Summary:

- KO now offers an above-average dividend yield and some valuation discounts amid an expensive overall market.

- As a result, I expect its long-term return potential to be noticeably better than what I expect from the overall market.

- However, such outperformance is largely relative and due to the overall market’s low return potential under its current expensive valuation.

- The growth and return potential are restricted by the limited valuation discounts and the possibility of market saturation in key regions.

Jonathan Knowles

Thesis

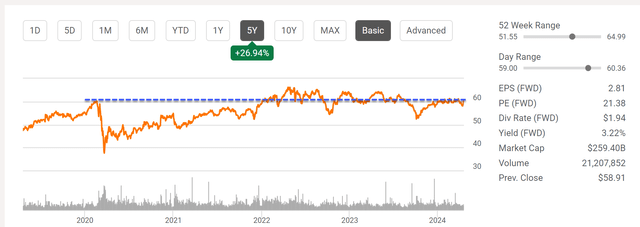

Coca-Cola (NYSE:KO) stock continues to trade mostly sideways. As seen in the next chart, its current price is about the same as the pre-pandemic level. While at the same time, the company has been steadily growing its EPS and dividends (at approximately 5% and 3.5% CAGR over the past 5 years). As such, the stock now features an above-average dividend yield and some degree of valuation compression.

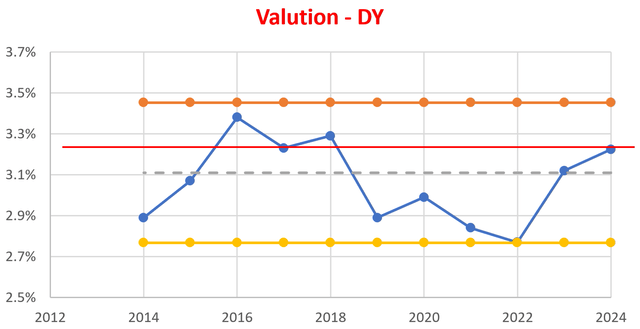

In terms of dividend yield (BTW, it is a quintessential example of a dividend champion), its current yield is about 3.22%. To better contextualize things, the chart below compares the current yield (the solid red line) to its historical variance, with the orange line showing the yield level that is 1 standard deviation above the mean and the gray dotted line showing the mean. As seen, the stock is yielding noticeably above the mean.

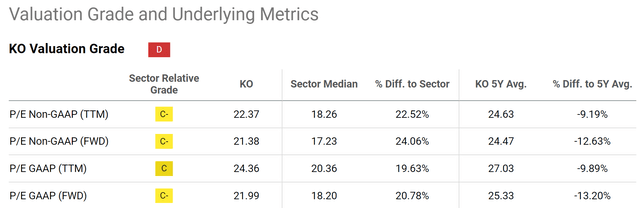

Other metrics such as the P/E ratio indicate similar valuation discounts. The chart below shows its P/E ratios in comparison to the sector medians and its own 5-year average levels. As seen, the P/E ratios of KO are lower than their 5-year averages by about 9-13%. For example, on a Non-GAAP and TTM basis, KO’s current P/E ratio is 22.37, about 9% below its 5-year average of 24.63. In terms of P/E on a Non-GAAP and FWD basis, its current ratio is 21.38, about 13% below its historical average.

Next, I will argue that such a valuation discount, combined with its stable profitability, has created the potential to deliver market-beating returns in the long term under current conditions.

Growth outlook and expected return projections

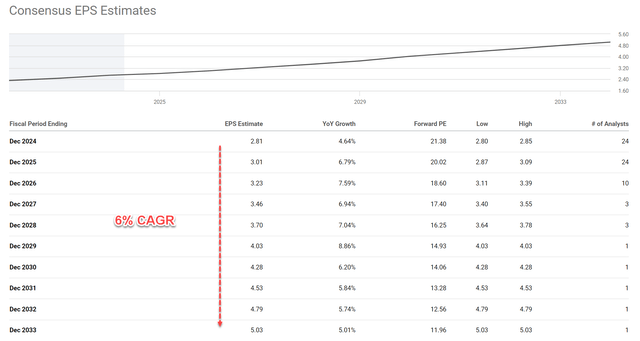

According to the next chart below, analyst consensus estimates project KO’s EPS to grow steadily in the long term. For the next decade, its EPS is estimated to grow from $2.81 in 2024 to $5.03 in 2033, representing a CAGR of 6.0% over this period.

I think such a projection is very reasonable considering KO’s business fundamentals. Its top strength is its strong brand power. KO boasts a globally recognized and iconic brand. Their aggressive marketing and successful advertising campaigns create a strong association between Coca-Cola and positive experiences, fostering brand loyalty that surpasses just taste preference. The second strength in my view is the well-established franchising and bottling network. KO utilizes a vast network of independent bottlers who manufacture, distribute, and merchandise their beverage products. This franchising system allows for greater operational flexibility and local market adaptation compared to a fully centralized production model. Finally, thanks to the first strength, I see KO as a high scalability business. The franchising model allows KO to rapidly expand into new markets and leverage the local knowledge and production capabilities of its bottlers. This reduces capital expenditure needs and provides faster market penetration (and I will revisit this later).

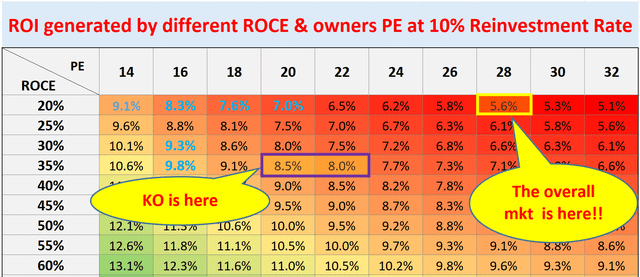

As for its profitability and return potential, my approach is detailed in this free blog article. The key concept involved here is the ROCE (return on capital employed) and owner’s earning yield (“OEY”). The gist of these concepts and the results are shown in the table below:

- The long-term ROI for a business owner is simply determined by two things: A) the price paid to buy the business and B) the growth rate of the business (which reflects its quality and moat).

- More specifically, part A is determined by the owner’s earning yield (“OEY”) when we purchased the business. Part B is determined by the ROCE and RR in the long term.

- That is, Longer-Term ROI = OEY + Growth Rate = OEY + ROCE*Reinvestment Rate

- For KO, I am approximating its OEY (owners’ earning yield) with the earning yield to be on the conservative side. At its current FY1 P/E of 22x, KO offers an OEY of ~5%. It has been maintaining an average ROCE of ~33% and RR of 5% sustainably in the long term. Thus, its real growth rate is projected to be 1.5% per annum. Thus, the real return before inflation would be ~6.5%. Adding an inflation escalator could push the return to the 8% to 8.5% range.

This is noticeably better than what I expect from the overall market (about 5.6%). However, this outperformance is largely relative and mostly due to the uninspiring return I expect from the overall market given its current expensive P/E valuation.

Other risks and final thoughts

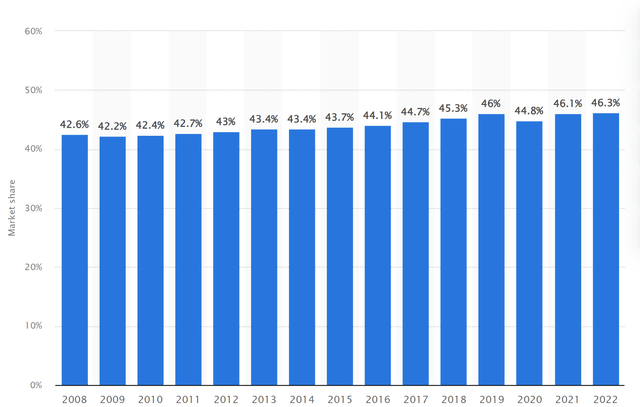

On to risks. KO faces largely the same common risks as its peers, such as market volatility, regulatory changes impacting the beverage industry, and economic downturns affecting consumer spending habits. More specific to KO, risks may involve challenges related to changes in consumer preferences for non-carbonated beverages, given its concentrated exposure in this area. Another key risk on my mind is the competition for market share and the possibility of saturation in the North American market. The chart below shows the company’s market share in the United States from 2008 to 2022. You can see a slow yet steadily increasing trend between 2008 and 2018. But since 2018, the data has begun to fluctuate without a clear, definitive direction.

As aforementioned, thanks to its vast franchising network, KO is well-poised for international expansion. However, there are also some near-term uncertainties on this front as well. For example, I expect some speed bumps caused by the refranchising of bottling operations in various countries, including India and the Philippines. In addition, its global exposure also makes it more sensitive to currency and geopolitical effects. The hyperinflationary conditions in a handful of markets, such as Argentina, provide a good recent example.

KO market share in the United States from 2008 to 2022, Statistica

All told, I consider KO as a good hold candidate for more conservative and income-oriented accounts under the current conditions. The shares now offer relatively low price volatility, above-average dividend yield, some valuation discount, and a long-term total return potential better than the overall market in my view. Although, its total return potential of ~8% in the long term may not be of enough appeal to other types of investors, such as growth-oriented or GARP (growth at reasonable price) investors. For example, I am a GARP investor myself, looking for opportunities with long-term return potential exceeding 10%. Given the limited valuation discounts and the possibility of market saturation in key regions, I see a slow (albeit steady) growth curve that is unlikely to deliver such long-term returns here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

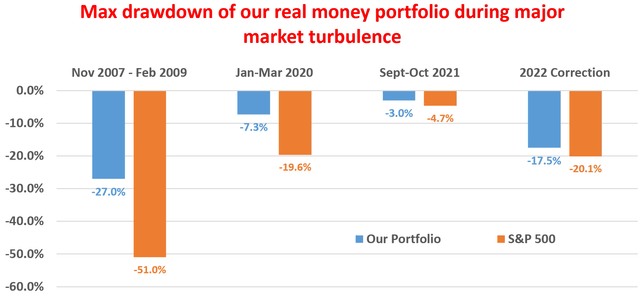

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.