Summary:

- Coca-Cola is a well-managed company with a strong set of brands and a wide economic moat.

- The company has expanded its portfolio through acquisitions and diversification into the coffee and alcoholic beverage industries.

- Coca-Cola has strong financial performance, with high profitability and a solid balance sheet, but its stock is currently not undervalued enough to justify building a position.

- Hold rating issued.

Justin Sullivan

Investment Thesis

Coca-Cola (NYSE:KO) is an exceptionally operated company that continues to grow metronomically. The firm has an outstanding set of brands and a real cost advantage that earns the company a wide and robust economic moat.

A recent selloff in shares combined with the low volatility nature of the stock has left many wondering whether or not now is the time to build a position within the beverage giant.

However, despite the excellent dividend and three year low in share prices, I do not believe sufficient value exists within shares to justify building a position in Coca-Cola.

While it is not a bad choice for any prospective investor, I believe Coca-Cola is not the best place to invest any additional capital at the present time.

Hold rating issued.

Company Background

coca-colacompany.com | Investor Relations

Coca-Cola is an American beverage corporation that manufactures, sells and markets both non-alcoholic and alcoholic beverages along with certain concentrates and syrups.

For years the firm has produced some of the most iconic non-alcoholic beverages and sodas such as Coca-Cola, Fanta, Sprite, Dasani water and Powerade.

Recent diversifications into the coffee business through the acquisition of Costa Coffee along with the firm’s move into the alcoholic beverage industry have seen Coca-Cola expand their portfolio like never before.

While the company has become synonymous among consumers across the globe, from a fiscal standpoint the firm has produced muted revenue growth YoY resulting in investor returns for the last ten years only being around 3-4% depending on one’s entry point.

James Quincey now heads the company as Chairman and CEO. Before Quincey’s 2019 move to CEO he was present in numerous leadership positions around the world both within the Coca-Cola enterprise and in other beverage companies.

I believe Quincey’s unique past experiences across a variety of industries along with his acute understanding of the inner workings of Coca-Cola should allow the CEO to confidently lead the company towards significant future growth.

Economic Moat – In Depth Analysis

Coca-Cola has a wide and robust economic moat that the firm has built around a massively popular set of brands that bolster the firm’s intangible assets along with some significant cost advantages that help Coca-Cola earn outsized returns on their ROIC compared to competitors.

Quite simply, Coca-Cola is easily the most recognizable and popular beverage brand in the entire world. The Coca-Cola brand has massive reach, cultural significance and multiple variations that allow the iconic beverage to target the largest audience of consumers possible.

By producing a variety of Coca-Cola branded beverages such as Diet, Zero and Caffeine Free has allowed the firm to target various market demographics and increase sales accordingly within each segment.

Furthermore, Coca-Cola as a company has acquired multiple iconic soda and beverage brands such as Fanta, Sprite, Powerade and Dasani water which the firm now manufactures and sells through their established and efficient supply and distribution networks.

The overall portfolio of beverages may be smaller than competitors such as PepsiCo (PEP), but I believe Coca-Cola has an even more recognizable and popular set of brands under their portfolio umbrella.

Coca-Cola therefore tends to diversify their beverages through the marketing of different versions of drinks under their handful of brands rather than having hundreds of individual brands.

Coca-Cola’s slightly more streamlined portfolio of brands also allows the firm to ensure their product banners remain popular and memorable within the minds of consumers which I believe should help the firm’s products remain popular within their respective markets.

The firm has also embarked on a diversification journey into the alcoholic beverage industry which began in 2018 with the release of an alcopop (alcoholic soda) beverage in Japan.

Topochicohardseltzer.com | Homepage

Since this initial move into the new market segment, Coca-Cola has developed a handful of increasingly popular alcoholic beverage brands such as Topo Chico hard seltzer, Lemon-Dou alcoholic lemonade and Fresca Mixed brand of canned cocktails.

To ensure this expansion remains in line with Coca-Cola’s existing supply network structures, the firm has focused on the ready to drink canned alcoholic beverage segment.

I believe this will allow Coca-Cola to gain valuable exposure to this increasingly popular segment of alcoholic beverages while still exploiting the massive economies of scale the firm has developed from their non-alcoholic business.

Ultimately, the strength of Coca-Cola’s brands and intangible assets allows the company to resonate with consumers and increase the appeal of their products over those of competing brands. This allows the firm to enjoy strong pricing power within the market which is evidenced through the significant markup on Coca-Cola produced beverages compared to their non-branded competitors.

The sheer scale upon which Coca-Cola operates also generates the firm significant moatiness thanks to the cost advantages the firm enjoys within their supply and production processes.

The firm’s massive scale allows for significant negotiating power when inking bulk ingredient and supply contracts which enables the firm to substantially lower their unit input costs. The process of brewing beverages is also incredibly scalable which once again enables Coca-Cola to enjoy a cost advantage thanks to their overall scale compared to essentially all of their competitors.

These market-leading production cost efficiencies consequentially allow Coca-Cola to focus significantly on ensuring their products remain differentiated and unique within the marketplace.

Fundamentally, the lower the costs associated with producing a product, the more room Coca-Cola has to spend on the marketing and branding of their products while ultimately enjoying a similar gross margin compared to their smaller competitors.

This creates a form of positive feedback loop whereby Coca-Cola is able to further strengthen their brand image within the market and in the minds of consumers through the increased gross margin and lower production costs that earn the company.

Considering both the firm’s massive set of intangible assets along with the clear cost-efficiencies the firm enjoys within the non-alcoholic and alcoholic beverage business, I believe Coca-Cola enjoys the benefits of a wide economic moat which lends the firm around 25 years of competitive advantages.

Quite simply, for a firm to match Coca-Cola in terms of overall production capacity (to get the same economies of scale advantages) would take a huge amount of capital and time. Furthermore, such a scale of production is only sensible if the given beverage business has products with the same levels of brand recognition and demand as Coca-Cola’s leading drinks.

These limiting factors are the key variables that support my hypothesis of a 25-year competitive advantage stemming from Coca-Cola’s wide economic moat rating.

Financial Situation

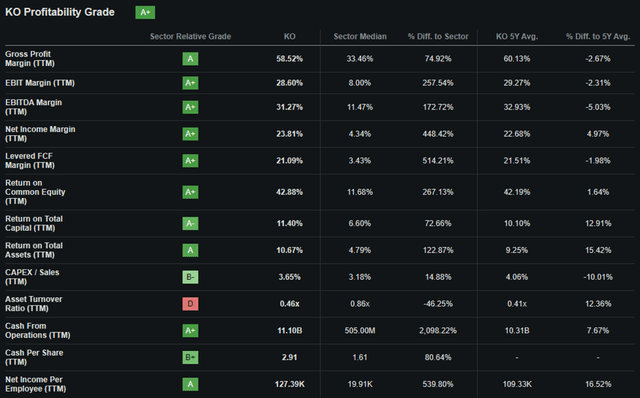

From an operating performance perspective, Coca-Cola is an absolute profitability powerhouse.

Coca-Cola has 5Y average (as measured from FY22-FY18) gross, operating and net margins of 60.37%, 29.35% and 22.68% respectively. The high gross margin in particular acts as an efficient yardstick for illustrating the clear pricing power and overall ability Coca-Cola has in producing revenues from the business operations.

The firm also has 5Y (FY22-FY18) average ROA, ROE and ROIC of 9.25%, 41.64% and 13.79% respectively. The already generous ROIC is dragged down by a difficult FY18 which not with counting sees the firm have a 4Y average ROIC of over 15.20%.

The healthy returns and margins are even more impressive when compared to their closest peer PepsiCo who have managed a 5Y average gross margin of just 54.7% and a ROIC for the same period of just 11%.

Even from these basic operational performance metrics we can see that Coca-Cola is truly a market-leading firm from an efficiency and profitability standpoint. Not only has the firm managed to become the largest player in the industry but has simultaneously illustrated that they are able to operate their business incredibly efficiently.

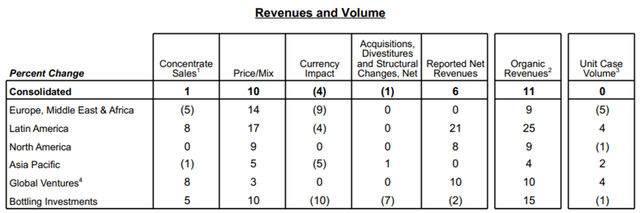

FY23 has been largely successful for the drinks giant as Coca-Cola has managed to produce relatively consistent unit case volume improvements along with substantial organic revenue growth.

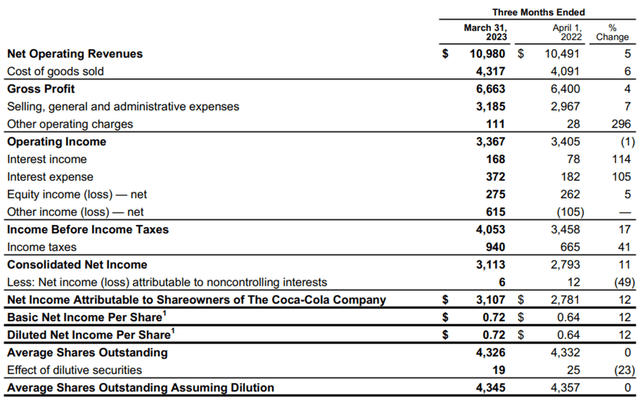

Q1 saw Coca-Cola grow their net operating revenues by 5% YoY while organic revenues (non-GAAP) grew a whopping 12%.

This revenue growth was achieved partly thanks to strong volume growth being achieved by a number of the firm’s brands in a number of different geographic regions and market segments.

Coca-Cola’s smartwater line of bottled water saw 8% volume growth thanks to the company continuing to innovate with the brand by launching an alkaline variant of the water and through well-executed Spotify, TikTok and Meta adverts.

The firm also saw their flagship drink Coca-Cola grow 3% in volumes thanks to strong demand in the Asia Pacific and Latin America market segments. This was partly offset by the firm’s suspension of business in Russia.

Coca-Cola Zero also saw strong 8% volume grow thanks to demand increases in North America, Latin America and Asia Pacific.

Across the board, European market demand for Coca-Cola products decreased in Q1 largely due to the higher levels of inflation impacting the region increasing the frugality of consumers.

Coca-Cola also managed an 11% price/mix growth thanks to increasing pricing actions and a favorable channel and packaging mix aiding overall spending per consumer. While concentrate sales were 2 points behind unit case volumes, this was largely due to the timing of concentrate shipments rather than any fundamental weakness in the segment.

Nonetheless, despite the overall strength shown by Coca-Cola’s geographic regions and brands, the firm reported a 1% decline in operating income in Q1 of FY23. This was due to an 8-point impact from unfavorable FX rates.

Comparable currency operating income (which of course is a non-GAAP metric) saw a 15% increase thanks to the overall strong growth witnessed across the firm’s business segments.

Q1 also saw COGS increase by 6% along with a 7% increase in SG&A expenses which were mainly caused by increasing prices for input supplies along with more marketing being utilized to bolster sales.

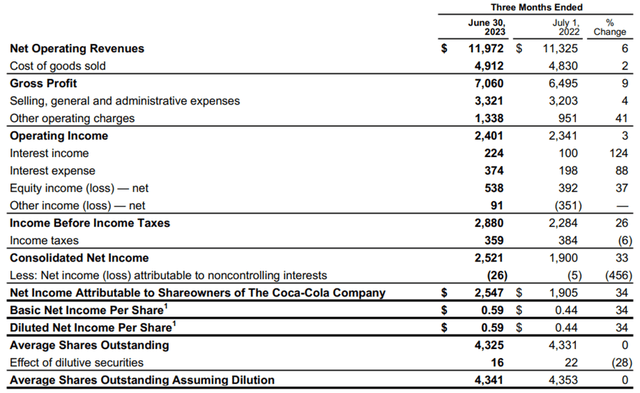

The firm’s most recent Q2 results indicate that Coca-Cola’s pricing power and ability to extract revenues per consumer continue to excel with the firm recording a 6% increase in net revenues for the quarter YoY.

This growth was achieved despite flatline unit volumes YoY thanks to strong price/mix growth of 10% thanks to a number of new packaging options increasing the overall spend per consumer.

While the overall growth in revenues was positive to see especially as some peers are reporting flatlines or decreasing revenues due to the pressures current macroeconomic conditions are placing on consumers, the firm’s overall operating margin decreased 0.6% YoY to just 20.1%.

This decrease was largely driven by items impacting comparability and continuing currency headwinds. Without the effects of unfavorable FX rates, Coca-Cola’s operating margin actually increased by 1.1% YoY which is incredibly impressive.

COGS for Q2 increased by just 2% YoY while SG&A costs continued to rise by 4% YoY. Coca-Cola’s overall inventory levels in Q2 were also up 9.7% YoY but down 1.3% QoQ.

While the higher levels of inventory are to be expected given the slowdown in overall volume growth, the improvements QoQ suggest that Coca-Cola’s marketing strategies are working as intended.

I believe the consistent ability for Coca-Cola to manufacture and sell their products throughout increasingly inflationary macroeconomic conditions illustrates just how well revered and loved the firm’s iconic brands really are.

Operating income for Q2 increased by 3% despite the effects of a 10-point impact by unfavorable FX thanks to the strong organic revenue growth across all operating segments.

While the EMEA market segment continued to show weakness reporting a 12% drop in operating incomes, Coca-Cola actually managed to increase their market share within the region thanks to successful packaging and marketing improvements leading to a 14% increase in price/mix.

This market share growth was achieved despite overall unit case volumes decreasing in EMEA which once again illustrates that the company is currently suffering simply from overall macroeconomic conditions rather than any weakness within their business model.

Guidance from management issued during the Q2 webcast suggests that full year 2023 organic revenue growth of around 8-9% should be expected along with comparable EPS growth of around 5-6% YoY.

The firm also issued some slightly dampening information regarding their upcoming Q3 results due to be released on 24 October. Coca-Cola stated that around 2% impact from unfavorable FX rates and 1% impact from acquisition, divestitures and structural changes should be considered when forecasting Q3 performance expectations.

Nonetheless, the mostly positive guidance for full year 2023 illustrates that Coca-Cola is an incredibly well-managed and profitable enterprise that continues to grow revenues and market share despite uncompromising macroeconomic conditions.

I also believe the evident strength of their core brands supports my earlier hypothesis derived during the analysis of Coca-Cola’s economic moat. They clearly hold incredibly strong pricing power and continue to manage COGS efficiently.

Seeking Alpha | KO | Profitability

Seeking Alpha’s Quant calculates an “A+” profitability rating for Coca-Cola which I believe to be an accurate representation of Coca-Cola’s situation at present time.

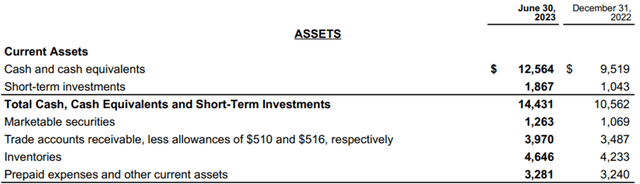

Coca-Cola’s balance sheets continue to be in excellent shape with the firm exhibiting controlled fiscal planning despite a flurry of acquisitions post-Covid.

The firm has $27.6B in total current assets while total current liabilities amount to just $24.1B. This reasonable short-term liquidity leaves the firm with a quick ratio of 0.82x and a current ratio of 1.14x.

Total assets for the firm amount to $98.5B with total liabilities just $70.9B. This leaves the firm with an excellent debt/equity ratio of 0.71. While Coca-Cola’s balance sheet does consist of over $18.5B in goodwill, I believe much of it is reasonable given the high-profile acquisitions the firm has recently undertaken.

Coca-Cola’s recent acquisitions of Topo Chico, the Costa Coffee chain of coffee shops and recently BODYARMOR saw the beverage giant pay significant sums to acquire not only the assets these businesses had but specifically the brands themselves.

While $18.5B in goodwill is a huge amount to see on a balance sheet, considering how it got there in the first place, I do not have a problem with this value.

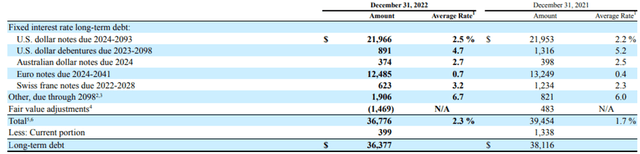

At the end of FY22, Coca-Cola had $36.4B in long-term debt. While this is a relatively large sum of debt, the firm has consistently been paying off maturities as they have arisen which has proven easy fiscally given their massive FY22 annum unlevered FCF of $10.1B.

Moody’s credit ratings agency affirmed an excellent A1 credit rating for Coca-Cola’s unsecured domestic notes and affirmed a Prime-1 rating for their domestic commercial paper. The outlook remains stable.

Moody’s classifies “A1” credit ratings as being of “high investment grade” and classifies “Prime-1” short-term debt ratings as being of the “highest quality”.

Considering Coca-Cola as a whole it is clear that the firm is fundamentally profitable and operates in a fiscally restrained manner despite their recent flurry of acquisitions.

Furthermore, the company has managed the debt they have carefully, and their debt maturity schedule means the firm’s near-term debt obligations should not place excessive pressure on the firm’s net margins.

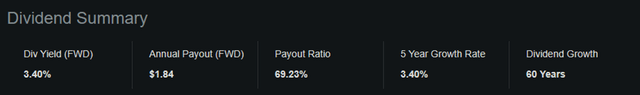

Coca-Cola pays an impressive dividend which along with the relatively low volatility of the stock (just 0.60x beta) has been one of the key reasons investors have continued buying shares throughout the years.

The firm has continued growing their dividend for an outstanding 60 years which illustrates just how stable and metronomic the firm’s revenue growth has been. With a dividend yield FWD of 3.40% and an annual payout FWD of $1.84, the firm certainly can be classified as a bona fide dividend aristocrat.

I eagerly await the Q3 earnings report which will significantly expand the ability for investors to understand how elastic demand truly is for Coca-Cola products as pricing levels continue to rise across the globe.

Valuation

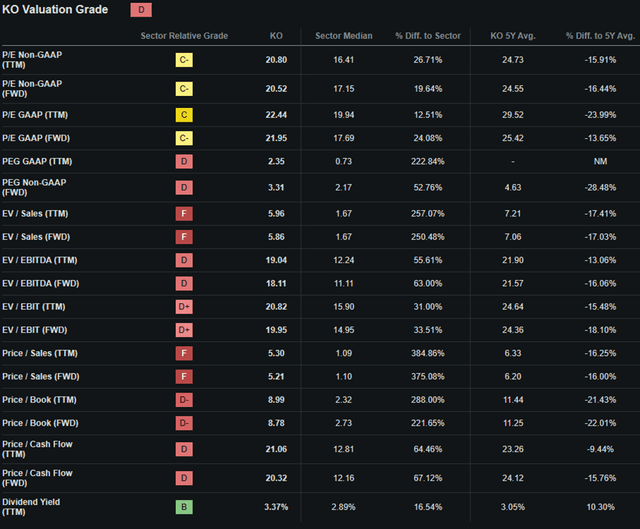

Seeking Alpha | KO | Valuation

Seeking Alpha’s Quant assigns Coca-Cola with a “D” Valuation grade. I believe this is an excessively pessimistic representation of the value present within Coca-Cola stock and perfectly illustrates how even very accurate quant ratings can sometimes poorly represent the real value present in a company’s shares.

The firm currently trades at a P/E GAAP FWD ratio of 21.95x. This represents a 13% decrease in the firm’s P/E ratio compared to their running 5Y average.

Coca-Cola’s P/CF FWD of just 20.32x is relatively positive and once again is 16% lower than their 5Y running average. Their FWD EV/EBITDA of just 18.11x is representative in my opinion especially when considering the firm’s EV/Sales FWD of just 5.98.

Considering these basic valuation metrics alone I believe Coca-Cola should already start to appear slightly undervalued given the stock’s historic averages. While the letter grade assigned by the quant is less optimistic, we must remember that this grading system is relative to Coca-Cola’s peers.

Therefore, and given the truly unique nature of Coca-Cola within the industry, I am not sure it is reasonable to compare this firm directly with its competitors in a purely quantitative manner.

Seeking Alpha | KO | Summary Chart

From an absolute perspective, Coca-Cola shares are trading at a significant discount relative to previous valuations with current share prices of around $54.00 representing a three-year low for the stock.

However, when compared to the 56% growth seen in the S&P 500 tracking SPY index over the past five years, Coca-Cola has been soundly outperformed by the U.S. market index as a whole by over 39%.

This underperformance – despite the excellent dividend paid out by the firm – has begun to test the patience of some investors who understandably feel that the stock has not performed as expected.

While the relative valuation provided by simple metrics and ratios along with the absolute comparison allows for a basic understanding of the value present in Coca-Cola shares to be obtained, a quantitative approach to valuing the stock is essential.

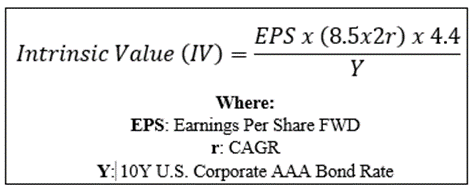

The Value Corner

By utilizing The Value Corner’s specially formulated Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Using Coca-Cola’s current share price of $54.35, an estimated 2024 EPS of $2.79, a realistic “r” value of 0.07 (7%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.13x, I derive a base-case IV of $58.20. This represents a modest 6% undervaluation in the firm.

When using a more pessimistic CAGR value for r of 0.05 (5%) to reflect a scenario where a globally spanning recession causes Coca-Cola’s revenue growth to flatline, shares are still valued at around $47.50 representing a 14.4% overvaluation in shares.

Considering the valuation metrics, absolute valuation and intrinsic value calculation, I believe that while Coca-Cola is trading for cheaper than it ever has for the last three years, shares are most likely fairly valued.

In the short term (3-12 months), I find it difficult to say exactly what may happen to valuations. The general uncertainty regarding the future direction of both the U.S. and global markets as a whole means predicting the direction for most stocks from a qualitative side is essentially impossible…

Tax harvesting could see Coca-Cola shares decline further as a less than stellar 2023 may lead some investors to cut the firm from their portfolio as the year winds to a close. Ultimately, I do not believe there is much upside potential in shares in the short term.

In the long term (2-10 years), I see Coca-Cola continuing to dominate the beverage industry, particularly in the non-alcoholic ready to drink beverage market. While I do believe their recent strategic acquisition should allow the firm to become more exposed to markets with greater growth potential, I do not expect share prices to rocket upwards.

Instead, I see a mostly gradual yet consistent addition of value occurring year after year.

Risks Facing Coca-Cola

Coca-Cola is mostly well protected from any high-profile threats that could expose the firm to any significant level of risk. However, I do believe that the cyclical nature of the business they operate can harm earnings potential on acute timeframes.

Given that Coca-Cola beverages are (by the most part) additional purchases which are not necessary to the livelihoods of most consumers, any further levels of inflation or macroeconomic pressures could see the total volume of sales decrease for the firm.

Any recessionary effects such as increasing unemployment, decreasing real disposable income, increasing inflation or even an increasingly bearish outlook on the future direction of markets could see consumers becoming more cautious with their spending habits.

This could place pressure on Coca-Cola sales as simply less consumers would be willing and able to purchase their beverages.

While such a scenario would be acute and not pose a long-term threat to the Coca-Cola operation, it could lead to a tangible degradation in revenues, margins and ultimately share prices.

The increasing presence of weight-loss drugs could also pose some threat to Coca-Cola as multiple new entrants into the obesity management drug segment could curb the sugar appetite of consumers.

While Coca-Cola produces more than just sugary beverages, the firm’s products are almost all dependent on the craving for sugar or at least an appetite for the taste (in the case of sugar-free beverages) to drive the customer purchasing process.

I believe this threat is currently latent and I do not assign any real risk level to Coca-Cola from these weight-loss drugs. However, it is worth mentioning as the emergence of such medications must be watched carefully both by investors and the company.

From an ESG perspective, Coca-Cola faces a few threats most notably from an environmental and societal perspective.

Many ecological activist groups accuse Coca-Cola of contributing excessively to global warming through the production of their beverages. The water-intensive nature of producing their beverages combined with the GHG emissions emitted throughout their product production processes is something Coca-Cola must address moving forwards into the future.

Considering the firm’s ESG report, I believe Coca-Cola is making realistic steps towards achieving net-zero carbon emissions along with minimizing the ecological footprint the production of their beverages produces.

From a societal perspective, some far-left activist groups have accused Coca-Cola of creating a dependence, particularly among less educated consumer groups on their products due to the high levels of sugar present in their drinks.

While sugar is a highly addictive substance and is present in most of the firm’s products, I am not sure blaming the producer for the health consequences of excess consumption is a particularly relevant argument.

Nevertheless, Coca-Cola understands the importance both socially and economically of their sugar-free beverage alternative and now offers most of their soft drinks in a sugar-free variety.

I believe the overall lack of major environmental, societal or governance concerns would make Coca-Cola a suitable pick for a more ESG-conscious investor.

Of course, opinions may vary, and I implore you to conduct your own ESG and sustainability research before investing in Coca-Cola if these matters are of concern to you.

Summary

Coca-Cola is undoubtedly an incredibly well-run business that benefits from wide economic moat and multiple competitive advantages. Their unrivalled portfolio of brands is incredibly valuable and arguably the single most influential advantage the company holds over its competition.

Furthermore, a solid balance sheet and massive yearly profits have allowed the firm to truly cement themselves at the forefront of the industry both from a market share and fiscal stability perspective.

While a recent drop in valuations has corrected what seemed like a severe overvaluation of the past, I still don’t necessarily see the stock as being of particularly good value.

Given the lack of any catalyst leading to a sudden explosion or even an uptick in the rate of value generation along with any real undervaluation being present in shares, I find it difficult to suggest building a position in the company at the present time.

Therefore, I rate the stock a Hold.

To find other stock picks with potentially great upside potential, check out my recent articles on Dollar General, Disney, and Nike: all rated Strong Buy!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.