Summary:

- Coca-Cola is likely to raise its dividend for the 62nd straight year, but by no more than 2 cents.

- The stock price performance of Coca-Cola has been modest, with average annual returns of 8.6%.

- The company’s dividend growth track record is impressive, but recent increases have been unimpressive.

- Investors looking for more than single-digit returns should look at other opportunities.

Justin Sullivan

Coca-Cola (NYSE:KO) is likely to raise its dividend for the 62nd straight year in mid-February, but by no more than 2 cents in my view.

A little over two years ago, I wrote a fairly optimistic article about Coca-Cola, outlining how it might finally have turned the corner and entered a new period of growth again. The stock is up since then, but only by about 10%. Adding in slightly more than two years of dividends gets us to approximately 17%. Okay, but not the kind of double-digit annual total returns most investors are looking for.

I was right about predicting an increase from the customary one cent increase to two cents — which is the kind of increase this company also offered last year. As I will analyze in this article, I predict another two cent increase, or 4.3%, this year.

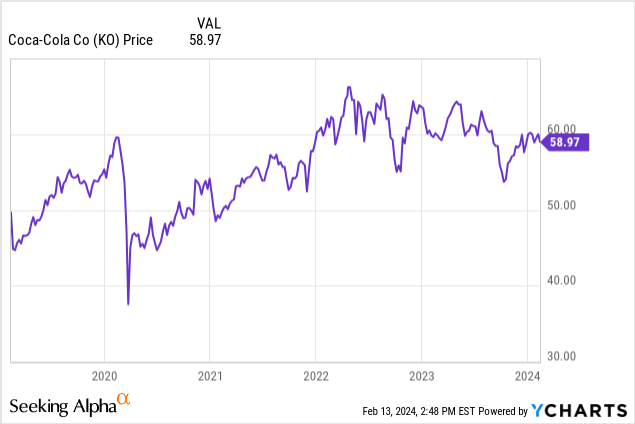

As I alluded to earlier, the stock price performance of Coke has not exactly been stellar. Five years ago it was at $45.24, and it is currently at $58.97 — for an increase of 30% or 5.4% on average per year. Adding in the approximate 3% annual dividend yield, investors have gotten around 8.4% total annual returns. Yes, you can rely on that dividend being paid, but this stock is no longer a millionaire-maker in my opinion.

Historical Dividend Growth

What does count in Coca-Cola’s favor, though, is its stellar dividend growth track record. Last year, it raised its dividend for the 61st consecutive year. That is a testament to the stability and resilience of its business. There are very few Dividend Kings — and even fewer that can add more than a decade to that criteria.

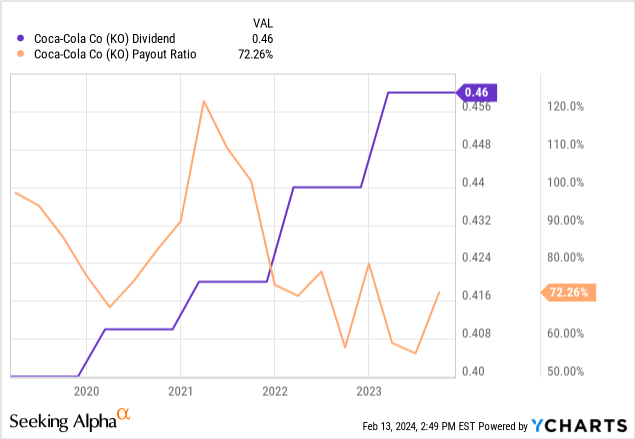

Even so, it is not only the streak of years that is important, but of course the size of the increases. This is the area investors have been underwhelmed with for the last decade or so. I would say the last solid increase from this company was the one in 2015 when it was raised from $0.305 to $0.33 for an increase of 8.2%. At that rate, and with a yield of 3%, you could still achieve total returns in the double-digits. The next year the increase was only 6.1% and ever since it’s been either a one cent or a two cent increase. Steady, but not stellar. The last dividend of 2018 was $0.39 per share, five years later in December 2023, it stood at $0.46. That’s an average annual increase of 3.3%. Not enough to get me excited.

If we look at the graph above, we can understand why growth has been muted. After all, the company has to keep its payout ratio at a decent level so as not to jeopardize the business. This has oscillated between 60% and 120%. When the payout ratio is generally elevated, you can’t really boost the dividend too much. In order to grow the dividend long term, earnings per share must also grow. So we need to see some signs of more stable long term EPS growth before we can hope for some juicy dividend growth.

February Dividend Hike

Right around the middle of February, Coca-Cola’s dividend will most likely be raised. It is nice with some certainties in this uncertain world. As we have seen, its track record over the last decade or so very clearly points in the direction of a one to two cent increase in the quarterly dividend.

There is potential for a higher increase if recent numbers or forward guidance are particularly auspicious. As it happens, numbers were quite good in the latest reported quarter. Revenues grew by 7% to $10.8 billion, while comparable EPS grew by 10% to $0.74. An encouraging bit is the price/mix increase of 9%, which means Coca-Cola has some real pricing power in the marketplace, a testament to the value of its brands. It also provided guidance for next fiscal year. It expects comparable EPS to grow by 4% to 5% in 2024.

In very simplistic terms, one could say that a 10% EPS growth could translate into a similar dividend growth. However, taking into account the relatively high payout ratio and a Board that I believe wishes to continue the company’s stellar dividend streak and would want to be cautious, a 10% bump in the dividend is unrealistic. Especially when we consider its guidance for the current year of an EPS growth of only 4-5%. There is really no need for a big bump, as the market is accustomed to a much lower growth rate, and the company would just set itself up for a real disappointment when it has to revert to a low growth rate in future years.

Even though the EPS growth this year is in line with Coca-Cola’s long term growth target, it is too early yet to conclude that this year’s growth rate is sustainable. I therefore think the Board will go conservative and offer investors a decent growth rate, but keep it small enough to save some as a buffer for later years. A two cent bump to $0.48 therefore seems prudent. That would translate into a 4.3% growth rate, which is just about the EPS growth it expects in 2024. In all, that seems like a prudent dividend growth rate.

Risk Factors

Even though Coca-Cola is a global giant, selling a wide range of non-alcoholic beverages, it is certainly exposed to risks. One such risk is weight loss drugs like Wegovy. Such drugs seek to reduce the appetite of the person taking it, reducing the amount of food and drinks the body craves. That is naturally a risk for Coca-Cola, if people want to consume fewer and/or smaller drinks. A risk to growth is the sheer size of the company. When it has quarterly revenues of $10-12 billion and a presence around the world, it is just hard to keep up high percentage-wise growth rates. Lastly, I would like to highlight currency risk. Although selling around the world is a nice form of diversification, it also exposes you to currency fluctuations. If the U.S. dollar were to strengthen going forward, foreign currency profits will be reduced when exchanged into the U.S. dollar. Currencies tend to even out over time, but the dollar has been strengthening almost continually for a decade now, illustrating that over time might turn out to be a very long time.

Current Valuation

I always check comparable companies before considering buying any stock. I will compare it with two close competitors: PepsiCo (PEP) and Keurig Dr Pepper (KDP).

| Coca-Cola | PepsiCo | Keurig Dr Pepper | |

| Price/Sales | 5.7x | 2.5x | 3.0x |

| Price/Earnings | 22.2x | 20.9x | 17.6x |

| Yield | 3.1% | 2.9% | 2.7% |

Source: Seeking Alpha

Well, one of the above clearly stands out when it comes to the Price/Sales category. Coca-Cola is by far the most expensive one of the three. When it comes to the Price/Earnings ratio, however, the competitive field is much closer. Coca-Cola is still a tad more expensive and Keurig Dr Pepper is clearly the cheapest one, but all of them are within the decent price range.

The last category is won by Coca-Cola with a dividend 0.4 percentage points above Dr Pepper, which loses this one. Each company wins one category each. I think all of these are decently priced, though I would consider Coca-Cola and PepsiCo to be slightly less risky than Dr Pepper, due to the massive global size of the first two.

Analysts on Wall Street expect Coca-Cola to be able to grow long term EPS by 6.4% annually. Assuming a relatively constant earnings multiple, which after all has been the case over the last decade or so, and adding in the 3.1% dividend yield, we arrive at an expected total shareholder return of 9.5%. This is decent given the comparatively low risk nature of this company, but it is less than the double-digit return I am looking for when investing in stocks. You are taking on risk when investing in stocks, and if you cannot expect to earn double-digit returns, you should either invest in something with lower risk or search for better opportunities in the stock market. At this moment, at this price and expected growth rate, KO is a holding I would sell.

Conclusion

Coca-Cola will soon raise its dividend for the 62nd consecutive year and looks set to raise it by 2 cents later this February. In recent years, the dividend growth rate has been rather disappointing. The company has emerged in good health after the pandemic and is managing to grow both revenues and earnings per share. Even so, it does not look like it will come anywhere near double-digit EPS growth on a long term sustainable basis. The total return outlook is therefore not good enough to warrant an investment at this time and I would sell existing holdings in favor of other opportunities.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.