Summary:

- The Coca-Cola Company is a fundamentally strong business with solid pricing levers to mitigate inflation challenges.

- The company has observed a shift in consumer behavior due to worsening purchasing power, but overall demand remains robust.

- Coca-Cola’s pricing growth is expected to normalize as it refocuses on driving volume growth.

- The Coca-Cola Company’s enhanced digital capabilities could drive efficiency gains and unveil new growth opportunities through AI.

- I argue why the stock isn’t cheap, but its valuation seems justified. The Coca-Cola Company also looks ready to break out of its $65 zone. Read on.

Carlos Andres Serna Pulido/iStock Editorial via Getty Images

Coca-Cola Is A Fundamentally Strong Business

The Coca-Cola Company (NYSE:KO) is a fundamentally strong consumer staples sector (XLP) company. With its globally well-diversified revenue base, Coca-Cola has managed to capitalize on solid pricing levers to mitigate the inflation challenges. However, Coca-Cola isn’t immune to currency headwinds, although they aren’t expected to impact KO’s long-term model. Moreover, Coca-Cola expects inflation headwinds to moderate moving forward, as Coca-Cola anticipates “a more normalized pricing environment in 2024.” As a result, it should provide a more balanced price/volume growth roadmap from 2024 as KO refocuses its execution through more robust underlying volume growth improvements.

In my previous article in March 2024, I urged investors to remain bullish on KO. I highlighted Coca-Cola’s ability to maintain its highly resilient business model, bolstered by its robust pricing actions. Since then, KO stock has slightly outperformed the S&P 500 (SPX, SPY), even though it has pulled back from its recent May highs.

Notwithstanding KO’s pricing levers, Coca-Cola observed a shift in consumer behavior, likely attributed to worsening purchasing power among value-conscious consumers. As a result, Coca-Cola has implemented “revenue growth management and packaging efforts” to mitigate the shift in consumer behavior due to these adverse inflationary dynamics. Coca-Cola management observed a “marginal shift towards more at-home volume and slightly less away-from-home volume.”

Despite that, overall consumer spending in the US has remained robust among the wealthier consumers. However, fast-food restaurants have likely assessed slower growth dynamics recently. Consequently, McDonald’s (MCD) has recently revisited efforts to introduce its value meal in collaboration with Coca-Cola. However, MCD’s operators face challenges attributed to the labor costs and inflation headwinds. Burger King (QSR) reportedly aims to introduce its value meal to compete against McDonald’s. Accordingly, Burger King “is determined to launch its $5 value meal ahead of McDonald’s and intends to run it for several months.”

Coca-Cola’s Pricing Growth Should Normalize

Despite that, KO management’s confidence that inflation could moderate in 2024 suggests these headwinds may not persist. Therefore, Coca-Cola may see its pricing levers weaken in the second half of 2024, suggesting KO needs to reignite volume growth across its key segments. Thus, investors must monitor whether Coca-Cola can rejuvenate growth in its total volume, which increased by just 1% in Q1.

However, Coca-Cola’s confident full-year outlook should placate investors worried about execution risks in a more normalized pricing environment. Accordingly, KO’s guidance telegraphed an adjusted organic revenue growth of between 8% and 9%, surpassing Wall Street estimates. Therefore, I assess it underscores the resilience of KO’s ability to manage its pricing/volume mix to drive topline growth over time.

In addition, Coca-Cola’s enhanced digital capabilities in leveraging generative AI could help “deepen relationships with consumers and customers.” Coca-Cola highlighted that “AI-enabled suggested orders drove growth.” As a result, investors should pay closer attention to KO’s AI initiatives across “various business functions.” These initiatives have the potential to “boost efficiency and uncover new growth opportunities.” However, generative AI is costly to implement widely. As a result, I assess that KO can leverage its best-in-class profitability to invest more aggressively than its peers.

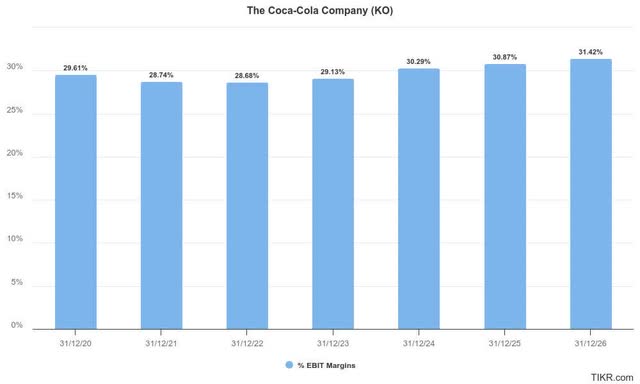

Coca-Cola adjusted operating margin estimates (TIKR)

As seen above, KO is expected to maintain relatively robust margins over the next two years. So, Wall Street expects Coca-Cola’s RGM and supply chain initiatives to continue benefiting its operating leverage gains.

While AI might not be a near-term margin driver, Coca-Cola’s 5Y “strategic partnership” with Microsoft (MSFT) in late April indicates its conviction in AI-driven gains. Therefore, I wouldn’t be surprised if Coca-Cola could unveil more robust bottom-line growth not anticipated in Wall Street consensus estimates.

KO Stock Valuation Isn’t Cheap But Justified

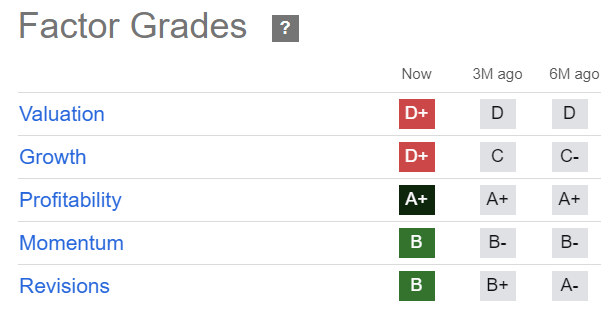

KO Quant Grades (Seeking Alpha)

As seen above, KO’s valuation isn’t cheap (“D+” valuation grade). In addition, KO’s forward adjusted PEG ratio of 3.68 is nearly 60% above its sector median. Consequently, it could be challenging for the market to re-rate KO markedly above its current valuation unless management guides for a more robust forward outlook.

Notwithstanding the caution, KO’s forward adjusted EBITDA multiple of 19.1x is aligned with its 10Y average of 19.4x. Therefore, KO buyers don’t seem unduly perturbed by its relatively high valuation, likely attributed to its fundamentally strong business model and sustainability.

Warren Buffett’s confidence in KO stock should underpin investor sentiments in the leading beverage maker. Accordingly, the Berkshire Hathaway (BRK.A, BRK.B) CEO reminded investors why he would continue to own KO stock:

We own Coca-Cola, which is a wonderful business. And we own Apple (AAPL), which is an even better business, and we will own, unless something really extraordinary happens, we will own Apple and American Express (AXP) and Coca-Cola. – Berkshire Hathaway Annual Meeting 2024.

Moreover, with the Fed confident of potentially lower inflation moving ahead, it should improve the appeal of KO’s dividend yield. KO’s forward dividend yield of 3.1% is slightly above its industry peers. KO’s “B” dividend safety grade corroborates the robustness of KO’s dividend payout, helping to keep Coca-Cola investors onside.

Is KO Stock A Buy, Sell, Or Hold?

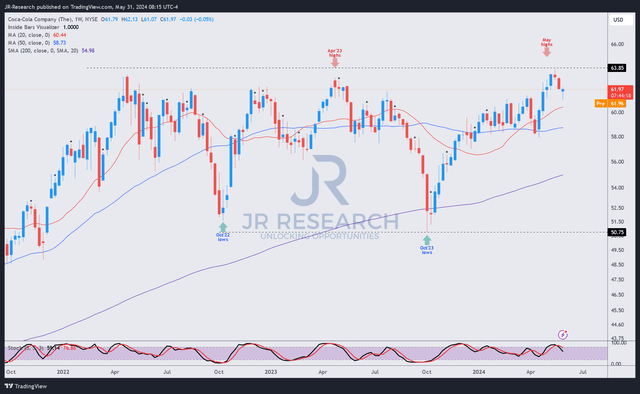

KO price chart (weekly, medium-term, adjusted for dividends) (TradingView)

KO’s price chart suggests it remains in a consolidation zone between the $50 and $65 levels. However, I assess that KO has likely regained its uptrend bias, which augurs well for KO’s uptrend continuation thesis. In other words, KO has the potential to finally break out of its consolidation zone after a two-year period if dip-buyers can hold above KO’s $60 level.

Therefore, KO investors considering buying the dips should capitalize on its nascent uptrend continuation thesis before KO potentially attempts a breakout above the $65 level.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!