Summary:

- KO is not a buy right now; Hold.

- KO’s P/E is high and the yield is below its average.

- An alternative investment is provided.

Justin Sullivan

Coca-Cola Is Not A Buy Right Now

You’ve likely already seen the latest print for Coca-Cola (NYSE:KO). And, the analysts are happy:

On Wall Street, the reaction from analysts has been highly favorable. Morgan Stanley reiterated an Overweight rating. Analyst Dara Mohsenian and team’s breakdown was that underlying momentum for Coca-Cola (KO) remains robust and full-year EPS visibility has increased after the better than expected Q1.

Plus…

Wells Fargo said Coca-Cola (KO) overcame the sales bar, which had been a concern. Strength in the away-from-home category was noted to help KO over-deliver on volume.

And…

Meanwhile, Bank of America maintained a Buy rating and price objective of $74 on KO that is based on a 26X multiple to the firm’s FY24 EPS estimate.

Frankly, I don’t get it. While it’s true that KO is a world class company, with world class operations, brands, and the like, it’s simply not a great deal. In fact, it hasn’t been a good deal for at least six months. And, it hasn’t been a great deal for at least two years, but probably more than that.

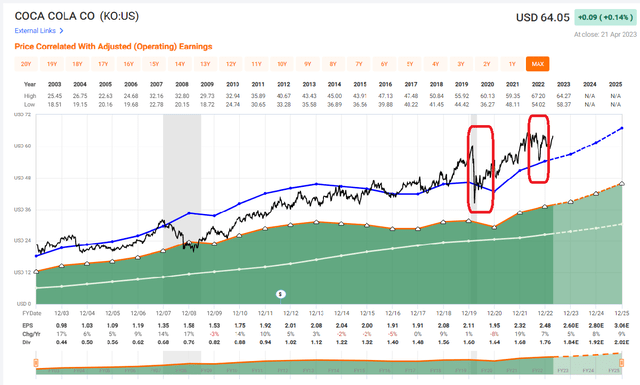

Viewing KO from outer space gives us a view that says it all. Take a gander at October 2022 and then the middle of 2020:

KO 20-Year Valuation (FASTgraphs)

Again, roughly speaking, other than what I’ve indicated, KO has been riding above an already elevated valuation trend. There was something like a reasonable opportunity to grab KO in 2020 and a short window to grab KO in 2022 at prices that made some sense.

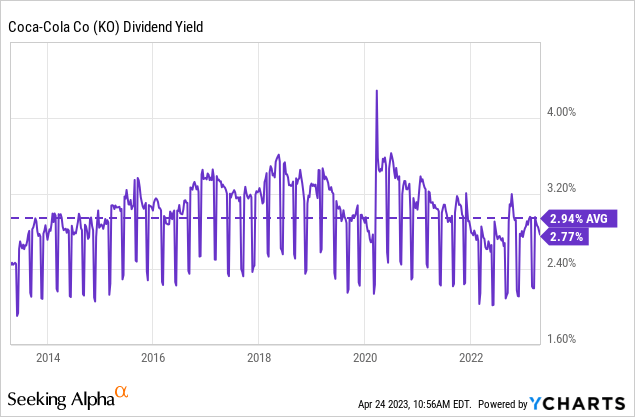

If that’s not good enough, I understand. It’s simplistic. So, let’s see how the valuation looks through the lens of KO’s yield. This is rational, especially for dividend growth and income investors, or perhaps even buy-and-hold forever investors.

Per YCharts, KO’s yield is 2.77%, as you’ll see above. As a sanity check, and using the data in front of me, my own calculations of $1.84 per year and $64.40 per share indicate that KO is sporting a 2.85% yield. Toe-MAY-Toe or Toe-MA-Toe, really.

The point is that KO’s yield today is below its 10 year average. Personally, I don’t even think about KO unless I’m seeing a dividend yield of a least 3%. Then, I only start to look closer when the yield hits 3.25% or higher.

So, the above average or even high valuation of KO makes this an easy pass. This is further confirmed, in a simplistic manner, using KO’s yield as a guide. In other words, KO is not a buy, and is perhaps a Hold right now.

My History

How’d I get here? I literally bought my first KO shares back in June 2013. Here’s how I added over time:

- Added on 18-Feb-2014 @ $37.29

- Added on 24-Feb-2014 @ $37.48

- Added on 01-July-2015 @ $39.49

- Added on 13-May-2020 @ $44.22

So, my buys in 2014 are up about 8% annualized and the P/E was about 19 at that time. My buy in 2015 is about 8.5% when the P/E was around 20. And, my buy in 2020 has returned about 16% when the P/E was about 21 or perhaps 22. Being exact isn’t necessary here.

The point is simple, at least for me. Seeing a P/E up around 24 or 25 right now makes this a Hold. It’s not like we’re seeing a P/E of 30, or higher. So, clearly for most long-term buy and hold investors, KO isn’t a Sell. But, it’s also not a Buy at these prices.

Let’s pause and add it all up. The analysts are gushing. They are loving KO. But, the truth is pretty clear to me. First, the price is well above the trendline. Second, the yield is below its own average. Third, the P/E ratio also confirms that KO is not undervalued.

In my opinion, the analysts are wrong. KO is doing just fine as a business. It’s one of the best in the world. There’s no doubt about it in my mind. But, even my basic, 5th grade level analysis above tells me that now is not the time to buy KO. There’s no reason to dig any deeper on the fundamentals at this point, or any technical analysis or anything like that at all.

Do This Instead

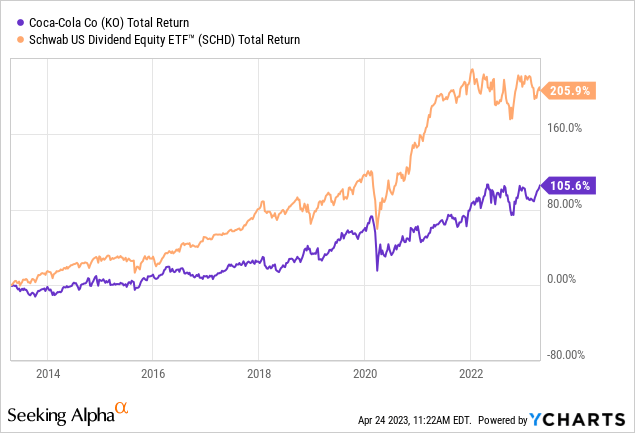

If you’re desperate to buy something right now, you could do far worse than grabbing Schwab U.S. Dividend Equity ETF (SCHD). I’ve already explained how I think of SCHD as a benchmarking tool, so I won’t go in that direction. Instead, I’ll just quickly show how KO compares to SCHD over a decade.

First, on 10-year total return:

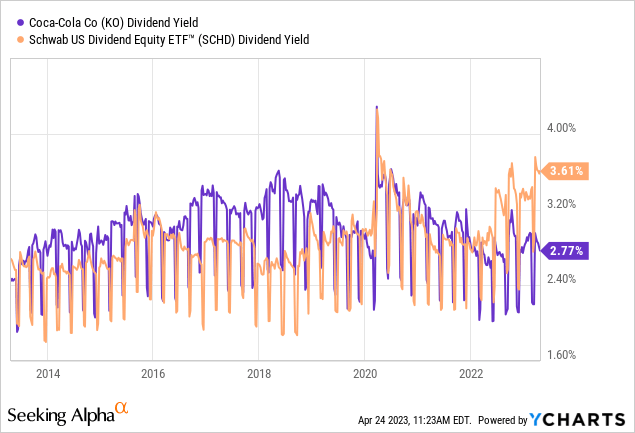

Second, on 10-year yield:

I’ll pause here for a moment. You can see that SCHD handily beats KO in returns over the years. But, in fairness, you can also see that there were several points where KO’s yield was superior. From let’s say 2015 to 2019, KO was the winner. However, since 2022, SCHD is ahead in terms of yield.

It’s been a while since KO’s yield made it worth buying versus SCHD. Furthermore, long-term, total return investors would be far ahead of KO. What’s more, right now, KO’s P/E ratio is way higher than SCHD’s. Keeping it kind of dumb and simple, KO’s way over 20 and SCHD’s is well below. The gap is big enough that it’s not worth trying even do back-of-napkin calculations. That alone tells you which is likely the better deal, if not far better deal today.

Wrap Up

Putting all this together, yet again: Hold KO, or at least don’t buy. And, if you’re desperate to deploy funds, then maybe SCHD is better and smarter. You might say that SCHD is a Buy, but that depends on your current portfolio, your goals, and all the usual caveats.

I might also say again that I think the analysts are wrong. Yes, they are smart, and directionally they are right. KO is a great company and the situation actually looks pretty good. But, the price? The yield? Think for yourself, look at the data, and draw your own rational conclusions.

Lastly, I think SCHD could be a good alternative, as I’ve expressed above. It’s a good way to juxtapose KO with a benchmark. But, it’s also a reasonable place to deploy funds, if you’re looking for a better value right now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO, SCHD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.