Summary:

- Coca-Cola leads in U.S. market share and global brand value, outpacing competitors like Pepsi.

- Coca-Cola is well-positioned to benefit from rising demand in the growing global carbonated drinks industry.

- Coca-Cola’s recent acquisitions, including Monster and Costa Coffee, have diversified its portfolio and sustained strong ROIC.

- Based on a 6% projected CAGR and current valuation, Coca-Cola stock remains a hold for now.

Chinnachart Martmoh

Investment Thesis

In my opinion, Coca-Cola (NYSE:KO) stock is currently a hold. The company is a powerhouse in the beverage sector, holding the top spot in U.S. market share and global brand valuation. It’s well-placed to benefit from the expanding global market for carbonated drinks. Strategic acquisitions like Monster Beverage and Costa Coffee have broadened its product range and bolstered its Return on Invested Capital. However, caution is warranted. The company’s expected 6% Compound Annual Growth Rate over the next half-decade doesn’t present a compelling case for investment, especially when compared to the over 4% yield of the U.S. 5-year treasury bond. Given these factors, I’d recommend holding off on investing in Coca-Cola until the valuation becomes more attractive.

Company Overview

Coca-Cola is a beverage company that operates on a franchise model, producing syrup concentrate that is sold to bottlers globally. These bottlers then create and distribute the final products. The company’s product line includes brands such as Coca-Cola, Diet Coke, and Coca-Cola Zero Sugar, as well as other beverages like Minute Maid and Powerade. In my view, the company primarily makes money by selling concentrates and finished goods to bottlers and retailers. Coca-Cola operates in more than 200 countries, giving it a broad market reach.

The company faces competition from other major players in the beverage industry, including PepsiCo (PEP), Nestlé (OTCPK:NSRGY), and Dr Pepper Snapple Group, now part of Keurig Dr Pepper (KDP). These competitors offer a variety of products, from carbonated drinks to juices, which pose a challenge to Coca-Cola’s market position.

Unmatched Market Dominance and Brand Value

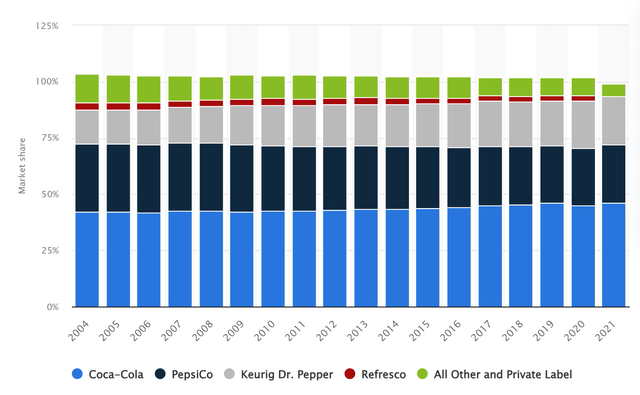

In my opinion, Coca-Cola’s market share and brand value offer compelling evidence of its strong position in the beverage industry. Data from Statista shows that Coca-Cola has led the U.S. market for carbonated soft drinks from 2004 to 2021. The company’s market share increased from 42% in 2004 to 46.3% in 2021, indicating a growing influence. This suggests that Coca-Cola has been effective in maintaining customer loyalty and attracting new consumers, even in a competitive market.

Statista

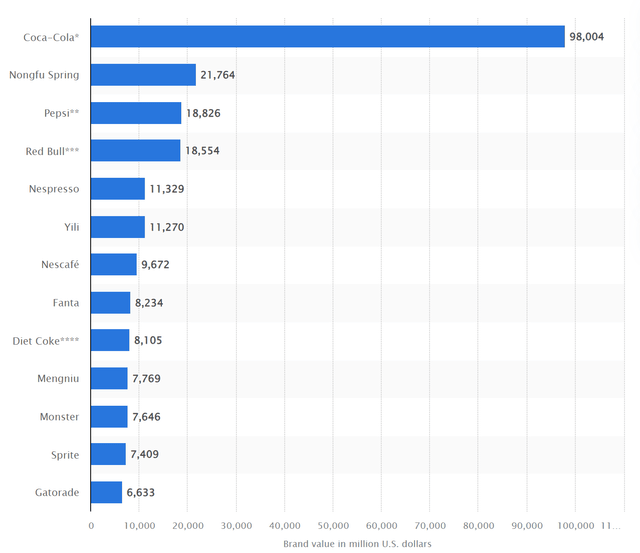

Additionally, Statista’s 2023 data on global soft drink brand values reveals a significant gap between Coca-Cola and its competitors. Coca-Cola’s brand value is nearing 100 billion dollars, while Pepsi, its closest competitor, has a brand value that’s roughly one-fifth of that. This disparity highlights Coca-Cola’s dominant market presence and suggests that its marketing strategies have been highly effective. Overall, the data points to Coca-Cola as a resilient and growing force in the global beverage sector.

Statista

Growth Prospects in the Expanding Carbonated Beverage Market

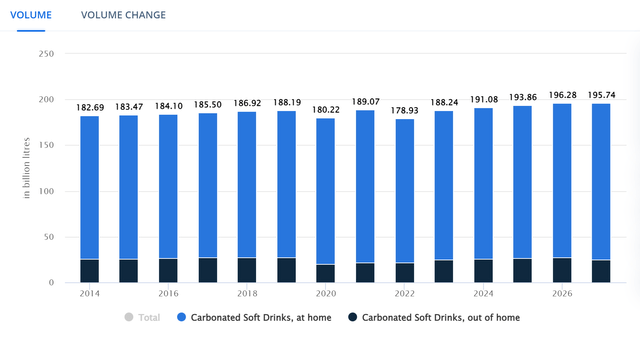

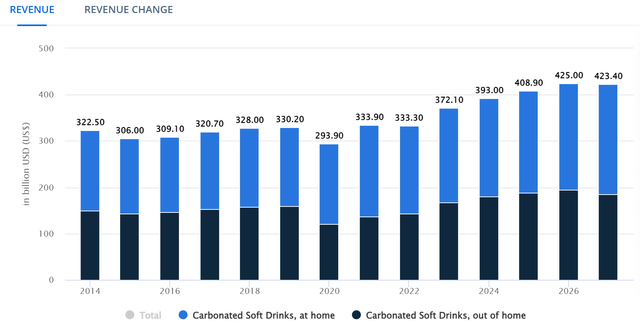

In my view, Coca-Cola stands to gain from the expanding carbonated beverages industry. Statista data indicates that the Carbonated Soft Drinks segment will have a revenue of $372.10 billion in 2023, with an annual growth rate of 3.28% from 2023 to 2027. Most of this revenue is expected to come from the United States, contributing $149.60 billion in 2023. Per person revenues are estimated at $48.44 for that year. The segment’s volume is also expected to reach 195.70 billion liters by 2027, with a 1.5% growth projected for 2024.

Given Coca-Cola’s market share and brand value, the company is in a good position to capture a sizable portion of this growth. Its distribution network and consumer loyalty offer a strong base for tapping into the growing market. Overall, the data suggests a favorable landscape for Coca-Cola.

Statista

Statista

In my view, several key factors are driving the volume growth in the carbonated beverage industry. One significant driver is the world’s growing population, particularly in emerging markets like India, Pakistan, and Turkey. These countries are experiencing rapid economic development, leading to an increase in disposable income among the rising working class. As more people enter the middle-income bracket, the demand for branded and packaged goods, including carbonated beverages, is likely to increase. This demographic and economic shift presents a ripe opportunity for companies like Coca-Cola to expand their market share and capitalize on the growing demand.

Coca-Cola’s Strategic Acquisitions Boost ROIC

In recent years, Coca-Cola has made several strategic acquisitions to diversify its beverage portfolio and tap into new markets. One significant move was its long-term partnership with Monster Beverage in 2015, where Coca-Cola acquired a 16.7% minority stake in the company. This partnership allowed Coca-Cola to establish a strong foothold in the global energy drink market, transferring its energy drink business to Monster while receiving Monster’s non-energy drink business in return.

Another noteworthy acquisition was that of Costa Coffee for $5.1 billion in 2018, which marked Coca-Cola’s entry into the hot beverage market. Costa Coffee had nearly 4,000 retail outlets worldwide, providing Coca-Cola with an established global presence in the coffee sector.

The company also took full ownership of Chi, a Nigerian beverage company, in 2019. Known for its Chivita brand of premium fruit juices and Hollandia dairy products, this acquisition expanded Coca-Cola’s reach in the African market.

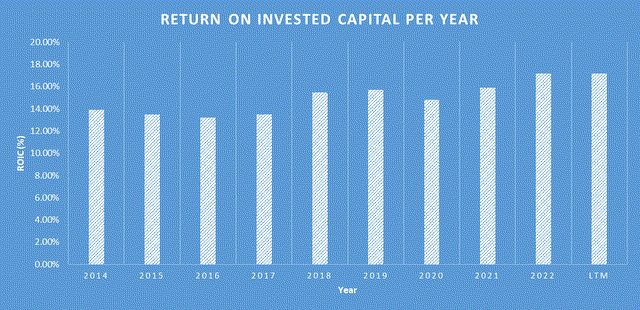

In my view, Coca-Cola’s recent acquisitions and partnerships, such as its stake in Monster Beverage, are integral to the company’s broader strategy to diversify its offerings and adapt to changing consumer preferences. This approach appears to be financially rewarding, as evidenced by Coca-Cola’s consistent Return on Invested Capital over the past 10 years. The company has maintained an ROIC ranging between 13% and 17.5%, indicating effective capital allocation towards profitable ventures, including key acquisitions like Costa Coffee. These consistent ROIC figures suggest that Coca-Cola’s strategic investment activities have not only expanded its product portfolio but have also generated substantial returns. Overall, this reinforces Coca-Cola’s position as a market leader, adept at both diversification and capital management.

DJTF Investments

Financial Analysis

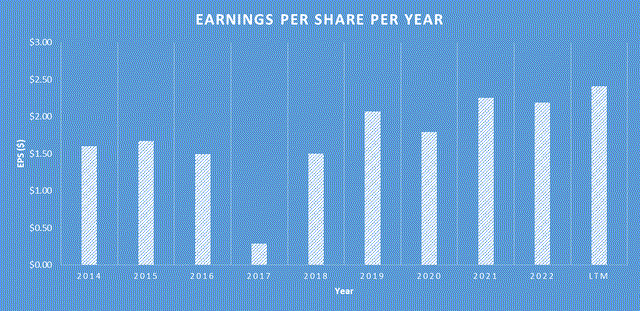

Over the past 5 years, the company has demonstrated status quo financial performance. Its revenue has shown a consistent and strong growth, increasing from $34,300.00 million in 2018 to $44,140.00 million in the last 12 months in 2023, representing a compound annual growth rate [CAGR] of approximately 5%. The earnings per share [EPS] has grown steadily from $1.50 to $2.41 over the past five years, reflecting the company’s ability to translate revenue growth into bottom-line success with a 9% CAGR.

DJTF Investments

As of the most recent quarter, the company reported cash and cash equivalents of $15,694.00 million. The company’s total debt stands at $37,183.00 million, a manageable amount that reflects the company’s responsible approach to leverage as the total debt can be paid off with approximately 3 years of free cash flow. The company’s current ratio, a measure of its ability to cover short-term liabilities with short-term assets, is 1.14, which is generally considered healthy.

For at least the next 12 months, I expect Coca Cola’s earnings to continue to grow in the high single digit range driven by organic growth through increased demand as the worldwide consumption volume and positive market share trends. I also expect growth to be driven inorganically through growth of KO’s past acquisitions as well as product price increases to match the rate of inflation Looking beyond the next 12 months, the company should still benefit from current secular tailwinds, its strong branding and growth in emerging markets.

Valuation

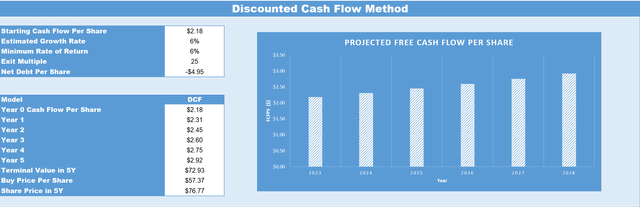

When considering valuation, I always consider what we are paying for the business (the market capitalisation) versus what we are getting (the underlying business fundamentals and future earnings). I believe a reliable way of measuring what you get versus what you pay is by conducting a discounted cashflow analysis of the business as seen below.

KO’s current TTM Cashflow per Share as of Q2, 2023 is $2.18. Based off 3% organic growth from population growth and market share gains and 3% inorganic growth from acquisitions and price increases, I believe that KO Cashflow per Share should grow conservatively at 6% annually for the next five years. Therefore, once factoring in the growth rate by Q2 2028 KO’s TTM Cashflow per Share is expected to be $2.92. If we then apply an exit multiple of 25, which is approximately what KO’s P/E ratio is, this infers a price target in five years of $76.77. Therefore, based on these estimations, if you were to buy KO at today’s share price of $57.94, this would result in a CAGR of 6% over the next five years.

DJTF Investments

Tikr Terminal

While Coca-Cola boasts a strong business model and market leadership in the beverage sector, I believe the current investor expectations might be too optimistic to provide a meaningful margin of safety. The company’s projected 6% CAGR doesn’t offer a compelling case for investment, particularly when weighed against the U.S. 5-year treasury bond, which is yielding over 4%. Despite Coca-Cola’s consistent ROIC and history of strategic acquisitions, the current market valuation makes it difficult to see the stock as a high-reward investment. For now, Coca-Cola will remain a hold on my investment list. I’ll be looking for more favorable conditions, similar to when the stock was priced at a P/E ratio of 15, as it was in 2009 and 2020, to consider making a move.

Conclusion

Coca-Cola continues to be a dominant force in the beverage industry, leading in both U.S. market share and global brand value. The company is also strategically positioned to capitalize on the growing demand in the global carbonated drinks industry. Recent acquisitions such as Monster Beverage and Costa Coffee have not only diversified Coca-Cola’s product portfolio but also contributed to a strong Return on Invested Capital. Despite these positive indicators, the company’s projected Compound Annual Growth Rate of 6% over the next five years raises some caution. When compared to the U.S. 5-year treasury bond yield of over 4%, the projected growth doesn’t offer a compelling investment case at the current valuation. Therefore, while Coca-Cola remains a market leader with strong fundamentals, it is advisable to hold off on investment for now, awaiting more favorable valuation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.