Summary:

- Coca-Cola faces a long-standing IRS claim for payment of potentially billions in back taxes, with a potential aggregate liability of $14 billion-plus.

- The Tax Court has made two rulings, one as recently as Nov. 8, 2023, finding in favor of the IRS on both matters.

- Coca-Cola plans to appeal the Tax Court rulings and remains confident in its ability to win the case.

- While Coca-Cola might be confident of success, it acknowledges the risk of failure of its appeal. While the risk might be low, the consequences of failure are fairly dire financially.

Alfribeiro/iStock Editorial via Getty Images

Image: Coca-Cola FEMSA Brazil delivery truck

Coca-Cola Investment Thesis – Putting IRS Claim To One Side

I previously published an article on The Coca-Cola Company (NYSE:KO), “Coca-Cola: Debt Levels Reduced, Attractive Multiple, Upgrade From Hold To Buy” on Oct. 9, 2023, ahead of Q3-2023 earnings release on Oct. 24, 2023. Subsequently, Coca-Cola continued its long run of earnings beats with a beat of $0.05 for Q3-2023. SA Premium analysts’ consensus EPS estimates for 2023 have also increased by $0.05 from $2.64 to $2.69. However, SA Premium analysts’ consensus EPS estimates for 2024 have remained unchanged at $2.81, a modest increase of 4.5% over 2023 estimated EPS. Analysts’ consensus EPS estimates for 2025 and 2026 show little change from last October. My change from Hold to Buy rating back in October 2023 has been justified by an increase of 13.35% in the share price from $52.88 at the time of my previous article to $59.94 at close on Feb. 6, 2024. However, the higher share price results in the dividend yield reducing from 3.35% to 3.06%. And at the higher share price, with no change in EPS estimate for 2024, the forward P/E ratio for 2024 has increased from 19.81 last October to 22.62 currently. The current 22.62 is still below my modified long-term average P/E ratio calculation of 23.70 for Coca-Cola, and on that basis I will maintain a Buy rating. But I do not expect the share price to grow at the same high rate it has achieved since my October 2023 article. A more detailed Financial Analysis and Comment section in support of these conclusions appears further below.

Caveat Re IRS Billions Tax Payment Claim

The foregoing assumes Coca-Cola management is correct in believing they will win their appeal against an IRS claim for potentially billions in retrospective tax payments related to the Coca-Cola FEMSA Brazilian operations. Success by the IRS would also mean a higher annual tax burden affecting earnings going forward. From working with engineers during my mining industry days, I’m familiar with the concepts of risk and consequence. From an engineering viewpoint, a risk that’s very low but has potential very impactful consequences, is seen as a greater risk than another risk that’s high but has minor consequences. So design of a concrete slab for a suspension bridge would be considered far more critical regarding avoidance of risk of failure than risk of a slab on ground developing a crack. The risk and consequence of the IRS claim appear to be more in the suspension bridge category.

The IRS claim, and consequences if not overturned on appeal, are discussed in detail below.

Coca-Cola Litigation – IRS Claim For Billions In Back tax

Coca-Cola’s Position on the Billions IRS Claim

This is a long-standing matter as per various selected excerpts below from Coca-Cola’s SEC filings showing the historical timeline:

- From 2015 10-K – On September 17, 2015, the Company received a Statutory Notice of Deficiency (“Notice”) from the IRS for the tax years 2007 through 2009, after a five-year audit. In the Notice, the IRS claims that the Company’s United States taxable income should be increased by an amount that creates a potential additional federal income tax liability of approximately $3.3 billion for the period, plus interest… The Company firmly believes that the IRS’ claims are without merit and plans to pursue all available administrative and judicial remedies necessary to resolve this matter.

- From 2016 10-K – Consequently, if this dispute were to be ultimately determined adversely to us, the additional tax, interest and any potential penalties could have a material adverse impact on the Company’s financial position, results of operations and cash flows.

- From 2017 10-K – A trial date has been set for March 5, 2018.

- From 2020 10-K – On November 18, 2020, the U.S. Tax Court (“Tax Court”) issued an opinion (“Opinion”) predominantly siding with the IRS. Although the Company disagrees with the unfavorable portions of the Opinion and intends to vigorously defend its position, considering all avenues of appeal, there is no assurance that the courts will ultimately rule in the Company’s favor.

- From 2022 10-K – We concluded, based on the technical and legal merits of the Company’s tax positions, that it is more likely than not the Company’s tax positions will ultimately be sustained on appeal.

- From Coca-Cola’s September 29, 2023, Q3-2023 10-Q filing – We are currently in litigation with the IRS for tax years 2007 through 2009. On November 18, 2020, the Tax Court issued the opinion in which it predominantly sided with the IRS; however, a decision is still pending and the timing of such decision is not currently known. The Company strongly disagrees with the IRS’ positions and the portions of the Opinion affirming such positions and intends to vigorously defend our positions utilizing every available avenue of appeal. While the Company believes that it is more likely than not that we will ultimately prevail in this litigation upon appeal, it is possible that all, or some portion of, the adjustments proposed by the IRS and sustained by the Tax Court could ultimately be upheld. In the event that all of the adjustments proposed by the IRS were to be ultimately upheld for tax years 2007 through 2009 and the IRS, with the consent of the federal courts, were to decide to apply the underlying methodology (“Tax Court Methodology”) to the subsequent years up to and including 2022, the Company currently estimates that the potential aggregate incremental tax and interest liability could be approximately $14 billion as of December 31, 2022. Additional income tax and interest would continue to accrue until the time any such potential liability, or portion thereof, were to be paid. The Company estimates the impact of the continued application of the Tax Court Methodology for the nine months ended September 29, 2023 would increase the potential aggregate incremental tax and interest liability by approximately $1.2 billion….The Company does not know when the Tax Court will issue its opinion regarding the effect of Brazilian legal restrictions on the payment of royalties by the Company’s licensee in Brazil for the 2007 through 2009 tax years. After the Tax Court issues its opinion on the Company’s Brazilian licensee, the Company and the IRS will be provided time to agree on the tax impact of both opinions, after which the Tax Court would render a decision in the case. The Company will have 90 days thereafter to file a notice of appeal to the U.S. Court of Appeals for the Eleventh Circuit and pay the tax liability and interest related to the 2007 through 2009 tax years. The Company currently estimates that the payment to be made at that time related to the 2007 through 2009 tax years, which is included in the above estimate of the potential aggregate incremental tax and interest liability, would be approximately $5.6 billion (including interest accrued through September 29, 2023), plus any additional interest accrued through the time of payment. Some or all of this amount would be refunded if the Company were to prevail on appeal….While we believe it is more likely than not that we will prevail in the tax litigation discussed above, we are confident that, between our ability to generate cash flows from operating activities and our ability to borrow funds at reasonable interest rates, we can manage the range of possible outcomes in the final resolution of the matter.

Tax Court’s Upholds Coca-Cola Transfer Pricing Adjustment – November 8, 2023

On November 8, 2023, the Tax Court found against Coca-Cola in its decision in the case of The Coca-Cola Company and Subsidiaries, Petitioner v. Commissioner of Internal Revenue, Respondent, as follows –

In sum, petitioner has failed to satisfy its burden of proof in two major respects. It has offered no evidence that would enable us to determine what portion of the transfer-pricing adjustment is attributable to exploitation of the non-trademark IP, which we have found be the most valuable segment of the intangibles from the Brazilian supply point’s economic perspective. And petitioner has offered insufficient evidence to enable us to determine what portion of the transfer-pricing adjustment is attributable to exploitation of the 8 original core-product trademarks, as opposed to the 60 other core-product trademarks and the entire universe of non-core-product trademarks. Because petitioner has failed to establish what portion of the aggregate transfer-pricing adjustment might be attributable to exploitation of the eight grandfathered trademarks, we have no alternative but to sustain that adjustment in full.

To implement the foregoing, Decision will be entered under Rule 155.

Coca-Cola’s Response To November 8, 2023 Tax Court Ruling

Excerpted from November 9, 2023 Coca-Cola press release on Tax Court ruling.

While we disagree with the court’s interpretation of the facts and law in this case, we are pleased to move closer to a final resolution of the Tax Court case so that we can pursue an appeal, where we can assert our claims and vigorously defend the company’s position…. We do not expect the results in this recent supplemental decision to change the methodologies we have used to calculate the tax reserve we have taken or the potential aggregate incremental tax and interest liability we have disclosed related to the dispute with the IRS or our effective tax rate.

Forbes Article Suggests Coca-Cola Unlikely To Win Against IRS Claim For Billions

Per excerpts below from a November 27, 2023 article, “IRS Doesn’t Need The Blocked Income Tax Regulations In Coca-Cola“, Forbes Contributor, Ryan Finley, suggested Coca-Cola’s prospects of eventual success are dim.

The Tax Court’s new opinion deciding the blocked income question raised in Coca-Cola v. Commissioner, T.C. Memo. 2023-135, suggests that Coca-Cola’s prospects of eventual success are dim, whether the blocked income regulations are upheld on appeal or not. …The supplemental opinion, which also sides with the IRS, will likely be the last step in the Coca-Cola case before it heads to an inevitable appeal.

Coca-Cola Appeal of Tax Court Rulings

From the company filings and press release detailed above –

- Coca-Cola will need to engage with the IRS to agree on the amount of tax that would be payable if the Tax Court’s decision were implemented. It is presumed this is already in train and additional information will likely become available in the upcoming Q4-2023 earnings release scheduled for pre-market Feb., 13, 2024 and the 10-K generally released around a week later.

- After agreement with the IRS on the quantum of the payment, Coca-Cola will have 90 days to file a notice of appeal. Assuming the payment amount has already been agreed then the appeal would need to be lodged possibly in May 2024.

- In order to appeal, Coca-Cola will have to firstly pay the portion of the potential aggregate incremental tax and interest liability related to the 2007 through 2009 tax years. Coca-Cola estimates this amount to be in excess of $5.6 billion.

- Coca-Cola has stated it remains confident of winning this case on appeal and does not intend to change its methodologies for calculating its tax reserve. Accordingly, 2023 full year results are unlikely to be impacted by the 8 November 2023 Tax Court decision.

Coca-Cola is due to release its full year 2023 results pre-market on Feb. 13, 2024, and an update on the IRS claim can be expected. A more comprehensive update can be expected with the 10-K annual report likely to be released around Feb. 20, 2024, based on past timing. Any appeal and provisional tax payment would be disclosed as a post-balance date event.

Impact on Coca-Cola the Company of Loss of Appeal Against IRS Tax Payment Claim

The company has expressed confidence in an ultimate win against the IRS claim. At the same time, the company has by no means ruled out the possibility of the IRS sustaining its claim, resulting in billions in additional tax payments. In order to appeal the case the company must in any case first pay $5.6 billion upfront. That appears to be likely to occur in the first half of 2024. The company appears well positioned to take on another $5.6 billion in debt or to meet this payment out of its large cash and investments balance. Since December 2020 net debt as a percentage of net debt plus equity has decreased from 62.3% to 50.1% at end September 2023. The $5.6 billion payment, if also booked as an expense, could be expected to increase net debt as a percentage of net debt plus equity to ~61%, still below 2020 level of 62.3%. If the $14 billion payment were made in the near term and booked as a cost, net debt as a percentage of net debt plus equity could be expected to increase to ~77%. However, a court ruling on any appeal is likely to take ~3 years and over the last 3 years Coca-Cola has reduced net debt by ~$5.5 billion and increased shareholders’ equity by ~$7 billion. Assuming similar improvement over the next 3 years and the tax payment claim increasing to $17 billion in 3 years’ time, net debt as a percentage of net debt plus equity could be expected to increase to ~70% at the time of payment of the $17 billion. There would also be an impact on future yearly earnings and EPS due to the ongoing higher tax payments. Reduced liquidity could result in a reduction in share repurchases with an adverse impact on EPS due higher share count. Lower EPS, reduced liquidity and higher share count could limit dividend growth.

Conclusion:

I believe the view of the company expressed in the excerpts above is reasonable, viz.,

…we are confident that, between our ability to generate cash flows from operating activities and our ability to borrow funds at reasonable interest rates, we can manage the range of possible outcomes in the final resolution of the matter.

Impact on Coca-Cola Shareholders of Loss of Appeal Against IRS Tax Payment Claim

While, it’s believed the worst-case outcome for the company does not present in any way an existential threat, the impact for shareholders could manifest in a number of ways. The immediate impact would likely be a significant dip in the share price. The secondary impacts could be in reduced future EPS growth and a limitation on dividend growth, or even a reduction in dividends. These in turn could adversely impact future share price growth.

Conclusion:

Any appeal could likely take ~3 years or more before a verdict is handed down. Given this matter, and the associated potential risks and consequences, have been disclosed as far back as 2015 with regular updates in the intervening period, it may be the risk is already reflected in the share price. However, as the case progresses, greater awareness might begin to put downward pressure on the share price. The loss of the appeal by Coca-Cola in November 2023 does not appear to have been widely reported. It will be interesting to see if there is any impact on the share price when Coca-Cola provides an update on the IRS claim and Tax Court ruling and any appeal in the 4th quarter earnings release and the 2023 annual report.

Financial Analysis and Comment

Looking for market mispricing of stocks

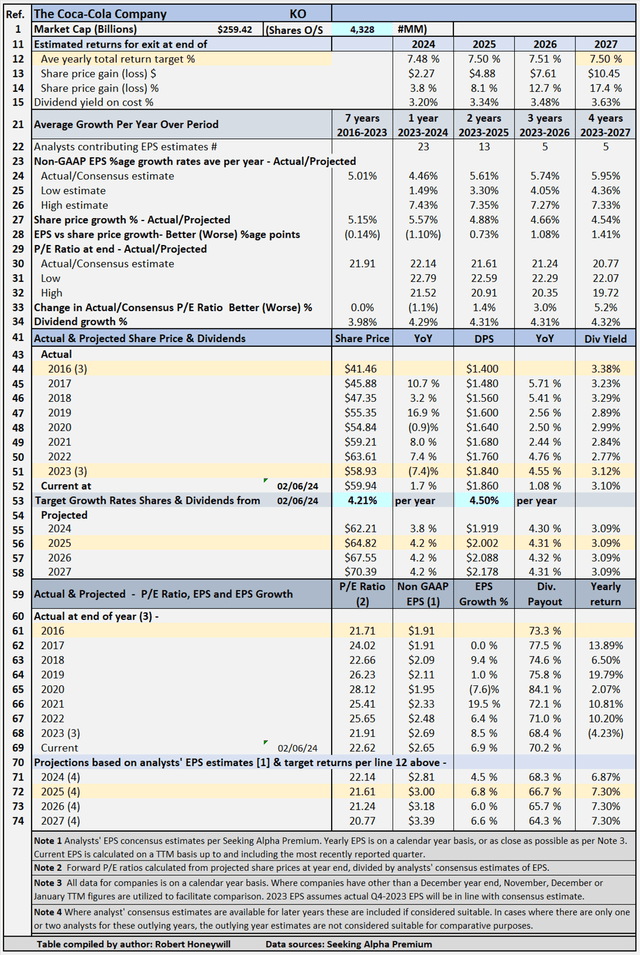

What I’m primarily looking for here are instances of market mispricing of stocks due to distortions to many of the usual statistics used for screening stocks for buy/hold/sell decisions. I believe the answer is to compare projections, based on analysts’ estimates out to the end of 2025 or later, to past performance. Summarized in Tables 1 and 2 below are the results of compiling and analyzing the data on this basis.

Table 1 – Detailed Financial History And Projections

Table 1 documents historical data from 2016 to 2023, including share prices, P/E ratios, EPS and DPS, and EPS and DPS growth rates. The table also includes estimates out to 2027 for share prices, P/E ratios, EPS and DPS, and EPS and DPS growth rates. (Note – while estimates are shown for analysts’ EPS estimates out to 2024 to 2027 where available, estimates do tend to become less reliable, the further out the estimates go. These estimates are only considered sufficiently reliable if there are at least three analysts’ contributing estimates for the year in question). Table 1 allows modeling for target total rates of return. In the case shown above, the target set for total rate of return is 7.5% per year through the end of 2027 (see line 12), based on buying at the Feb. 6, 2024, closing share price level. As noted above, estimates become less reliable in the later years. I have decided to input a target return based on the 2027 year, which has EPS estimates from five analysts, because it allows for the impact of the projected EPS growth rates to be taken into account in the assessment of the value of Coca-Cola shares. The table shows to achieve the 7.5% return, the required average yearly share price growth rate from Feb. 6, 2024 through Dec. 31, 2027, is 4.21% (line 53). Dividends and dividend growth account for the balance of the target 7.5% total return. The 4.21% compares to actual share price growth over the last 7 years of 5.15% (see line 23). This 5.15% share price growth compares closely to EPS growth of 5.01% over the same period.

Coca-Cola’s Projected Returns Based On Selected Historical P/E Ratios Through End Of 2027

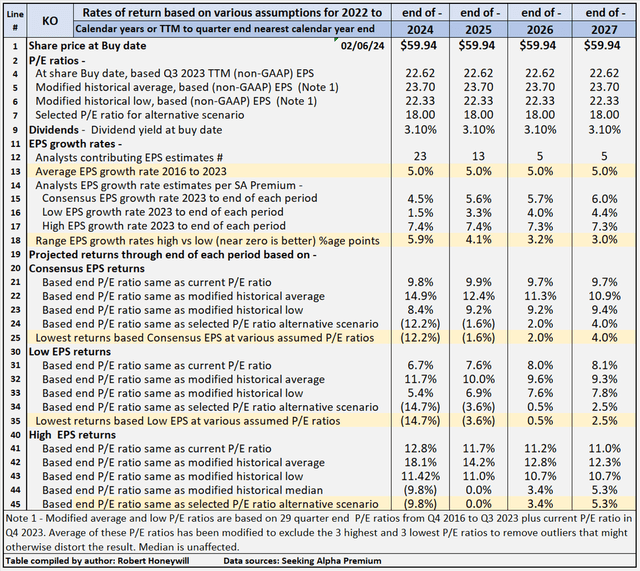

Table 2 below provides additional scenarios projecting potential returns based on select historical P/E ratios and analysts’ consensus, low, and high EPS estimates per Seeking Alpha Premium through end of 2027.

Table 2 – Summary of relevant projections Coca-Cola

Table 2 provides comparative data for buying at closing share price on Feb. 6, 2024, and holding through the end of years 2024 through 2027. There’s a total of twelve valuation scenarios for each year, comprised of three EPS estimates (SA Premium analysts’ consensus, low and high) across three different P/E ratio estimates, based on historical data, plus a fourth P/E ratio selected to provide an alternative scenario. Coca-Cola’s P/E ratio is presently 22.62, which is below the historical average P/E ratio of 23.70. Table 2 shows potential returns from an investment in shares of the company across the range of P/E ratios This analysis, from hereon, assumes an investor buying Coca-Cola shares today would be prepared to hold through 2027, if necessary, to achieve their return objectives. Comments on contents of Table 2, for the period to 2027 column follow.

Consensus, low and high EPS estimates

All EPS estimates are based on analysts’ consensus, low and high estimates per SA Premium. This is designed to provide a range of valuation estimates ranging from low to most likely, to high based on analysts’ assessments. I could generate my own estimates, but these would likely fall within the same range and would not add to the value of the exercise. This is particularly so in respect of well-established businesses such as Coca-Cola. I believe the “low” estimates should be considered important. It’s prudent to manage risk by knowing the potential worst-case scenarios from whatever cause.

Alternative P/E ratios utilized in scenarios

- The actual P/E ratios at the share buy date are based on actual non-GAAP EPS for Q4-2023 TTM (note for convenience the model assumes actual EPS for Q4-2023 will be in line with analysts’ consensus EPS estimates).

- A modified average P/E ratio based on 30 quarter-end P/E ratios from Q4 2016 to Q4 2023 and current P/E ratio in Q1 2024. The average of these P/E ratios has been modified to exclude the three highest and three lowest to remove outliers that might otherwise distort the result.

- A modified low P/E ratio was calculated using the same data set used for calculating the modified average P/E ratio, and calculated on a similar basis, with the three highest and lowest P/E ratios excluded.

- A median P/E ratio is calculated using the same data set used for calculating the modified average P/E ratio. Of course, the median is the same whether or not the three highest and lowest P/E ratios are excluded. In the case of Coca-Cola, I have chosen to use an assumed P/E ratio of 18.0 in place of the historical median of 23.81 (similar to the average). I have done this to provide an idea of the impact on returns of the multiple declining significantly below the present level and the historical average. The selected P/E multiple of 18.0 compares to the sector median of 17.94 for PE Non-GAAP [FWD], per Seeking Alpha Premium metrics.

Reliability of EPS estimates (line 18)

Line 18 shows the range between high and low EPS estimates. The wider the range, the greater disagreement there is between the most optimistic and the most pessimistic analysts, which tends to suggest greater uncertainty in the estimates. There are five analysts covering Coca-Cola through end of 2027. In my experience, a range of 3.0 percentage points difference in EPS growth estimates among analysts is relatively low, and suggests a degree of certainty, and thus increased reliability.

Projected Returns (lines 19 to 45)

Lines 25, 35 and 45 show at Coca-Cola’s historical average P/E multiple of 23.70, the indicative returns range from 9.3% to 12.3%, with consensus 10.9%. If Coca-Cola’s present multiple of 22.62 continues through 2027, returns ranging from 8.1% to 11.0% are indicated, with consensus 9.7%.

At a selected lower P/E multiple of 18.0, roughly in line with the sector average, Coca-Cola is conservatively indicated to return between 2.5% and 5.3% average per year through the end of 2027. The 2.5% return is based on analysts’ low EPS estimates and the 5.3% on their high EPS estimates, with a 4.0% return based on consensus estimates. The 2.5% return at the analysts’ low EPS estimate for 2027 and at a reduced P/E ratio of 18.0 shows that positive returns are still possible even if EPS and multiple fall short of current expectations, provided the shares are held for a number of years. In contrast, buying the shares now and holding only until end of 2024 gives an indicative negative (14.7)% return under the low EPS and low P/E ratio scenario.

Checking Coca-Cola’s “Equity Bucket”

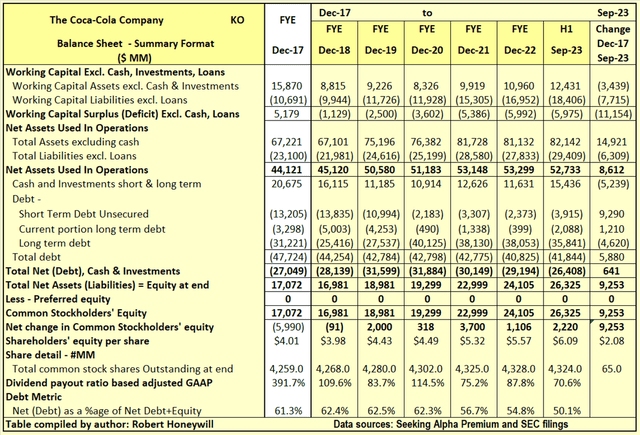

Table 3.1 Coca-Cola Balance Sheet – Summary Format

Seeking Alpha Premium and SEC filings

Over the 5.75 years end of 2017 to end of Q3-2023, Coca-Cola increased net assets used in operations by $8,612 million. This $8,612 million increase was funded by a $641 million increase in debt net of cash, and a $9,253 million increase in shareholders’ equity. Net debt as a percentage of net debt plus equity has decreased from 61.3% at end of 2017 to 50.1% at end of Q3-2023. It’s noteworthy the improvement in debt to equity is mainly due to retention of profits for investment in growth of the company, and share issues to employees, thus increasing shareholders’ equity. Outstanding shares increased by 65.0 million from 4,259 million to 4,324 million, over the period, due to shares issued for stock compensation, partly offset by share repurchases. The $9,253 million increase in shareholders’ equity over the last 5.75 years is analyzed in Table 3.2 below.

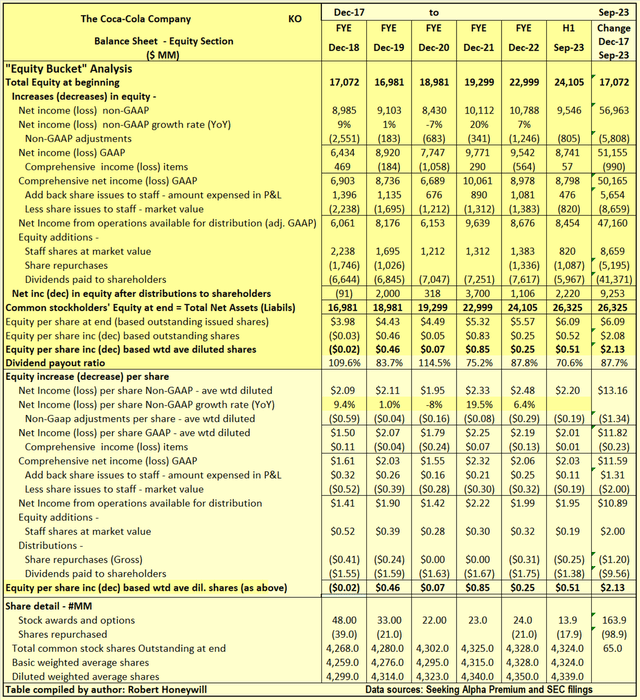

Table 3.2 Coca-Cola Balance Sheet – Equity Section

Seeking Alpha Premium and SEC filings

I often find companies report earnings that should flow into and increase shareholders’ equity. But often the increase in shareholders’ equity does not materialize. Also, there can be distributions out of equity that do not benefit shareholders. Hence, the term “leaky equity bucket.” I look for evidence of this in my analysis of changes in shareholders’ equity. Coca-Cola’s “leaky equity bucket” issues relate mostly to non-GAAP adjustments and shares issued for staff stock-based compensation.

Explanatory comments on Table 3.2 for the period end FY-2017 to end Q3-2023.

- Reported net income (non-GAAP) over the 5.75-year period totals to $56,963 million, equivalent to diluted net income per share of $13.16.

- Over the 5.75-year period, the non-GAAP net income excludes a significant $5,808 million (EPS effect $1.34) of items regarded as unusual or of a non-recurring nature in order to better show the underlying profitability of Coca-Cola. It always is of concern when companies exclude costs year after year on the basis they are temporary or unusual.

- Other comprehensive income includes such things as foreign exchange translation adjustments in respect to buildings, plant, and other facilities located overseas and changes in valuation of assets in the pension fund – these are not passed through net income as they fluctuate without affecting operations and can easily reverse in a following period. Nevertheless, they do impact on the value of shareholders’ equity at any point in time. For Coca-Cola, these items were a net loss of $990 million, EPS effect negative $(0.23), over the 5.75-year period.

- Amount taken up in equity to account for shares issued to staff over the 5.75 years is $5,654 million. This compares to an estimated market value of $8,659 million at the time of issue for these shares. The real cost of these shares is greater by $3,005 million (EPS effect $0.69) than allowed for in arriving at non-GAAP EPS, a material difference.

- By the time we take the aforementioned items into account, we find, over the 5.75-year period, the reported non-GAAP EPS of $13.16 ($56,963 million) has decreased to $10.89 ($47,160 million), added to funds from operations available for distribution to shareholders.

- This $47,160 million is sufficient to cover dividends of $41,371 million, leaving an adjusted net operating surplus after dividends of $5,789 million. On this basis, dividend payout ratio is 87.7%.

- Issue of shares by way of stock compensation effectively raised $8,659 million through the issue of 163.9 million shares to staff at an average market price of $52.83 per share (without these issues this staff compensation would have required cash of $8,659 million to provide similar compensation benefit (ignoring differing tax treatment for cash versus stock compensation). These staff share issues were offset in part by repurchase of 98.9 million shares for $5,195 million at an average price of $52.53 per share. The net effect of shares issued to staff less shares repurchased was an increase in shareholders’ funds of $3,464 million ($8,659-$5,195).

- The foregoing analysis shows the $9,253 million net increase in shareholders’ funds per Table 3.1 above was comprised of the $3,464 million net capital raised through issue of shares to staff offset by share repurchases, plus the adjusted net operating surplus after dividends of $5,789 million.

Coca-Cola: Summary and Conclusions

The current dividend yield is 3.04% and dividend yield on cost is projected to grow to 3.6% by end of 2027, underpinning potential returns. There also appears to be an opportunity for share price gains from EPS growth, which could be further magnified by multiple expansions. Table 2 above shows a potential for 10% plus returns from buying now and holding through end of each of years 2024 to 2027. On this basis Coca-Cola continues to be rated a Buy. The only caveat is the possibility of Coca-Cola failing in its appeal to Tax Court decisions upholding IRS claims for billions in tax payments in relation to the Brazilian operations. As discussed above, an unfavorable outcome could have a significant negative impact on share price. However, Coca-Cola appears quite capable of meeting these potential payments from a liquidity viewpoint. Also, a shareholder prepared to hold longer term would likely achieve lower, but still positive returns, due to dividends and continuing EPS growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. I do not recommend that anyone act upon any investment information without first consulting an investment advisor and/or a tax advisor as to the suitability of such investments for their specific situation. Neither information nor any opinion expressed in this article constitutes a solicitation, an offer, or a recommendation to buy, sell, or dispose of any investment, or to provide any investment advice or service. An opinion in this article can change at any time without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.