Summary:

- Rising interest rates during 2021-2023 have hurt Coca-Cola’s valuation, and kept my long-term view in the Hold/Neutral camp.

- Coca-Cola’s investment proposition over Pepsi looks much stronger, reviewing business margins/returns and immediate valuations.

- To better account for today’s interest rate level and risks associated with deglobalization, I would prefer to buy Coca-Cola shares at a price closer to $45.

- A recession and bear market on Wall Street over the next 3-6 months could produce another terrific entry point for astute/patient investors.

Justin Sullivan

I last mentioned Coca-Cola (NYSE:KO) in a bullish light right after the worst of the pandemic in August 2020 here. I was a raging bull in March 2020 here at $39 a share, as both a defensive and income pick during “peak” COVID-19 fears in the stock market. However, since 2021, KO’s valuation has kept me in the Hold/Neutral camp.

Rising interest rates as competition for investment money has been a drag on the stock in 2023, and I discussed major peer/competitor PepsiCo (PEP) as a Sell earlier in the year here. The selling in both Coca-Cola and Pepsi since summer has coincided with even higher interest rates in the bond market. With risk-free savings, bank CDs, and short-term Treasuries delivering 5% or better in annual income, slow-growing food/beverage and consumer product companies with cash yields in the 2% to 3% range did [do] not make much sense to buy with new capital.

It does feel, to me, we may be approaching another smart time to buy Coca-Cola shares, especially if the price dips below $45 before the new year begins. Follow along with me. Given a recession starts soon, where interest rates can actually backpedal in a positive direction, AND a bear market in stocks generally pulls KO even lower than today’s $52 quote, a 4% dividend distribution annually could again become a rock-solid value and income choice for your portfolio.

Valuation Story Steadily Improving

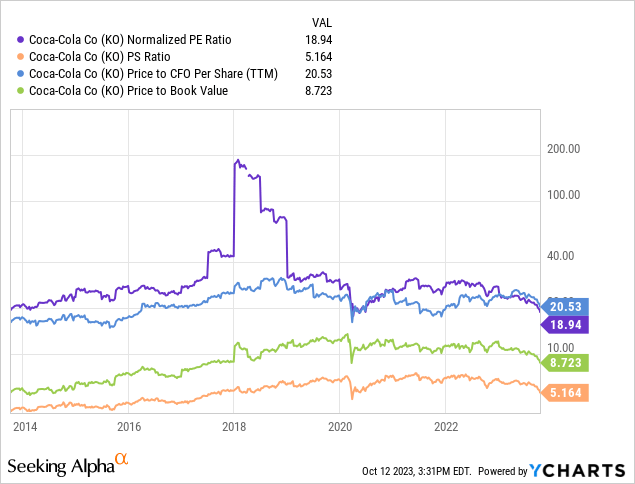

While Coca-Cola traded at a P/E around 30x in 2021 and 2022, better operating results combined with the latest stock price dive of -20% have combined to create a far more appealing 20x EPS setup. In addition, price to sales, cash flow, and book value have fallen back to late 2017 levels. Overall, on basic fundamental analysis comparisons, KO is now at a 6-year valuation low.

YCharts – Coca-Cola, Price to Basic Trailing Fundamentals, 10 Years

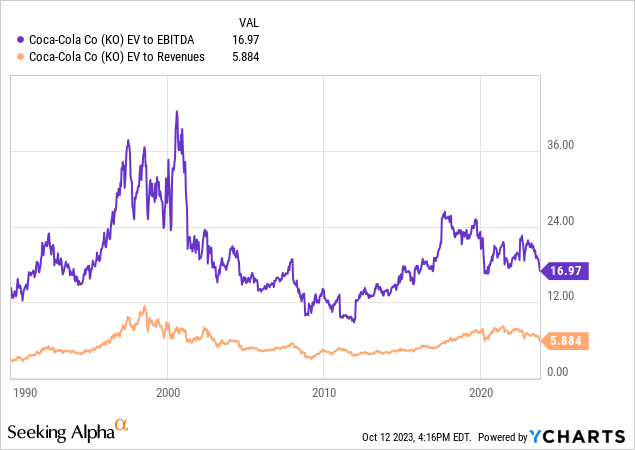

When we include changing debt and cash levels, the enterprise valuation on core cash EBITDA and revenues has also been moving in the right direction for share buyers. Using these valuations stats, KO is getting closer to 2017-18 multiples, and are sitting roughly at long-term average settings, measured from 1990. So, any price down move of -10% or -20% into December will likely open up a stronger than “average” valuation for your capital.

YCharts – Coca-Cola, Enterprise Valuations, Since 1990

Coke Beats Pepsi

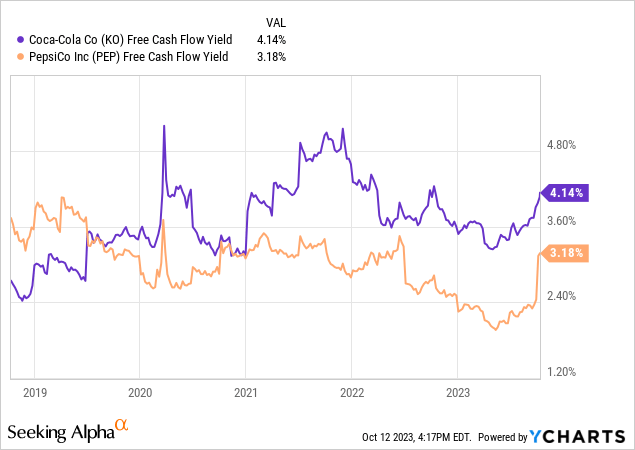

As of right now, I do prefer Coca-Cola’s investment proposition over Pepsi. At this stage, KO sits at a slightly stronger valuation, with business results delivering higher margins than PEP. Who doesn’t want to own one of the strongest brand names in the world, at a below average valuation, with high/improving margins, and smarter investor returns than its closest competitor?

For example, Coke’s free cash flow yield of 4.14% is nearly a full percentage point higher than Pepsi. Warren Buffett and other value investors hunt for the best free cash flow returns on their money, especially from easy to run and understand business models.

YCharts – Coca-Cola vs. Pepsi, Trailing Free Cash Flow Yield, 5 Years

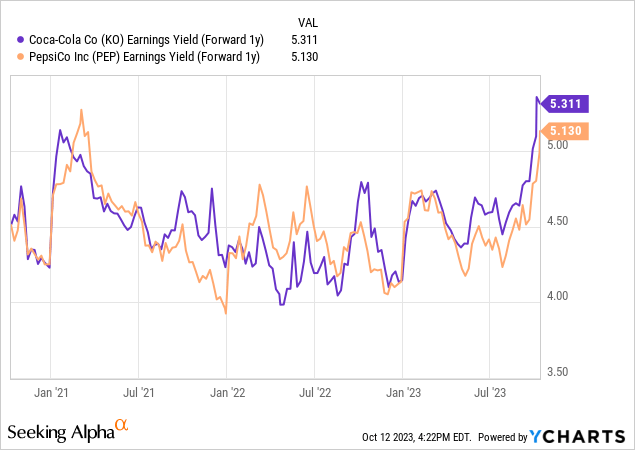

When we look at price to forward 1-year EPS estimates by analysts, KO is also delivering nearly 0.2% better in earnings yield for calendar 2024 at 5.31%. Plus, this sum approximates what I can get from cash-equivalent risk-free savings investments like bank CDs and 1-year Treasuries, my minimum bar for reasonable equity valuations.

YCharts – Coca-Cola vs. Pepsi, Forward Projected Earnings Yield, 3 Years

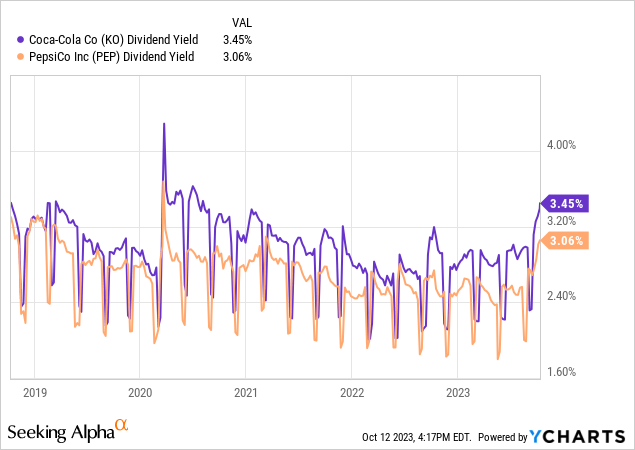

Another positive for Coca-Cola is the trailing dividend yield of 3.45% is nicely above Pepsi’s 3.06%. If you are a dividend/income investor, the whole valuation story must include a stronger cash distribution. The really good news is the S&P 500 index of blue chips is returning just 1.5% for a cash yield, while the Russell 2000 and NASDAQ 100 Big Tech names are sending out even weaker distributions currently.

YCharts – Coca-Cola vs. Pepsi, Trailing Dividend Yield, 5 Years

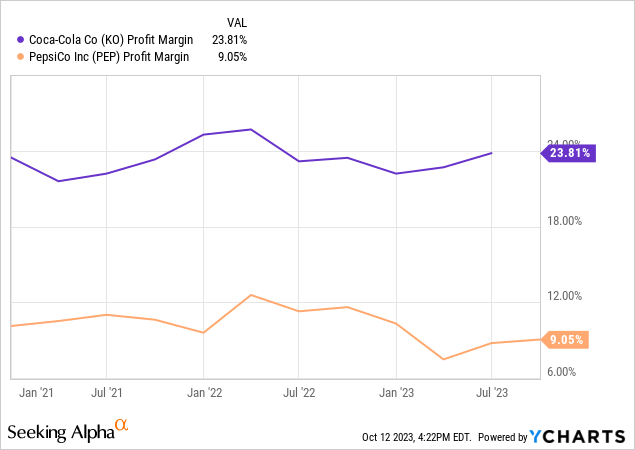

In terms of final profit margins, Coke remains one of the highest margin-on-sales large-cap businesses for investors, not tied to leapfrogging technology patents and quickly changing consumer demand for gadgets or social media. Measured against Pepsi’s more capital-intensive snack-making divisions, Coca-Cola’s simplified licensing business model to beverage bottlers and distributors is the hands down profit-motive winner. KO’s final profit margin of nearly 24% easily surpasses PEP’s 9%.

YCharts – Coca-Cola vs. Pepsi, Final Profit Margin on Sales, 3 Years

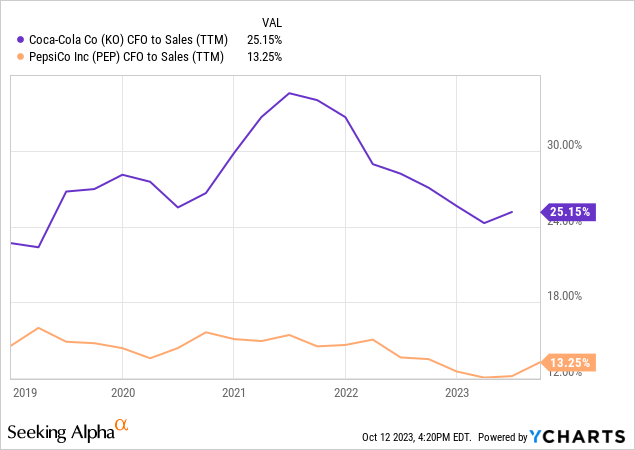

Again, cash flow to sales (a function of the profit margin design) at Coke is almost DOUBLE the rate of Pepsi. To me, the financial operating margin appeal of owning KO is a much stronger pull than Pepsi, and is one of the reasons Mr. Buffett purchased his massive stake in the business during the late 1980s.

YCharts – Coca-Cola vs. Pepsi, Cash Flow to Sales, 5 Years

Technical Trading Analysis

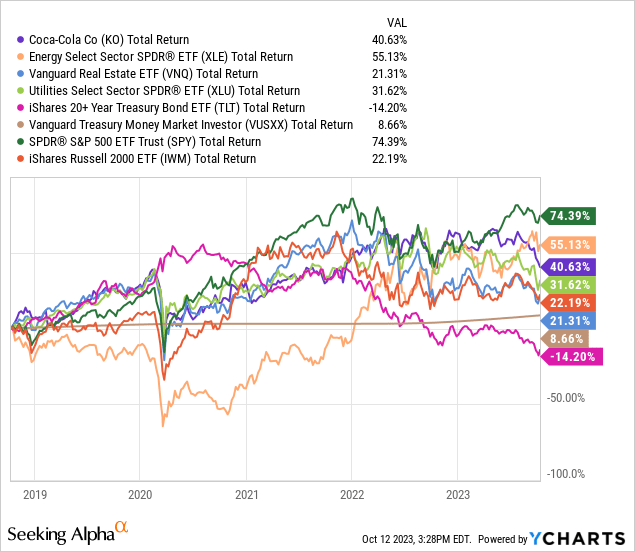

Despite not getting much press over the last five years, Coca-Cola has still performed admirably for income investors since 2018. Below is a total return graph comparing the company to investor returns achieved by the large-cap oil and gas Energy Select Sector SPDR ETF (XLE), Vanguard Real Estate ETF (VNQ), Utilities Select Sector SPDR ETF (XLU), iShares 20+ Year Treasury Bond ETF (TLT), and cash-savings vehicle Vanguard Treasury Money Market (VUSXX), alongside the general market blue-chip tracking SPDR S&P 500 ETF (SPY) or small-cap iShares Russell 2000 ETF (IWM). Really, for long-term investors, only the leading performance Big Tech-heavy SPY product and the oil/gas sector have beaten Coca-Cola investors for buy-and-hold gains (out of this simplified group of picks).

YCharts – Coca-Cola vs. Various Income Alternatives, Total Returns, 5 Years

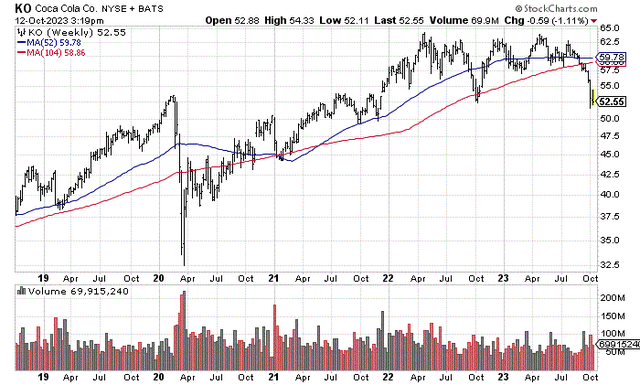

On the 5-year graph of weekly price and volume changes below, we can see the late summer price swoon has pushed KO well under its 1-year and 2-year moving averages (just like the pandemic bust of March-April 2020).

StockCharts.com – Coca-Cola, 5 Years of Weekly Price & Volume Changes

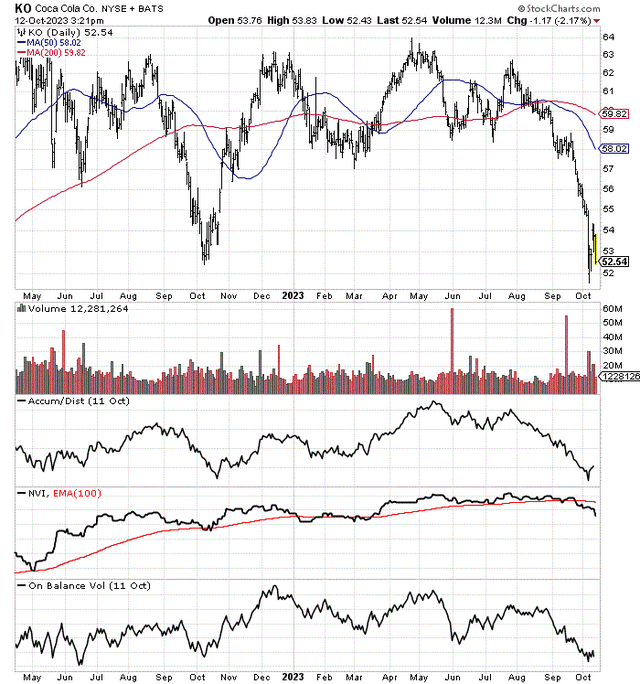

Over the short run, the jury is out regarding a bottom in price anytime soon. On the 18-month chart of daily price and volume changes, very little stands out to me suggesting the price decline is over. Momentum trading constructs like the Accumulation/Distribution Line, Negative Volume Index, and On Balance Volume are in limbo or pointing to lower quotes. Is there an amazing amount of selling taking place? No, but I don’t feel like bottom fishing just yet, with so many geopolitical and credit crunch risks approaching.

StockCharts.com – Coca-Cola, 18 Months of Daily Price & Volume Changes

Final Thoughts

Do I think Coca-Cola will be able to generate massive trading profits for new shareholders at $45? No, but my estimated total return of +10% annually going forward from there should be an easy decision to own, and a core position for the majority of investors. If inflation averages less than 4% per annum after 2023-24, the dividend will cover basic cost-of-living changes in wealth. Translation: if we can earn +5% or even +10% in price appreciation each year, you will be compounding real-world wealth materially over time, especially in a tax-deferred IRA or 401-K portfolio. Honestly, this math did not exist a year or two ago for KO share owners.

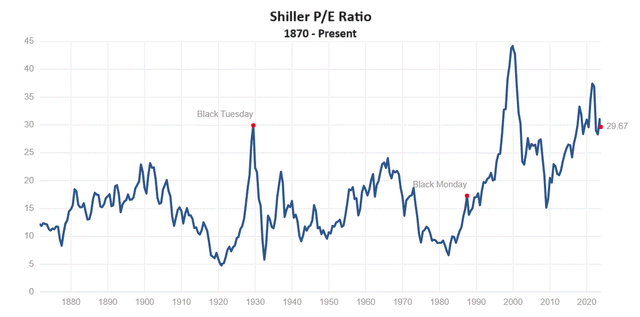

Would I run out and buy shares in the low-$50s or upper-$40s. I personally will not. I need a lower price to offset the “risks” of stagnate beverage industry growth, deglobalization trends, and rising nationalism potentially leading to trade barriers and tariffs on U.S. goods. While Coca-Cola has benefited from consumers all over the world loving American brands for decades, the next 10-20 years may not be as kind to this business in terms of global acceptance. My readout is, even a price of $45 carries some risk. On top of this concern, the U.S. stock market remains quite overvalued on long-term statistics like total Wall Street value vs. GDP or the famous Shiller P/E Ratio (reviewing 10 years of earnings).

Multpl.com – Shiller P/E Ratio, Since 1870

In other words, I cannot guarantee KO won’t drop to $40 or under before finding a lasting bottom. Without doubt, assuming the world is not ending, $40 and a rough 5% dividend yield would be Strong Buy territory. With the company’s (distributor production chains) ability to hedge inflation with small price increases per drink (with percentage of sales to KO), and my expectation for moderate rates of inflation between 2% and 5% annually now the new normal to lessen America’s monster debt load over time, I suspect earnings growth rates could surprise on the upside. Again, this bright future will depend on foreign sales and consumer demand holding up.

A bunch of talk this past week is trying to explain the difficult last month of trading in packaged food, snack maker, and sugar-heavy beverage businesses like Coca-Cola is related to rising diet drug use in America (Ozempic/Wegovy specifically). I strongly disagree. More likely, I believe an approaching recession in all types of consumer demand would be the primary reason for any weakness in sales over the past few months. I know these prescription weight-loss injectables are supposed to suppress appetite while changing how sugars are broken down in your body, but really. If you can lose weight while eating your favorite junk foods, maybe you will consider eating MORE of them.

For now, I remain in the Hold/Neutral camp for a rating, patiently waiting for another terrific entry point into Coca-Cola. This name is on my watch list for sure. I thought I would mention the buy argument now, in case the stock market dives in coming months. The likelihood of a recession into 2024 is now front and center, after another huge jump in long-term borrowing costs since early summer grinds down the financial system. With consumer pocketbooks and liquidity in the banking system squeezed tighter every day, odds are increasing (not decreasing) that a -20% bear market drop is becoming unavoidable at some point over the next 3-6 months.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.