Summary:

- Coca-Cola, the world’s second-largest beverage company, remains a strong investment option with a market cap of $260.99 billion and a history of increasing dividend payouts.

- The company’s growth opportunities include its category expansion, focus on emerging markets and heavy investment in data analytics and supply chain optimisation.

- Despite risks such as currency fluctuations and challenges in the carbonated soft drink market, analysts remain bullish on the stock, which has consistently met or beaten earnings and revenue expectations.

karandaev

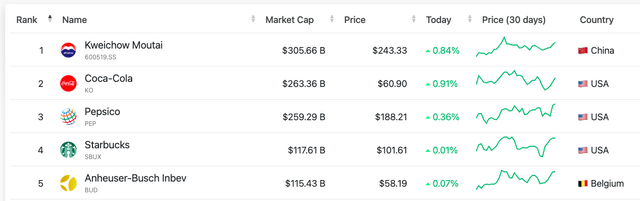

Coca-Cola Company (NYSE:KO) is ranked second among the world’s largest beverage companies, with a market cap of $260.99 billion. The stock is known for its consistent dividend payouts, having increased them for the past sixty years. It is also one of Berkshire Hathaway’s key investments, accounting for 6.76% of the portfolio. Unsurprisingly, the stock trades at a premium and currently has a FWD price-to-earnings ratio of 23.17, although this is 3.14% below its five-year average. Over the past five years, investors have enjoyed a return of 36.15%.

Five-year stock trend (SeekingAlpha.com)

Coca-Cola has been expanding beyond sodas since 2017, with the goal of becoming a total beverage company and increasing its TAM potential. While market headwinds are a concern in the short-term, I believe that Coca-Cola is a timeless company with long-term growth potential due to its beverage diversification strategy and expansion into emerging and growing markets. Furthermore, earlier this week PepsiCo (PEP), the world’s third-largest beverage company, recently announced strong earnings results. This could indicate positive prospects for Coca-Cola’s Q2 2023 Earnings, which are due to be released on July 26th. As a result, investors may want to consider taking a bullish stance on this stock.

Company overview

Coca-Cola, the world’s largest beverage company, was established 130 years ago. It boasts 200 bottling partners, 950 production facilities, and 30 million retail outlets worldwide. With a portfolio of over 200 brands, Coca-Cola offers a diverse range of products including carbonated soft drinks, water, sports drinks, energy drinks, juice, and coffee. 26 of these brands generate over 1 billion dollars in revenue. Coca-Cola operates in more than 200 countries, with two-thirds of its revenue coming from international operations. The company has been expanding beyond soft drinks since 2017, focusing on becoming a total beverage company. Emerging economies in Latin America and Asia have become significant sources of revenue for Coca-Cola.

Total beverage company (Envisionreports.com)

Long term growth opportunities

Coca-Cola has promising long-term growth strategies that involve expanding their beverage categories, targeting emerging and growing markets, and investing heavily in technology and data analytics. We have seen the company enter the coffee category through the Costa acquisition in 2019 with the aim of increasing their foothold in this category and gathering more consumer insights. Additionally, we are seeing Coca-Cola diversifying into the alcohol industry through experimentation.

Experimenting with alcohol (coca-colacompany.com)

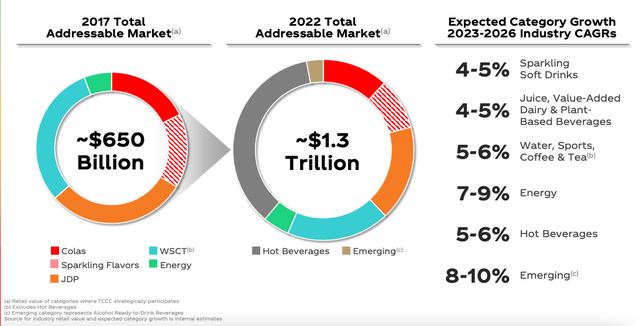

We can observe the potential for market growth in several beverage categories below, and the impact expansion has to increase the total addressable market, which increased from $650 billion in 2017 to $1.3 trillion in 2022 with the total beverage strategy.

Wider range of beverages (Investor Presentation 2023)

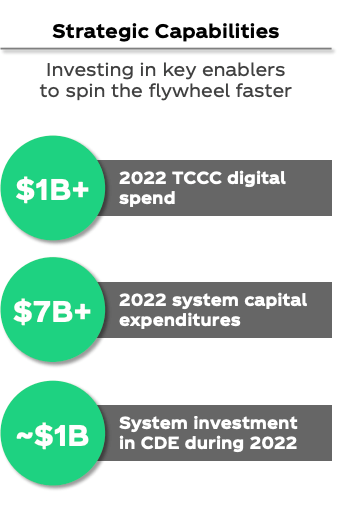

Coca-Cola has heavily invested in technology, data analytics, and optimisation capabilities for the year 2022.

Investing in technology (Investor presentation 2023)

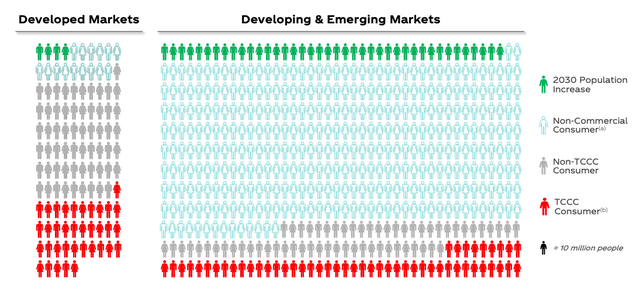

Finally, the company is expanding its growth by concentrating on emerging markets worldwide, which currently represent the majority of its overall revenue. The approach involves increasing the production of classic products and introducing new ones that are customised to suit local preferences.

Tailored products (Investor presentation 2023)

Growth potential in emerging economies (SeekingAlpha.com)

Although performance in the short term continues to be impacted by near-term market headwinds such as high inflation and increasing raw material costs due to geopolitical factors. Earlier this week, we have seen beverage peer PepsiCo report strong quarterly results, and Coca-Cola HBC raised its financial guidance for FY 2023 after a strong first-half performance which all indicate that Coca-Cola could have a similarly strong performance.

Upcoming earnings release

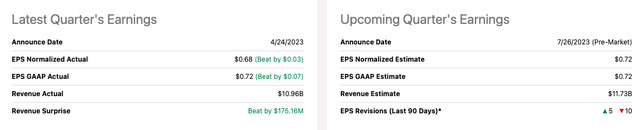

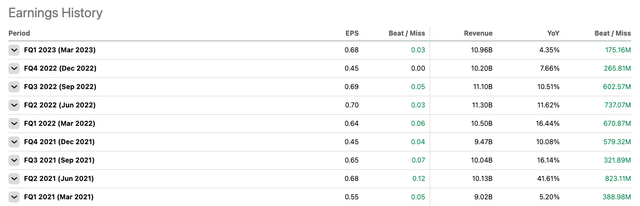

Later this month, Coca-Cola will release its Q2 2023 Earnings results. However, in the last ninety days, there have been more negative revisions to the EPS than positive ones. The current consensus is that the EPS will be $0.72.

Earnings overview (SeekingAlpha.com)

Over the past nine quarters, Coca-Cola has consistently exceeded earnings and revenue expectations. Additionally, their annual EPS have increased by 53% over the last five years. It is also worth noting that their growth per share is outpacing share dilution, due to the small number of shares issued.

Quarterly Earnings history (SeekingAlpha.com)

Financials and valuation

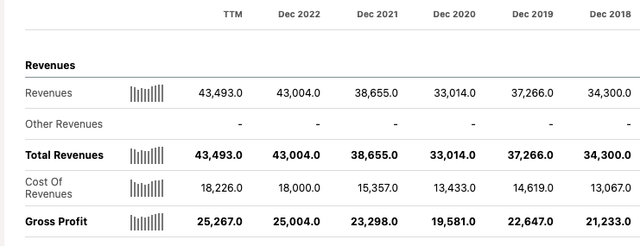

Over the past several years, Coca-Cola has consistently delivered impressive financial results in both its revenue and profits. Additionally, the company has generated strong cash flow and has been reducing its debt levels. It’s worth noting that over the last three fiscal years, Coca-Cola has experienced steady revenue growth.

Annual revenue growth (SeekingAlpha.com)

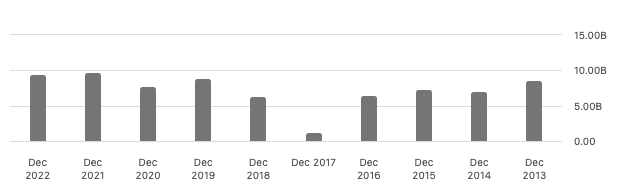

If we exclude the COVID-19 FY2020 outlier, the net income has shown a consistent increase over the past five financial years.

Annual net income (SeekingAlpha.com)

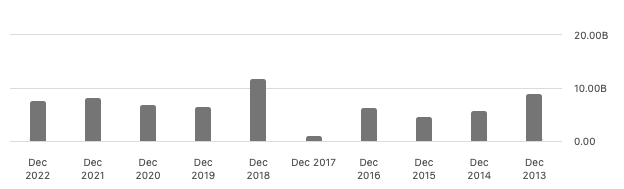

For the last four years, Coca-Cola has seen a steady increase in its leveraged free cash flow, which has remained positive. This has enabled the company to reinvest in its business, offer rewards to its shareholders, and pay off any outstanding debts.

Annual levered free cash flow (SeekingAlpha.com)

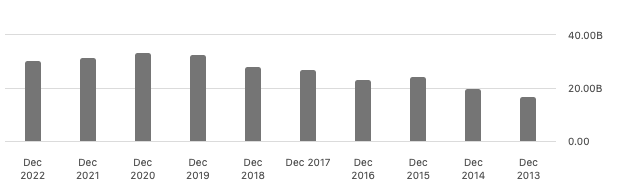

Over the past 10 years, Coca-Cola’s net debt has risen, but in the last three years, they have been decreasing their debt levels and currently sit at $29.57 billion. Additionally, Coca-Cola has a significant amount of cash on hand, with $14.3 billion compared to their debt. When examining liquidity, their current ratio of 1.15 suggests they can cover their short-term liabilities.

Annual net debt (SeekingAlpha.com)

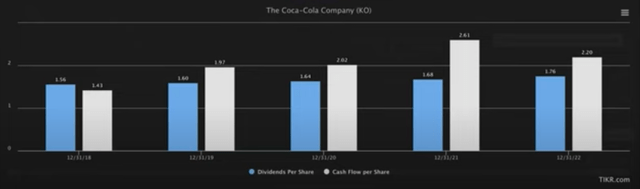

One of the major reasons to invest in this stock is its dividend. Coca-Cola is a dividend king, raising its dividend for the last sixty years. This is one of the longest track records of any business. It pays an above-average dividend yield of 3.05%. In four financial years, Coca-Cola has used its cash flow to support its dividend.

Dividend versus cash flow per share (TIKR.com)

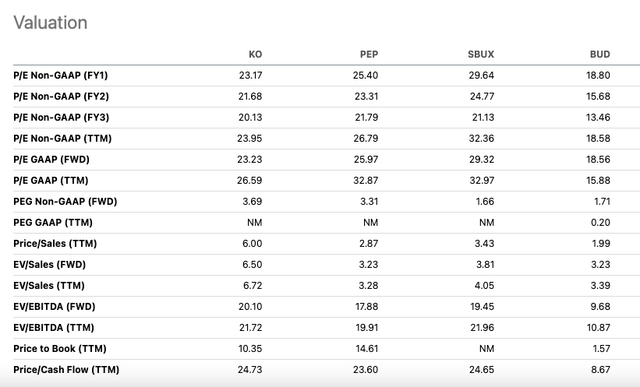

According to analysts, the stock is looking good, with a 4.19 Buy rating given by Wall Street. It is currently trading below the average price target of $59.54 and has a low short interest at 0.50%, indicating that there is positive sentiment towards the stock. When compared to other major players in the market, Coca-Cola has a high price-to-sales ratio of 6, which is much higher than its peers. This suggests that the stock may be overpriced. However, if we take a look at the FWD price-to-earnings ratio, it is high at 23.95 but still lower than that of its direct competitor, PepsiCo (PEP).

Largest beverage companies by market cap (Companiesmarketcap.com)

Relative peer valuation (SeekingAlpha.com)

Risks

It’s important to be aware of certain risks. As of now, two-thirds of the company’s revenue comes from international markets, resulting in revenue fluctuations due to currency changes. Additionally, the company needs to invest more in their non-sparkling product offerings to strengthen their position in the market. Challenges such as a decline in demand for carbonated drinks in developed markets pose a threat to long-term growth. The World Health Organisation has declared aspartame as “possibly carcinogenic” to humans, which could have an impact on future growth.

Final thoughts

Coca-Cola is an enormous company that offers a generous dividend program and maintains growth through category expansion, focusing on emerging markets and investing in technology and data analytics. Despite its high price-to-earnings ratio that may not yield the same returns as Warren Buffett’s investment back in 1988, it still presents a promising long-term opportunity. Therefore, investors may want to take a bullish stance on this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.