the S&P 500 index (SPY) than Coca-Cola today.

In this article, I will briefly explain why Coca-Cola is a wonderful company, look back on its performance in 2022, and discuss some bullish and bearish arguments for Coca-Cola stock.

Coca-Cola is a wonderful company

The Coca-Cola Company is one of the most recognized and valuable brands in the world. The company calls itself a ‘total beverage company’ as its brand portfolio comprises of different beverage types, such as sparkling soft drinks, water, water enhanced & sports drinks, ready-to-drink coffee & tea, juices, dairy, and plant-based drinks. Despite the ongoing diversification and expansion into other beverage categories, trademark Coca-Cola remains the top revenue driver. In both fiscal year 2021 and 2020, trademark Coca-Cola accounted for 47 percent of worldwide unit case volume.

Coca-Cola’s in strong brand presence across the globe results in solid pricing power. Consumers are willing to pay a premium for Coca-Cola beverages over lesser-known brands. This enables the company to pass on cost inflation and keep margins high.

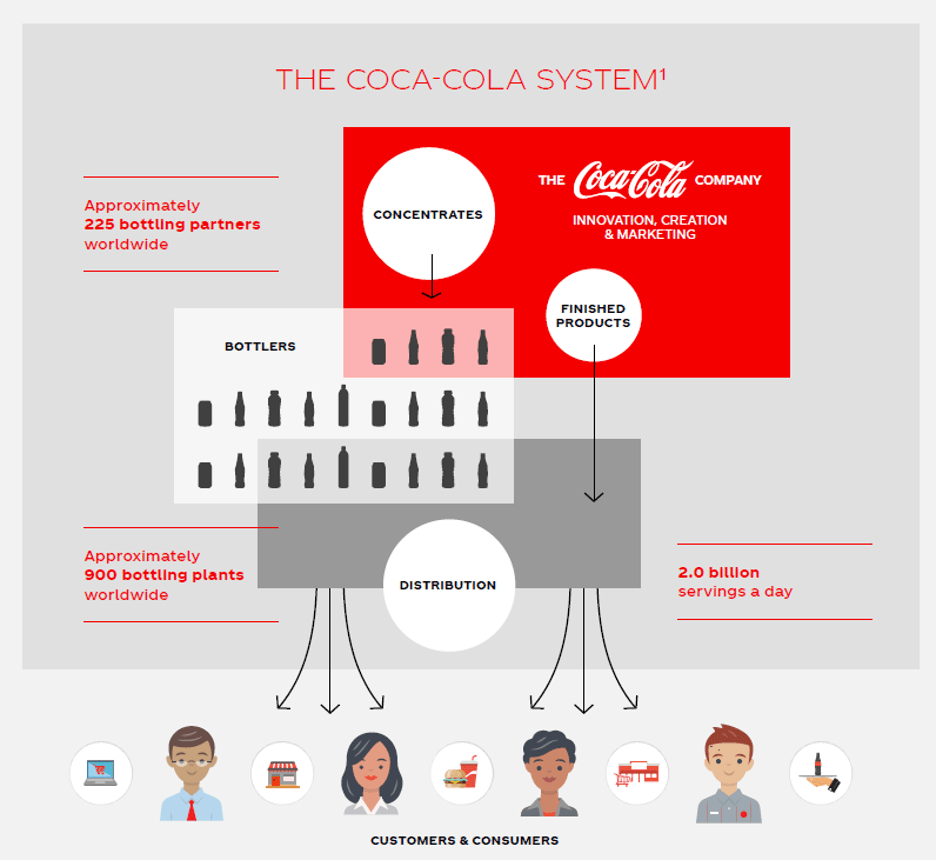

Besides the brand, I believe that the so-called ‘Coca-Cola System’ is the most important competitive advantage of the company (see figure below). The network of independent bottling partners, distributors, partnerships with wholesalers and retailers will be nearly impossible to replicate for new market entrants. Currently, approximately 225 bottling partners and 900 bottling plants are integrated into the Coca-Cola system worldwide.

The Coca-Cola System (The Coca-Cola Company Investor Relations)

As shown in the figure, the company makes a distinction between concentrates and finished products. For its concentrate operations, The Coca-Cola Company sells beverage concentrates to bottling partners, after which they combine the concentrates with (sparkling) water and sweeteners to produce finished beverages. Finished products are directly sold to distributors, wholesalers and retailers.

The Coca-Cola Company has been actively refranchising its bottling system over the past decade. Most bottling operations are currently in the hands of local bottling partners. As a consequence, the majority of worldwide unit case volume for The Coca-Cola Company is attributable to concentrate operations rather than finished products. Over fiscal year 2021, 83% of unit case volume was attributable to concentrate operations and only 17% to finished product operations. The share of concentrate operations has increased significantly over the past decade as the company has been divesting its bottling operations and other assets. Over fiscal year 2013, 72% of unit case volume was attributable to concentrate operations and 28% to finished product operations.

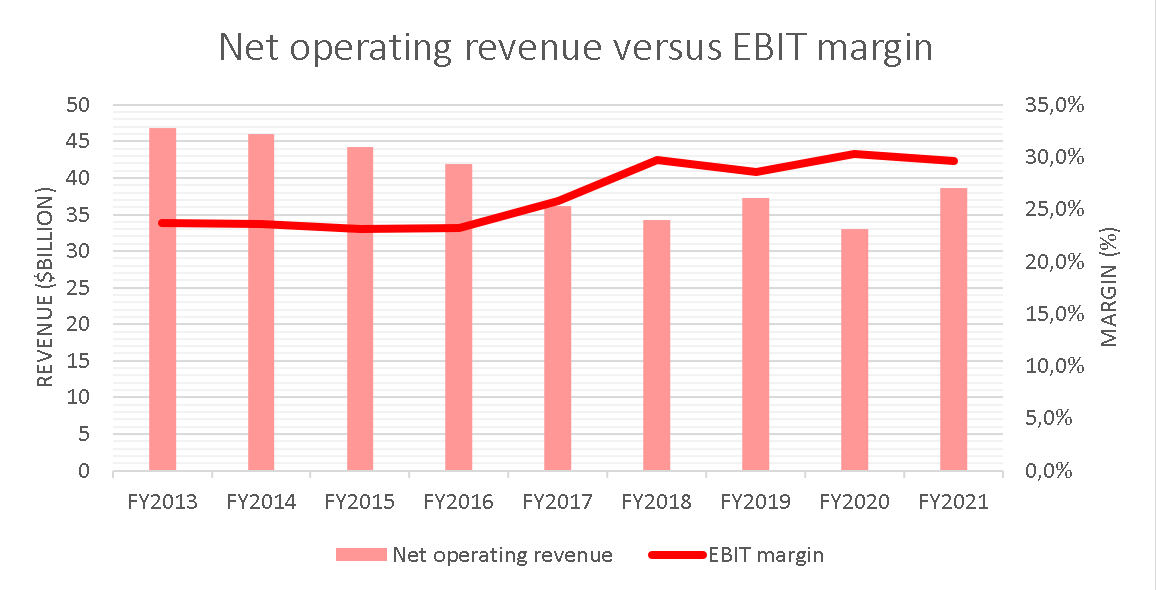

Divestments have negatively impacted top-line revenue growth. Net operating revenues fell from $46.9 billion in 2013 to $38.7 billion in 2021. Finished products generally have higher net operating revenues per unit compared to concentrate operations. On the positive side, the shift to concentrate operations has boosted Coca-Cola’s margins. The EBIT margin was 23.7% in 2013 but increased to 29.6% in 2021. The figure below shows the net operating revenue and EBIT margin history.

Net operating revenue and EBIT margin history (Author, Seeking Alpha Financials)

The Coca-Cola Company still fully owns some bottlers, especially in Africa and South East Asia. The company also holds stakes in divested bottling partners. Some of them are publicly traded, such as Coca-Cola FEMSA S.A.B. de C.V. (KOF) and Coca-Cola Europacific Partners PLC (CCEP).

The impact for further divestures on net operating revenue remains unknown, but it seems that the majority of refranchising activities is finished for now. After nearly a decade of declining revenues, analysts currently predict net revenue growth in the mid-single-digits through fiscal year 2025, which is in-line with long-term management guidance for organic revenue growth. It is time to boost that top-line growth again.

Outperforming the index in 2022

The Coca-Cola Company has experienced a great 2022 so far. In the third quarter of 2022, organic sales were up 16% driven by 12% growth in price/mix and 4% growth in concentrate sales. Organic revenue growth over the first nine months of 2022 was also 16%.

There was only a slight decrease in the operating margin which fell to 29.5% from 30.0% in the prior year. This really showcases the pricing power of The Coca-Cola Company. The company expects to deliver 14% to 15% organic revenue growth over full year 2022.

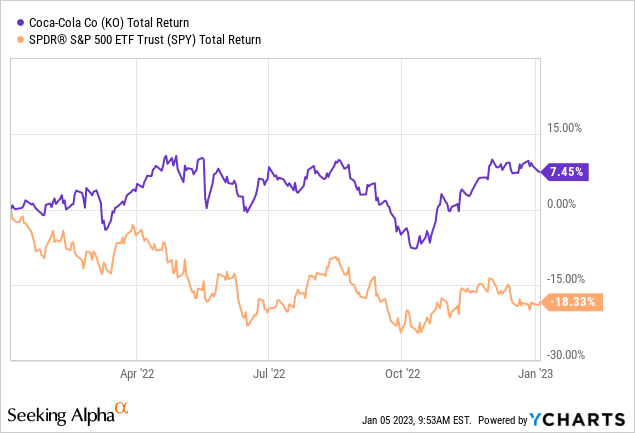

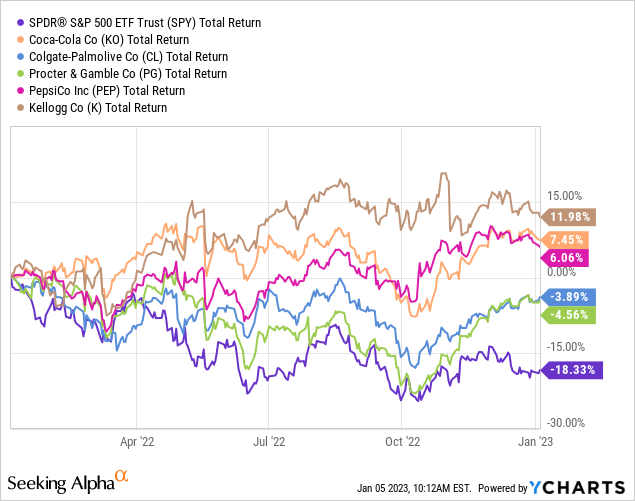

The excellent financial performance this year has been reflected in the stock price. The next graph shows the 1-year total return chart for Coca-Cola and the S&P 500 index. While the total return of the S&P 500 came in at -18.33%, Coca-Cola shares delivered a total return of 7.45%!

But will this outperformance continue in the coming years?

3 reasons why Coca-Cola will not outperform the index going forward

1: Coca-Cola stock is significantly overpriced

As mentioned in the investment thesis, Coca-Cola stock has traded in overpriced territory for quite a while now. Yes, it is a wonderful company, but I prefer to buy at or below fair value.

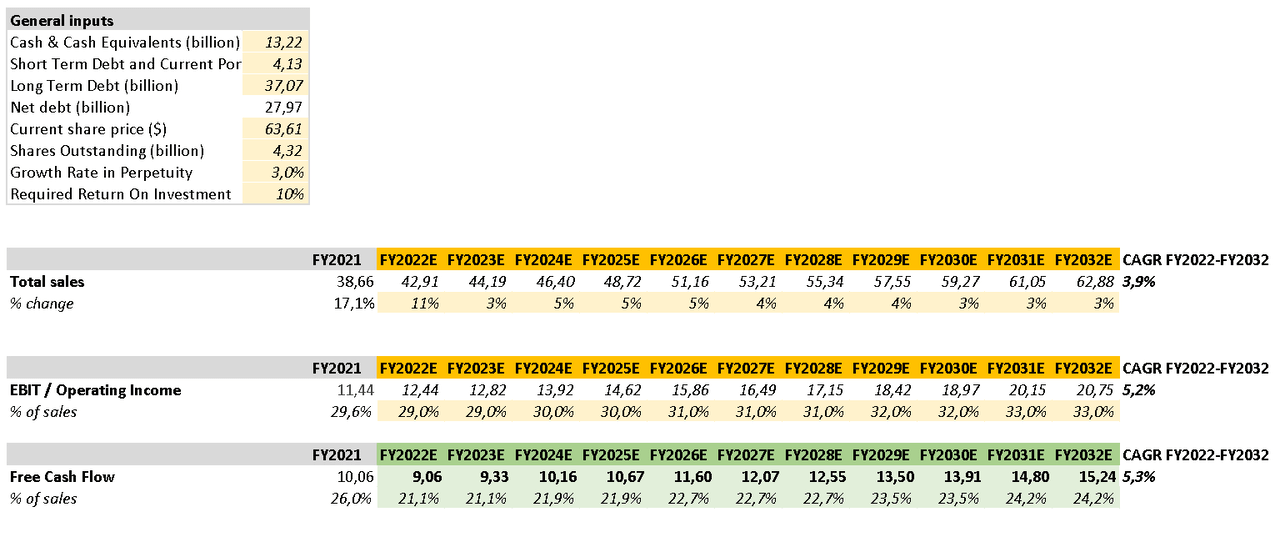

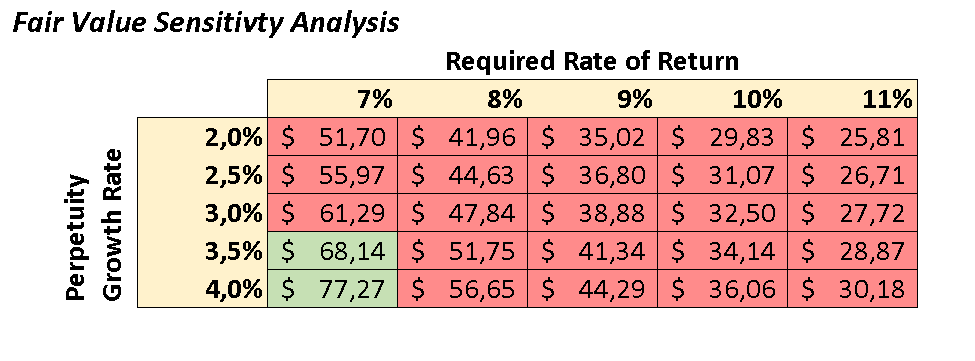

An often used method to calculate the fair value of a company is the discounted cash flow analysis. The following figure shows the selection of my main assumptions. I assume mid-single-digit revenue growth in-line with management guidance and continued margin expansion in the longer term. I also include the $27.97 billion net debt position which cuts the fair value by roughly $6.47 per share.

DCF analysis main assumptions (Author, Seeking Alpha Financials)

The output is a table with the fair value per share for different combinations between the required rate of return and perpetuity growth rate. At the current share price ($62.92), Coca-Cola stock is overpriced for most scenarios. For me it only makes sense to buy individual companies if they have the potential to outperform the index. My personal required rate of return is therefore 10% or higher. It seems that the stock is currently priced to deliver a 7% total annual return at best. This might be sufficient for some investors, but for me it makes more sense to buy the broader market or other stocks.

DCF analysis output for different scenarios (Author)

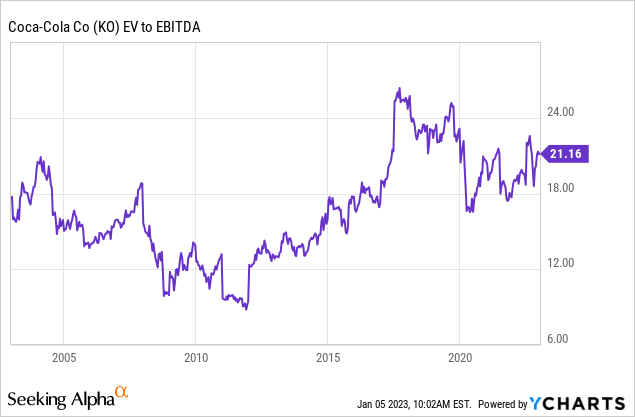

We could also consider multiples to value a stock. In this case I will opt for the EV/EBITDA ratio to include Coca-Cola’s sizeable net debt position. In the following graph it can be observed that the EV/EBITDA ratio is at the upper end of the 20-year range. It is true that Coca-Cola has always been trading at an elevated valuation, but a 21.16 multiple is very rich for such a mature and leveraged company. Just for comparison: Microsoft Corporation (MSFT) and Apple Inc. (AAPL) are trading at EV/EBITDA multiples respectively.

2: Margins are not expected to increase in the short to mid-term

I showed that Coca-Cola has increased the EBIT margin over the past decade by reshaping its bottling activities. Given that the refranchising of bottling operations is completed in various large countries (e.g. Canada, United States, China), I don’t think margins will continue to rise at a fast pace in the short term. This is also partly due to the current cost and currency headwinds. Analysts seem to agree with this assumption according to the earnings estimates from Marketscreener. Consequently, momentum for the stock is likely to slow down.

3: The law of large numbers

The Coca-Cola Company is expected to deliver a net operating revenue of $42.8 billion over full fiscal year 2022. Having such a huge market share in the beverages market is great, but it also limits the future growth rate. The law of large numbers implies that a company has to grow its revenue by a larger number every year to maintain the same growth rate. It therefore often happens that large companies experience difficulties maintaining growth rate targets. The Coca-Cola Company is a particular case as it has reduced the revenue base on purpose to boost margins, but it is still unlikely that the company will maintain double-digit growth rates going forward. Management currently predicts 4% to 6% organic revenue growth over the long term. This is slightly higher than the expected total industry growth. In any case, momentum in sales growth will slow down next year or the year after.

3 reasons why Coca-Cola could continue to outperform the index

1: Valuation multiples remain elevated

Multiples are trading at the upper end of the 20-year range, but that does not mean that multiples have to return to the long-term average. The company is operating at considerably higher margins than ten year ago so that justifies a higher multiple.

Also, a higher than average multiple does not mean that a stock will deliver negative returns. The graph in the previous section shows that Coca-Cola stock was also trading around a 21.16 EV/EBITDA multiple during February of 2004. Since then, the stock delivered a total annual return of 7.8%. That is actually pretty decent. On the other hand, the S&P 500 delivered a total annual return of 8.6% over the same period, so Coca-Cola did not outperform the broader market.

2: Consumer staples remain popular

The Coca-Cola Company was not the only company to outperform the S&P 500 market in 2022. In the following chart I plotted the 1-year total return of multiple large consumer staple names (Colgate-Palmolive Company (CL), The Procter & Gamble Company (PG), PepsiCo, Inc. (PEP), Kellogg Company (K)) against Coca-Cola and the S&P 500 index. All these defensive companies weathered the 2022 storm pretty well. They were able to hike prices without losing to much volume, resulting in significantly higher revenue and flat to slightly lower margins. Investors may continue to favour these consumer staples over beaten-down tech companies as interest rates will remain high for some time. Coca-Cola stock could benefit from this and do better than the tech-heavy S&P 500 index.

3: The Coca-Cola Company could expand into new growth categories

Trademark Coca-Cola remains the main revenue driver for the company, but this could change as the company is diversifying into other beverage categories.

In 2019, Coca-Cola made a big entry into the coffee market by acquiring Costa Coffee. The plans to create a scalable coffee platform were postponed by the pandemic, but Costa currently aims to accelerate global expansion. In the most recent quarter, unit case volume for coffee grew 5% compared to 4% for the overall company. Costa Coffee could become a larger portion of The Coca-Cola Company over time as the brand continues to expand.

Other categories that are expected to grow faster than the overall industry are energy drinks and flavoured alcohol beverages. The Coca-Cola Company expects market growth of 6% to 7% for energy beverages (referred to as ‘sports drinks’) and 9% to 10% for flavoured alcohol beverages. Sports drinks unit case volume grew with 6% in the third quarter of 2022, driven by the Bodyarmor, Aquarius and Powerade brands. The company is also making new entries in the ready-to-drink alcohol beverages category with Topo Chico, Simply Spiked Lemonade and Fresca Mixed. Despite the currently small portfolio of alcohol beverages, it is the fastest growing category and I think Coca-Cola will definitely leverage its competitive position to take advantage of growth in this category.

These are only a few examples of how Coca-Cola tries to gain market share in the faster growing sub-markets of the beverage industry.

Concluding remarks

Warren Buffett is right: The Coca-Cola Company is indeed a wonderful business. It has a wide moat and I think it will only expand its market share in the beverage industry. In 2022, the company has shown once again that it can perform remarkably well during difficult economic times. It is therefore only logical that Coca-Cola stock has outperformed the broader market by a wide margin.

So will this outperformance continue in the coming years?

For me the answer is a definite ‘no’. I have shown with a discounted cash flow analysis that investors can expect a long term total annual return of 7% at best by buying Coca-Cola now. Could Coca-Cola continue to outperform the index in the shorter term? Yes, this is certainly possible if investors keep fleeing to consumer staples. However, I think this trend will end sooner or later as valuations of growth-oriented stocks are becoming more and more attractive. Despite double-digit revenue growth in 2022, Coca-Cola’s long term revenue growth will be limited to mid-single-digits. This also limits the upside for further stock price appreciation.

For me, it only makes sense to buy individual stocks if they could potentially outperform the S&P 500 index in the long run. I expect Coca-Cola stock to deliver below-market total annual returns when buying shares at the current price level. Investors are therefore better off buying the broader market or by looking for investments opportunities elsewhere.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.