Summary:

- Coca-Cola printed 9% revenue growth, 7% operating income growth, and 7% EPS growth in Q3 ’23.

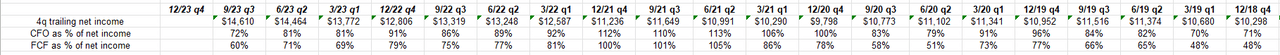

- For the last 5 years, there have only been a handful of quarters where cash flow has exceeded net income, which is not really a positive.

- Coke has incredible brand strength and appeal, and you’d think management could leverage that into other areas, but it hasn’t happened.

jetcityimage

Coca-Cola (NYSE:KO): KO reports before the opening bell on Tuesday, February 13, 2024.

Here’s the consensus estimates:

- EPS: $0.47 or 9% yoy growth

- Rev: $10.67 bl or 5% yoy growth

- Operating inc: $2.4 bl or 6% yoy growth

In Q3 ’23, KO printed 9% revenue growth, 7% operating income growth, and 7% EPS growth. Case volume rose just 2%, but this was after a 9% price increase. Coke, like so many companies, went through a tough time in the post-Covid years, mainly 2022 and early 2023, but the carbonated soft drink giant has rebounded, pushing through price increases, which are now finally complete.

Here’s my biggest worry about KO (the stock): The quality of earnings isn’t the best.

Readers have to click on the above spreadsheet to expand the spreadsheet, but for the last 5 years, there have only been a handful of quarters where cash flow has exceeded net income for Coca-Cola, which is not really a positive.

This may come as a surprise to readers, but for many S&P 500 components, cash flow typically exceeds net income (meaning cash flow per share is typically greater than earnings per share), particularly with businesses with depreciation expense. Industrial, retail, certainly technology, etc.

KO spun off the bottling operations starting in the middle part of last decade, which was supposed to boost margins and make the business less capital-intensive (which it did), but cash flow has really not improved very much.

While James Quincey has tried to be innovative (launched their first alcoholic beverage in the last year), the fact is the company moves at a snail’s pace. After modeling KO since the late 1990s, it seems at times to act like a government bureaucracy. Coke has incredible brand strength and appeal, and you’d think management could leverage that into other areas, but it hasn’t happened.

The Super Bowl commercials reflected a number of “emerging soft drinks” like Poppi (?), but the mainstays like Coke and Pepsi passed on the event. Not sure how to factor that into the fundamental valuation picture for KO.

Some final data points on KO relative to other staples:

Total return since 1/1/2000 (through 12/31/2003):

- Pepsi: +9.43%

- SPXTR: +7.03%

- Walmart: +5.35%

- Coca-Cola: +5.83%

- (Return data sourced from YCharts)

Total return since 1/1/2010 (through 12/31/2023):

- SPXTR: +13.12%

- Pepsi: +10.78%

- Walmart: 10.46%

- Coca-Cola: 8.63%

Clients own a 1% position in the stock, but Coke is a perennial underperformer. Ultimately, KO may be swapped for another staple, possibly Walmart (WMT). (Walmart reports their fiscal Q4 ’24 next week.)

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.