Summary:

- Despite a more diversified total portfolio and dominance in North America, Coca-Cola’s core high-margin segments are still from overseas regions in the traditional namesake soft drinks.

- Fast growth in the past five years can be seen as catching up to its existing potential after the slump in 2016-2018.

- Continuing the higher growth from here has several obstacles, including sources of additional growth contribution, currency factors, and the direction of where interest rate policies are going to travel.

jetcityimage

Investment Thesis

Company Overview

Coca-Cola (NYSE:KO), founded in 1886 and headquarters in Atlanta, Georgia, is a total beverage company with its trademark products sold around the world in over 200 countries. Its segments are categorized by geographical locations as well as operation concentration such as Europe, Middle East & Africa (“EMEA”), Latin America (“Latam”), North America (“NA”), and Asia Pacific (“AP”), Global Ventures and Bottling Investments.

Strengths and Weaknesses

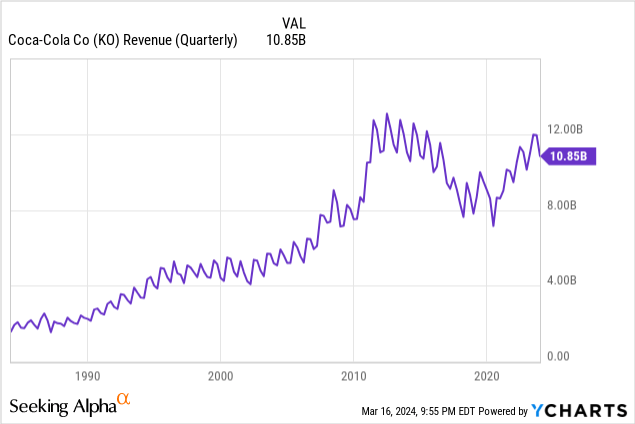

Due to its sheer size and broad appeal, Coca-Cola is regarded as the all-weather investment option in many investors’ portfolios. From the long-term perspective, its revenue growth has been mostly consistent at a rate that is growing by $4 billion every decade.

Not to take away the appeal of its trademark beverage, but as iconic as Coca-Cola to the American culture and its influence in the world, that power is most translatable into a massive network when it comes to business development. The company delivers 2.2 billion servings of the brands it either owns or is licensed to each day in its network. In less than 5 days it would have delivered one serving per person on earth. As we mentioned earlier, the company has a distribution partnership with Monster Beverage (MNST). Coca-Cola estimated that by the end of last year, Monster Beverage had about $11.7 billion fair value and its carrying value invested in MNST is about $4.8 billion. This is one of the major investments that allows Coca-Cola to benefit from distributing another company’s soft drinks with its network. This partnership is filed under the Global Venture segment. Although it is still small, the equity stake allows Coca-Cola to join the wave of a fast-growing energy drink market without spending a significant amount of acquisition capital and leveraging its network which is already in place. This is a new adventure that came about in the past four years, but we expect to see more deals like this moving forward.

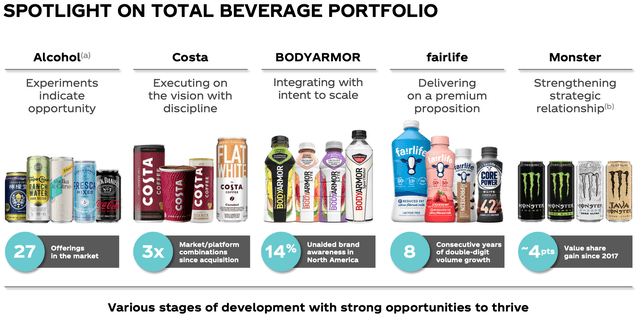

The total portfolio of Coca-Cola might surprise some as it includes not only the namesake sparkling soft drink Coke but also a variety of beverages from sports, coffee, and tea beverages to juice, dairy, and plant-based beverages. Costa products, BodyArmor and Fairlife belong to the Global Venture segment, which was only 6.7% of its total operating revenue. Alcohol products are in the experimental stage and sold under a firewalled subsidiary. And Monster Beverage sales are through a partnership program Coca-Cola system acts as a product distributor. We will get back to this later.

Coca-Cola: Spotlight on Total Beverage Portfolio (Company 2024 CAGNY Presentation)

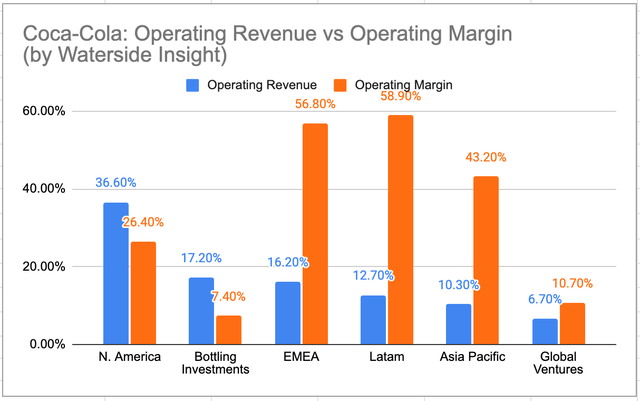

So it takes our focus back to the majority of its revenue, which expectedly has the largest contribution from North America, but the second largest again could be surprising, the Bottling Investments segment, then followed closely by the revenue generated in EMEA. These top three segments make up about 70% of its revenue. When we sort the segments by revenue, it shows that the highest margin was not generated by the largest two segments by revenue, but instead by the middle two segments, EMEA and Latam, both of which have over 55% operating margin. And Asia Pacific, although only contributing about 10% of revenue, delivers 43.2% of margin.

Coca-Cola: Operating Revenue vs Operating Margin (Calculated and charted by Waterside Insight with data from company)

To make sense of these numbers, investors need to look into each segment’s characteristics. In the Bottling Investment segment, Coca-Cola takes the bottling process in-house and delivers the finished products at a location that is unsuitable to set up bottling partners. Such delivery has higher revenue but a lower margin than the concentrate operation that only sells the syrup and concentrate to the bottling partners. North America, as much as being the home base of Coca-Cola, is also a mature market with high competition. So perhaps margin pick-up from these two segments won’t have a high potential. EMEA and Latam, given the size of their identifiable operating assets at two-fifths of North America at about $10.1 billion, and their diverse geographies across countries and regions within, more investment in these regions by the company seems plausible. And Asia Pacific, which has always posted a faster growth rate until recently, only has a meager 4% of North America’s operating assets but 43.2% of operating margin. Great China and Mongolia reported a 6% decline in 2023, but other countries in the region still had mid to high single-digit growth. Expanding in this region could be another strategic decision for the company to make.

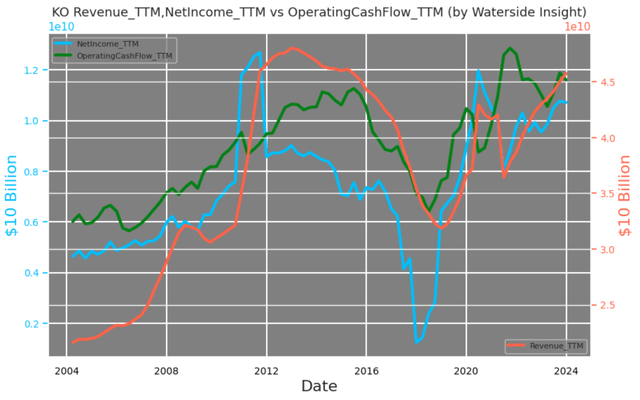

One of the biggest growth setbacks in recent years for the company was from 2016 to 2018. Both its top-line and bottom line suffered a large drop of as deep as 50% from the previous peak. Its net income dropped to almost a minuscule level, by its own standard.

Coca-Cola: Revenue, Net Income vs Operating Cash Flow (Calculated and charted by Waterside Insight with data from company)

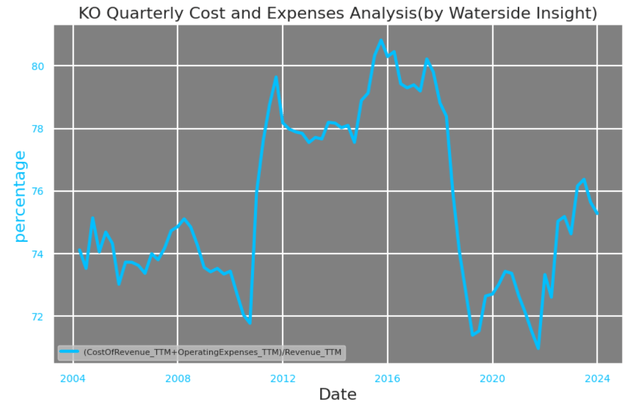

What made its net income vulnerable during that time was not only because of the decline of revenue but also the persistently high costs and expenses that lasted for almost seven years. In total, they reached over 80% of revenue. Currently, this ratio is at 75%. This means Coca-Cola has to be vigilant to guard its revenue growth currently growing at a mid-single-digit.

Coca-Cola: Cost and Expenses (Calculated and charted by Waterside Insight with data from company)

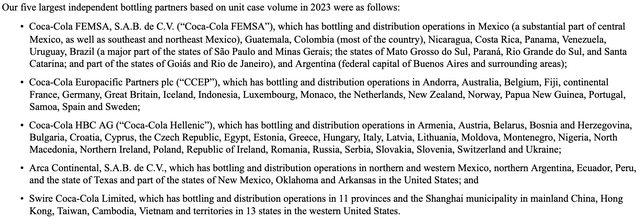

On the other hand, it’s worth mentioning Coca-Cola has an important relationship with its independent bottling partners. By selling concentrates and syrups to these partners to bottle, package, and distribute the final products, the company relies on these partners to generate a significant portion of its operating revenue. Following are the top five independent bottling partners by volume in 2023, each of which is responsible for certain geographic locations and markets.

Coca-Cola: Independent Bottling Partners (Company 2023 10K)

Although most of these partners have names with “Coca-Cola” in them, they are in fact independent in their business operation from the company. In theory, they can choose to prioritize their operation away from Coca-Cola if they have such business incentives, which could pose risks to Coca-Cola. But so far, these relationships are evidently on a solid footing judging from the climb of its revenue since 2019.

Coca-Cola has always had a cash conversion cycle at about negative 98 days, which means in theory the company sold its inventory even before paying for it because the vendors and bottling partners are financing it for the products. Indeed, its days of inventory at 80 days on average and days of sales outstanding at 31 days on average have more or less been at a similar level for the past twenty years, but its days of payable have increased from an average of 150 days before 2019 to about 230 days since then. It gets almost two-thirds of a year in advance from vendors and suppliers due to a supply chain finance program that was set up voluntarily by two global financial firms, although Coca-Cola has no direct financial relationship with these two firms. So its cash conversion cycle, which has been negative 100 days on average before 2016, has since dropped to an average of 150 days.

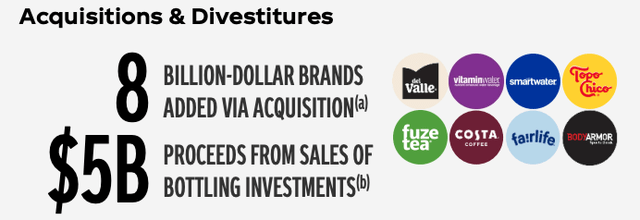

The soft drink market is highly competitive as newcomers emerge every year. Coca-Cola has been active in valuable acquisitions to boost its competitiveness. Since 2020, it has spent $8 billion in adding brands to its portfolio, including “Fairlife” which it regards as a core component with consecutive years of double-digit volume growth. After a $5 billion divestiture during this time, its net investment for acquisition is only $3 billion, less than a third of its annual free cash flow. Given its cash ratio is 58%, we think the company could continue looking for suitable targets in the coming quarters or years. The direction could potentially be targeting the healthy soft drink category which has had the fastest growth in recent years; or in the highest margin regions, such as EMEA, Latam, and Asia Pacific. Besides through acquisition, it is likely to enter more partnership programs with other value-added brands in addition to Monster Beverage to leverage the value of its massive network.

Coca-Cola: Acquisitions and Divestitures (Company 2024 CAGNY Presentation)

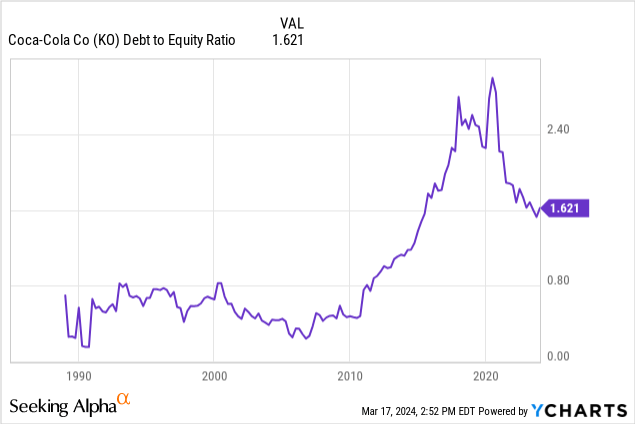

It is possible it doesn’t need to extend its debt leverage for business expansion, but the company has a target of 2-2.5x debt-to-equity, and it is currently at around 1.7x. This means it will feel comfortable to leverage up from here, and investors shouldn’t be surprised.

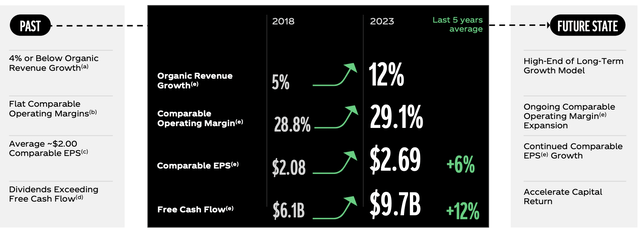

In its presentation in February this year, Coca-Cola showed its progress in 2018 as proof of its strategy’s effectiveness. But as we showed earlier, 2018 was the trough of its recent growth. Coming back to its current level was more reaching its current potential as how it should be if the growth was continued, so the higher growth rate was easier to achieve. But going forward to stay at this rate will require it to create additional value and growth beyond its current potential, which may not be coming as fast and strong. This was also confirmed as management expected the past 5 years’ average to be at the “high-end of long-term growth model”.

Coca-Cola: Last Five Year Average Growth (Company 2024 CAGNY Presentation)

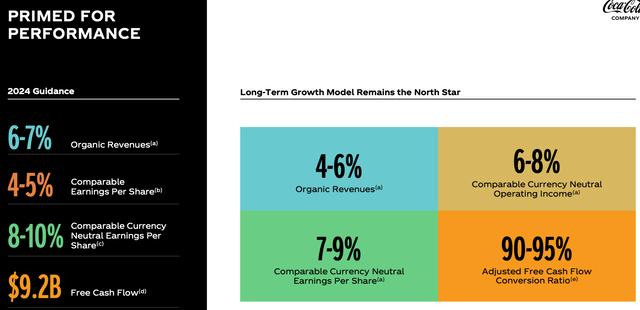

The long-term growth model, which Coca-Cola regarded as its “North Star”, has some indication of where it wants to go. It has a 4-6% organic revenue growth target, 6-8% current-neutral operating income growth, and 7-9 currency-neutral EPS growth, which we think are reasonable and achievable. But if investors invested in USD, then the EPS growth rate could be different. Its CEO mentioned that the previous obstacle preventing it from achieving sustained EPS growth was the currency headwinds. But in the past seven years, it has been able to manage the headwinds’ impact by focusing on its large-scale global system and competitive advantage. It delivered 8% EPS growth last year against a 7% current headwind, and there are reasons to believe it can continue to deliver since its internal system is relatively stable. But when the Fed’s interest rate policy could be in the direction of weakening the USD in the medium term, reversing the trend of where the rates were going in the past seven years, the headwinds could be stronger for USD-based EPS growth. What we also want to cast some doubts on is the free cash flow conversion rate. Although this ratio was 89% in 2022, that was almost the best it has been in the past twenty years. Its average FCF conversion rate is more at 70-75% on average.

Coca-Cola: 2024 Guidance (Company 2024 CAGNY Presentation)

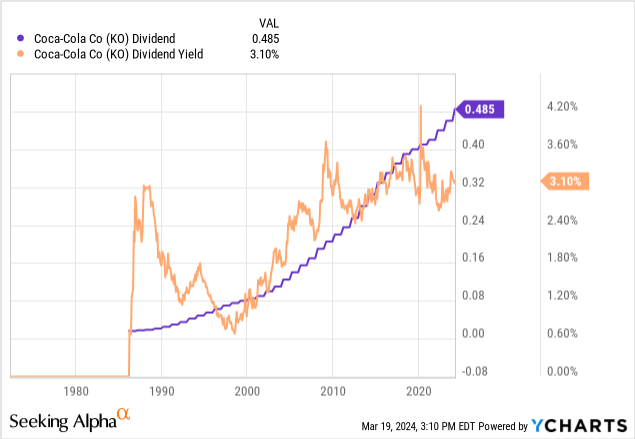

For any long-term all-weather investment, the dividend expectation is the key. Coca-Cola has had an almost impeccable dividend-raising streak for over 30 years, even during the period its stock price was stagnant. This is good news for buy-and-hold long-term investors. 3.1% yield that you can buy and forget is a lot safer than higher-yielding assets with sleepless nights.

Financial Overview & Valuation

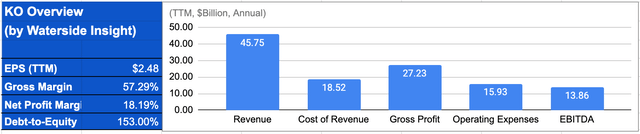

Coca-Cola: Financial Overview (Calculated and charted by Waterside Insight with data from company)

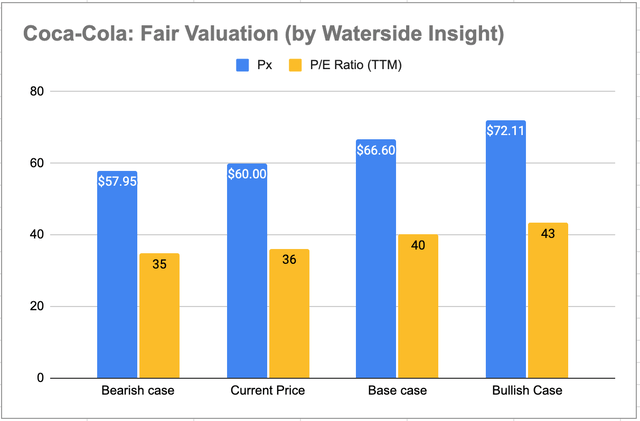

We assess Coca-Cola’s valuation based on our analysis above with a proprietary model. The observation and conclusion we drew above serve as the basis of our model. We assume a cost of equity of 7.05% and a WACC of 6.45%. In the base case scenario, the company has an average 5% growth of free cash flow at a slower speed compared to the past five years due to both reaching its near-term potential and also currency headwinds, but eventually accelerated to low-to-mid-teens through more robust growth in higher margin segments; it was priced at $66.6. In the bullish case, the near-term moderation of the growth rate was short-lived and it stayed at a high single digit in the near term due to more diversified product lines bringing higher revenue and margin while its core products in Coke remained growing stably; it was priced at $72.11. In the bearish case, it was unable to grow past the previous peak in revenue and stagnant for the next 18 months during which it had declines at mid-to-high single digits instead of growth, it was priced at $57.95. The current price is on the bearish side perhaps because the market isn’t seeing strong endogenous growth momentum.

Coca-Cola: Fair Valuation (Calculated and charted by Waterside Insight with data from company)

Conclusion

As a beloved brand and essential part of pop culture for decades, Coca-Cola continues to enjoy tremendous support from within its massive network and consumers around the world. The company has successfully grown out of a slump incurred seven years ago and is currently facing a transitional moment. It will either continue its strong momentum from the past seven years or potentially become stagnant. We see opportunities abundant for the company both from acquired growth externally or improved internal networks to weather currency headwinds, which is not small compared to its mid-to-high single-digit top-line growth rate. The all-weather king of dividends will continue to shine but long-term investors possibly need to be more patient. We recommend a hold as the initial rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.