Summary:

- Coca-Cola’s defensive characteristics and predictable cash flows have made it attractive amid market fears, outperforming the S&P 500 over the past three months.

- Despite its strong dividend history and appeal to income-focused investors, current premium valuations offer little margin of safety for new investments.

- Coca-Cola’s financial health is solid, with a healthy balance sheet and sustainable dividend payments, but I recommend waiting for a price correction.

Jonathan Knowles

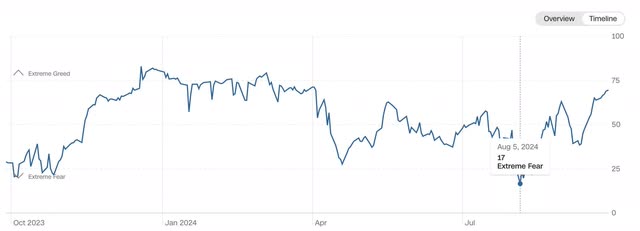

Coca-Cola (NYSE:KO) stock has performed extraordinarily well throughout this year, as it has attracted investors because of its defensive characteristics in the midst of a market still fearful of a recession. The company also proven resilient with strong quarterly results even with weak consumer spending trends. Although over the course of September, fear in the markets dissipated somewhat, if we look at the Fear & Greed index over the course of this year, there have been periods of extreme fear in the markets in recent months.

CNN

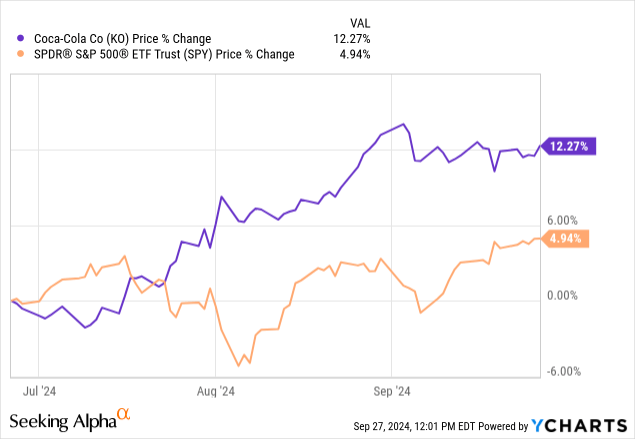

As such, this may explain the inverse correlation between the S&P 500 (SPY) and Coca-Cola stock a few months ago, with one losing strength and the other rising. Based on Coca-Cola’s performance over the last three months, being up 12.3%, while the S&P 500 is up only 5%, this shows how investors have put aside high-growth tech stocks, highly valued in recent years, and are increasingly interested in stable companies with predictable cash flows paying good dividends.

However, even if I am a long-term holder of KO, I’m not buying Coca-Cola at the moment and have no plans to buy it until there is a correction in its share price. Although its tight valuations are deserved for the various defensive qualities of its business, at the current share price, I see little margin of safety for it to be sustained in the medium to long term.

That still doesn’t mean that Coca-Cola isn’t a suitable investment. In my view, it does and should suit extremely well a profile of investors who want to live off dividend payments, as the company plans to continue allocating capital to favor this type of return for its shareholders, and especially without exceeding its free cash flow.

Although I find the dividend investment thesis appealing, I believe that KO is fairly valued at the moment and does not bring a very attractive risk-reward.

Why the Dividend King Remains a Strong Investment for Income-Oriented Investors

For almost half a century, Coca-Cola has attracted mainly income-focused investors, including none other than Warren Buffett. The Atlanta-based company has been in Berkshire Hathaway’s (BRK.A) portfolio for quite a long time and is now its fourth largest holding. What’s more surprising is that based on his position built up over all these years, it’s estimated that Buffett has a yield on cost of 60%, which basically means that for every $1,000 invested, $600 is being generated in dividend payments each year.

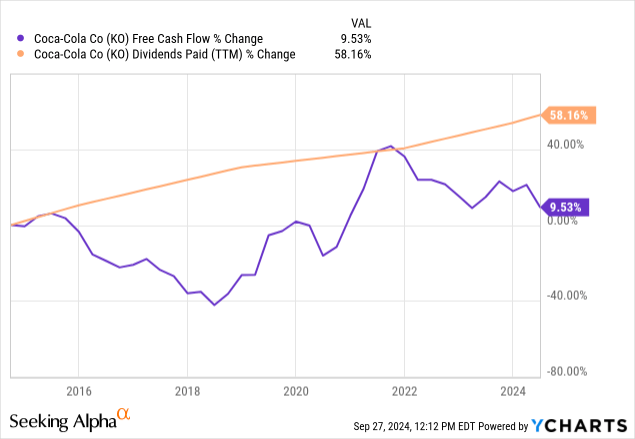

Consequently, nothing could be more fitting than to label Coca-Cola as a Dividend King. Currently, the stock yields around 2.72%, but it has been increasing these payments for around 61 years, and since 2019, free cash flows have covered these dividends. This highlights just how defensible Coca-Cola’s investment thesis has been, with consistency and stability resulting in a very reliable dividend track record. That said, Coca-Cola has also reported very high payout ratios. The payout ratio is sitting at 67.7%, and the free cash flow payout ratio is around 90%.

Seeking Alpha

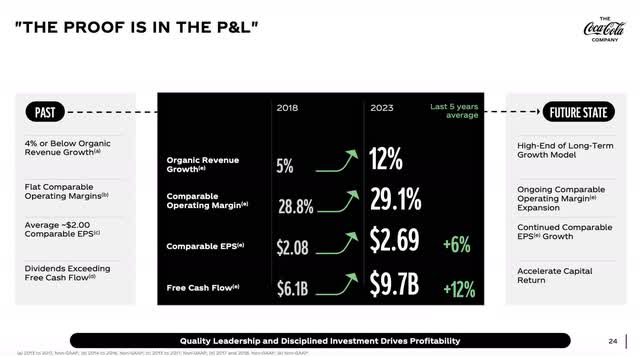

Bringing up some data from Coca-Cola’s most recent investor presentation, I’d like to draw attention to where the company has placed itself in the past and where it projects its future.

Coca-Cola’s Investor Relations

In the not-so-distant past, Coca-Cola had its organic revenue growth weaker than desired, with comparable operating margins staying flat, and an average of 2$ in comparable EPS. But perhaps the biggest problem (and the biggest threat for the dividend thesis) in the not-so-distant past was that dividends were exceeding free cash flow, as happened in 2017. At that time, Coca-Cola paid out around $6.3 billion in dividends while generating $5.4 billion in free cash flow. This was a problem, considering that, as I mentioned earlier, dividends are paid out of free cash flow generation.

As you can see from the graph below, Coca-Cola’s dividends have grown at a rate five times greater than the growth in free cash flow over the last ten years.

Although what really matters is that dividend payments do not exceed free cash flow generation, regardless of growth, if this does happen, it creates an unsustainable long-term trend for an income stock. This also leaves not enough capital to reinvest in the business itself to be able to generate even more free cash flow in the coming years. However, it seems that Coca-Cola’s management is determined to prevent this from happening in the next few years.

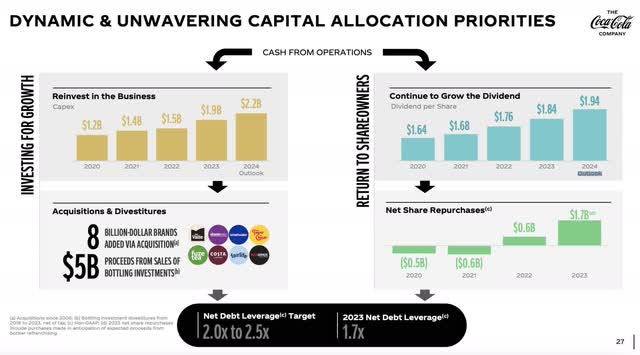

In terms of free cash flow and capital allocation, Coca-Cola also highlights as one of its top priorities how it reinvests back into its business.

Coca-Cola’s Investor Relations

For the 2024 outlook, Coca-Cola plans to reinvest about $2.2 billion back into the business. However, the top priority remains dividends, where the 2024 outlook is to pay $1.94 per share in dividends. Below this, we can see they hope to have positive net share purchases, which hasn’t always been the case for the company. They are planning to buy back some shares. Along with these three items, we can see they have also made a few acquisitions in the past few years.

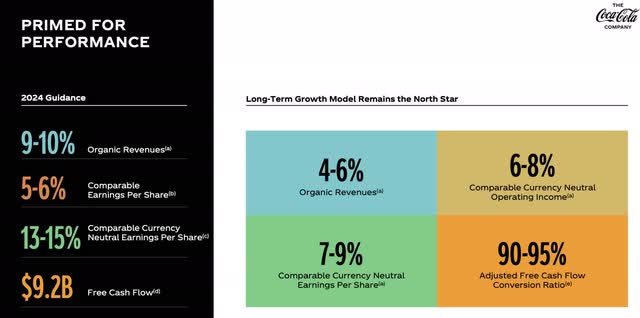

Coca-Cola also provided through its guidance that organic revenues should come in between 9-10%, which was somewhat above market projections. Coca also expects comparable earnings per share to grow by about 5-6%, comparable currency-neutral earnings per share by 13-15%, and free cash flow at $9.2 billion. If we go back to 2023, we can see that free cash flow was about $9.74 billion. While they’re projecting a slight decline, their projected free cash flow should still cover their dividend payments in a sustainable manner. So far, so good.

Coca-Cola Investor Relations

When we look at top and bottom line growth, we’ll see is over the past 5 years their compounded annual growth rate (OTC:CAGR) for revenue is around 6%. This is about what you would expect given where they are in the lifespan of their business. We can see that net income is a bit better at about a CAGR of 8.7%, which is pretty solid, and Coca-Cola have decent gross profit ratio above 60%.

The last point I’d like to bring up is Coca-Cola’s balance sheet, which looks pretty decent. Its debt-to-assets ratio is in a healthy range at around 43%, so total assets are definitely covering the total debt. The same is true with their current ratio, which is sitting at 1.13. We want to see a number above 1, as it means they can meet their short-term debt obligations.

Current Valuation Provides No Margin of Safety

Despite the high appeal as a defensive choice, is the Coca-Cola trading at a fair value of $71.66, and should we consider buying? In this case, that’s going to depend on a few different variables.

Now, the reason people like to buy Coca-Cola when a recession is potentially looming is because of the beta. This is a measure of the stock’s volatility, and it’s only sitting at 0.59. So, it doesn’t have a lot of volatility, which a lot of investors like. It’s pretty rare to see months like the past one where the company’s up 7.5%. The stock doesn’t typically move that much.

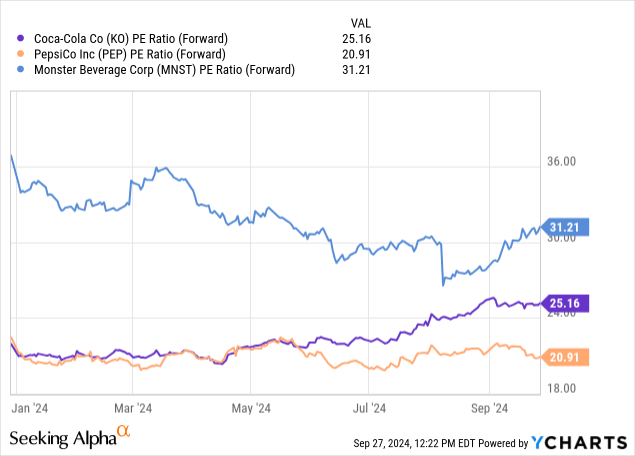

When it comes to valuation multiples, we’re seeing how the market is valuing companies that are comparable in structure, like Pepsi (PEP) and Monster Beverage (MNST). If we look at the forward P/E multiples of these companies, the average is sitting at about 25, which is precisely the multiple that Coca-Cola trades at. Applying Coca-Cola’s expected earnings per share of $2.85 to this average P/E multiple, we come to a share price of about $71.25, which is really close to the company’s current trading price.

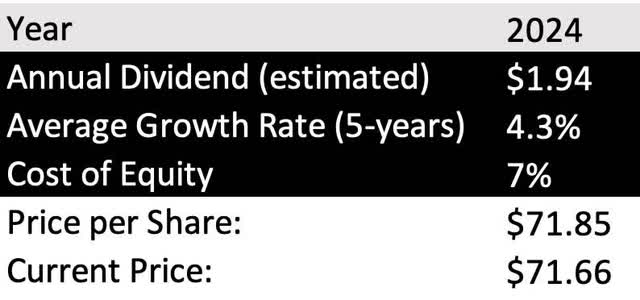

To further support this view, I highlight the dividend-based valuation model. This values the company based on how much they are paying out in dividends and how much that dividend is increasing over time, where I divide the value of the next year’s annual dividend, in this case using $1.94, by the cost of capital (8%), decreased by the growth in perpetuity (3%). When we put into the equation the average dividend growth rate over the past few years is around 4.3%. If the company can achieve 4% dividend growth moving forward with a discount rate of 7%, we come to a dividend discount model price per share of $71.85. This suggests that Coca-Cola appears to be fairly valued.

Author, Seeking Alpha data

If a 10% margin of safety is taken into account, an acceptable share price to buy would be $64.67, which is somewhat lower than the latest share price at $71.66.

The Bottom Line

It’s no surprise that in periods of fear, defensive names such as Coca-Cola rise even though it trades at tight valuations. However, I believe this is justified by its defensive qualities and extensive geographic diversification. But even though I feel uncomfortable buying highly valued stocks, even if they are good dividend payers, I believe that Coca-Cola’s investment thesis still serves well investors wanting to live off dividend payments.

Over the long run, this should continue to make KO a solid winner and a valuable addition to a balanced portfolio. However, for those who are not focused on dividends, I would only buy more Coca-Cola shares in front of a correction that brings the price below my margin of safety.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.