Summary:

- Coca-Cola’s stock has lost over 10% since the recommendation to hold it earlier this year.

- The company’s recent earnings report showed strong growth and raised guidance for the future.

- However, concerns remain about the slow growth of the dividend and high payout ratio, making it a hold rather than a buy.

Klubovy/E+ via Getty Images

Coca-Cola Still Isn’t a Buy

Back in April, I explained that Coca-Cola (NYSE:KO) wasn’t worth buying. My analysis revealed that it was instead a Hold. Now, a few things about that article that are quickly worth mentioning.

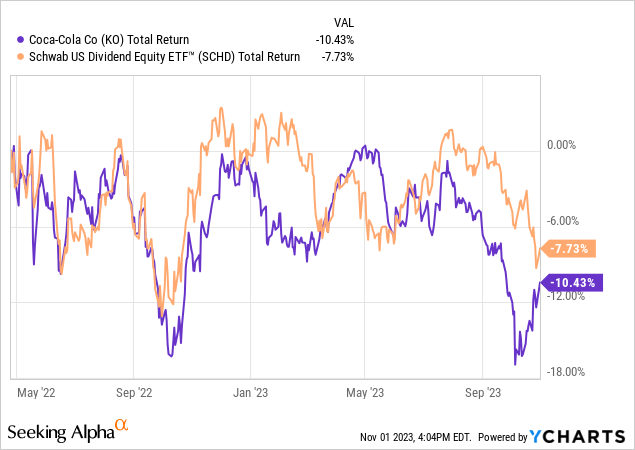

I can review two things using the chart below. First, you can see that KO has lost a bit over 10% since I made my Hold call earlier this year. Second, the Schwab U.S. Dividend Equity ETF (SCHD) has done better than KO, which I said was a smarter choice at that time.

Here’s a pinch more on this comparison:

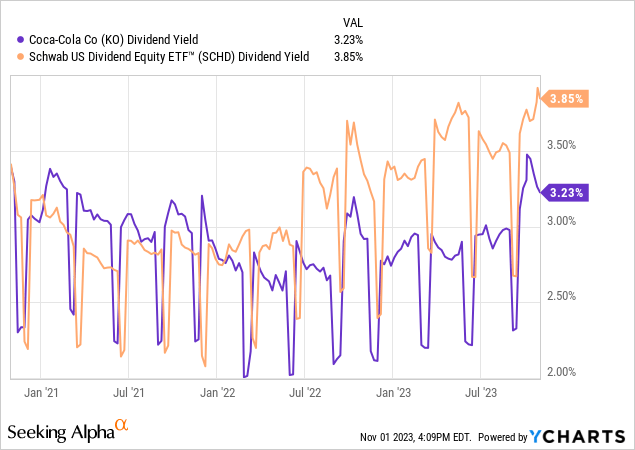

It’s been a while since KO’s yield made it worth buying versus SCHD. Furthermore, long-term, total return investors would be far ahead of KO.

Let’s take a look at yields now:

Both KO and SCHD have been hit hard this year. KO is down over 10% and SCHD is down just under 10%. What matters more, is that SCHD still maintains a superior yield to SCHD. If you’re interested in the comparison, I suggest you read the original article. For now, we’re turning to another topic.

In this article, I will focus on something that’s been bothering me more and more over the last couple of years. It’s a big enough thorn now to review. Furthermore, it’s annoying enough to keep good news about KO in check, keeping my KO rating a Hold.

Next, Some Good News

As you probably already know, KO reported Non-GAAP EPS of $0.74 and Revenue of $12B. These were both beats for the company. Even more, the FY2023 Outlook looks solid:

Organic revenue (non-GAAP) growth of 10% to 11%; Effective tax rate (non-GAAP) is estimated to be 19.0%; Comparable currency neutral EPS (non-GAAP) growth of 13% to 14% and comparable EPS (non-GAAP) growth of 7% to 8%, versus $2.48 in 2022; Free cash flow (non-GAAP) of approximately $9.5 billion through cash flow from operations of approximately $11.4 billion, less capital expenditures of approximately $1.9 billion.

What you should notice is the Non-GAAP growth across the board. Everything is strongly up. Impressive for such an icon. Even better, the Q3 call was solid. Here’s a small taste:

In the third quarter, we delivered strong top line growth, comparable operating margin expansion and earnings per share growth. Our strategy is working. These results continue our track record of consistent delivery. And given our year-to-date performance, we are raising both our top line and bottom line guidance.

It’s always cheery when top line and bottom line guidance is raised. India is strong, Latin America is strong. There are many levers they can still pull to improve the business even more. If you’re curious, and you love numbers and charts, then I encourage you to take a peek here. KO is looking just fine from this perspective.

What’s Bothering Dividend Growth Investors?

I’ve been a KO shareholder for just over 10 years at this point. My cost basis is just a pinch over $40 and my personal spreadsheet indicates I’m up about 41% in terms of price. I’ve collected roughly $15 in dividends in that time. My total annual rate of return appears to be right around 6%.

Here’s a wee bit more about the last 10 years. KO’s adjusted operating earnings growth rate has been just over 3%, with a normalized P/E of just over 23x. As you likely know KO’s P/E is sitting closer to 21x at this point. Some would say that means KO is Undervalued or that KO is a Buy. However, I don’t see KO’s slight price contraction to $56 right now, or the P/E sitting at 21x as being any kind of Buy signal. It’s mostly just noise.

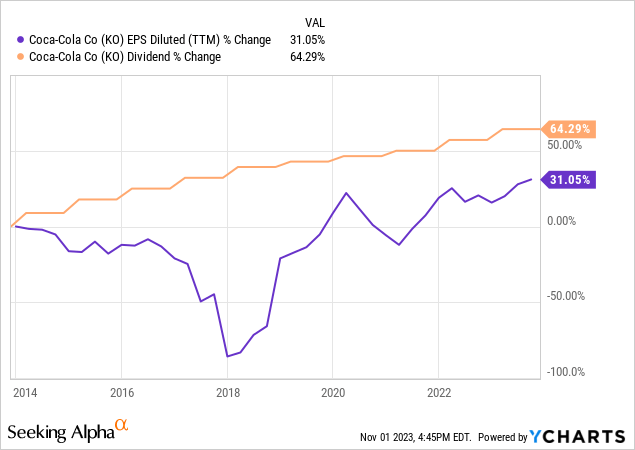

Before moving into my main “beef” with KO, let’s take a quick look at KO’s dividend in relation to KO’s earnings over time. Here’s how that looks.

I like this view because it shows us how quickly a company is growing earnings in relation to how quickly the dividend is growing. Typically, with a strong dividend paying company, you’ll see a stair-step up with the dividend itself. Plus, when the company is growing and healthy, you’ll see the earnings also moving up and to the right.

Above, we see the dividend steadily increasing, year by year. We also see that earnings increased over the period, although there was a dip; here’s why:

The Coca-Cola Company recorded a 15% net operating revenue decline in 2017 to $35.41 billion as it continues to refranchise its bottling operations. For the year, operating income was down 13% to $7.5 billion.

Coke, which finalised the refranchising of its US operations last year, saw its net operating revenue shrink 20% in the fourth quarter to $7.51 billion and operating income decline 3%.

This refranchising was intelligent, since it puts bottling in the hands of local owners, plus it reduces KO’s capital infrastructure and requirements. In short, it makes KO more “asset light” which investors typically appreciate.

Now, all of that said, if you look back at the chart above, you’re probably still wondering what’s going on with the dividend growth. After all, it’s growing at a faster rate than KO’s EPS. I think you’re on to something here. Let’s bring it together. My concern is shown in this payout ratio chart:

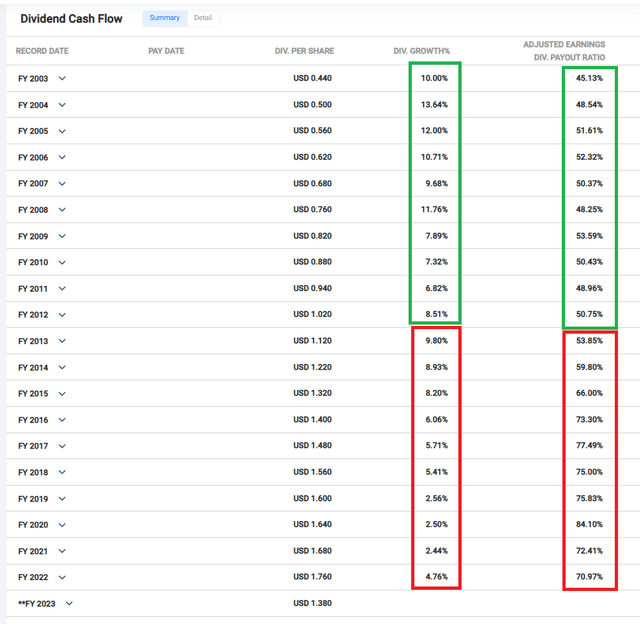

I’ve broken it into 2003-2012 and 2013-2022 because that’s how I am seeing the situation. Roughly speaking, KO was raising its dividend 8-12% then it shifted to raising 3-8%. But even if you don’t see it that way, over the last 20 years, KO’s dividend growth has certainly slowed.

Furthermore, and perhaps more importantly, KO’s payout ratio was steady at around 50% for a long while. But now, KO’s payout ratio is more like 70%. Slice it any way you want, you can see that KO’s growing the dividend more slowly, and it’s doing it by expanding the payout ratio. This spells one thing to me as an investor. Growth is slowing and it’s been hurting KO’s dividend.

40% Payout Ratio Increase

This next part is a stretch, so you can flame me in the comments. However, my very fast math tells me something crazy. If we assume KO’s payout ratio has gone from 50% to 70%, that’s a 40% increase. It’s a weird calculation and if you don’t like my math, just realize [(70% – 50%) / 50%] * 100 = 40%. So yes, KO has systematically increased their payout ratio by 40%. Flame away if I’m wrong.

That said, here’s something wild to think about. In 2013, KO’s dividend was $1.12. If we increase that 2013 dividend by 40%, we reach $1.57. So, again, if my math is correct, KO’s dividend has increased by about $0.45 simply because it’s handing out more earnings, and not really due to growth.

The point? Simply that unless there’s a true surge in earnings growth, KO’s current dividend of 3.25% probably isn’t going to grow more than 3-4% going forward. The payout ratio has been rather high, and will likely remain high. This pressure will suppress dividend increases. It’s not terrible news. Instead, this is just another reason KO is a Hold and not a Buy.

Super Fast Wrap Up

If we pretend inflation is 3.7% then perhaps getting a starting yield of 3.25% is good enough, since you’d keep even. You’d collect a bit more each year, but you’d be matching inflation, give or take. I don’t see it as a great bargain, which to me screams that KO is a Hold, and nothing more. This is especially true with money market accounts paying out 4-5% and CDs paying out well over 5%. Being blunt, even with strong dividend increases, which I doubt, KO isn’t going to beat these plain vanilla investments over the next few years. Well, at least not in terms of cash payouts; price is another matter. KO might catch a bid, with slight P/E expansion possible, and the like.

I’ll wrap up by saying that even if you love KO, there’s still very little reason to shell out your investment cash at this point in time. While it’s a great company and I’m not selling, it’s simply not a Buy at this time. But, I wouldn’t sell either. It’ll continue to do fine with or without any recession. Plus, speaking of inflation, it can pass along costs to customers via price increases. It’s credit rating is fantastic. KO is low risk, but it’s also low reward at this time. In case you missed it, KO is a screaming hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO, SCHD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.