Summary:

- KO has seen a significant increase in share price and total return since March, but I am no longer bullish on future appreciation.

- With KO’s yield below 3% and a high forward P/E ratio, I believe there are better opportunities for capital allocation in a rate-cutting environment.

- Comparing KO to PepsiCo, the author finds PEP more attractive from a dividend perspective and in terms of growth potential based on forward earnings.

Heiko119

This may be one of the hardest articles I have ever written because I absolutely love The Coca-Cola Company (NYSE:KO). I am drinking an ice-cold coke while writing this article, and I even purchased a physical share of KO as gifts, so people close to me get quarterly dividend checks from KO. While KO is one of my favorite companies, and I can’t see a situation where I would exit my position, I can no longer be a KO super bull. The reason this article is hard to write is because the forward P/E is still enticing. My problem with adding to the position at these levels is that I think there are other opportunities that capital will gravitate toward as we enter a rate-cutting environment. KO’s price has reached the point where its yield is below 3%. I think this will act as a deterrent for new capital coming into the market as investors look to allocate capital toward dividend growth companies as the risk-free rate of return declines. By all means, KO is a well-run company with strong margins, and I am not selling my position. I want to see how the IRS back tax case unfolds, and I would be much more willing to add to my position in the low $60 range rather than when shares are about to crack $70.

Following up on my previous article about The Coca-Cola Company

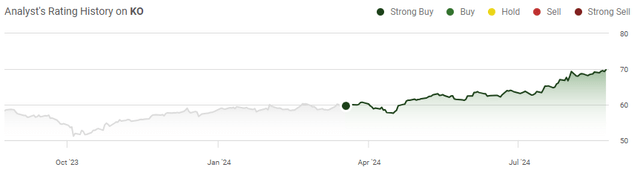

Since my previous article about KO was published in the middle of March (can be read here), shares have increased by 16.53% compared to the S&P 500, increasing by 9.31%. When the dividend is factored in, KO’s total return is 17.43% over this period. I had discussed how KO increased the dividend by 5.4% and why I felt shares were undervalued. My investment thesis looks to be playing out how I envisioned, but I am now at a crossroads where I believe shares may have run too far too quickly. I am no longer bullish on future appreciation at the moment and I am reducing my investment thesis to neutral. I will always be a shareholder of KO, but I am not looking to acquire more shares at this point in time. I also believe that KO is losing some appeal as an income-producing asset now that the yield has dipped below 3%. I will discuss my rationale for simply sitting back and holding KO until a better entry point is established.

Risks to my investment thesis

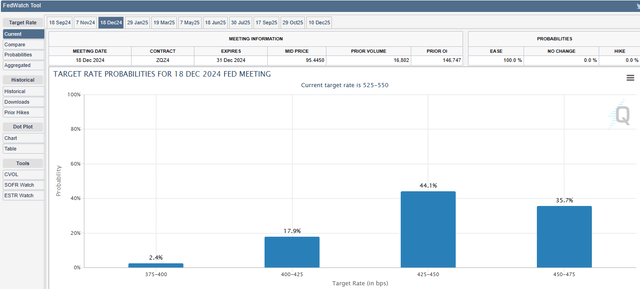

I could be absolutely wrong, and shares of KO could continue appreciating into the rate-cutting environment. While I would still benefit as a shareholder, I may miss out on an opportunity to increase my position below $70. Fed Chair Powell delivered remarks at Jackson Hole, indicating that it was time to adjust the policy regarding rates. CME Group is projecting that the most likely scenario is that rates will finish at least 100 bps lower than where they are today at the close of 2024. We could see a large amount of capital come off the sidelines, try to front-run rate cuts, and invest in income-producing assets with established trends of dividend growth. This could be a catalyst for KO despite the metrics I am looking at and may help shares rise into the $70s. I am not bearish on KO as I am a shareholder, but I don’t see the upside potential that I once did. For now, I am no longer in the market to add to my position, but I will be actively paying attention to KO for a better entry point because I would like to add to my position.

The Coca-Cola Company is still a great company, but it’s too expensive for me at these levels

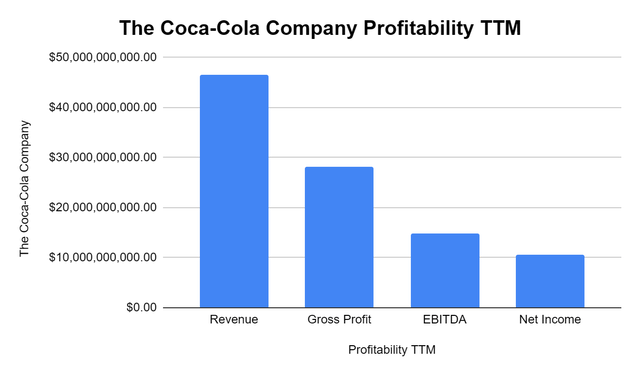

I want to be clear that I am not bearish on KO as a company, I am just not bullish on upside appreciation from these levels. In Q2, KO beat on the top and bottom line as they produced $12.4 billion in revenue and $0.84 in non-GAAP EPS. KO is a unique company because its products can be found almost anywhere in the world. After 138 years of operations, products from the KO portfolio can be found in more than 200 countries and territories through around 31 million outlets. This is a footprint that is next to impossible to replicate, and as the global population increases, I believe more people will be enjoying KO products 10 years from now than they are today. From a profitability standpoint, KO is firing on all cylinders. In the trailing twelve months (TTM) KO has generated $46.47 billion in revenue and is running a high-margin business. The fact that KO is operating a global supply chain and is able to squeeze out a 32.08% EBITDA margin as they generated $14.91 billion in EBITDA over the TTM is astonishing. KO is operating at a gross profit margin of 60.53% as they have produced $28.13 billion in gross profit over the TTM. This has provided KO with a larger spread to conduct their operations and squeeze out strong profitability. In the TTM, KO has generated $10.65 billion in net income, which is a bottom-line profit margin of 22.92%. This is why I could never see myself selling my position unless something drastic occurred. KO’s operating level is incredibly strong for a business that sells goods on a global scale. When I think about how technology will impact productivity over the next several years, KO could be a large beneficiary, and their margins may improve.

Steven Fiorillo, Seeking Alpha

Shares of KO have broken out since May and are at the top end of their range for 2024. YTD KO has appreciated by 18.43%, and momentum is certainly on its side. Despite beating profitability estimates, KO is no longer attractive from a dividend yield or P/E perspective. There is around $6.5 trillion sitting in money markets and even more capital locked up in CDs and bonds. As the Fed cuts rates, I think the biggest catalyst for income-producing assets is that investors will look for enticing dividend yields with a history of growth and investments that could offer some capital appreciation. KO yielding 2.78% with a 2024 forward P/E of 24.48 isn’t nearly as enticing as its previous metrics from March when it was yielding 3.24% with a 21.31 forward P/E. When it comes to the beverage sector, I think investors will look at KO or PepsiCo, Inc. (PEP) for exposure to the sector, and for the first time in recent years, I think capital will flow to PEP over KO.

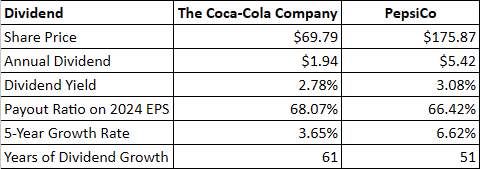

KO and PEP are both Dividend Kings with more than 50 years of consecutive dividend increases, but from a dividend perspective, PEP is more attractive at the current valuations. While the metrics are similar, PEP has the edge over KO in every category when it comes to dividends, except for years of growth. PEP is now yielding 3.08% compared to 2.78% for KO and has a 66.42% payout ratio against 2024 expected EPS compared to 68.07% for KO. PEP also has a 6.62% 5-year average annual growth rate compared to 3.65% for KO. PEP looks more enticing from a dividend perspective, considering the yield is above 3%, it has a lower payout ratio, and it has a higher growth rate than KO.

Steven Fiorillo, Seeking Alpha

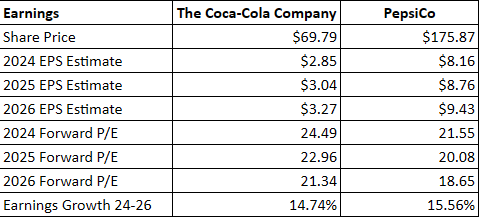

When I look at KO and PEP on a forward earnings basis, PEP is also more enticing as there is more growth on the horizon, and it trades at a better valuation. KO trades at 24.49 times 2024 earnings, while PEP is trading at 21.55 times 2024 earnings. KO is expected to grow its EPS from $2.85 in 2024 to $3.27 in 2026, while the street is looking for PEP to expand earnings from $8.16 to $9.43 over this period. PEP is expected to grow its EPS by 15.56% over the next 2 years, while KO is expected to produce a growth rate of 14.74%. Today, investors are able to pay 18.65 times 2026 earnings for PEP instead of 21.34 times earnings for KO. From an EPS perspective, PEP has become more enticing than KO in addition to having more appealing dividend metrics.

Steven Fiorillo, Seeking Alpha

Conclusion

I am a long-term shareholder of KO, and I plan on adding to my position at some point in the future when shares represent a better value. Today is not that day, and I think that while KO is a fantastic company, I am not bullish about adding to my position at these levels. I am now neutral on its share price because the recent appreciation has made its valuation lose most of its appeal. I think we’re going to see investors come into the market looking for yield over the next several months, and if the choice is between KO and PEP at this point, capital will be allocated to PEP. KO isn’t nearly as attractive as it was when shares had a dividend yield that exceeded 3%. PEP has a dividend yield of 3.08% and trades at 18.65 2026 earnings, while KO yields 2.78% and trades at 21.34 times 2026 earnings. I would turn bullish on KO around $64 as this would put the yield above 3%, and KO would trade under 20 times 2026 earnings. I think shares of KO will stall out for the time being or retrace as a 3% yield and less than 20 times 2026 earnings, which is a much more palatable valuation for KO than where shares are today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.