Summary:

- Iconic companies often come with a premium, but Coca-Cola’s stock has underperformed in the last decade.

- Coca-Cola’s recent earnings report showed warning signs, including unsustainable price increases and currency headwinds.

- With slowing revenue growth, rising costs, and high valuation, Coca-Cola’s stock is overvalued and faces challenges in the current economic environment.

Jonathan Knowles

Iconic companies almost always command a premium. While many well-known brands have been very good long-term investments, these labels almost always make investors pay for famous product names.

The Coca-Cola Company (NYSE:KO) is one of the most recognizable brands in the world. Today, the company sells over 500 products in 200 different countries. Coke has a market cap of nearly $300 billion.

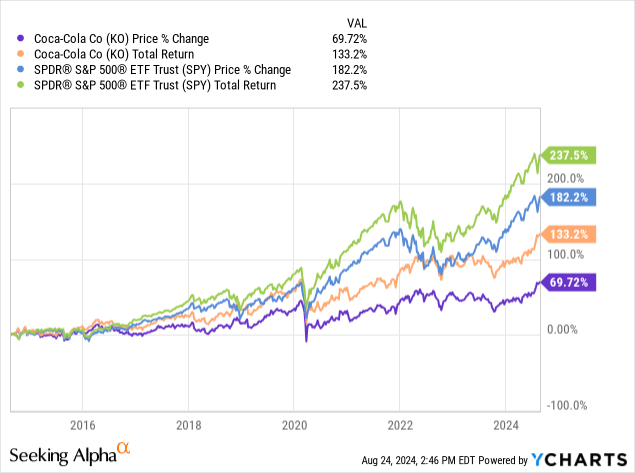

Still, the well-known beverage company was one of the best-performing stocks in the market for some time, the stock has underperformed over the last decade.

Coke has offered investors total returns of 133.2% since 2014, while the S&P 500 has offered investors total returns of 237.5% during this same timeframe.

I last wrote about the Coca-Cola Company in May of this year, and I rated the company a sell. Today, I am changing my rating of Coke to a strong sell. The company’s last earnings report contains several warning signs, and management won’t likely be able to continue to drive earnings with what looks like unsustainable price increases. Coke will also likely continue to face currency headwinds, the stock looks overvalued using multiple metrics.

While Coke’s recent earnings report looked solid on the face of things, but the statement contained some warning signs. The company reported second-quarter earnings of $.84 a share, versus expectations of $.81 a share. Management also reported revenues of $12.36 billion, versus expectations of $11.76 billion. The company raised the already conservative guidance slightly. Management now expects earnings growth of 5-6%, versus previous expectations of 4-5%.

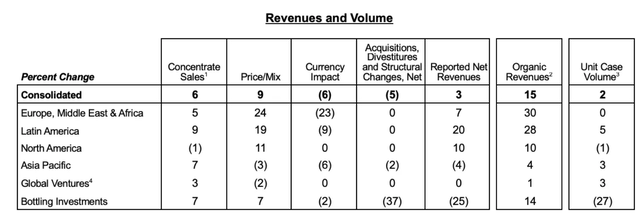

There are multiple signs that the US and global economy are weakening, with many key retailers such as Target (TGT), Walmart (WMT), and McDonald’s (MCD) reported that consumers are increasingly trading down. Credit Card debt and default rates have also hit near all-time highs in the US, while growth rates in China and the EU are slowing as well. Analysts are also expecting consumer spending to slow in the back half of the year, and the recently revised jobs reports are further evidence that the economy is decelerating. While Coke traditionally sells the company’s products at a very low price point, the corporation has raised prices significantly since 2021, both in the US and abroad. Coke increased prices by 24% on the net in Europe, the Middle East, and Africa, 19% in Latin America, and 11% in North America, this year.

A Grid of Coke’s Volume and Price Mix (Coca-Cola Company)

The company’s unit volume was flat or negative both in the US, as well as in Europe, the Middle East, and Africa. With rates still high and consumers facing increasingly tough choices, Coke is not likely going to be able to drive revenue and earnings growth with what are likely unsustainable price increases moving forward, as the economy in the US and abroad continues to deteriorate.

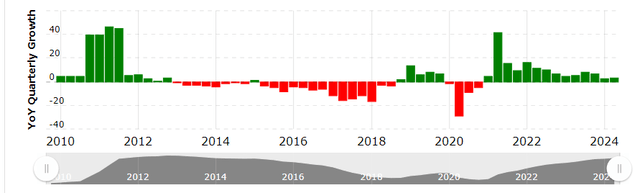

Coke’s quarterly revenue growth rate has also been consistently slowing for nearly 3 years.

A Chart of Coke’s Quarterly Revenue Growth (Macrotrends)

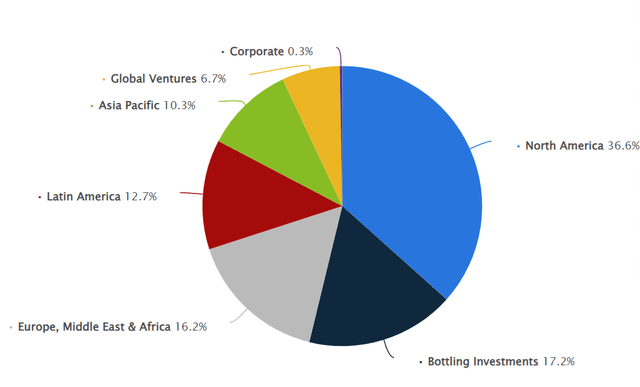

Coke also continues to face significant forex headwinds, and these currency challenges should remain for a number of reasons. The company is currently forecasting a 4% negative impact from forex issues to net sales, and an 8% negative impact from currency issues to earnings for the third quarter. Coke gets nearly 65% of the company’s revenues from outside of the US.

A Graph of Coke’s Revenue Sources (Statista)

Even though the Fed has signaled as the market expected that rate cuts will begin, Powell has maintained for some time that the Central Bank views efforts to curb inflation as being long-term ones. Prices also remain high, even though inflation rates have come down, and the core drivers of inflation, such as labor shortages and rising wages, remain in the economy. The ECB and Chinese Central Bank have also been much more aggressive than the Fed in cutting rates, and the US economy remains the strongest in the world. The dollar is likely to remain strong against the Euro and other major currencies in the world.

Coke is pricing products in the US and abroad at much higher levels today than historically, the company is more vulnerable to business cycles than normal, as the beverage company’s slowing revenue and sales unit volume growth shows.

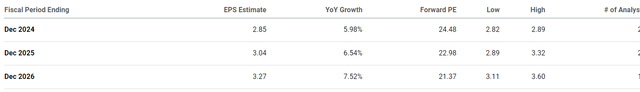

This is also why the stock looks overvalued at 26.88x expected forward GAAP earnings and 23.99x forecasted forward cash flow. While Coke’s 5-year average valuation is 25.2x projected forward GAAP earnings and 23.60x expected forward cash flow, Coke is currently in a much more difficult operating environment, since the company faces slowing growth, rising costs, and increasing forex headwinds.

A List of Analysts’ Revenue Expectations for Coke (Seeking Alpha)

Coke is only expected to grow revenues at a mid-single-digit rate over the next 3 years, and consumers are increasingly trading down even with lower ticket purchases in more mature economies such as the US and EU. Management has also been conservative with share buybacks and Coke’s cash flow has also fallen over the last year, the company isn’t likely to aggressively buyback shares moving forward.

While all investment theses have risks, and if the Fed were to begin cutting rates aggressively, or pursuing other forms of monetary stimulus such as another round of quantitative easing, the dollar would likely weaken significantly, and growth rates in the US would likely rebound. Still, with prices high and Powell adamant that the effort to lower inflation will be a multi-year battle, that seems very unlikely. Growth rates in China and the EU are likely to remain weak as well, since Europe is more vulnerable to price increases and the negative impact of China’s weak property sector continues to hurt consumers in the world’s second-largest economy.

Coke was one of the best-performing stocks in the market for decades, but the iconic company has consistently and significantly underperformed the broader indexes over the last decade. Coke is also relying heavily on what looks like unsustainable price increases, and the company’s higher prices make the business model more vulnerable to business cycles and consumers trading down. While Coke remains one of the most recognized brands in the world, investors should be able to find better value elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.