Summary:

- High return option selling strategies are often perceived as dangerous by the broader investing community, but they have strong benefits that cannot be overlooked.

- Today, we break down the stability, value, margins and technicals of two consumer staples giants to determine which is a better underlying stock to sell puts on.

- We outline two different trades for two different types of investors; long term income oriented folks, and short term dip-buyers.

Olivier Le Moal

Over the last few months, we’ve written a number of articles that focus on selling put options for income – see here and here. As an investor, they can be a great tool to earn solid returns, reduce portfolio volatility, and potentially “buy low” into companies with excellent long-term prospects.

However, option income strategies often maintain a negative stigma within the broader investment community, as a result of high-profile blowups and broad misunderstandings about how options and leverage work. If used correctly, put selling strategies can actually reduce risk, all while offering investors immediate income and a bigger margin of error on their positions.

Since selling a put option on a specific stock requires that investors be ready to purchase shares in the underlying company, typically, the work to identify good trade ideas often begins with identifying great, or at least, stable, companies. Then, it’s simply a matter of identifying the best time to sell puts, based on technical analysis and relative valuation.

Today, we’re going to take a look at two companies that are as stable as they come: PepsiCo (NASDAQ:PEP) and Coca-Cola (NYSE:KO). We’ll dive into each underlying business to determine which company has better long-term prospects, and then we’ll take a look at which company may be better positioned for a short put strategy at the current moment in time. Sound good?

Let’s jump in.

Stability

In their most recent respective quarters, both companies turned in strong results.

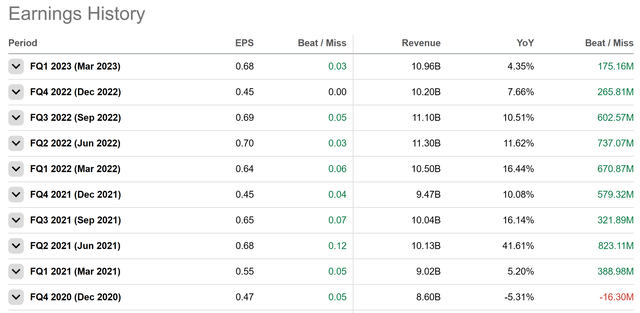

Coca-Cola reported a beat in Q1, with EPS of $0.68 beating expectations by 3 cents. revenue also came in $175 million above estimates, although top line growth continued to slow, down to a rate of 4.4% YoY. Overall, though, this report fits well within a pattern of growth and beats:

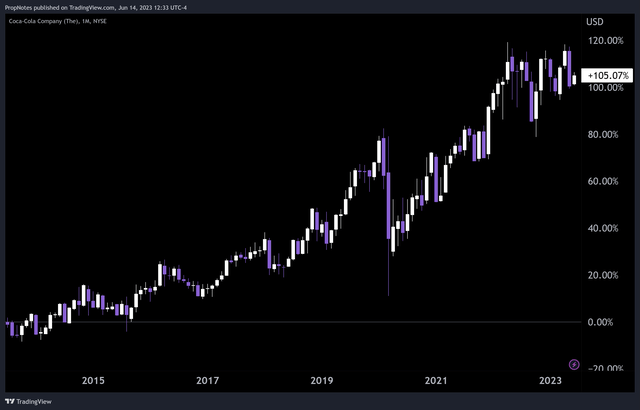

Over the last several years, KO has done an excellent job of growing the top line, while beating on EPS and revenue, especially considering how saturated their end-market is. This performance can be attributed to KO’s strong operational efficiency and unbelievable consumer brand. Not surprisingly, the market has rewarded this performance with a steady rise in the company’s stock price:

Over the last decade, KO has returned more than 100% to shareholders, with an extremely low level of volatility.

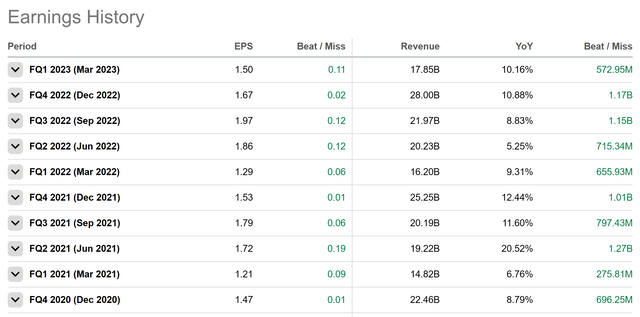

It’s a similar story with PepsiCo. In their most recent quarter, PEP reported EPS of $1.50, which beat estimates by $0.11. revenue also beat by more than half a billion dollars, and growth remained strong, with a YoY% increase in the double digits. Like KO, strong results like these seem to be a pattern:

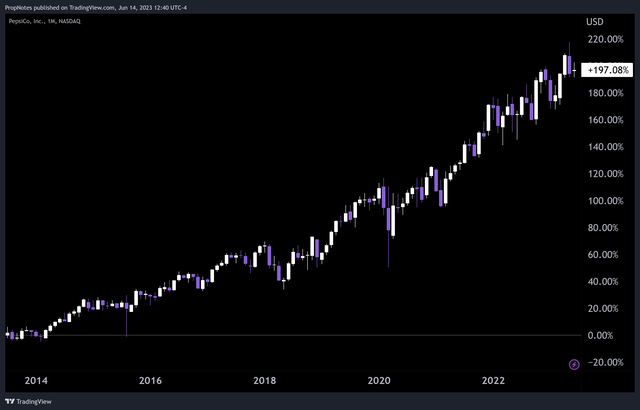

And, like KO, in turn, the market has rewarded shareholders of PEP with nearly 200% in total returns over the last decade:

Sure, these aren’t the lofty returns of market beating growth stories like Apple (AAPL), but they come with a much lower volatility profile.

Margins

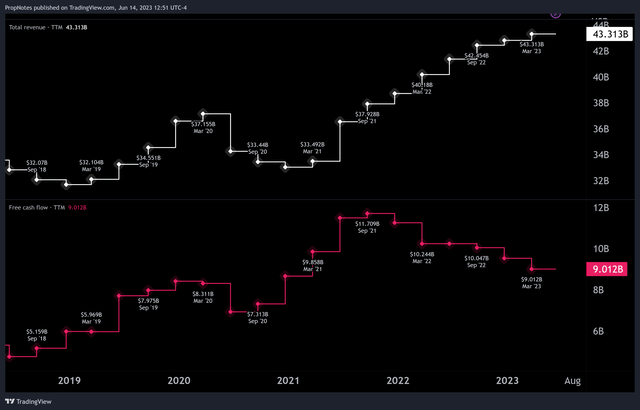

Zooming out for a moment, we can see KO’s TTM revenue has grown steadily over the last 5 years, from 34 billion to 43 billion, a solid CAGR of 4.8%:

TTM Free cash flow also came in around $9 billion, putting KO’s FCF margin % at a remarkable ~20%.

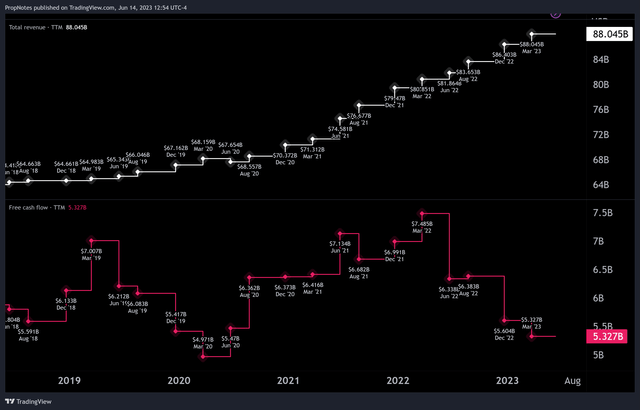

PEP’s TTM revenue has grown more steadily, and recently came in at around double KO’s, at $88 billion:

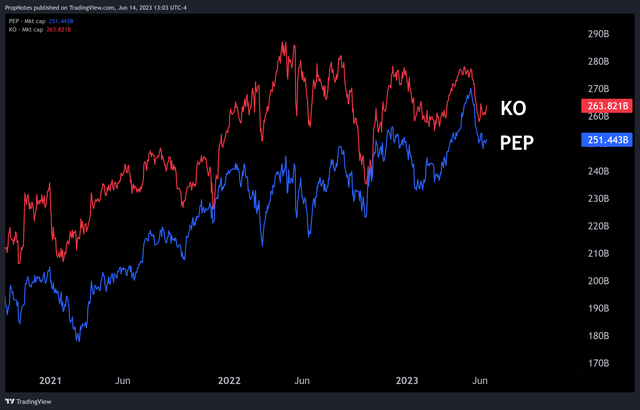

However, TTM FCF came in quite a bit lower than KO’s, at around $5.3 billion. This gives PEP an FCF margin of 6%, and indicates that KO has nearly quadruple the margins of PEP, which is why despite the difference in revenue, KO is actually still a larger company by market cap:

This margin is a strength of KO’s and should cushion the company against future instability in a way that PEP’s 6% simply cannot.

Valuation

While KO boasts better margins, it’s actually “cheaper” on a multiple basis.

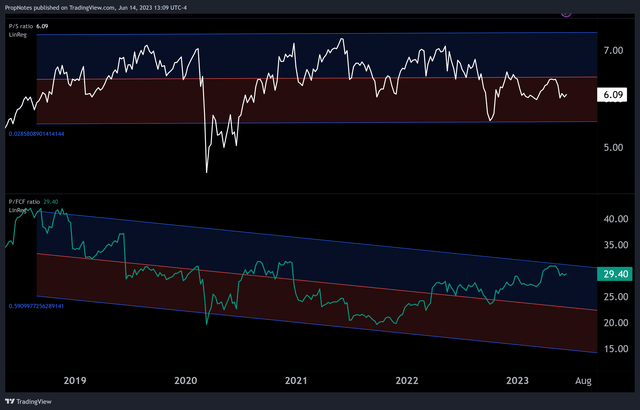

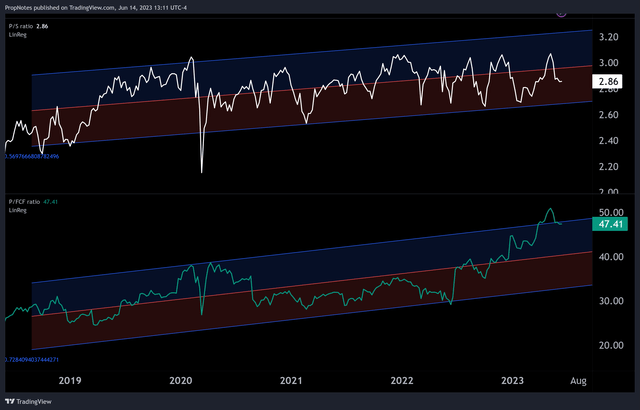

Here, we can see the historical revenue and FCF multiple for KO:

At 6.1x sales and ~29x FCF, it’s hard to call KO, a consumer staples company, “cheap”. However, the company is trading within lower ranges compared to where it’s traded historically.

PEP, on the other hand, is more expensive on a cash flow basis, the multiple is more than 60% higher than KO’s:

The FCF valuation point is also at the very top of the standard deviation band overlaid onto PEP’s multiple history, indicating that it’s potentially “too rich” vs. history.

Ultimately, as mature businesses with saturated end markets, profitability matters most at the end of the day, and we’d give the relative value edge to Coca-Cola.

Technicals

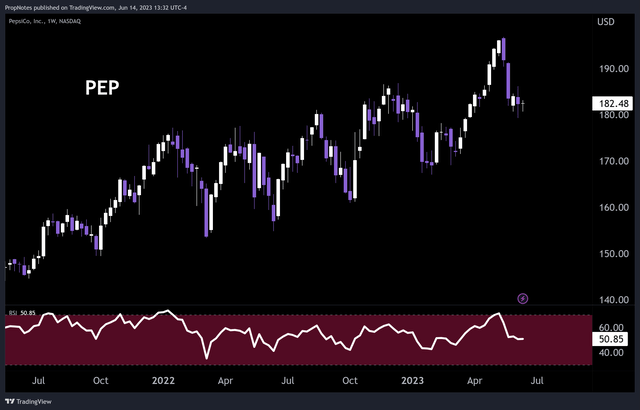

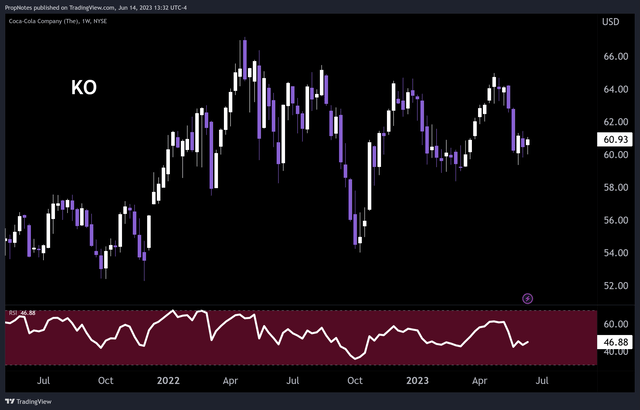

From a price action standpoint, both companies stand in similar stead. Neither are overbought or oversold, limiting what short-term directional edges may be available to exploit:

PEP (TradingView) KO (TradingView)

Both are also trading within a range, which limits what edges can be gleaned from supply or demand zones (Support & Resistance) in the stock.

The only real difference between both stocks is their YTD performance, which stands at 1% for PEP and -3.5% for KO – a very negligible difference. Ultimately, there’s really no technical edge available in either of these stocks that makes one more relatively attractive vs. one another.

The Trade

So; PepsiCo and Coca-Cola share similar levels of stability and are trading in similar technical patterns. However, KO has stronger margins and a more compelling valuation, which makes it a better candidate for us to sell puts on.

Thankfully, using options, there are a few different ways to structure a high-yielding trade in the name; and today we’ll touch on 2.

First up – for those looking for something similar to “bond-like” exposure, the $60 strike, June 21st, 2024 put options offer a 4.9% cash-on-cash return, which is 63% more income than you’d receive in dividends over the next year as a simple common stock investor. If assigned, you’d also get the stock at a 2% discount to the current price, which, while small, is decent for a stock with such a small amount of realized volatility.

For those looking to scoop up shares in KO at a better price while getting paid to wait for the opportunity, our second option is a great choice: the $57.50 strike, August 18th put options. They return 0.6%, which isn’t great, but considering that’s only 65 days away, the return annualized to 3.36%, which is higher than the current dividend. Plus, assignment would be nearly 6% cheaper to where the stock is trading now. Again – KO has an extremely low level of realized volatility, which makes this more attractive than at first glance.

Risks

There are some risks to selling put options, chief among them that being short puts means that one needs to stand ready to buy stock, even if the stock trades below the strike price. This may force a purchase above where the market is trading, which may cause losses.

Ideally, we mitigate this risk by picking great companies and great exposures for our cash. Plus, it’s the same amount of risk as holding the stock, as long as the puts sold are “cash secured”, which means that there is always cash to back up a purchase of shares in your account. However, it’s still something to be aware of nonetheless.

Summary

Coca-Cola looks more attractive vs. PepsiCo due to its stronger margins and better valuation, which makes it a great candidate for a put selling strategy. We’ve outlined two different specific options for your consideration, but always be aware of the risks, and ensure that you have the cash available in your account to back up purchases if necessary. If done this way, this strategy can reduce risk and increase yield, all while allowing investors to potentially get better prices in great long-term winners.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.