Summary:

- Coca-Cola faces macroeconomic challenges, with shares dropping significantly and struggling to surpass the 200-day moving average despite a brief rally.

- Earnings growth is steady, but risks rise with regulatory changes under the new administration, impacting the Soft Drinks & Non-alcoholic Beverages industry.

- KO’s Q3 results beat revenue expectations but missed GAAP EPS, with strong volume but weaker pricing and gross margin below some analysts’ expectations.

- I maintain a hold rating on KO due to its fair valuation, weak technicals, and potential risks from consumer preferences and economic conditions.

Riska

There’s a cart-load full of macro factors impacting food companies in the Consumer Staples sector today. Shares of Coca-Cola (NYSE:KO) plunged from the middle of the third quarter through November. A brief bounce, which included a better-than-week-long winning streak, brought KO from $61 to $65, but the stock failed at its 200-day moving average.

Fundamentally, earnings growth is expected to be steady in the mid-single digits, but potential risks grow as President-elect Trump soon takes office. His nomination of Robert F. Kennedy, Jr. to lead the Department of Health and Human Services (HHS) sent shockwaves across the Soft Drinks & Non-alcoholic Beverages industry and many areas of both the Staples and Health Care sectors.

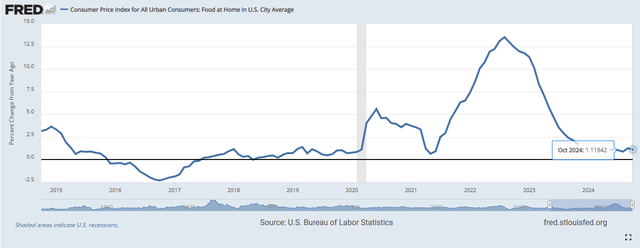

So, I reiterate a hold rating on KO. I see the Atlanta-based company as near fair value with a somewhat weak chart heading into the Santa-Claus season, which is associated with the $274 billion market cap American staple. CPI growth for food is also tepid.

Consumer Price Index for All Urban Consumers: Food at Home in U.S. City Average

Back in October, Coca-Cola reported a solid set of quarterly results. Q3 non-GAAP EPS of $0.77 topped the Wall Street consensus forecast by two pennies while revenue of $11.9 billion, down 0.8% from the same period a year earlier, was a material $290 million beat. KO grew organic revenues by 9%, but it did miss on its GAAP per-share earnings expectation.

Shares ended down by more than 2% in the session that followed – its worst earnings-day reaction going back over the last three years. It was really a pricing-over-volume story for Coke – sales performance included a 10% growth in price/mix and a 2% decline in sales.

The management team’s guidance didn’t feature many surprises; as of late October, the company sees constant-currency operating EPS growth of 14-15% with FY 2024 free cash flow excluding an IRS tax litigation deposit of $9.2 billion.

While its volume numbers were very strong compared to forecasts, the gross margin was solid, but below some analysts’ expectations amid weaker pricing – and that’s a risk looking ahead given sagging Food at Home CPI and a more cost-conscious consumer.

A stronger US dollar is another bearish factor for 2025 earnings. I’ll also be watching how its ex-US sales perform – Latin America was strong in Q3, but that region has recently undergone geopolitical turbulence, particularly in Brazil.

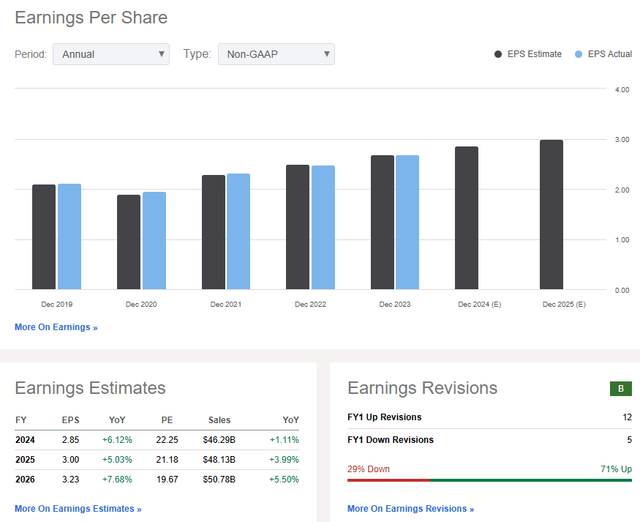

On the earnings outlook, analysts foresee annual EPS growth in the 5% to 8% range for FY 2024 through the out year and 2026. Coca-Cola’s top line is seen rising at a slower pace, but the sell side remains generally sanguine on the profitability trend.

In the last three months, there have been 12 EPS upgrades, compared to just five downgrades. Moreover, free cash flow per share had been averaging about $2.20 before the tax deposit in Q3, so the normalized free cash flow yield is about 3.5%.

KO: Revenue & Earnings Forecasts, EPS Revision Trends

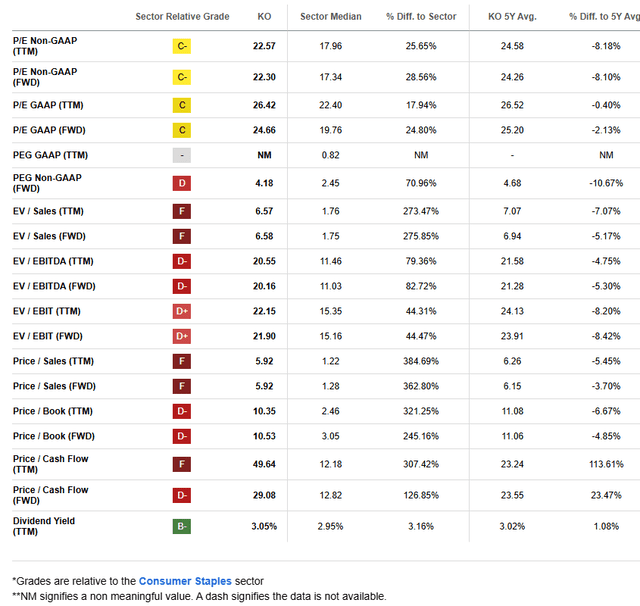

On valuation, KO typically trades at a premium P/E given its strong moat and industry position. Reliable earnings growth, though modest, also supports the valuation. I don’t see the stock has a compelling value or GARP play today.

If we assume $3 of EPS over the next 12 months and apply a 22x multiple, slightly below its long-term average due to heightened uncertainty around health policy in the new administration, then shares should be near $66. While that’s a notable intrinsic value increase from my January analysis, a poor chart and dreadful relative strength keep KO a hold.

Shares also trade a bit expensive on a price-to-sales basis.

KO: Somewhat Attractive on Earnings, Less Compelling on Sales

Key risks for KO include changing consumer preferences and adverse regulatory changes domestically. Weaker economic growth in developed and emerging markets could also lead to softer overall sales and earnings growth.

A strong dollar and weaker consumer spending at home could also lead to a weaker-than-expected 2025.

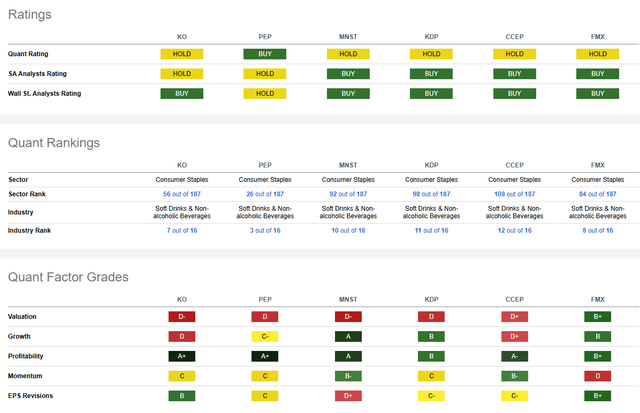

Competitor Analysis

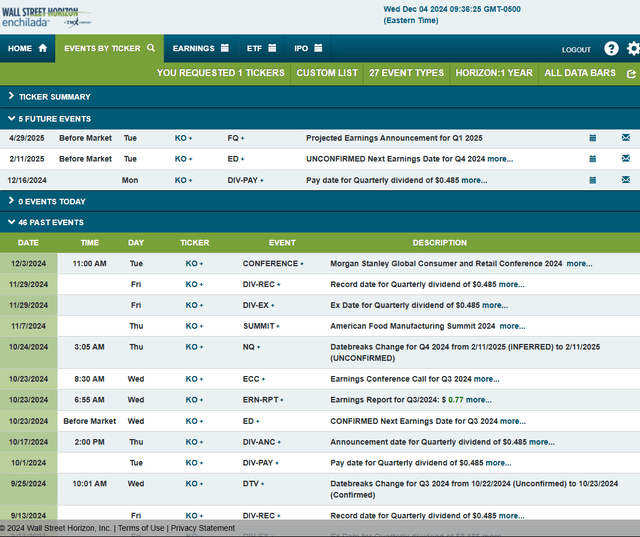

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2024 earnings date of Tuesday, February 11 BMO. Before that, shares pay a $0.485 quarterly dividend on Monday, December 16. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

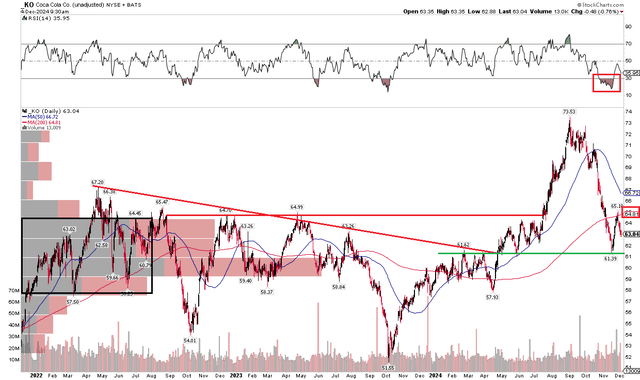

The Technical Take

KO rallied big during the middle of the year, jumping to an all-time high after busting through key resistance in the $63 to $65 zone that I pointed out back in the first quarter. Notice in the chart below, though, that the bears reasserted themselves. The Staples stock plunged almost 20% to support near $61. Moreover, KO is now under its long-term 200-day moving average, which is a negative signal as the 50dma comes back down to earth. A bearish death cross pattern is possible in the weeks ahead.

But take a look at the RSI momentum oscillator at the top of the graph – it has worked off technically oversold conditions while a high amount of volume by price is seen in the current price area – that should act as support for the underperforming blue chip.

Going forward, I see resistance back again at $65 while $61 is support.

KO: Shares Retreat to $61 Support, $65 Back In Play As Resistance

The Bottom Line

I have a hold rating on KO. Shares are up modestly from my January analysis but have underperformed the S&P 500 by nearly 20 percentage points. Though I see the company’s equity as slightly undervalued on earnings, the technical situation is far from bullish.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.