Summary:

- Staples stocks trade at more than 20 times forward non-GAAP earnings after a strong 2022.

- Coca-Cola sells at a valuation premium to both its sector and the S&P 500.

- Despite a strong EPS beat rate history, I see longer-term struggles for this expensive blue-chip stock.

Georgiy Datsenko

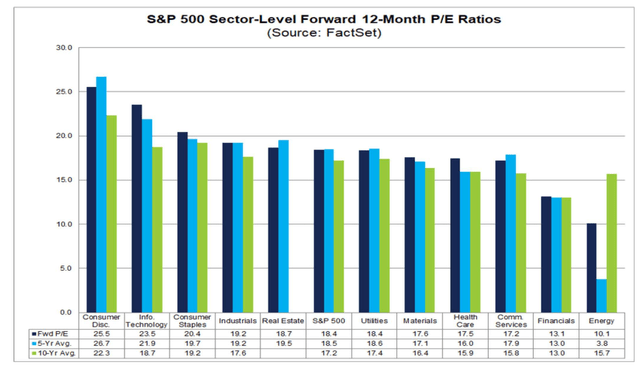

The Consumer Staples sector trades at quite a premium these days. Following a year of flights to quality in 2022, the sector sports a forward 12-month operating P/E ratio of above 20, third to Consumer Discretionary and Information Technology, according to the weekly John Butters FactSet Earnings Insight.

One major household name reports Q4 results next Tuesday morning. Should you take a swig of Coca-Cola (NYSE:KO) shares now? Let’s take a look.

S&P 500 Sector Valuations

FactSet

According to Bank of America Global Research, Coca-Cola is the world’s biggest brand and largest manufacturer of soft drink concentrate and syrups. It enjoys a 50% share of the world’s carbonated soft drink (CSD) market (and 44% share of the US market). KO continues to grow its portfolio of non-CSD brands as consumer diets shift. Over 70% of its profits are derived outside of the US. Key US brands include the Coca-Cola trademark, Sprite, Fanta, Minute Maid, Powerade, Dasani, and Nestea.

The Atlanta-based $260 billion market cap Soft Drinks industry company within the Consumer Staples sector trades at a high 26.2 trailing 12-month GAAP price-to-earnings ratio and pays a nice 3.0% dividend yield, according to The Wall Street Journal.

While Coca-Cola is best in class with a solid management team and strategic plan, shares trade at a lofty valuation. What’s more, emerging market risks continue, though China’s reopening could be an upside catalyst. A lower dollar also helps earnings, but currency moves are mean reverting and should not be a significant basis for an investment.

What is favorable for KO is that commodity prices and material costs should be on the decline compared to a year ago. More potential upside stems from a move into the alcohol space, but that’s unproven yet. Back in October, the firm reported strong organic sales growth, growing revenue by 11% overall while operating earnings of $0.69 beat by a nickel. The management team up’d guidance too.

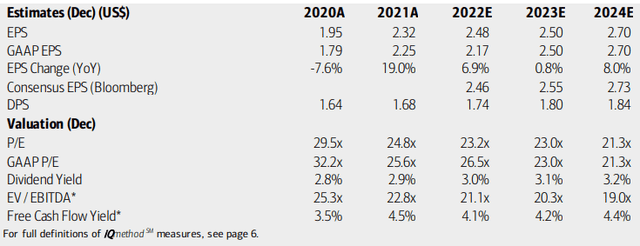

On valuation, analysts at BofA see earnings having risen at approximately the same rate as inflation in 2022, but then slowing to basically the unchanged line before an EPS acceleration next year. The Bloomberg consensus forecast is only slightly more sanguine compared to BofA’s outlook. Dividends, meanwhile, are expected to rise at a steady clip which would turn Coca-Cola into quite the yielder.

Unfortunately for the bulls, both KO’s operating and GAAP P/Es are quite high for such meager anticipated earnings growth while its EV/EBITDA multiple is about twice that of the S&P 500. The firm trades about 25x free cash flow – that’s an expensive ratio, too. Overall, I am just not convinced there are enough growth catalysts to warrant such a valuation premium to the broad market.

Coca-Cola: Earnings, Valuation, Dividend Forecasts

BofA Global Research

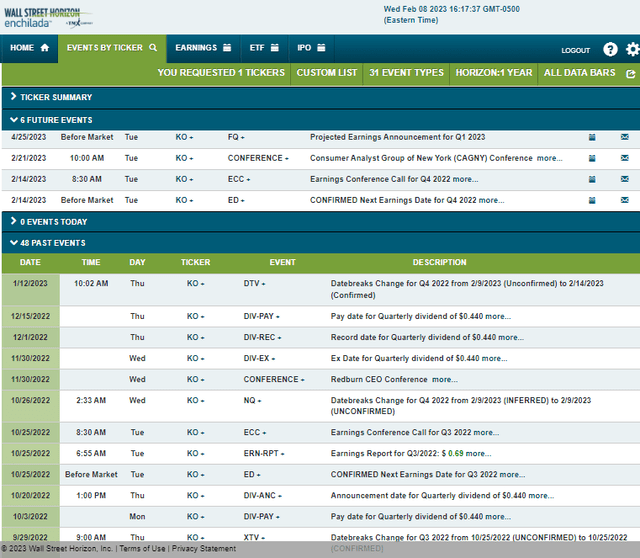

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q4 2022 earnings date of Tuesday, February 14, before the open with a conference call immediately after results cross the wires. You can listen live here. Also a volatility catalyst, the management team is expected to present at the Consumer Analyst Group of New York (CAGNY) Conference which takes place from February 20 to 24.

Corporate Event Risk Calendar

ORATS

The Options Angle

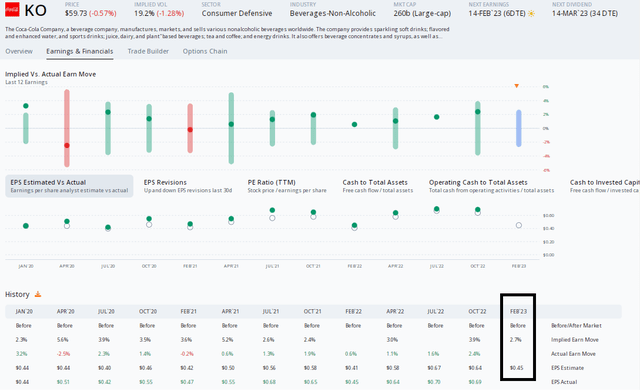

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $0.45 which would be unchanged from the same level of per-share profits earned in the same period a year ago. Impressively, though, earnings have topped estimates in each of the last 12 quarters while KO has traded higher in seven consecutive instances post-earnings. So there’s clearly a bullish trend here, and there have been six analyst upward revisions since the Q3 report.

In terms of the expected stock price swing this time, traders have priced in a small 2.7% earnings-related move using the at-the-money straddle expiring soonest after the Valentine’s Day report. This Staples behemoth usually doesn’t move a whole lot after earnings, as you can see in the image below, so I would rather just play the stock.

KO: Big Beat Rate History, Quiet Options Ahead of Earnings

ORATS

The Technical Take

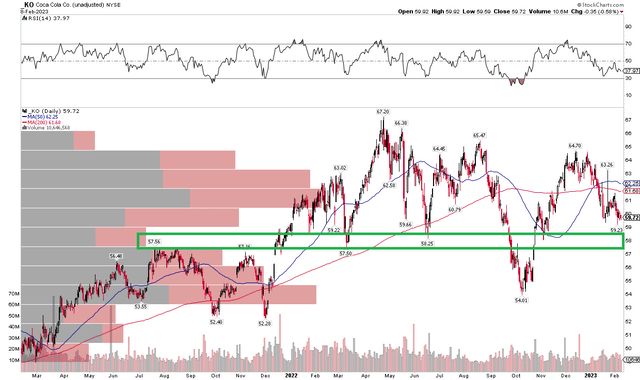

With a lofty valuation and unattractive options, how does the chart look? I see some support in the $57 to $59 range shown in the graph below. Notice how shares met selling pressure there late in 2021 but then rallied above the key zone at the turn of the year. After breaking above it, KO had support on a few tests before a washout last October that sent the stock plummeting.

After failing to make higher highs from Q2 last year on a recovery try last quarter, the stock now retests the important range. A long play here with a stop under $57 is fine, but the stock has exhibited relative weakness in the last few months, and that trend must reverse itself before I would get long for a longer timeframe.

KO: Shares Dipping To Soft Support

Stockcharts.com

The Bottom Line

Coca-Cola might be all fizzled out for now. Shares appear expensive, and the chart shows relative weakness and the stock remains well off its 2022 high. I expect the blue-chip name to beat on earnings next week, and the stock could even trade up, but I’d avoid it for now.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.