Summary:

- For the umpteenth time, Coca-Cola beats analysts’ estimates.

- I believe its pricing power makes this company “recession-proof”.

- Currently, it may be overvalued. This is the only flaw in my view.

fotostorm

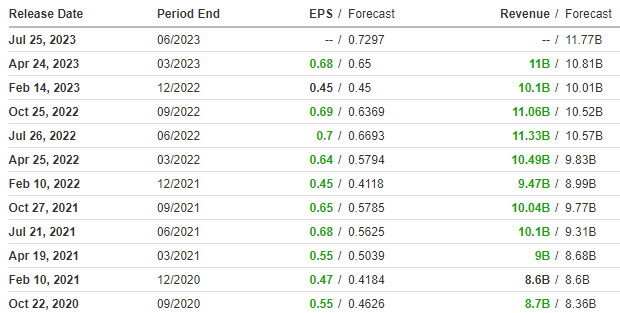

For the umpteenth time, Coca-Cola (NYSE:KO) beats analysts’ estimates by reporting Q1 2023 EPS of $0.68 and revenues of $11 billion; estimates were $0.65 and $10.81 billion, respectively.

Investing.com

By now it is no longer news that this company beats estimates and seems to have no breaks even in the face of a potential recession. The strength of its brand is unparalleled, and its consumers probably cannot do without its products even during the worst of macroeconomic scenarios.

Comment on Q1 2023

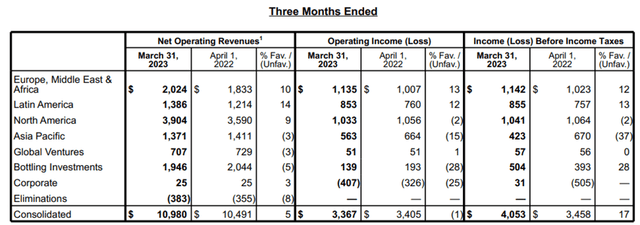

As can be seen from this table, both net operating revenues and pretax profit saw a marked improvement over Q1 2022, by 5% and 17% respectively. The geographic segments where Coca-Cola achieved major improvement are mainly Europe, Middle East & Africa, and Latin America, while North America generated good growth in revenues but not in pre-tax profit. The reason for the stalemate in the latter segment is attributed to heavy marketing investments and higher operating costs. Overall, I think we can still view this quarter as a success.

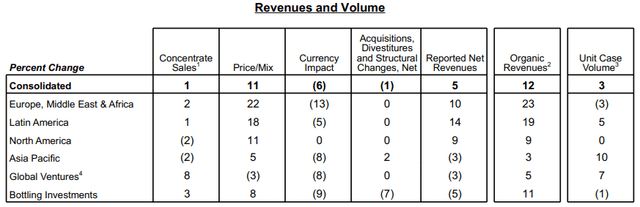

Going into more detail on the results in the table above, we can see how much the price/mix component affected the positive net revenue performance. Without it, Coca-Cola could never have done better than Q1 2022, especially considering that the strong dollar had a negative impact of 6%.

On this aspect, I would like to link back to what was said in the intro of this article: the pricing power of this company is its greatest strength.

Although prices increased by 11%, unit case volume still increased by 3% overall. In short, consumers don’t seem to mind paying a few cents more for a can. A small, insignificant impact on the millions of consumers, in this case, was crucial in recording yet another successful quarterly report.

Finally, there is one last important aspect to mention: To combat inflation, Coca-Cola did not just raise prices. Within the column recording an 11% improvement in net revenues is not only price but also mix. By this mix, the company refers to packaging practices adopted according to what is known as the shrinkflation process.

In order for the company to achieve a revenue improvement without necessarily changing the perception of the price of Coca-Cola drinks, it preferred to simply leave the price the same but reduce the size of the package. People check the price more often than the quantity, and the consumer without even realizing it buys at the same price as before a bottle with 50ml less. This 50ml less does not affect the consumer’s purchase choice, but it helps Coca-Cola to make its product sell at a higher price per quantity sold. This is a very common practice among consumer staples companies with pricing power.

Valuation

After a great quarterly report and having once again demonstrated its resilience, is it then time to buy Coca-Cola? In my opinion, no, it is better to wait until the price per share reaches more appropriate levels.

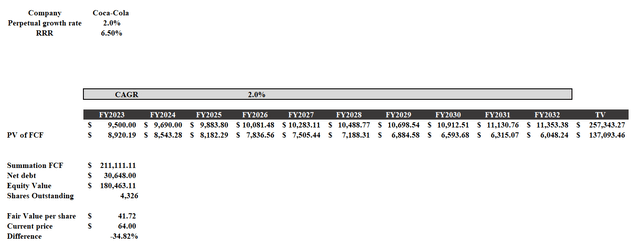

The fact that this company is among the most highly valued does not necessarily mean that it is a buy. The company and its current valuation are two separate aspects. To understand its fair value, it is necessary to create a discounted cash flow model.

This model will be constructed as follows:

- The expected free cash flow for FY2023 will be $9.50 billion as projected by the company. From 2023 onward, I have considered an annual growth rate of 2%, being the free cash flow growth rate of the last 10 years. The perpetual growth rate will also be 2%. Certainly, growth is not Coca-Cola’s strength.

- The required rate of return was calculated through the CAPM formula. According to GuruFocus, the result was 6.50%. Quite a low return, but it is inevitable for a defensive company like Coca-Cola.

According to these assumptions, the fair value of Coca-Cola is around $41 per share. As a company whose leadership is undisputed, it might also be reasonable to buy it at a higher price between $45-$50 per share. After all, this company for the past 50 years has been a certainty and deserves a premium. In any case, $64 per share, I think, is too much.

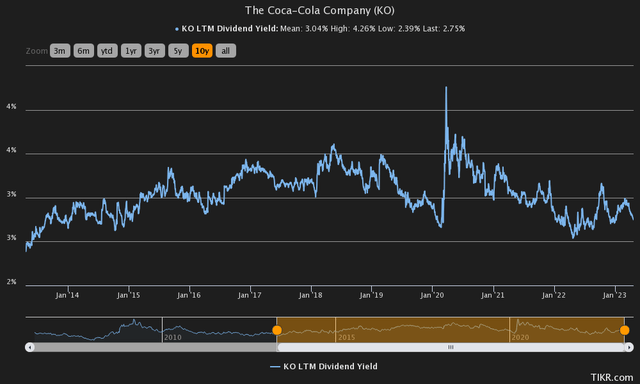

For anyone less interested in potential capital gains and instead preferring a dividend yield, Coca-Cola is likely to remain a dividend king for a long time to come. In FY2022 dividends of $7.61 billion were issued and almost certainly this year this figure will increase for the 61st time in a row. With free cash flow of $9.50 billion expected in 2023, the sustainability of the dividend remains high. The only flaw is the dividend yield, only 2.75%.

In fact, the dividend yield has often been higher over the past 10 years, peaking at 4.26%. This could be another sign of overvaluation, which is why I would wait before building a position.

Finally, the fact that Coca-Cola is now overvalued in my view cannot be a valid reason to consider it a sell or strong sell. This is a company to hold potentially forever, and its earnings strength is unlikely to be challenged. I personally do not have it in my portfolio, but I am waiting for the right price to do so.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not a financial advice, just my opinion.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.