Summary:

- Coca-Cola is expected to report a Q2 EPS of 72 cents on revenue of $11.73 billion, representing approximately 3% growth on EPS and 4% growth on revenue.

- Current oversold conditions has sent the stock’s yield above the significant 3% mark.

- I will be paying close attention to Q2’s Free Cash Flow.

Georgiy Datsenko

The Coca-Cola Company (NYSE:KO) is set to announce its Q2 earnings pre-market on Wednesday, July 26. Analysts expect the beverage industry behemoth to report an EPS of 72 cents on revenue of $11.73 billion. Should Coca-Cola meet these numbers, it’d represent approximately 3% growth on EPS and 4% growth on revenue. It should be noted that archival PepsiCo (PEP) recently reported strong earnings as organic sales helped the company beat on both top and bottom line.

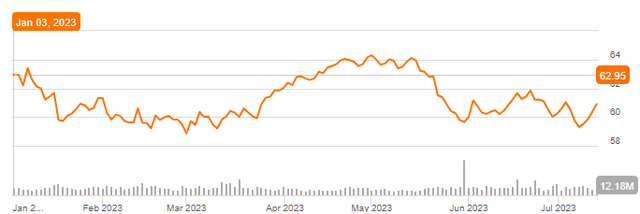

Coca-Cola Stock YTD (Seekingalpha.com)

I reviewed Coca-Cola’s Q1 earnings in April and rated the stock a “Hold”. Since then, Coca-Cola’s stock has lost nearly 6% compared to the S&P 500’s 9% gain. In addition, despite the strong market action YTD, Coca-Cola’s stock is down more than 3% (excluding dividends). But, I am far from surprised at this price action, as investors have chased growth and risky assets far more in 2023 than they did in 2022. I believe this presents a good opportunity for long term investors to accumulate shares in stable companies like Coca-Cola, which did far better than the market and your average technology stock in 2022 when reality seemed to have returned, albeit temporarily in hindsight.

I present three reasons why I believe Coca-Cola is a “Buy” as we head into Q2 earnings. As a bonus, I also present a key metric that I will be watching in the company’s earnings report. Let us get into the details.

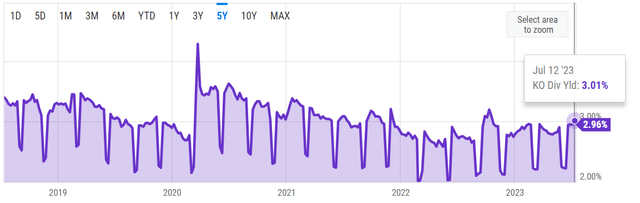

Reason #1: 3% Yield is Here

Long term investors and followers of Coca-Cola likely know that the stock has rarely been a very high yielding stock, despite its (justified) reputation as a dividend growth champion. I’ve written about this in the past, arguing that stocks like Coca-Cola have an implicit base price that tends to nudge up each year as the dividend is increased.

Given Coca-Cola’s slowing dividend growth, you may not notice this instantly each year, but the long-term effect is apparent. For example, 10 years ago in 2013 when the stock paid an annual dividend of $1.12, the 3% yield was at $37.33. Fast-forward 10 years now in 2023, the 3% yield is at $61.33 given the current annual dividend of $1.84. Almost always through this time period (except COVID lows), Coca-Cola stock has rarely yielded above 3%. This means only one thing: stock-price catches up slowly but surely over the years with increasing dividends.

Coca-Cola 3% Yield (YCharts.com)

Now, if you believe 5 years is too short a time frame, here is a chart showing Coca-Cola’s yield over 35 years. To put that history into context, Warren Buffett bought Coca-Cola 35 years ago. The two red circles represent outlier events that sent the yield above 4%: 2009 financial crisis and 2020 COVID.

Coca-Cola 35-Year Yield (YCharts.com)

Reason #2: The Twin Effect

Okay, PepsiCo and Coca-Cola are not twins. They are rivals. But then, many twins and siblings in general are rivals. So, PepsiCo and Coca-Cola may actually be the lost brothers (or sisters) from the same mother? I digress.

With PepsiCo reporting strong numbers recently, it is likely that Coca-Cola follows suit. Even though these two are rivals, their core consumers are generally deep-rooted, meaning PepsiCo having a good quarter was unlikely to be at the expense of Coca-Cola but rather a sign that the market conditions were in favor of the industry. Strong organic sales numbers have sent Coca-Cola’s stock higher in the past, and PepsiCo’s recent report had plenty of highlights in that regard, including but not limited to:

- 13% organic sales growth in Q2

- 10% full-year organic growth in revenue vs. 8% estimate

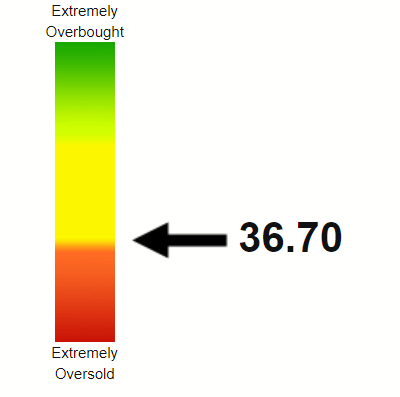

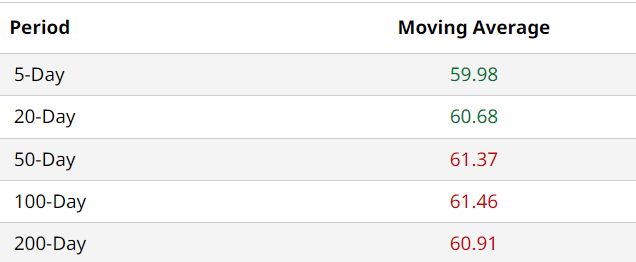

Reason #3: Technically Oversold But Showing Signs

Coca-Cola stock’s Relative Strength Index (“RSI”) of 37 shows the stock is very close to the textbook oversold condition. However, an encouraging sign for those who follow technical signs is that the stock has just reached its 200-Day moving average, as shown in the table below. A good earnings report should set the stock for a relief really at the very least if not a sustained uptrend from here.

Coca-Cola RSI (Stockrsi.com)

Coca-Cola Moving Average (Barchart.com)

Earnings – Free Cash Flow Concerns

Frequent readers of my articles know that I prefer Free Cash Flow [FCF] over Earnings Per Share [EPS] when it comes to understanding my stock’s dividend safety. Coca-Cola right now is a good example of why. With the company’s expected annual EPS of $2.61 and current annual dividend of $1.84, the payout ratio works out to a comfortable 70%. However, FCF started conveying a different story of late.

After Coca-Cola announced its 61st consecutive annual dividend increase in February, I wrote that the stock’s FCF concerned me despite the dividend increase. This concern was allayed a little after Q1 results, but one quarter does not change the story much, in either direction. Hence, I will be paying close attention to Coca-Cola’s Free Cash Flow in Q2, as the company needs close to $2 billion in average quarterly FCF to cover its dividend commitment to shareholders. This is based on the total shares outstanding of 4.32 billion and the current quarterly dividend of 46 cents/share.

Conclusion

The recent development around Aspartame and how it may impact the likes of Coca-Cola and PepsiCo is something to be monitored. However, Coca-Cola has been through many challenges in its existence since 1886, and I fully expect the company to find a way around potential challenges with Diet drinks, especially.

This may not be a bad time to initiate or add to your holdings. I see it as a win-win. If the company reports a strong Q2, the stock will pop given the current undervalued/oversold conditions. If the stock sells off, you get an opportunity to buy/add at a yield point that has been rare to come by over the last 35 years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.