Summary:

- Strong organic sales help The Coca-Cola Company beat expectations.

- Pricing power stands out in the earnings report.

- A forward multiple of 25 is still too rich for me as good as The Coca-Cola Company stock is.

- Free cash flow is my biggest area of concern.

AlizadaStudios

The Coca-Cola Company (NYSE:KO) has just reported its Q1 results, as Seeking Alpha has covered here. While the previous quarter (FY 2022 Q4) was a mixed bag, FY 2023 Q1 reminds me of the company’s smashing FY 2022 Q3, with almost all boxes being ticked. No wonder the stock is up 1.50% pre-market, although this can change on a dime.

I have a history of reviewing Coca-Cola’s earnings, as can be seen here and here. Referencing past articles and using the same approach to cover the latest numbers not only holds the authors accountable but also leads to consistent quarter-on-quarter or year-on-year comparisons. Let’s take a look at some of the highlights from the recent Q1 earnings.

- EPS of 68 cents beat expectations by 3 cents. More importantly, EPS shows an increase of 4 cents YoY. That’s a 6.25% increase for a company looked down for its growth prospects. Not too shabby.

- Revenue of $11 Billion beat by a healthy $220 Million. This, once again, is higher YoY, a 5% increase from the $10.50 Billion reported in the same quarter last year.

- Organic sales came in at 12%, well above the consensus of 9.6%.

- Global unit case volume rose 3% in Q1 while it declined 1% in Q4. This is an often overlooked but important metric for Coca-Cola. It includes beverages sold directly and indirectly by Coca-Cola and its partners.

- Throughout the report, Coca-Cola has mentioned at least 5 times that its pricing power helped its growth in many regions and product segments. This should surprise no one given the company’s brand power as is, in addition to the current inflationary environment.

- Despite the pricing power, operating margin declined from 32.50% to 30.70% on a YoY comparison, partially due to currency headwinds. This can also be a sign that not just Coca-Cola has the pricing power but its partners do as well.

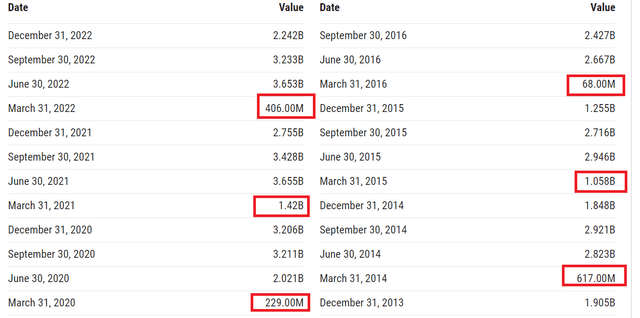

- Free Cash Flow (“FCF”) for the quarter was -$120 Million. Wait, what? A quarter with negative FCF for this cash flow machine? Yup. This, once again, highlights the concern I brought up in my previous Coca-Cola article after the company increased its dividend. I am not pressing the panic button yet but I am monitoring this metric closely every quarter. I’d also like to point out that historically, Q1 has been Coca-Cola’s weakest quarter when it comes to FCF as highlighted by the red boxes below.

- Coca-Cola has managed to gain market share in Nonalcoholic-Ready-To-Drink (“NARTD”) in both U.S and international markets., with the exception of Latin America, especially Mexico. With not many avenues to increase sales organically, NARTD is an important market for Coca-Cola, as it is expected to grow at about 6%/yr till to reach about $1.5 Trillion in 2030.

In summary, Coca-Cola had a stronger than expected Q1, thanks to its pricing power and organic sales. Free Cash Flow looks worrying and I am hoping this does not become a trend.

Outlook and Conclusion

All the above is in the rearview mirror. What is the outlook for Coca-Cola shares here on?

- The strength in organic sales has emboldened the company to reaffirm its organic revenue growth target between 7% and 8%.

- With today’s EPS announcement, we can confidently up FY 2023’s EPS projection to at least $2.63 given the company’s conservative guidance history. That would represent a forward multiple of 24.75 given the pre-market price action. With an expected earnings growth rate of 6% at best, that’s a Price-Earnings/Growth (“PEG”) of more than 4 for those who believe valuation matters irrespective of a stock’s pedigree.

- I was relieved to see the company is still guiding to $9.50 Billion in FCF for the FY, despite the blip in Q1. Given the new annual dividend of $1.84/share, Coca-Cola should set aside almost $8 Billion to cover its dividend commitment, based on current outstanding share count of 4.326 Billion. The payout ratio based on FCF is now almost 85% based on these numbers (i.e., $8 Billion divided by $9.50 Billion). This is definitely my biggest concern with Coca-Cola. I’d like to see this number ease into the 70s at least.

- At the time of my Q4 review, Coca-Cola had underperformed the S&P 500 Index (SP500) by about 10% YTD, making a case to consider the stock. With the stock’s strong performance since then, the gap is now down to 6%. If anything, this has only made the stock less compelling to buy here.

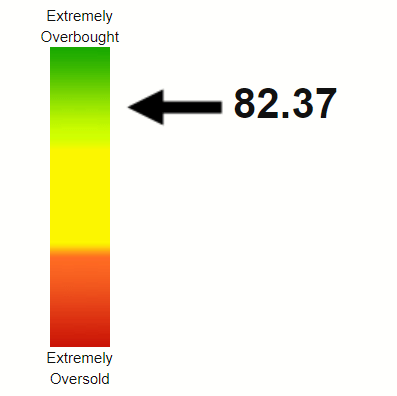

- Lastly, the stock is extremely overbought as shown by its Relative Strength Index (“RSI”) reaching 82 ahead of today’s price action. If the pre-market action holds and if analyst upgrades flow in, expect the stock to get even more overbought.

KO RSI (Stockrsi.com)

To conclude, The Coca-Cola Company stock is at least fully valued, if not overvalued here. As much as I love the stock’s safety and ever-growing dividends, everything has a fair price. And the price just isn’t right here for Coca-Cola.

Oh, I almost forgot the title. So, here you go for The Coca-Cola Company:

Good: Organic sales, Revenue guidance, Pricing power, Stock action.

Bad: Stock valuation, Operating margin.

Ugly: Free cash flow.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.