Summary:

- All eyes are on The Coca-Cola Company as it is set to release its first-quarter earnings report on Monday, the 24th.

- Although at a slower pace, Coca-Cola is anticipated to add to its top-line.

- Inflationary headwinds in Latin America might have had a material effect in Q1. However, Coca-Cola’s EMEA and North American results will probably blossom once more.

- FX-related headwinds and restructuring costs are expected to occur over the course of 2023. Nevertheless, most are non-core and unlikely to influence the stock’s valuation.

- Based on our absolute valuation, KO stock is fairly valued. Moreover, a relative valuation analysis shows that the asset is priced in.

Justin Sullivan

The Coca-Cola Company (NYSE:KO) is set to release its first-quarter earnings report on Monday, the 24th, with consumer resilience being the central area of focus. The beverage company’s stock has surged by more than 15% in the past six months, which is impressive for a low-beta stock. Despite Coca-Cola’s robust results in 2022, the company’s outlook remains on a knife’s edge as operational mean-reversion is a strong possibility.

Here are a few factors to consider before Coca-Cola’s Q1 earnings release.

Operational Update

To provide a baseline, I would like to reference a recent opinion from Citigroup (NYSE:C) analyst, Filippo Falorni, which reads:

Near-term, we also see potential topline/EPS upside with momentum exiting Q4, strong pricing power, solid emerging markets growth. We view KO’s valuation close to the average of 4 mega-cap peers as compelling given a stronger topline growth and higher margin profile.

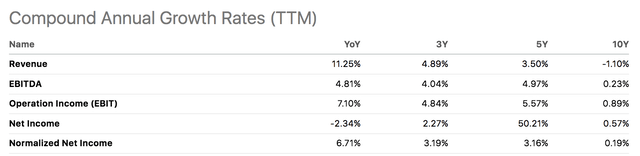

Falorni’s input aligns with the broad-based consensus of most financial analysts, which is that the company’s earnings are not sensitive to the economic cycle as it retails best-in-class consumer staples. Moreover, Coca-Cola’s hard pivot into emerging markets and its acquisition of alternative beverage brands are thought to have reignited the company’s top-line growth, which is evident by observing its growth rate distribution.

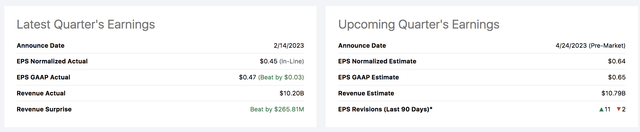

Coca-Cola trumped its earnings target in Q4 by outpacing analysts’ GAAP estimates by three cents per share. The firm’s previous quarter was steered by a 15% surge in organic turnover, stemming from a 32% spike in Latin American sales growth. Although we anticipate regional growth to remain solid, hyperinflation/high inflation in nations such as Argentina, Brazil, and Colombia must be factored into the preview of Coca-Cola’s Q1 report. In our view, high inflation will eventually curb consumer spending, even with regard to consumer staples.

Furthermore, we have not identified a reason to justify slower EMEA or North American sales in Q1. Although both regions’ economies have deteriorated over the past year, Coca-Cola’s strong brand reputation and consumer staple status likely provided it with the upper hand in Q1.

Coca-Cola has guided toward 7% to 8% in organic revenue growth for 2023. However, the firm anticipates that currency headwinds from adjustments and hedging positions will soften its growth by 2% to 3%. Additionally, Coca-Cola thinks its restructuring charges and divestiture costs will dent its top line by roughly 1%.

In our opinion, the latter is of no concern. Restructuring and M&A costs are considered non-core elements by the investors, meaning that they will probably not influence Coca-Cola stock’s valuation. However, slower sales growth and FX losses show that the broader economy and a volatile monetary policy environment pose moderate threats to Coca-Cola’s investors.

Quantitative Analysis

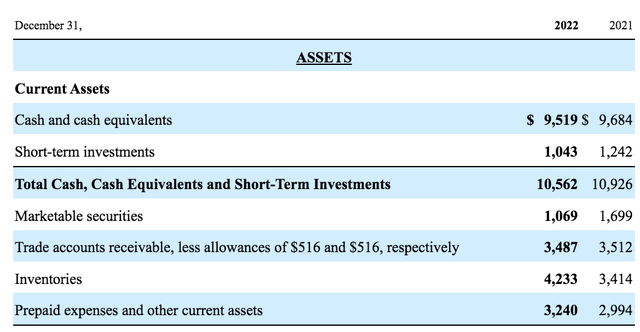

A quick look at Coca-Cola’s books conveys an interesting juxtaposition. Firstly, the company’s receivables trajectory has tapered in the past year while its inventory has increased. As a rule of thumb, the prior suggests that the company’s buyers are experiencing sound demand, while the latter implies that Coca-Cola expected stronger demand in Q1 by ramping up its available inventory.

On the other end of the playing field, Coca-Cola’s deferred income taxes increased by 3.297% during 2022, while its accounts payables and accrued expenses rose by approximately 7.73%. Although they form a small proportion of the company’s net income, these accrual-based costs will eventually need to be settled, posing a risk to the firm’s future earnings.

Current Assets (Coca-Cola 10-K)

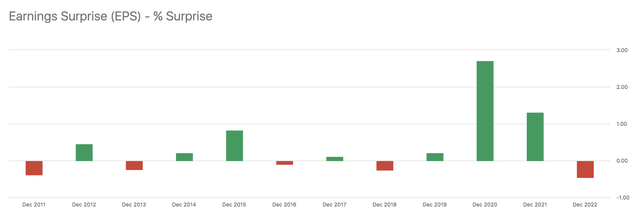

An additional factor to keep in mind is Coca-Cola’s past earnings surprises. Although a simple observation, seminal research has discovered that regular earnings beaters are likely to continue beating earnings (in the long run). Coca-Cola has surpassed seven of its last 12 earnings targets, lending me the argument to claim that it might do so once more on Monday.

KO Earnings Momentum (Seeking Alpha)

Coca-Cola Stock Valuation and Dividends

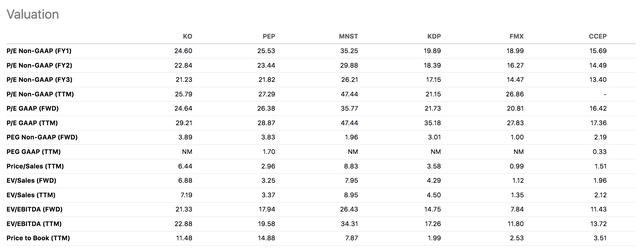

A peer comparison shows that Coca-Cola’s stock is in fair value territory. The beverage industry generally hosts elevated price multiples, and Coca-Cola’s headline multiples are more or less in line with the rest of its peers. The beverages industry is concentrated, and Coca-Cola possesses a substantial market share of 46.3%, meaning the stock’s high multiples are justified.

Based on a historical comparison, Coca-Cola’s EV/EBIT is 2.83% above its cyclical average, its price-to-book is 0.47% above its cyclical average, and its Price-to-earnings is 21.87% below its cyclical average. Although the P/E ratio provides a sign of value, our consensus is that the stock is fairly valued versus its normalized price multiples.

Peer Comparison (Seeking Alpha)

Furthermore, an absolute valuation also shows that Coca-Cola’s stock is fairly valued. I used an expanded P/E model to price the stock, which presented me with an intrinsic value of $64.

Model: 5-year Average P/E x EPS Forecast for Dec 2023 = 24.65 x 2.60 = $64.

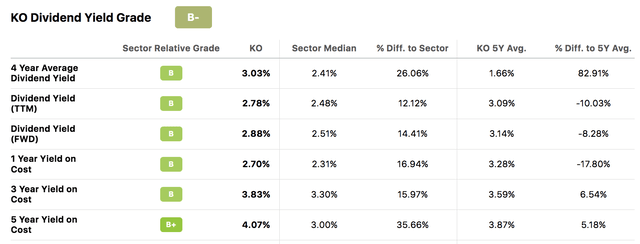

Considering Coca-Cola’s current price multiples and forecasted growth rates, its stock is most likely fairly valued with little upside potential. However, the asset provides a lucrative dividend with an average 5-year yield-on-cost of 4.07%. As such, Coca-Cola’s limited upside potential is phased out by attractive income-based benefits.

Final Word

To conclude, Coca-Cola’s first-quarter results will probably land softer than its 2022 results. Nonetheless, although at a slower pace, it is thought that the company experienced additional growth during Q1.

Features such as resilient inflation in Latin America and FX headwinds pose risks to Coca-Cola’s investors. However, the firm’s solid brand exposure and consumer staples status means it is unlikely to have suffered from macroeconomic headwinds in its stable regions such as North America, Europe, and Asia.

An extensive valuation analysis shows that Coca-Cola’s stock is fairly valued. Yet, its impressive dividend yield-on-cost phases out much of its price disadvantages.

In our view, Coca-Cola’s Q1 report will not present many material surprises, and the stock will trade flat for the remainder of 2023.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>