Summary:

- Coca-Cola is a stable and reliable dividend stock with little dividend growth, making it a favorite for long-term investors.

- The company’s business model is simple and predictable, with a wide range of non-alcoholic beverages and a strong global brand.

- Despite a lower dividend yield compared to other investments, Coca-Cola has a century of uninterrupted dividends and consistent total returns for shareholders.

- KO will continue to face headwinds in the near-term due to its top markets experiencing annual inflation over 20%.

porcorex/iStock via Getty Images

Introduction

As a dividend investor Coca-Cola (NYSE:KO) has always been on my radar. The stock is probably one of the most reliable stocks on the planet. One reason I like it is because of the stability. My readers probably know by now how I classify my stocks. If not, I’ll put out another reminder. Dividend stabilizers, growers, and showers. I consider KO a stabilizer. What is a stabilizer? Stocks that have a solid, and stable business model while delivering modest growth. Normally growth in the low to mid single digits, the 3%-5% range. And although that may not appease some investors due to their low-yields, these are some favorites in my portfolio.

KO’s business model is very simple and predictable. I honestly think that’s why Warren Buffett likes them so much. Those who follow him know that he’s a very simple man. I consider myself very simple as well so that’s probably why I enjoy stocks like KO and its peer PepsiCo (PEP). Another thing I enjoy about stocks like KO is that they normally trade within a certain price range. KO normally trades between the mid $50s to mid $60s. And for me they start looking real attractive under $60. Currently they are trading less than $58 and I think they are a good addition for investors looking for a safe, and reliable dividend for the long-term. Let’s get into why I think KO deserves a spot in your portfolio.

K.I.S.S.

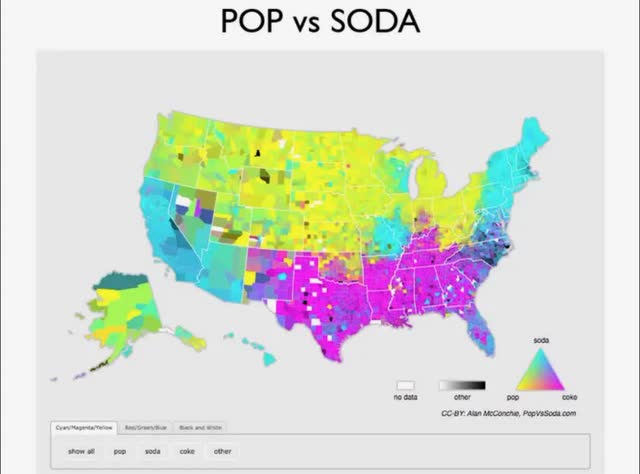

Keep it simple stupid. It’s one of the mottos I try to live by. Simplifying things in your life can help you alleviate a lot of stress and anxiety. In short, you can do things the easy way or the hard way. I prefer to do things the easy way. Whenever a problem arises, or anything for that matter happens, I try to break it down in the simplest way possible to help myself or others understand. In the simplest terms, Coca-Cola sells soda. Depending on what part of the country you are from, you might say pop or coke. I’ve even attached a map for you guys.

Businessinsider

But KO is a beverage company that manufactures, markets, and sells various non-alcoholic & alcoholic beverages worldwide. In fact, they currently have 27 offerings of alcoholic beverages in the market right now. Although soda or whatever you want to call it is considered bad because of the sugar content, that doesn’t stop people from drinking it. I think it’s safe to say people will always drink soda. But for you people that don’t drink it, they also sell water, coffee, tea, and sports drinks too. They are literally one of the world’s most well-known and valuable brands and have been around since the late 1800s. So it’s safe to say they’re not going anywhere anytime soon.

Steady Income

KO has more than a century of uninterrupted dividends and more than half a century of dividend growth. Not many companies can say that or boast that kind of record. With a dividend yield slightly above 3%, you can probably see why the stock is down over the last year. Investors can get more than 5% right now in T-bills and certificates of deposits, so investing in a stock with a yield this low doesn’t appeal to them.

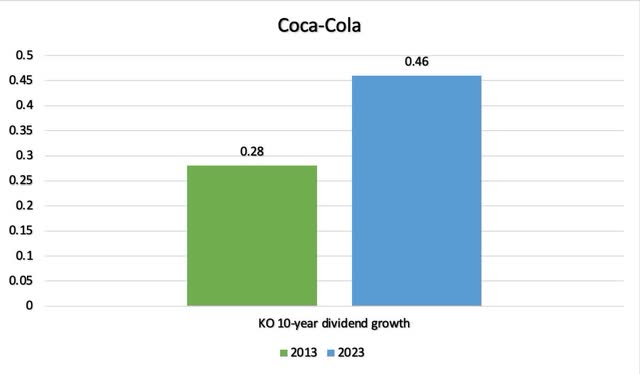

Over the past decade, KO’s dividend increased by $0.18 or 64%. Some might say that’s minimal compared to its peer PEP, whose dividend increase doubled KO’s at 135% over the same period. And this is probably why its rival normally trades at a higher valuation. Again, stabilizers aren’t going to knock your socks off, but what they will do is provide stable income through the ups and downs of the economy. They help you sleep well at night, and I’ll take those any day of the week and twice on Sunday.

Author creation

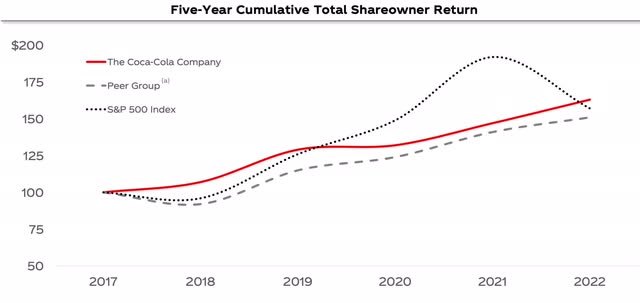

Total Return To Shareholders

As seen below, KO has delivered steady & consistent total return over the last 5 years. In the military, we like to call this unwavering devotion to duty. With a global brand that has been around since the 1800s, one should not expect anything different. The stock has delivered 66% in total returns from 2017 to 2022 while Pepsi delivered 91.5% over the same period. The S&P delivered 112% during that time, but as you can see, KO outperformed the latter from ’17 to ’19. I believe this is the most logical reason for Buffett’s ownership in the stock. While the S&P can be quite volatile depending on the macro environment, KO continues to deliver consistently & efficiently year after year.

KO investor presentation

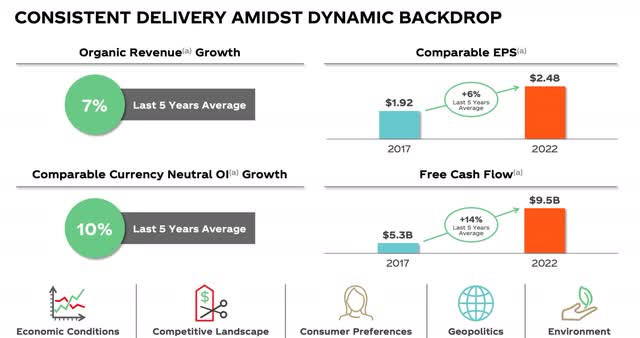

Organic Growth

All you can ask from your holding is for them to continue doing the job you require of them. Coca-Cola is a stabilizer, the blue-collar worker that’s just going to show up on time, and do exactly what they’re told to do. That worker that needs little to no supervision. So while the beverage maker has delivered consistent total returns over the last 5 years, they also posted some steady organic revenue growth at 7%. Additionally, they managed to grow EPS by +6% average in the last 5-years, while growing FCF by an average of +14% in the same period. Management also expects organic revenues to grow between 8% to 9% and EPS to grow between 5% to 6% for the rest of this year.

During Q2 earnings, KO continued on its path of impressive growth. EPS (Non-GAAP) was up 11% year-over-year, while organic revenue growth was 11% for the quarter. Net revenues grew 6% while EPS grew 34% to $0.59. They also delivered free cash flow of $4 billion during the first half of ’23, roughly in-line with $4.1 billion in Q2 ’22. Free cash flow is expected to also be flat at $9.5 billion by end of the year. Although as investors, we like to see growth, I expect my stabilizers to deliver flat to low growth in times of economic uncertainty. This further reinforces their financial stability & resilience.

KO investor presentation

Strong Balance Sheet

I view a balance sheet like a foundation on a house. You can have all the pretty fences and colors on the outside, but if the foundation isn’t strong, the house will eventually fall. The same goes for a company. If they’re posting growth but have an average or weak balance sheet, the company has a potential to fail if their debt is not a priority. Coca-Cola’s net debt leverage of 1.6x was well below their targeted average of 2 to 2.5 times. Over the last decade, the company’s average has been 2.24x, below the average for consumer staples. To note, their debt has increased from roughly $35 to $43 billion currently, but management has been focused on reducing this over the last 5 years. With more than $15 billion in cash on hand, I think investors have nothing to worry about as their debt load is very manageable. To put this into perspective, PEP currently has roughly the same amount of debt, with $43 billion and $6.5 billion in cash on hand.

Is It A Buy, Hold, Or Sell?

KO’s dividend yield is roughly in-line with its 5-year average. Like I mentioned earlier, the stock usually trades in the mid $50’s to mid $60’s and is now trading closer to its 52-week low of $54.02 at the time of writing, which makes it a buy in my opinion. With rates to remain higher combined with KO’s low-yield, I expect the price to drop further and investors should add on any share price weakness. Analysts have a current price target of almost $71. I’m expecting another $0.02 increase to next year’s dividend, for an annual of $1.92. Because of the expected higher for longer environment, I decided to be a bit more conservative using the Dividend Discount Model (DDM). With an expected 8% annual return and a 3% growth rate, I have a price of $64 for KO, in-line with its 52-week high of $64.99.

Tipranks

Risks

KO’s biggest risk is competing macro forces across their markets. The company is a global brand that has a strong presence all over the world. Because of this, inflation remains elevated in some of their most competitive markets. With more rate hikes expected, this will continue to affect consumer spending and impact the business in the near-term. And although inflation seems to be moderating in some countries, the number of KO’s markets that have been experiencing annual inflation over 20% has increased. At the end of the quarter that number had expanded to 5 of the company’s top 40 markets. This has caused consumer confidence to come in below pre-pandemic levels in some countries. But despite all of this, KO expects to continue its growth as seen by their recent raise to their top and bottom line guidance in Q2.

Conclusion

KO has delivered steady returns year after year, and although there’s a lot of uncertainty right now, I think the stock will continue to deliver low growth. The company has posted some impressive organic growth considering the macro environment and offers investors a safe haven to collect a steady dividend. Although T-bills offer a higher yield currently, they will not remain high and I think we are closer to a cut in rates. When that will happen I don’t know but I’m predicting by the 2H of ’24. This will cause investors to rotate back into the market which will drive the price of low-yielding dividend stocks higher. I think KO is a buy under $60 and a stronger buy below $55 offering investors a good margin of safety.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.